What Happened in the Market This Week?

Market Insight for 25th March - 4th April

After a turbulent 3 months, the 1st quarter of 2022 is finally behind us. The major U.S indices posted negative results.

- Dow Jones: -4.5%

- Nasdaq: -9.08%

- Russell 2000: -7.8%

- S&P 500: -4.95%

Meanwhile, we are starting to see the first impacts of the geopolitical turmoil and monetary policy changes:

-

The energy sector was the biggest winner - yet its average PE ratio is falling.

-

Sri Lanka is in an economic crisis – rising food and energy costs are taking their toll.

-

Mortgage rates are climbing – but with a negative real interest rate, it is overheating the housing market.

- The yield curve (2y/10y) has inverted – just 16 days after the Fed hiking cycle started.

Diverging performance in the Energy Sector

While the utility sector was one of the positive performers, the energy sector was in its own category due to rising inflation and war in Ukraine, lifting 38.8% in Q1.

Yet, despite this performance, the median PE ratio decreased from 17.5x to 15.4x, while the total market cap increased from US$1.6 trillion to US$2.1 trillion, as illustrated in the following chart.

US Oil and Gas sector, April 3rd, 2022

Yield Curve Inversion

The most famous yield curve is officially inverted, as the 2-year yield exceeded the 10-year yield. Yield curves naturally slope upwards as long-term yield “should” exceed short-term yield. This is due to the perception that the long-term investments carry more risks than the short-term, and the positive yield difference being the compensation for taking on that extra risk.

However, when the curve inverts, as it has now, this signals that short-term risk is greater than the long-term risk, signalling a potential recession on the horizon. Going back 120 years, the lag between a yield curve inversion and a recession has averaged 22 months and although the last time the 2y/10y curve inverted was in September 2019, it is widely accepted that the crash of 2020 was an unpredictable event.

Interestingly, 2022 marks the quickest yield curve inversion in recent history, as it happened only 16 days after the hiking cycle started. For comparison, the second-fastest inversion occurred on February 2, 2000 — 217 days after the Fed's rate hike.

It is essential to observe that it is not only 2-year/10-year that has inverted recently. As early as last October, 20-year topped 30-year, while on March 28, 5-year topped 30-year.

Mortgage Rates Climb

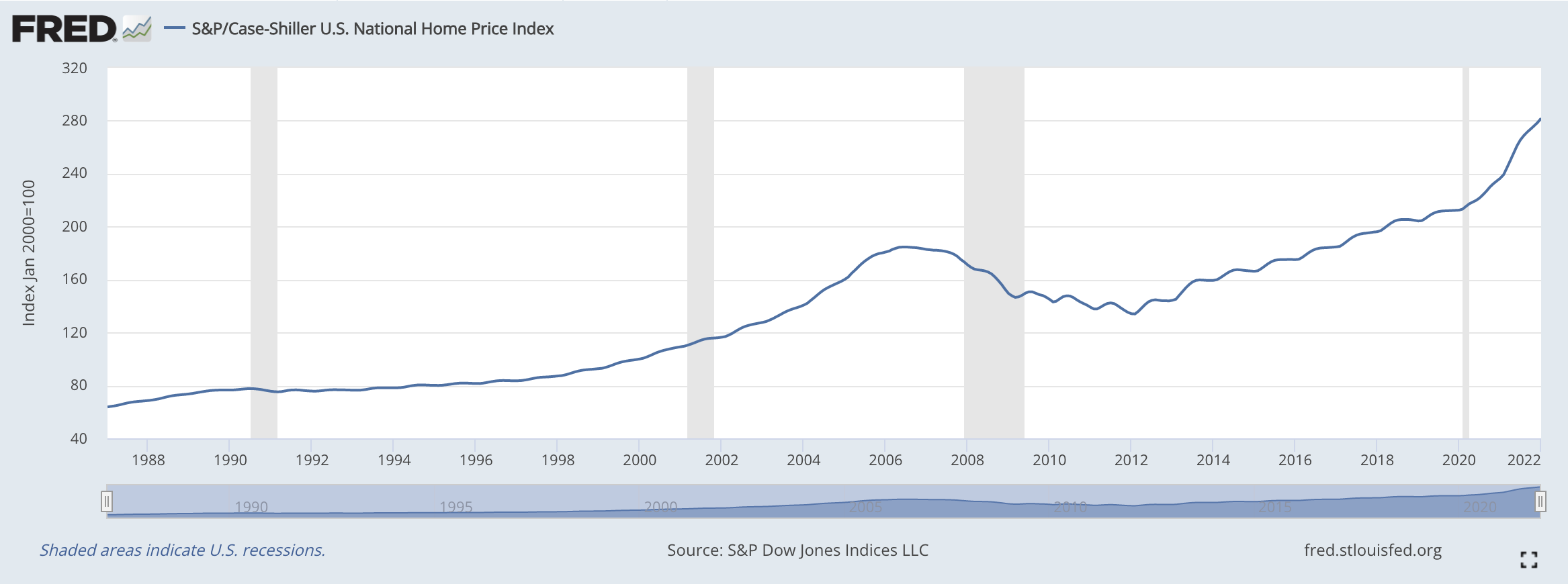

After the Fed's first increase of short-term borrowing rate since 2018, the cost of home loans is surging at its fastest pace since 2011. A fixed-rate 30-year mortgage, the most common loan used in home purchases, soared to 4.91%, up 1.78 percentage points year-over-year.

Considering that residential real estate prices in the top 20 major cities rose 19% through 2021, this creates a problematic situation for many aspiring homeowners. These prices are tracked through the S&P S&P/Case-Shiller price index, reaching its highest level in March.

While this might sound concerning, the situation is much better than in 2008. Before the Great Recession, over 30% of mortgages were Adjustable Rate Mortgages (ARM), while nowadays, those are less than 1%. Back then, the risk of default was 16% - compared to only 2.3% now.

Sri Lanka Economic Crisis

Overshadowed by other news, Sri Lanka faces one of its worst economic crises in decades as currency devaluation and rising commodity costs threaten civil unrest in the country.

Sri Lanka's main imports are fuel and food, whose prices are rising globally due to inflationary pressures and armed conflicts. To make things worse, electricity generation has also become a problem as low water levels negatively impact the functioning of hydropower facilities during the ongoing dry season.

Power outages, food rationing, and fuel shortages are now a daily experience for some 22 million residents who are currently in a government-imposed nationwide lockdown over the weekend between April 2 and April 4.

After receiving US$787m from the International Monetary Fund (IMF) last August, the country is now seeking additional help to deal with some US$4b in foreign debt maturing in 2022. Its primary creditors are China, India, Japan, and the Asian Development Bank.

How Do These Events Impact Investors?

Weeks ago, we wrote about the potential domino effect of rising inflation, and it seems that Sri Lanka is one of the first countries to experience that trend quite severely.

Its economy is not large enough to create a spillover effect into other economies, but it still exports billions of US dollars worth of women's clothing and tea — enough to cause additional cost-driven inflation in these categories. Investors should be on the lookout for their exposure to emerging markets, where monetary policy settings may be sub-optimal and could cause similar effects.

Meanwhile, according to professor Aswath Damodaran, yield curve inversions don't have the predicting power they used to post-2008. Fed economists agree, stating that it is not a valid independent measure of an impending recession.

If anything, Prof. Damodaran argues that post-2008, there is a stronger negative correlation between the inversion and returns — meaning the market could deliver healthy returns in the following quarters.

Spring is kicking off in the Northern Hemisphere, and demand-driven seasonality of energy demand has the potential to reduce consumption by populations in these regions as the weather warms up. However if higher energy prices persist this could soften some of the reduction in demand. Depending on what occurs, this could provide opportunities or risks within the energy industry.

Looking Ahead

The weeks ahead have several important events.

These include:

- April 5: The Institute for Supply Management's Services Purchasing Managers Index – shows business conditions in the US non-manufacturing sector

- April 6: FOMC minutes: Clues for the next policy decision vote that happens 3 weeks after

- April 12: Next release of US CPI Data - A fresh high in inflation figures could keep the real estate market rising, as the ongoing rise in value paired with a negative real interest rate offsets the mortgage rates.

FOMC minutes could drive some volatility, especially if the market caught any information about the potential 50 basis points hike in May.

Until next week,

Invest well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.