What Happened in the Market This Week?

Market Insight for 13th June - 20th June 2022

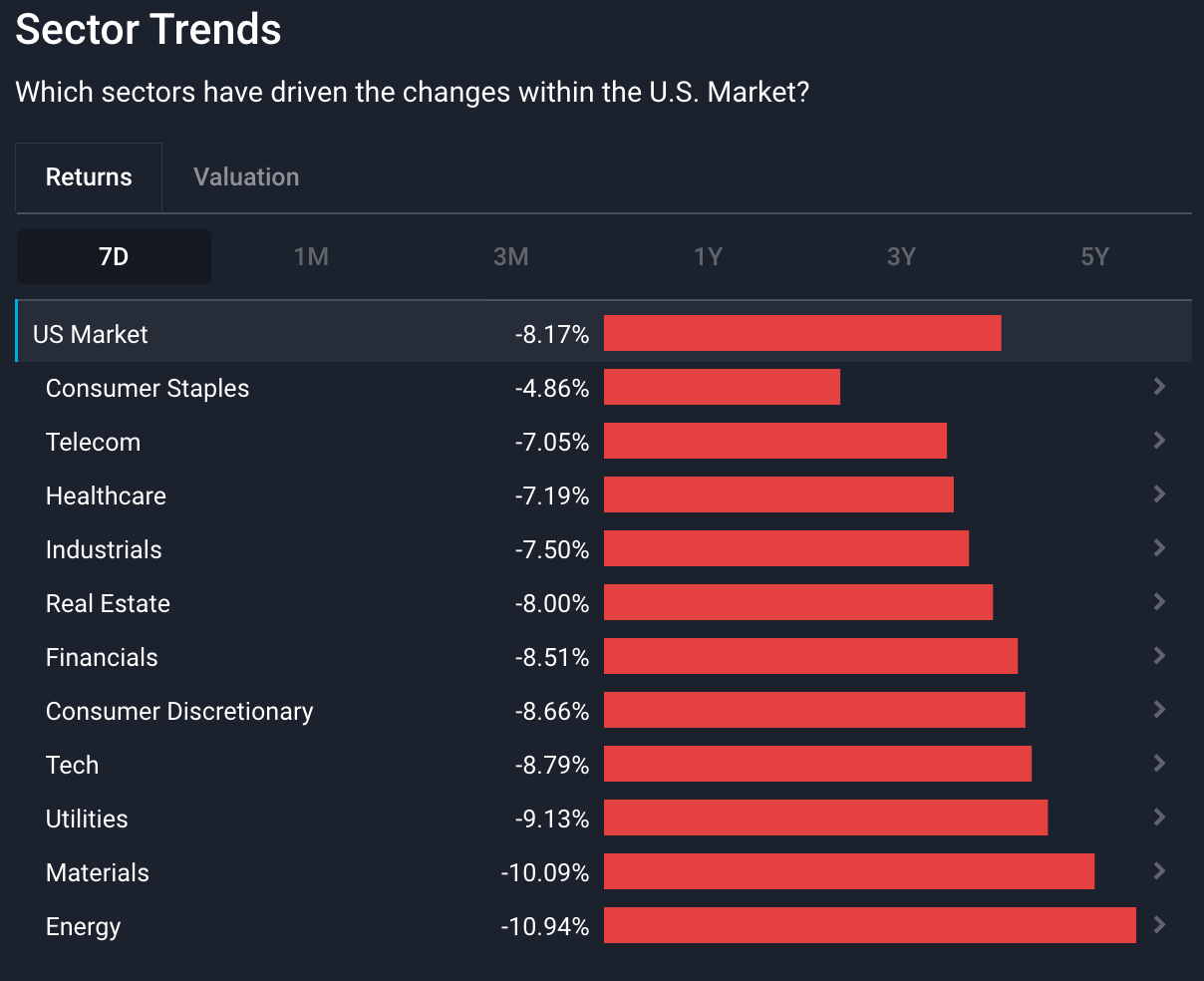

Global equity markets sold off again after U.S. inflation data suggested that food and energy prices rose more than expected. Over the past week, U.S. equity sectors were all sharply lower with energy , materials , and utilities faring the worst.

These are some of the developments we are watching:

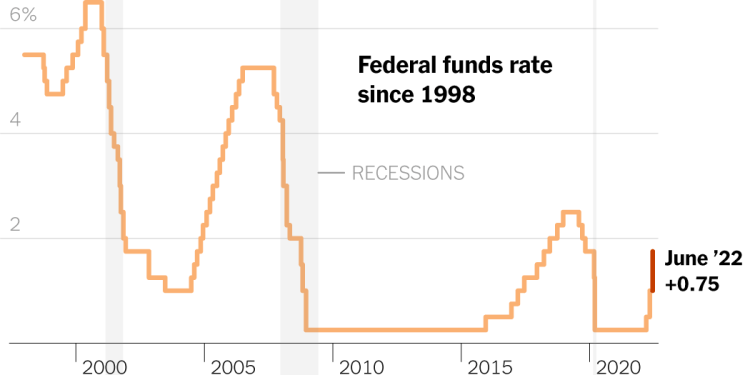

- The U.S. Federal Reserve raised rates by 0.75% after consumer inflation rose more than expected to 8.6% in May.

- The European Central Bank confirmed that it will raise rates by 0.25% in July and begin to taper its bond purchases.

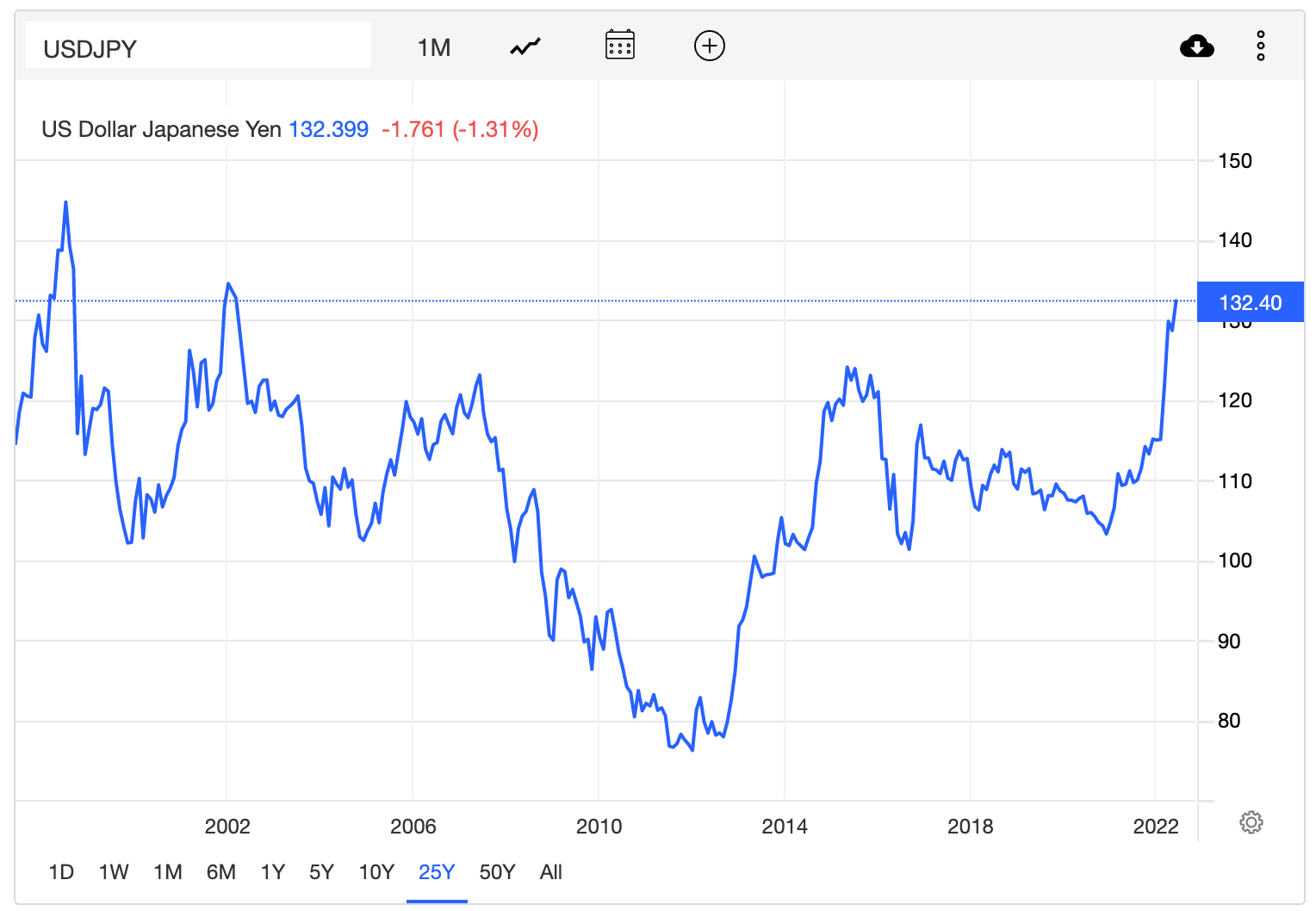

- The Japanese Yen fell to its lowest level since 1998 as the Bank of Japan continues its policy of yield curve control to stimulate its economy.

U.S. Sector 7D Performance - 17th June 2022 - Simply Wall St

Fed raises rates 0.75% as U.S. CPI figures reach 40-year high of 8.6%

The Fed raised the benchmark Fed Funds rate by 0.75%, the first time it has been raised by this much since 1994. The target range is now 1.50 to 1.75% , compared to 0 to 0.25% at the beginning of the year.

Until earlier this week the benchmark rate was expected to be raised just 0.50%. The larger than expected rate hike was in response to the U.S. consumer inflation rate for May which came in at 8.6%, compared to consensus forecast of 8.3%.The month-on-month inflation rate of 1% was also well above the 0.6% that economists expected. Interestingly, the core CPI rate which excludes food and energy matched forecasts at 6%. This reflects the substantial and unpredictable effect food and energy prices are having on the economy. The core inflation rate of 6% may seem high considering it excludes food and energy - however, the price of most goods and services reflect energy costs to some degree.

The FOMC (Federal Open Market Committee) members now expect the benchmark rate will be 3.4% by the end of the year, and 3.8% by the end of 2023. This is 1.5% higher than their estimate in March — however, it’s also a lot closer to what bond yields have suggested for some time.

Many analysts have believed that the Fed has been responding to inflation too slowly . The central bank is now acting more decisively, and appears to be committed to combating inflation “whatever it takes.”

This is because the Federal Reserve’s mandate aims to use monetary policy to “effectively promote the goals of maximum employment , stable prices , and moderate long-term interest rates ”. Considering the first goal is largely addressed (only 3.6% unemployment ), but inflation (price stability) is proving incredibly high and interest rates are still incredibly low, you can be sure that the Fed will be focusing on the latter two goals for the foreseeable future by raising rates.

The Insight: Until the Federal Reserve starts to see “ clear and convincing evidence ” that inflation is starting to come back down to the 2% goal, it is likely that interest rate hikes will continue.

The Fed’s more aggressive stance is likely to continue to weigh on stocks that are negatively affected by higher interest rates. These include companies with high levels of debt as they will have higher debt service costs. The stock prices of growth companies without positive cash flows are also at risk, as future cash flows will need to be discounted by a higher interest rate.

Our analysts have put together a collection of stocks that could benefit from a rising U.S. Dollar.

ECB confirms 0.25% July hike and tapering

The European Central Bank (ECB) confirmed its intention to raise interest rates by 0.25% in July, and to begin tapering its quantitative easing policy. Europe’s inflation rate is also above 8%, and it’s likely to take several rate hikes to bring it down. The ECB’s current intention is to raise rates in July, September, December and the first quarter of 2023, subject to a change in conditions.

Like many central banks, the ECB embarked on a program of quantitative easing to support European economies during the Covid-19 pandemic. The reversal of quantitative easing is known as tapering and essentially means the bank will stop buying bonds. More specifically, the ECB will stop net asset purchases — so it will be buying some bonds and selling others to provide liquidity where needed. The ECB also intends to raise some rates while leaving others unchanged.

On Wednesday, the ECB also held an emergency meeting to discuss the current market situation. The ‘Governing Council’ announced that a new anti-fragmentation instrument will be developed.

This is a response to Europe’s unique position: having one central bank and numerous member nations with different borrowing needs. In particular, the economies of Italy , Spain and Greece have much higher debt service costs which will put their economies in a difficult position when the ECB stops buying bonds. The anti-fragmentation instrument aims to provide more flexibility to certain economies during the tapering process.

The Insight: One thing to note about the ECB’s statements is that they are being very cautious about these rate hikes. ECB President Christine Lagarde emphasized that “ gradualism is probably appropriate .” The ECB is faced with the challenge of high inflation and an economy that is not as strong as it is in the U.S. If the central bank is forced to raise rates quickly, it may have a more pronounced effect on European companies, and is something investors should be aware of.

Japanese Yen weakness and the Bank of Japan's yield curve control

The Japanese Yen fell to its lowest level since 1998. Besides USD strength, The Bank of Japan’s (BoJ) policy of yield curve control (YCC) has resulted in the currency weakness. YCC is the central bank’s policy to keep the 10 year JGB (Japanese government bond) yields below 0.25% by buying those bonds (that’s because bond yields fall as prices rise from buying, and vice versa). This YCC is done to encourage lending to stimulate the economy with lower rates and to combat the deflation they’re experiencing.

USD/JPY 1997 to 2022 Source: tradingeconomics.com

Unlike most countries, Japan is suffering from deflation and is struggling to keep its inflation rate above its 2% target. But, as much as the BoJ would like to keep rates low, YCC may be unsustainable. When a central bank buys government bonds it amounts to money printing which typically leads to currency weakness from the increased supply of money and the lower interest rates make holding that currency even less appealing. Add to this the growing differential between U.S. and Japan’s interest rates, and there is not much appeal to own Yen.

A slightly weaker Yen is generally regarded as being beneficial to Japan’s economy as it makes exports more affordable for consumers in other countries. However, when the Yen is under as much pressure as it is now it creates greater uncertainty and discourages investment. A weak Yen can also lead to falling demand for commodity imports due to the lower international purchasing power of the Yen, which can therefore affect producers in other countries that export to Japan. The impact on stocks like Sony , Toyota and Panasonic is mixed given they benefit from a weaker Yen through their exports, but rises in their costs are increasingly difficult to pass on .

Many investors aren’t optimistic about the BoJ’s ability to maintain this stimulus. BlueBay Asset Management, a U.K. based hedge fund, is challenging the BOJ’s bond buying policy. The fund is building up a short position in Japanese government bonds as it anticipates the BoJ will have to abandon the policy, resulting in a selloff in bonds. Either way, further Yen weakness or volatility could be on the horizon.

The Insight: What’s occurring in Japan is indicative of what can occur in any country if a central bank gets heavily involved in a market. Japan is in an incredibly tough situation with its demographics and lack of growth leading to a situation where the Bank of Japan is heavily intervening to try and stimulate.

If the BoJ didn’t buy these bonds to artificially keep the interest rates low, natural selling of JGB would likely outweigh the buying and those bond prices would go down, which consequently pushes their yields up. When yields go up, capital costs more because of higher interest rates and thus Japan’s already low growth and deflation situation could be even worse.

Market Outlook Next Week

It’s a fairly quiet week for economic data, but market watchers will find out more about inflation around the world when the inflation rates for the U.K. and Japan are published this week. Australia’s central bank will also be releasing the minutes of the last interest rate meeting (where it raised rates 0.5%).

In the U.S., existing home sales and new home sales will give us an idea of how higher interest rates are affecting the real estate market. U.K. retail sales data will also be released on Friday.

The few remaining companies due to report first quarter financial results include non-US companies and a few small caps.

Some of the notable companies reporting include:

- Carnival Corporation & Plc ( NYSE:CCL )

- Accenture Plc ( NYSE:ACN )

- BlackBerry Limited ( NYSE:BB )

- FedEx Corporation ( NYSE:FDX )

- FactSet Research Systems Inc. ( NYSE:FDS )

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.