What Happened in the Market This Week?

Market Insight for 16th May - 23rd May 2022

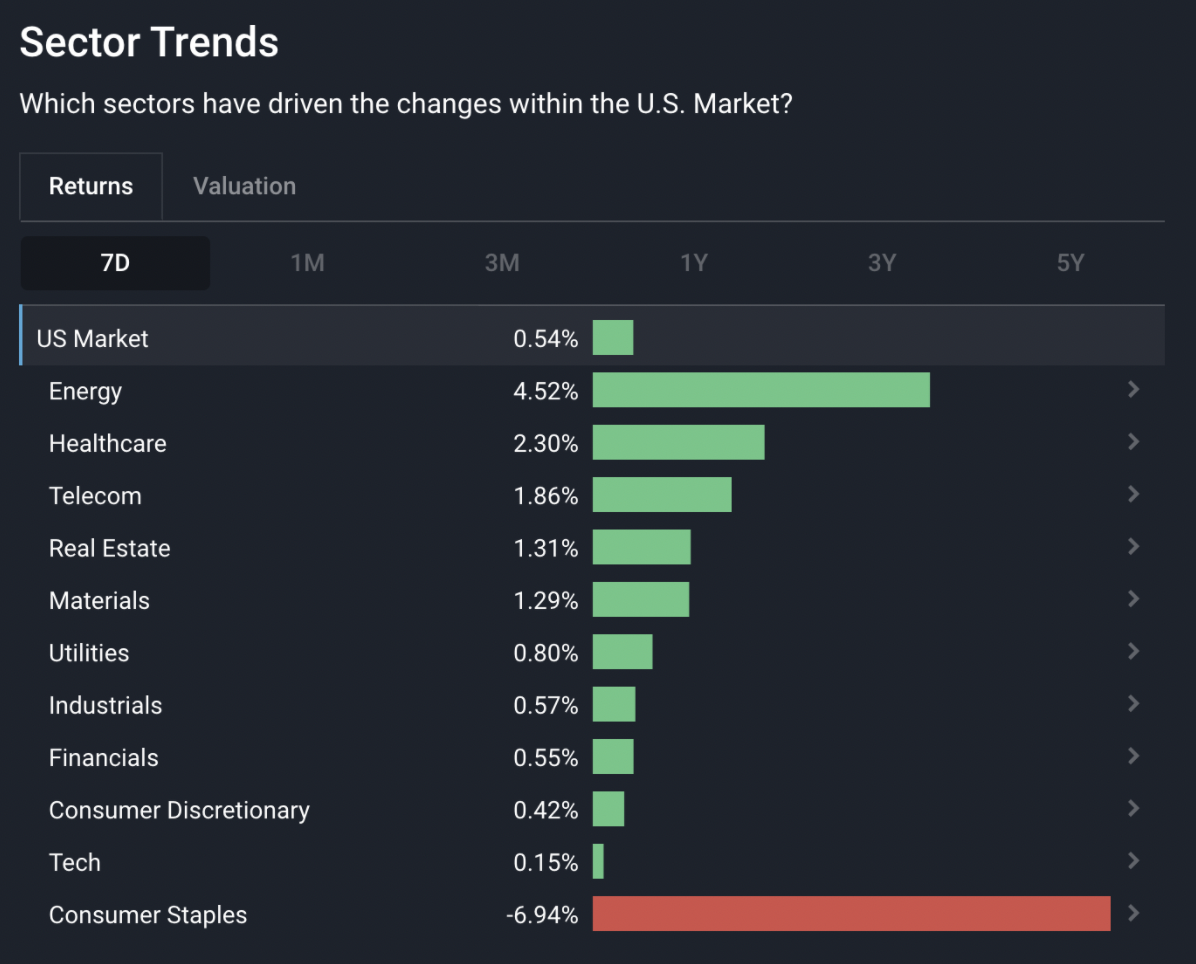

The recovery in equity markets that began the previous week initially followed through, but ran out of steam on Wednesday. Several new issues are now weighing on markets:

- The Consumer Staples sector came under pressure after several companies reported earnings that were negatively affected by inflation.

- China reported lower than expected industrial output and retail sales as Covid lockdowns took their toll on the economy.

- The price of wheat reached a record high after India banned exports due to a heatwave affecting the current harvest and concerns about food security.

US Market 7 Day performance to 19th May 2022 - Simply Wall St

Consumer Staples Stocks Under Pressure

Until last week, shares of consumer defensive companies had held up remarkably well relative to other sectors. This changed when Walmart Inc. ( NYSE:WMT ), Target Corporation ( NYSE:TGT ) and other large retailers reported first quarter results last week.

Both Walmart and Target managed to generate revenue that was better than the levels that analysts estimated, but EPS for both companies came in lower than expected as costs rose more than anticipated. We covered these quarterly reports with reference to Walmart’s shareholder activity , and Target’s current valuation .

Since their results were released, Walmart has fallen as much as 20% while Target traded more than 27% lower. Some of the other prominent consumer staples stocks including Proctor and Gamble ( NYSE:PG ), Costco ( NYSE:COST ) and Coca-Cola ( NYSE:KO ) also fell on fears that their bottom lines would be affected in a similar way.

According to their reports, overall spending has remained fairly resilient, however Walmart indicated that consumers are diverting their budgets to more essential items and cheaper brands. In addition, inflationary pressure is affecting these company’s profits on several fronts:

- Rising energy prices have led to higher freight costs.

- Supply chain constraints continue to result in higher prices and shortages of some items.

- The low unemployment rate has resulted in a more competitive labor market so companies are spending more on recruitment and retention of staff. This is affecting other industries too — Microsoft is planning to almost double its salary budget to retain talent.

Sectors that are considered defensive include consumer staples, healthcare and utilities. Demand for the goods and services the companies in these sectors sell is less sensitive to changes in consumer spending, and so their revenues are relatively stable compared to other sectors.

When market volatility increases money often rotates to these defensive sectors, resulting in their temporary outperformance. However, this can lead to relatively high valuations which are at risk when earnings disappoint. The following chart reflects the P/E (price earnings) ratios and the forecast earnings growth rates for the 11 sectors that make up the S&P 500 index. Interestingly, the consumer staples sector is still trading on a higher P/E ratio (25.6x) than the overall market despite much lower earnings growth forecasts.

US Market Sector Valuations and Growth Rates - Simply Wall St

The Insight: The shares of companies in the consumer staples sector are usually less volatile than those in sectors closely tied to economic cycles. However, this sector is not immune to valuation risks, particularly when combined with disappointing earnings. In this case, companies haven't managed to raise prices enough to offset increasing costs which has impacted the bottom line.

China’s Economy is Faltering due to its Zero-Covid Policies

China’s industrial output fell 2.9% in April from a year ago, while retail sales fell 11.1% as the country’s harsh lockdowns took their toll on the economy. While the output from the mining and utilities sectors increased, manufacturing output declined by 4.6%. The auto and equipment-manufacturing sectors have been worst affected by these lockdowns — resulting in even more shortages around the world.

Unemployment rates in major cities also rose, which contributed to the drop in retail sales. Economists are now lowering their forecasts for China’s economic growth for the year, with some saying they believe the economy may already be entering a recession.

The interruption to manufacturing is also affecting global companies like Apple ( NASDAQ:AAPL ), Tesla ( NASDAQ:TSLA ) and Toyota ( NYSE:TM ) , who have manufacturing operations in China. Foreign companies are now reducing their investments in China, and some are even considering relocating their operations elsewhere, according to a recent survey by the American Chamber of Commerce in China. Besides the Covid-related lockdowns, businesses are also concerned about geo-political issues and China’s close relationship with Russia.

The Insight: China’s Zero-Covid policy is clearly having a detrimental effect on the outlook for its economy and on global supply chains. However, the good news is that there may be some relief in sight. Shanghai has already begun to relax its lockdown, and the impact on the economy may force the government to rethink its approach. Earlier this year it relaxed the crackdown on technology companies when stock prices fell to new lows, so it’s not unheard of for China’s government to change course.

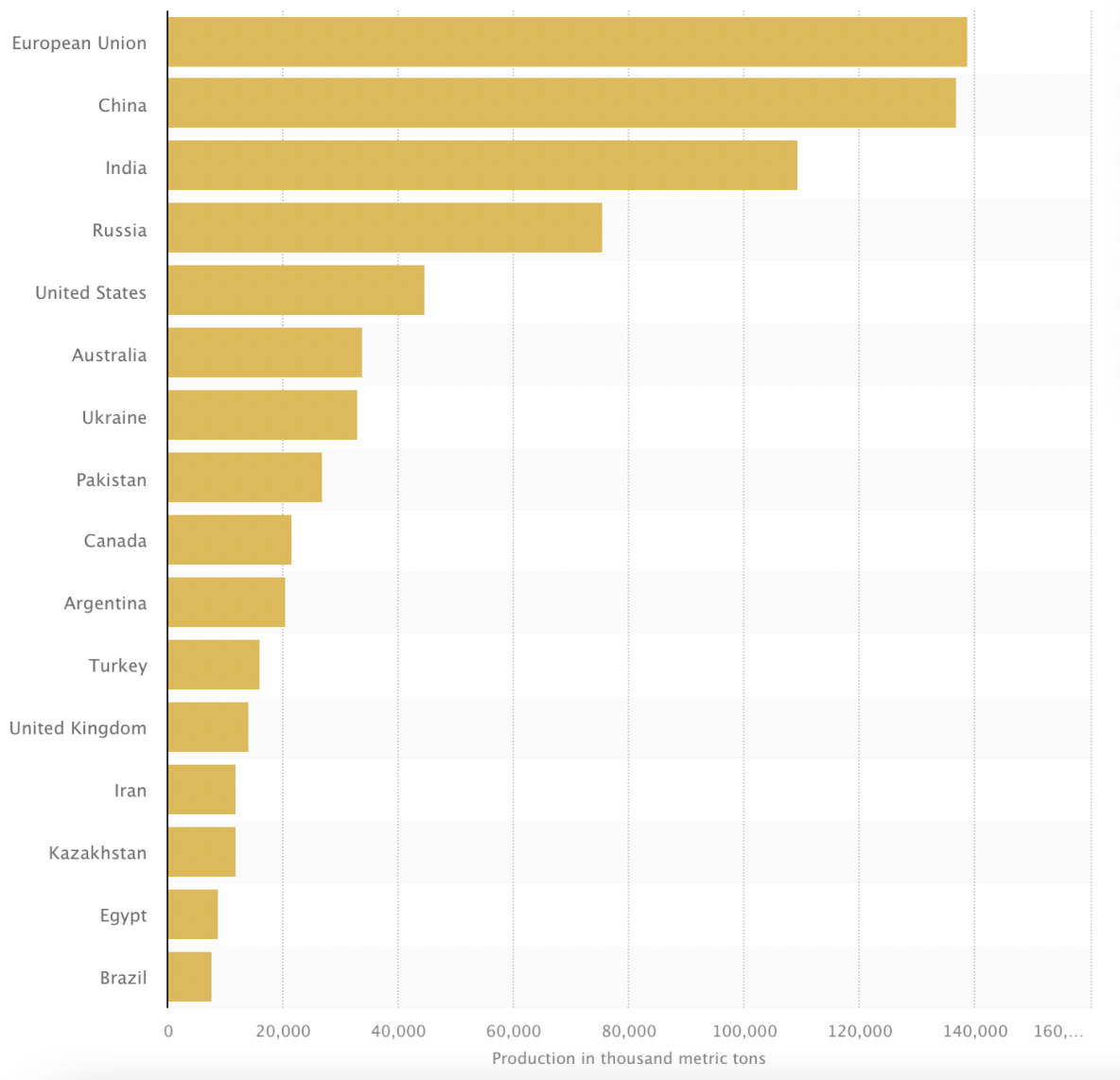

India Bans Wheat Exports

Last week, India announced that it was banning wheat exports as heatwaves affect current harvests. India is the third largest wheat producer in the world, and with Russia and Ukraine also historically being major producers, this is a significant development in the international supply of wheat.

Top 10 wheat producing countries 2021/2022 (in 1,000 metric tons) Source: Statista.com

At least 15 countries have now enacted bans on exports of various agricultural products , but this is the most significant ban. Countries generally decide to ban exports in a bid to combat local food inflation. The effects will be felt most by the populations of countries that are net importers of grain products, and particularly those with weak currencies. The largest markets for India’s wheat are Turkey (which is already dealing with hyperinflation), Egypt, Israel, Indonesia, Tanzania and Mozambique. However, because products like wheat are traded globally, higher prices will affect any country that imports grain products.

Source: International Food Policy Research Institute ( CNBC )

For India, the ban will result in lost foreign exchange revenue — however the country needs to weigh this up against the fact that wheat is becoming unaffordable for local consumers.

The Insight: Food security is a major concern for governments around the world, and often results in export bans, which can then jeopardize food security in other countries. Wheat is now trading at record high levels which is likely to put more upward pressure on inflation around the world.

Market Outlook Next Week

Next week, the Reserve Bank of New Zealand (RBNZ) will be releasing its Monetary Policy statement and Interest Rate decision for the quarter. The RBNZ holds policy meetings seven times a year, and just increased its cash rate by 0.50% last month. Similarly, the Bank of Japan will also be holding a press conference on the country’s monetary policies this coming Wednesday.

Earnings season in the U.S. is still ongoing, with these notable companies releasing their reports next week:

- Zoom Video Communications ( NASDAQ:ZM )

- NVIDIA Corporation ( NASDAQ:NVDA )

- Alibaba Group Holding Limited ( NYSE:BABA )

- Costco Wholesale Corporation ( NASDAQ:COST )

- National Bank of Canada ( TSX:NA )

Additionally, Australia, New Zealand and Canada will be announcing reports on retail sales.

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.