What Happened in the Market This Week?

Market Insight for 29th July - 5th Aug 2022

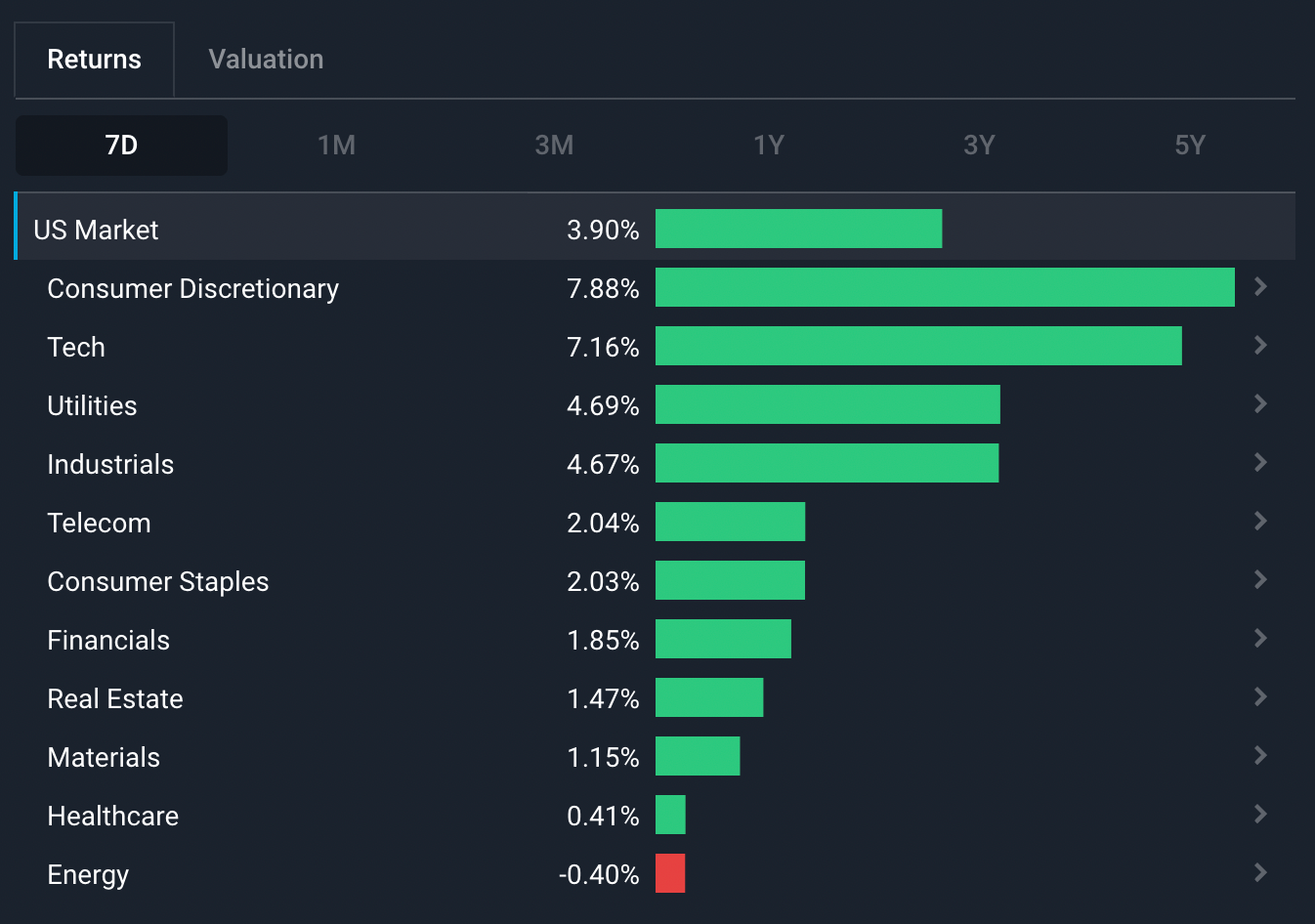

Global equity markets continued their rally last week and the S&P 500 index is now up 14% from its June low. Technology and consumer discretionary stocks have led the way higher after being the most oversold in the months leading up to June.

Q2 Earnings Reports continued, with notable companies including Tesla ( Nasdaq:TSLA ), Uber ( NYSE:UBER ), Airbnb ( Nasdaq:ABNB ) , and HSBC Holdings ( LSX:HSBA ) releasing their reports earlier this week. A full list of this week’s earnings calendar is at the bottom of last week’s market insight article . The tech sector’s rally is partly attributed to the stronger than expected earnings results released in the last few weeks.

U.S. Sector 7D Performance - 5th Aug 2022 - Simply Wall St

Some of the developments we have been watching over the last week include:

-

The U.S. is now technically in a recession , though officially it isn’t quite yet.

- US-China relations are deteriorating again after U.S. House Speaker Nancy Pelosi’s trip to Taiwan.

The U.S. is Now in a Recession - but NBER doesn't agree!

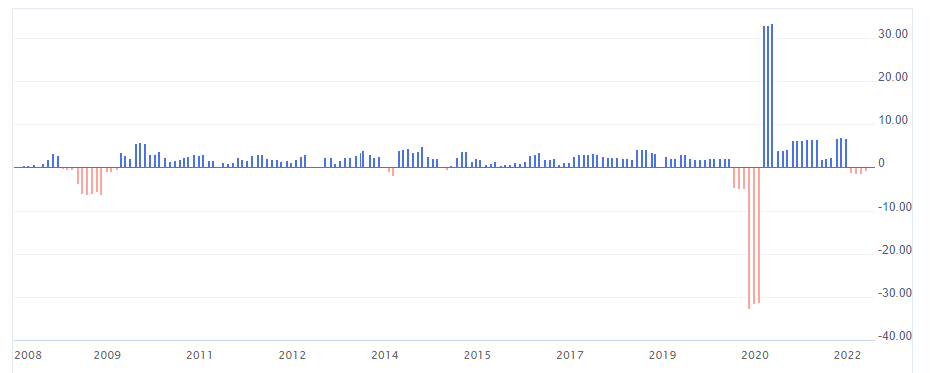

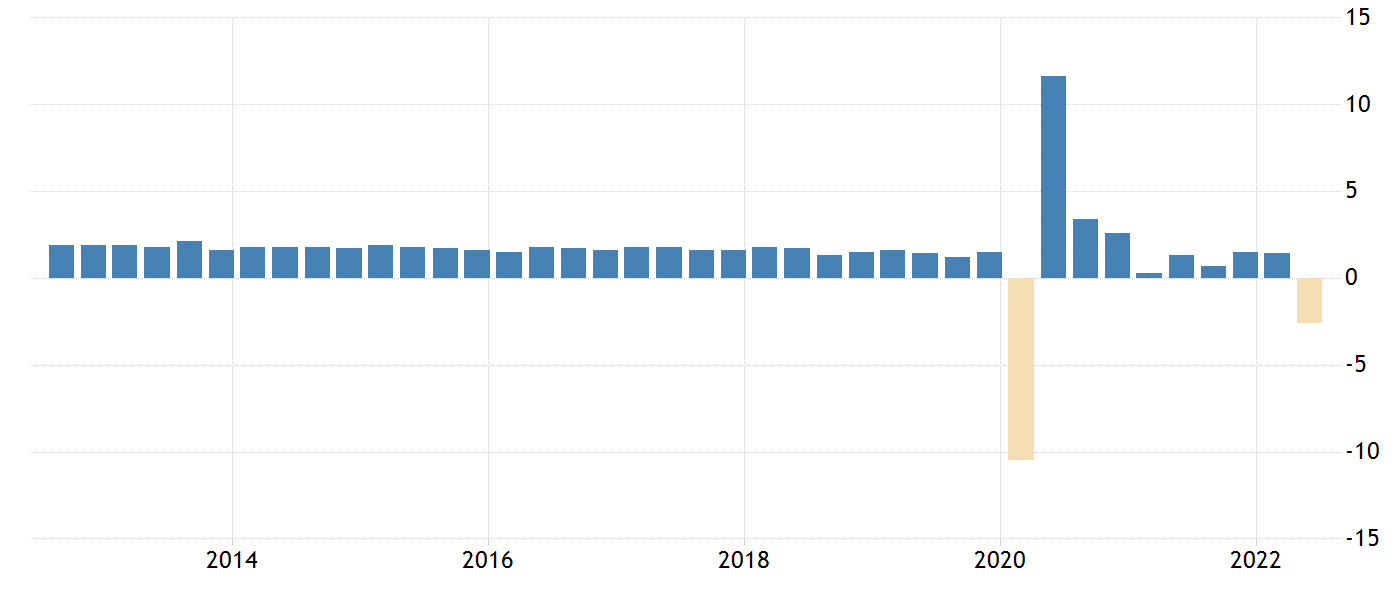

Last week, we found out that the U.S. GDP contracted by 0.9% during the second quarter. This followed a contraction of 1.6% during the first quarter, which means the U.S. economy is in a recession by the technical definition — i.e. two consecutive quarters of negative GDP growth.

United States Quarterly GDP Growth Year on Year - Image Credit: Investing.com

So is the U.S. actually in a Recession?

The definition mentioned above is a commonly cited definition of a recession, but not the only one. The U.S. National Bureau of Economic Research looks at a broad range of indicators to determine whether the economy is in a recession. And according to the NBER, the answer is no: the U.S. is not yet in a recession .

So technically , the U.S. is in a recession, but hold your horses because officially it’s not - yet ! The debate is academic really, because what really matters is how long it lasts and how severe it ends up being. If businesses and consumers feel like the economy is in a recession they are likely to spend and invest less, and that makes it more likely to occur. In one of our previous market updates, we go into the recession topic a bit more, including whether a recession is inevitable .

Is the Rest of the World in a Recession?

Most countries have yet to publish their second quarter GDP growth rates, and growth rates for the first quarter were generally positive. But several economists see recessions around the world as inevitable - in particular, the EU, U.K., Japan, Korea, Australia, and Canada are predicted to follow the U.S. into a recession . China’s GDP growth rate also fell to just 0.4% in the second quarter, after averaging 5.4% over the previous four quarters.

Whether or not the world is in, or entering, a recession, there is no doubt that economic activity has slowed considerably following persistent inflation rates and increasing interest rates .

The Insight: What does a Recession mean for me?

👉 There are two ways to think about investing during a recession: you can play defence or you can take opportunity . Playing defence means limiting losses and avoiding stocks that might not recover. Acting opportunistically means taking advantage of market weakness to make long term investments at bargain prices.

From a defensive standpoint, here are few points to remember:

- Make sure you have an emergency fund set aside, so that you won’t be forced to sell investments at the worst possible time.

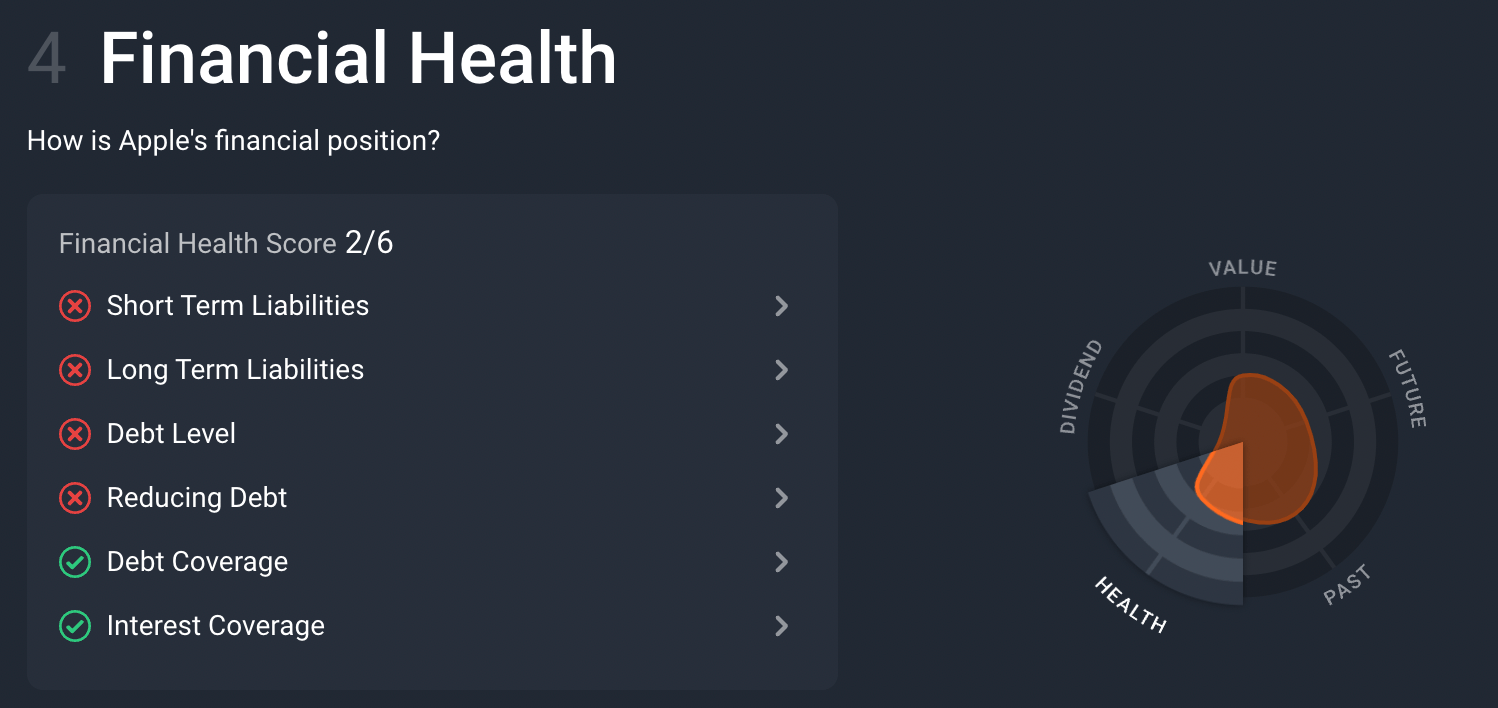

- Avoid or reduce exposure to speculative stocks and those that have a lot of debt relative to their cash flows. You can review our Financial Health checks we do in our company summaries to see if a business is using too much debt.

- Consider holding some companies in the defensive sectors such as healthcare , utilities and consumer staples . These sectors are considered defensive due to their products being in constant demand d espite volatility in the macroeconomic environment.

- Defensive sectors also experience relatively less volatility compared to the broader market - which means less drop in a downturn, but also less growth during a rally. As always, diversifying your portfolio with stocks from different sectors is a good way to balance your exposure amongst the industries .

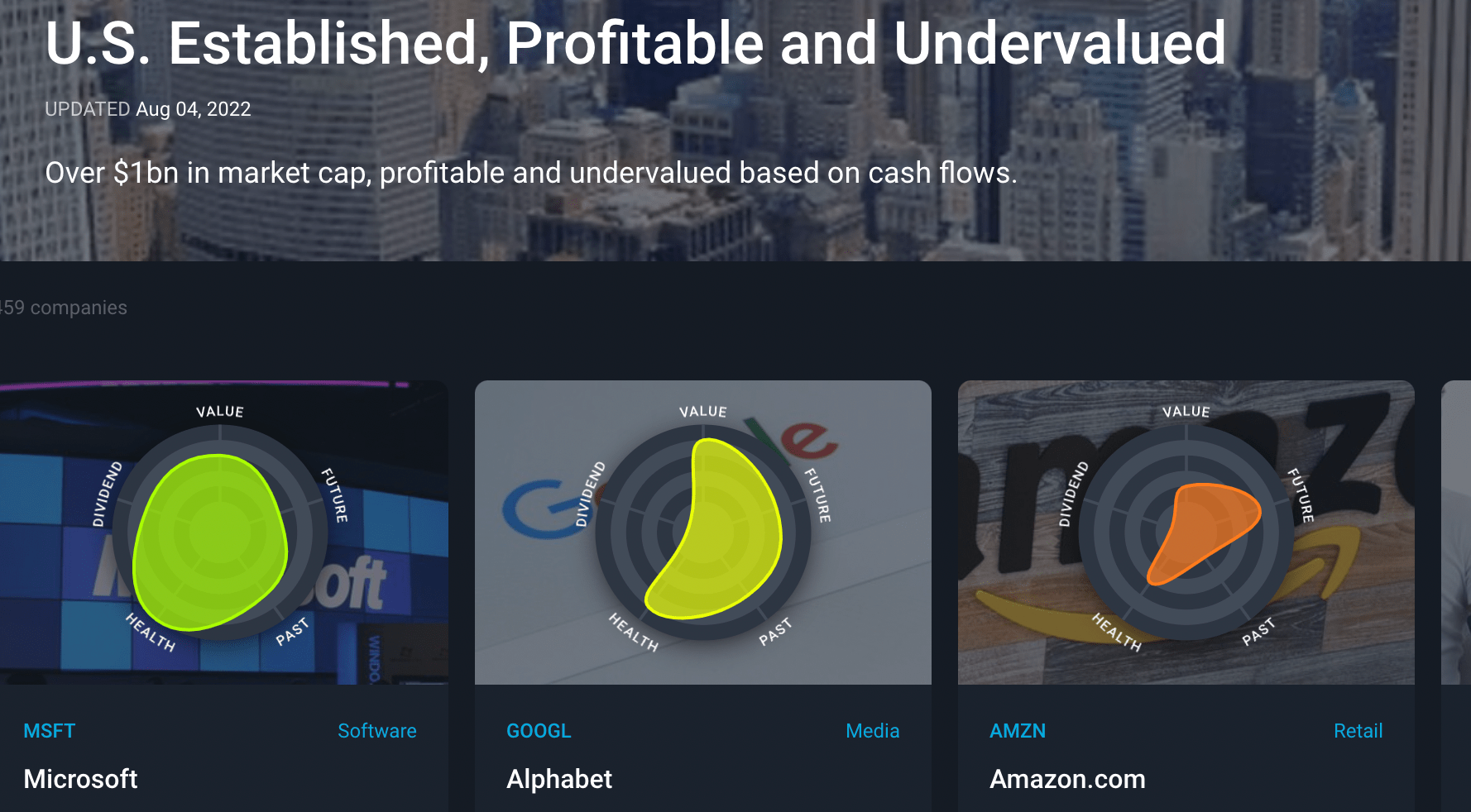

As far as opportunistic investing goes, bear markets and recessions can provide great opportunities to buy high quality stocks. Here are a few ideas to help you out:

-

Companies that perform well long-term tend to have some combination of industry leadership, competitive advantage, good margins and cash flows, a growing market, and solid leadership . Bear markets offer us the rare opportunities to buy them at reasonable or even bargain valuations.

- It may be tempting to simply buy the stocks that performed the best during the previous bull market, in the hope that they will return to their previous highs. However, many of the outperformers during the late stage of a bull market are speculative stocks in a bubble territory . If they were trading on unrealistic valuations back then, there’s a good chance they won’t regain their highs.

- Again, it’s not easy to time the market, nor do we advocate it. If a stock you are interested in is trading at a large discount relative to your estimate of fair value, dollar cost averaging can be a good way to slowly build a position in high-quality stocks during the volatile markets.

- This way, if its price declines further, you’ve still got more ammo to put into it, and if its price starts climbing after your first partial purchase, you’ll be glad you started building your position when you did!

👉 Lastly, with long-term investing during periods of market volatility like this, investors should remember to choose a balance of defensive/growth stocks that suits their investing profile. Not every investor has the same risk tolerance or financial objectives.

US-China Relations are Deteriorating Again - What Does it Mean for Investors?

Back in 2019, it was a well-known fact that the U.S. and China entered into a trade-war, which caused political and economic unrest. This week, U.S. House speaker Nancy Pelosi’s trip to Taiwan has reignited tension between the U.S. and China. While Pelosi said the U.S. will not abandon Taiwan, China began military drills in the seas and airspace surrounding Taiwan.

Global markets initially reacted with increased volatility, but soon shrugged off the fears and rallied to levels last seen in early June. But it still seems that the relationship between the U.S. and China is deteriorating .

To some extent this has also proved to be a distraction from China’s own economic problems. As mentioned in our previous Market Insight, China’s economy came close to shrinking in the second quarter and the country is facing a nationwide real estate crisis which could spill over to the financial sector.

Either way there are implications for the global economy and financial markets.

China Quarterly GDP Growth Year on Year - Image Credit: Tradingeconomics.com

How does China affect the Global Economy?

China is the second largest economy in the world and accounts for around 17% of the global output, compared to the U.S.’s 24%. It is also the U.S.’s largest trading partner, alongside several other emerging economies and countries like Australia that supply and import resources to China. China’s Covid-19 lockdowns over the last two years have had a major impact on global supply chains, which illustrates just how integrated China is with the world economy.

Besides China’s own economy, there are now two more concerns related to China. The first is another increase in geopolitical tension, which could potentially see China become more closely aligned with Russia . The second is a return to the US-China trade war that had supposedly ended back in 2021.

The Insight: How to Manage your Portfolio during Political Crises

With the Russian-Ukraine conflict already causing highs in energy and commodity prices, international tensions around the world are now reinforcing the importance of resilience in systems rather than cost efficiency (the main reason why Western countries export labor into countries like China). Global companies have started building independent systems and moving investments outside of China in a bid to limit exposure to political conflicts, and increase their independence.

👉 With China-related risks rising, investors should consider how exposed their investments are to the region.

Several global companies depend on China for production and for sales. As an example, Apple ( NASDAQ: AAPL ) is dependent on China for manufacturing, and the country is an important market for companies like Nike ( NYSE: NKE ) . On the other hand, Alphabet ( NASDAQ: GOOGL ) and Meta’s ( NASDAQ: META ) sites are blocked in China, which would mean that escalated conflict between the U.S. and China would affect the latter two companies a lot less.

Stock Market Next Week

It's a relatively quiet week on the economic front, but there are plenty of companies reporting quarterly results.

On Tuesday , consumer and business confidence data will be released in Australia . Confidence impacts economic activity, and such is a key indicator for where the economy currently is or where it is heading to.

On Wednesday and Thursday , the latest monthly U.S. inflation rate and PPI data will be published. This will be key as inflation surprised on the upside in July.

On Friday , the U.K. ’s second quarter GDP growth rate will indicate whether the U.K. may be heading into a recession. U.K. GDP grew 0.8% in the first quarter.

🗓 Earnings Season Calendar (Aug 8 - Aug 12, 2022)

Mon 8 Aug

SoftBank Corp (TSE:9434) • Suncorp Group (SUN) • Marriott International (MAR)

Tue 9 Aug

Sysco (SYY) • Asahi Group Holdings (TSE:2502) • Hyatt Hotels (H) • Mazda Motor (TSE:7261)

Wed 10 Aug

Walt Disney (DIS) • Commonwealth Bank Australia (CBA) • Honda Motor (TSE:7267)

Thu 11 Aug

Siemens (SIE) • Resmed (RMD) • Zurich Insurance (ZURN) • Telstra (TLS)

Fri 12 Aug

China Mobile (SEHK:941) • Bharti Airtel (BSE:532454)

Until next week,

Invest Well,

Simply Wall St

Enjoyed this weeks article? Sign up for free to receive this in your inbox weekly!

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.