What Happened in the Market This Week?

Market Insight for 11th - 18th March

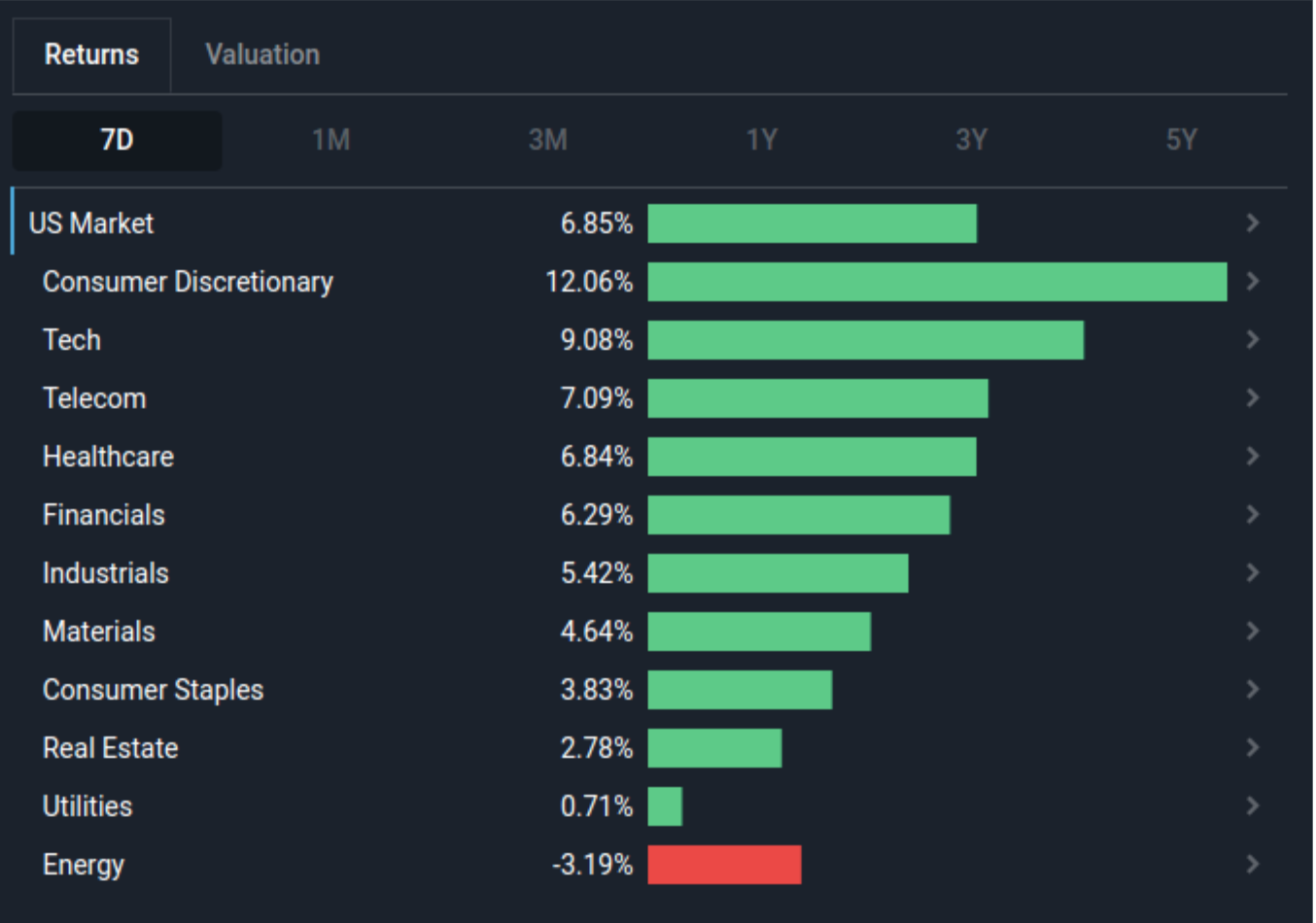

The US market has climbed 6.9% in the last 7 days, led by the Information Technology sector with a gain of 9.1%. On the other hand, the Energy sector is lagging behind with a decline of 3.2%.

- Rates Rise: The Federal Reserve announced last week that they are raising the benchmark rate by 0.25%, with more hikes forecasted.

- QE in Russia: The Russian Central Bank announced a program of Quantitative Easing after rates rose to 20% and trading remains closed.

- Chinese tech stocks bounce: The Chinese government announced that the crackdown on tech companies is nearing an end, sparking a significant rise in Chinese stocks.

Looking at the US market, we can see the following sector performance breakdown:

The market is currently pricing-in the long awaited FOMC rate hike. The Fed voted to raise the interest rate paid on reserve balances by 0.25%, to a total of 0.33%effective on the 17th March. The Fed stated that they have revised their 2022 projections by 1% from a year ago, indicating that they have changed their policy or underestimated the impact of inflation.

A member of the committee, Governor Christopher Waller was more hawkish (favours increasing rates) and pushed for a 0.5% hike in this and future meetings.

The Fed also stated that the invasion is likely to create spillover disruption effects in the US economy through trade, supply chains and other channels.

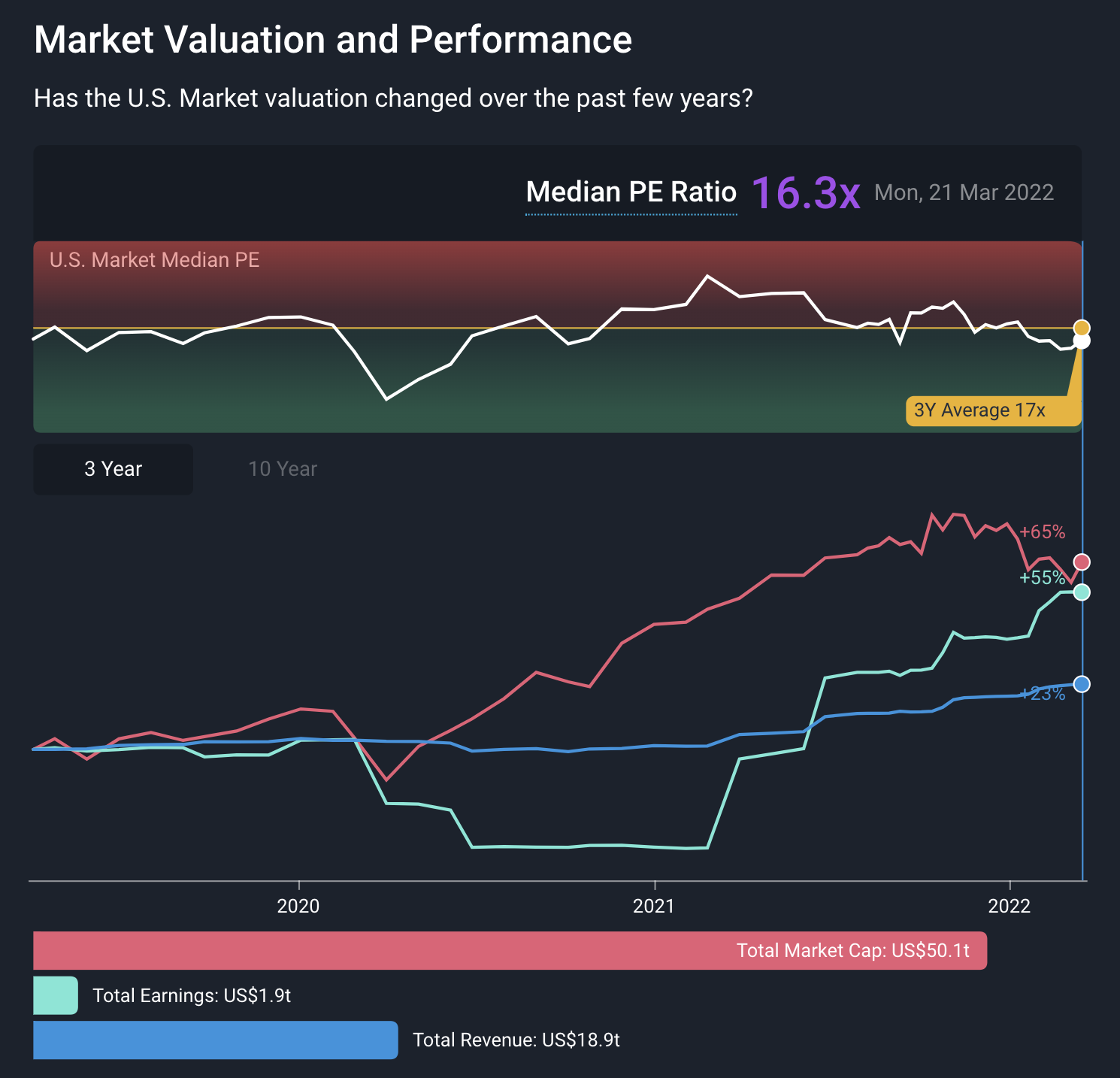

Looking at the 3 year US market performance below, we can see that earnings are catching up with the percentage change in market cap over the last 3 years. This is a result of the latest earnings season with companies posting strong earnings growth.

We need to be mindful that not all of that growth is organic, and also reflects making up what was lost during 2020 and 2021.

The market is currently trading at a price to earnings ratio of 16.1x, which is below the median 3 year PE of 17x, which means that given constant earnings, stocks seem to be trading around their fair value.

Shifting to the European front, the Russian economy is still under heavy pressure. Rates rose to 20% and the Russian central bank announced quantitative easing. This has not been enough to ease fears among the international investment community that Russia may default on some debts and even seize international property.

The Chinese landscape keeps developing and volatility has not subsided yet as investors are uncertain in which direction the government will choose to move. The week started with a general pullback of US listed Chinese stocks, only to see arebound later in the week after the government issued statements in support of markets and indicated that the tech crackdown on Chinese companies is nearing an end.

Why it happened and how can it impact investors?

The Federal Reserve has stated that they are raising rates in an effort to combat inflation, which has been surging over the last year as a result of the economic disruptions of the pandemic. Raising interest rates is a measure designed to reduce demand, thereby reducing the upward pressure on prices.

However, as we explained last week, a lot of the inflation, particularly with food and gasoline is stemming from what is known as ‘cost-push’ inflation. This means that it is due to a supply side issue, with the cost of raw materials increasing, rather than an excess of demand. This will make it harder for interest rates to have the desired effect.

For investors, rising rates will have an effect on valuations. Stocks are valued based on expectations of their future cash flows, which are discounted to a present value. The higher interest rates get, the more aggressive will be that discounting, and the lower valuations will be.

Last week, there were some investors expecting more than a 0.25% increase in interest rates, which is why stocks rose directly after the announcement.

If you would like some more detail about how inflation and interest rates affect valuations, one of our analysts has made a video discussing exactly that. Click below to watch.

Looking Ahead

In the future, the Fed anticipates further rate hikes that will reach a median of 1.9% by the end of 2022 and around 2.8% in 2023 and 2024. These projections are likely to be revised as the economic outlook changes. The ECB (European Central Bank) is expected to follow with a forecasted 0.25% hike at the end of 2022, bringing the ECB rates from -0.5% to -0.25%.

One way investors can navigate this landscape is to convert money into assets that have an underlying commodity attached, such as gold.

Another approach is to find reliable stocks that have high pricing power - This means that the company can pass at least some of the rising costs of inflation over to their clients and is less impacted.

Investors should be aware that the habits of consumers may also change during high-inflation periods, and they may switch from buying discretionary (luxury) products to their low-cost alternatives.

In any case, a long term and disciplined approach to investing is usually a better option than reacting to sudden shifts in markets, and it is much better to plan moves some time in advance.

Until next week,

Invest well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.