What Happened in the Market This Week?

Market Insight for 4th March - 11th March

Over the last week, the US market is up 1.2%, with the Federal Reserve raising rates by 0.25% which seemed to be less than what investors were expecting. The biggest gainer was the Financials sector, up 3.5%.

- US Gasoline prices surpassed the 2008 high of $4.11 per gallon to reach $4.31

- Inflation hits a 40 year high, recording 7.9% for the past 12 months.

- Wheat and other commodities reach fresh high as supply issues, export restrictions and sanctions persist.

- Chinese stocks rallied Wednesday after Pro-market comments from China. The likes of Alibaba (NYSE:BABA) gained 36%.

- US Stocks also rallied after positive tone on economic growth from Federal reserve.

Gasoline prices are getting out of hand

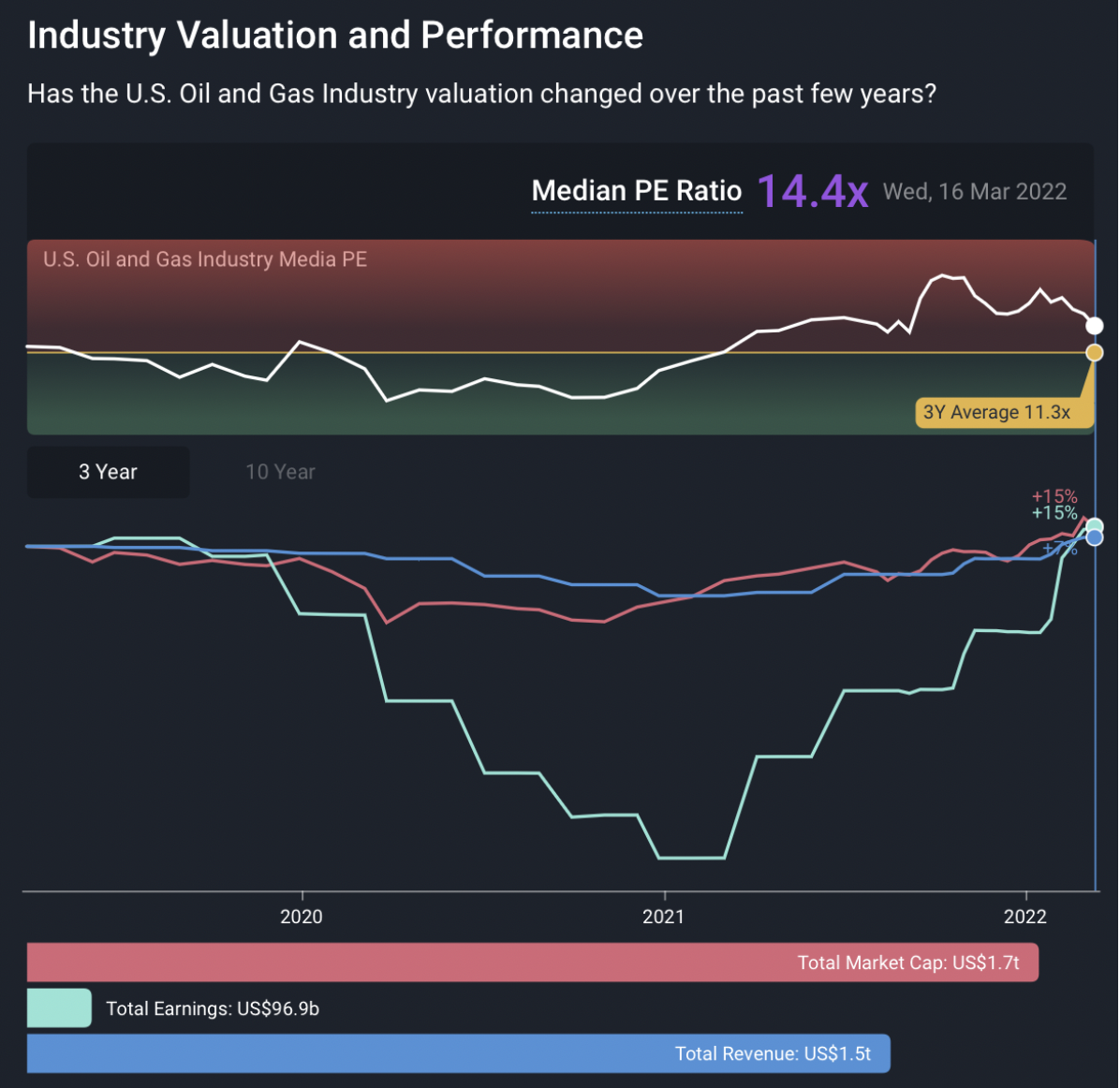

- The US is experiencing runaway gasoline prices after a ban on the import of Russian oil. The national average for a gallon of gas surpassed the US$4 mark and the 2008 record, which was US$4.11 to reach $4.318 (in today's dollar, gas was around $5.31 in June 2008). Meanwhile, the Oil and Gas industry has dropped 7.1% in the past week, with Chevron (NYSE: CVX) pulling back 7.2%, but both had solid gains before the past week. The following chart best depicts the steep recovery of the oil sector in the aftermath of 2020.

US Oil and Gas Industry Valuation and Performance, March 16th 2022

Inflation hits 40 year high

- The US recorded inflation of 7.9% last month, the highest level in the last 40 years. Even excluding the leaders (food & energy), core inflation still gained 6.4% in a month.

- Meanwhile, the Fed dropped the hammer as the first rate hike came in this Wednesday, with more expected to come during the year. However, there is growing uncertainty about the impact of these measures.

Wheat prices at an all-time high

- The consumer staples sector is under threat of severe supply restrictions as wheat prices move to all-time highs. Higher food prices will impact the entire world, but they also create a risk of raising the geopolitical tensions even further.

- In the last week, the agricultural products sector remained flat, and it is doing much better than the overall US market year-to-date with a gain of 18%.

- Notable stocks to watch: Bunge (NYSE: BG) – an established player in the sector with a 200-year history, Archer Daniels Midland (NYSE:ADM) and other stocks within the sector.

Why did it happen and how can it impact investors?

Wheat Prices

Together, Ukraine and Russia account for 29% of global exports of wheat, which provides staple food for much of the world's population. Anything from pasta, bread, cereal, noodles, and much more is made from wheat.

Food prices have already been rising before the war in Ukraine. The Food Price Index increased 20.7% year over year due to pandemic related shipping disruptions, rising costs for farmers and adverse weather, but wheat prices have been further impacted by the war (since Ukraine is banning exports of wheat and other food staples to feed its own population).

With wheat prices spiking up to the highest level in history, additional demand pressure will be mounting on the world’s biggest producer: China. It produces roughly 41% of the world’s wheat, however it just announced that this year's crop could be the worst in history due to adverse weather conditions. So on top of demand increasing for China’s wheat, it’s potentially going to have less supply going around as well, which is a recipe for further price increases.

Exports winding down

Russia and Ukraine are the largest exporters of sunflower oil, providing 80% of the worldwide supply. With Russia under sanctions and Ukraine introducing a ban on food exports, other key producers like Indonesia have introduced export restrictions on palm oil, a substitute product.

The effect seems infectious, as other countries like Serbia, Hungary, and Bulgaria are banning various staple exports. Obviously, a decrease in foreign trade will hurt the global economy.

Russia produces 13% of worldwide fertilizers, and its natural gas is vital in producing nitrogen-based fertilizers. As much as 25% of the European supply of the key crop nutrients comes from Russia. If these sanctions are ongoing, they will impact the supply of fertilizer, and therefore potentially food production for areas like Europe, which can again push up prices.

Who is going to be impacted the most?

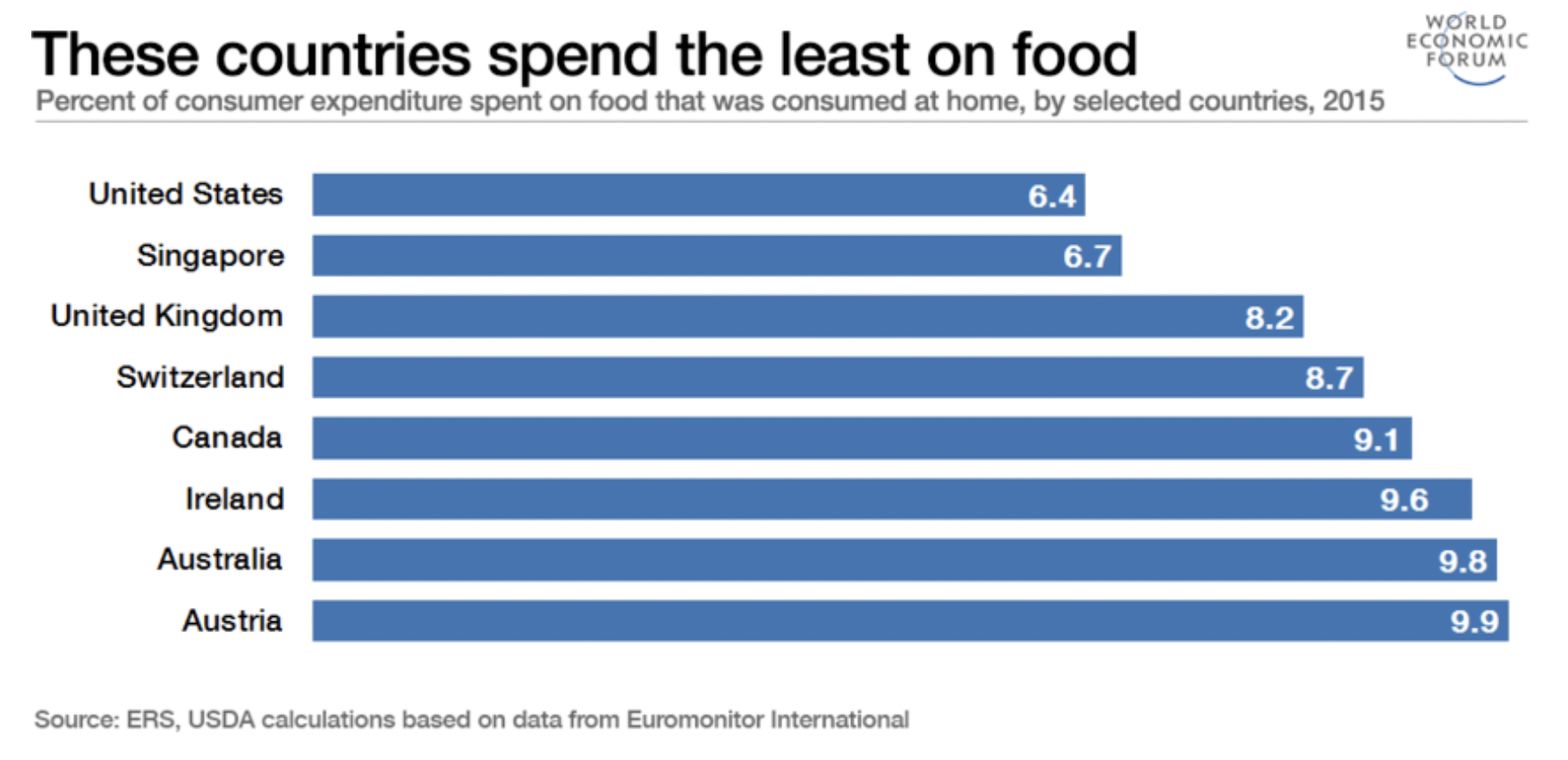

The developed world spends less than 10% of its disposable income on food; thus, it can typically absorb the price increases a bit better by cutting down on other expenses. However, emerging economies won't be able to compete with rich countries for a shrinking food supply because some nations spend well over 40% of total consumer expenditure on food.

Not only will the developing countries suffer from rising food prices, but their domestic production will also take a hit from the higher fertilizer prices — fueling a dreadful loop of lower agricultural yields due to mineral depletion of the soil that creates further food shortages that push the prices even higher.

In the U.S, this could mean additional pressure on the Consumer Discretionary sector (an area where people can reduce expenses), while companies in the Consumer Staples sector will either focus on absorbing the costs as much as possible through their business model, or pass the cost increases on to consumers, which we’ve already seen occurring.

Notable stocks to watch: Costco Wholesale (NASDAQ: COST), Walmart (NYSE:WMT) and other US Consumer Staples.

Why interest rate hikes might not work in fighting inflation

The current inflation problem did not originate from the latest geopolitical turmoil (though the war is currently impacting oil, gas and some foods). Its origins go to the start of the global pandemic that severed demand and saw unprecedented liquidity in-flows from supportive monetary policy measures (i.e. Federal Reserve bond buying, interest rate cuts, etc).

Two years later, as previously mentioned, food costs have been going up by over 20% year-over-year. As the ongoing conflict tangled up some of the largest commodity and staples suppliers, the situation would have been problematic even without the sanctions.

With the troubled crop harvest in China and rising export restrictions worldwide, food prices will continue to go up, thus likely bringing inflation to fresh highs.

Although central banks worldwide think they can stop it by raising interest rates, this might not work because of the demand inelasticity. Food is the primary, essential need for the entire planet, and higher interest rates won't bring that demand down.

This type of inflation we’re seeing is cost-push inflation, rather than demand-pull inflation (there has been demand-pull inflation in other areas outside of food, like used cars). The Fed can raise rates to curb demand-pull inflation (making consumers less keen to spend because debt is more expensive), but the Fed’s tools give it much less leverage in controlling cost-push inflation (because the Fed can’t increase supply of commodities, foods, etc).

What to watch

This week, on Wednesday, March 16, Federal Reserve Board announced an interest rate hike of 0.25%. Investment bank Morgan Stanley (NYSE: MS), previously expected the Federal Reserve to hike the rates as many as 6 times in 2022, and the Fed confirmed as much on Wednesday.

In the days after an announcement like this, Federal Reserve Board members often give various speeches and statements, in which they can signal what they are thinking in relation to further rate hikes in the future.

Regarding what we covered this week, it is crucial to remember that humanity can forgo many things that we take for granted (as seen in 2020), but it cannot give food production the same treatment.

Facing the shrinking global trade amidst war and geopolitical tensions, it is worth keeping an eye on the consumer staples sector and agricultural products in particular.

Until next week,

Invest well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.