What Happened in the Market Last Week?

It was another choppy week for markets, but most sectors still finished the week in the green.

Investors chose to shrug off higher-than-expected inflation data and stronger retail sales (which is also inflationary). In light of this data, Fed officials have left the possibility of a peak Fed funds rate above 5.1% on the table if inflation persists higher for longer. So don’t pop the champagne yet.

The US Tech , Utilities and Consumer discretionary sectors led on the upside while most defensive sectors lagged once again.

Some of the developments we have been watching over the last week include:

- Artificial intelligence is the new ‘hot sector’ after the launch of ChatGPT which has started a new battle in the online search industry. Investors need to be careful though to distinguish hyped-up AI associates from legitimate potential.

- Europe’s economic prospects have improved, and some opportunities are present, but risks still remain.

The AI-Powered Search War Begins: Microsoft takes on Google

Artificial intelligence has once again attracted investor interest since OpenAI released its new ChatGPT chatbot in November. ChatGPT can answer questions, generate code and even write essays and poetry. Similar generative AI models can produce images, videos and music based on simple text instructions. These models don’t always get things right, but they give us an idea of where the world is headed.

Microsoft ( Nasdaq: MSFT ) initially backed Open AI with a $1 billion investment, and reportedly plans to invest another $10 billion in the coming years. Microsoft also plans to incorporate the AI model in its new Bing search engine in a bid to challenge Google.

Alphabet ( Nasdaq: GOOGL ) responded by announcing that it will soon make a similar model available as part of Google search. During a demo of Google’s ‘ Bard ’ chatbot, the model produced inaccurate answers, resulting in a market stir that led to Alphabet’s share price falling 9% . It’s worth pointing out that Microsoft’s ChatGPT-powered Bing demo also produced some errors .

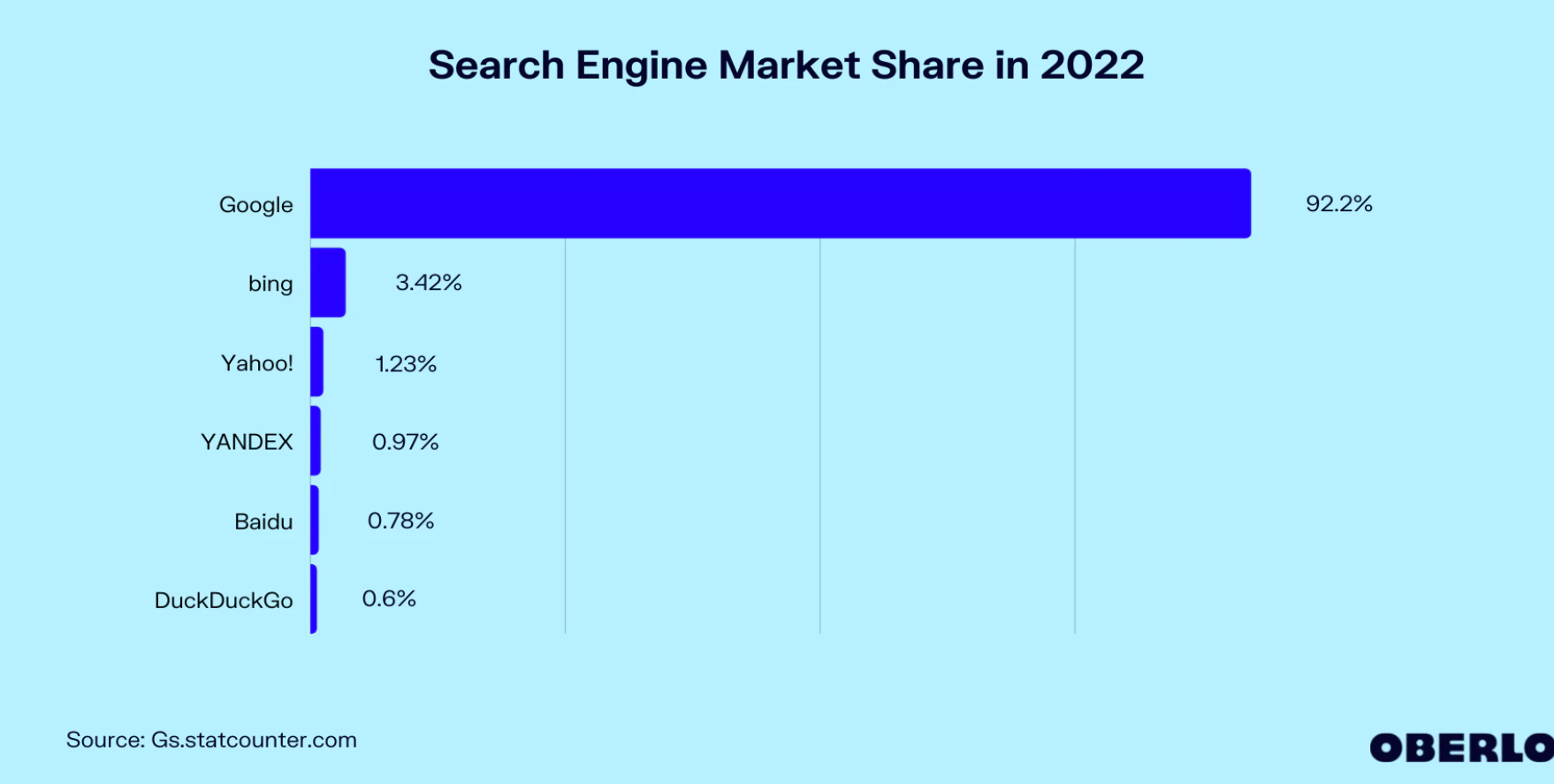

Nevertheless, the search industry, which Google has dominated for two decades, has been upended.

Search Engine Market Share 2022 - Image Credit: Oberlo.com

Is Alphabet in trouble?

When ChatGPT was launched, Alphabet’s management reportedly went into panic mode and issued a code red. That doesn’t mean Alphabet didn’t already have something in the works - the company has invested in and developed dozens of AI projects over the years. But giving Google search users the answer they want instead of a list of links and ads (ie. something that can be monetized) just wasn’t in their interest. Microsoft has now forced Google’s hand, and the search industry could soon look very different.

The challenge both companies now face is finding a way to give users a better search experience and still make money. AI-enhanced search is also more expensive in terms of the computing power required - so until both companies figure out a model that works, it could be a costly transition.

Given their relative market share, Microsoft has a lot to gain and Alphabet has a lot to lose. Google does still have some advantages though. ‘Googling’ is a habit for many people, and habits are hard to break, while Bing has always been an unpopular search engine. Microsoft’s product will need to be noticeably better to lure users away from Google.

💡 Insight: There’s a lot more to AI than ChatGPT and Bard

Artificial intelligence is once again topical - but the AI revolution isn’t new and it’s already being used in almost every industry. For investors, there are lots of ways to invest in AI, either directly, or indirectly.

We can break these opportunities down into three types of companies:

- AI providers: Companies that actually provide AI-powered solutions to other businesses. Alphabet , Microsoft , and IBM ( NYSE: IBM ) are just a few examples.

- AI-powered companies: Companies that use AI as a core part of their business to improve productivity and efficiency. Meta ( Nasdaq:META ), Crowdstrike ( Nasdaq: CRWD ) , and AstraZeneca ( LSE:AZN ) fit into this category.

- Infrastructure and equipment providers: Artificial intelligence uses significant computing power. Cloud infrastructure providers like Microsoft , Alphabet , Amazon and IBM provide computing power to most of the market. Semiconductor companies like Nvidia ( Nasdaq: NVDA ), AMD ( Nasdaq: AMD ) and TSM ( NYSE:TSM ) provide the chips that power these data centers.

Check out our top AI stocks collection for more AI-related companies.

For Short or Medium-Term Investors (< 5 years)

While the long-term potential of AI is very compelling, in the short to medium term there are risks of a bubble amongst AI related stocks. Case in point: Buzzfeed ( Nasdaq: BZFD ) rallied 300% after announcing it will use ChatGPT to generate some content. C3.AI ( Nasdaq:AI ) is up 125% YTD, and, while the company did announce a new suite of generative AI tools, the move seems a bit extreme. If this is a bubble, there could be better opportunities on the other side.

For Long-Term Investors (5+ years)

If you are investing in AI-related companies, there are two key factors to consider:

-

An impressive AI model will have some value. But the real value will come from having a business model that can effectively monetize it. Look past the impressive demos and try to find out how a company will make money from its AI investments.

-

Artificial intelligence models learn and make predictions using data, so the quality and quantity of data that goes into a model has a considerable impact on its accuracy.

Just imagine the data companies like Facebook , Alphabet , Salesforce and Visa have access to. Companies that already have access to valuable datasets have a significant advantage.

Europe’s Economic Outlook is Improving

Europe’s economy has been stronger than anticipated. Last week the EU Commission raised its growth forecast for 2023 from 0.3% to 0.9% . The Eurozone economy reportedly grew by 0.1% in the fourth quarter, which was slightly better than the expected 0.1% drop .

The relatively mild winter meant energy prices were lower than anticipated, helping with inflation and taking some pressure off consumers. Corporate earnings reported so far for the fourth quarter were also generally better than expected and are expected to have risen 11.4% year-on-year according to Refinitiv.

European Central Bank and Bank of England rates playing catch up with US

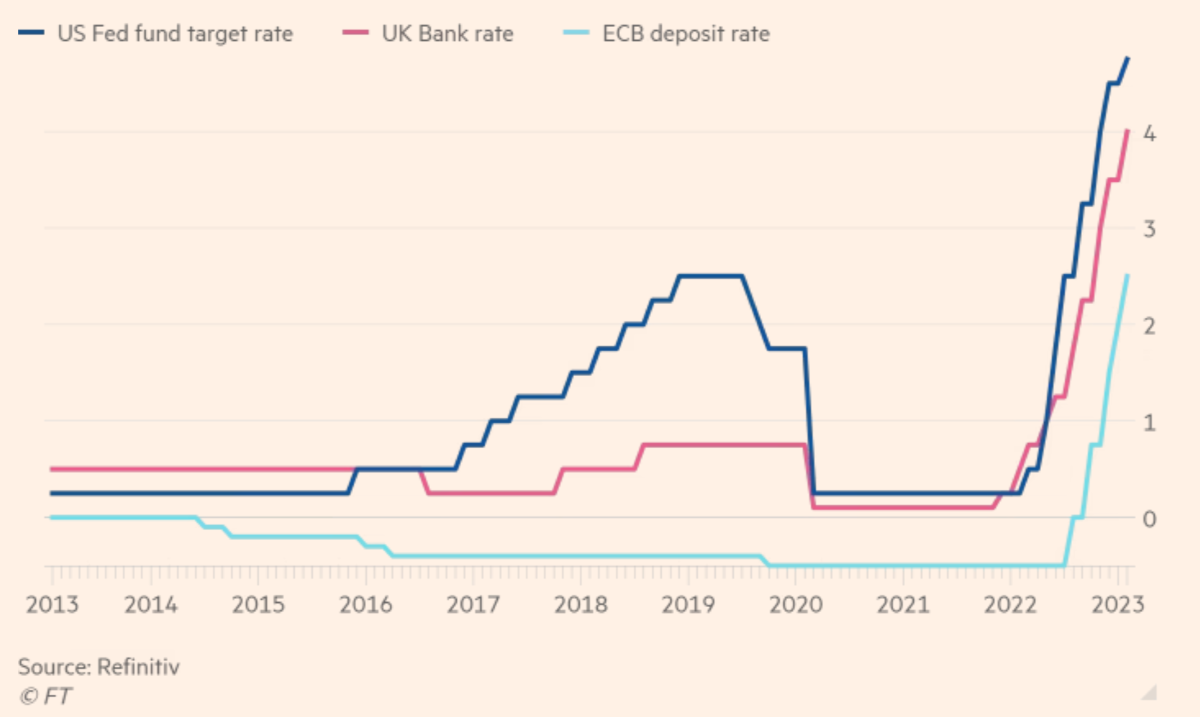

Interest rates in Europe and the UK are still lower than the US Fed Funds Rate, but catching up now that the Fed has slowed the magnitude of hikes to 0.25%.

On Wednesday European Central Bank (ECB) governor, Christine Lagarde, said the bank intends to raise the deposit rate (currently at 2.5%) by another 0.5% in March . Lagarde noted that underlying inflationary pressures remain despite lower energy prices. Another ECB official said the rate could rise to 3.5%, and will likely stay there for some time.

The ECB will also accelerate its balance sheet reduction program which will remove liquidity from the financial system and could result in higher bond issuance - ie. more bond selling putting upward pressure on rates.

The UK is still under pressure in 2023

Data from the UK has also been better than expected. The economy expanded - barely - during the fourth quarter, growing by 0.1% after contracting 0.7% during the third quarter . Inflation fell more than expected in January, but is still just above 10%.

While the data is a little better than expected, the UK is still expected to be in a recession during the first half of this year. In fact, the UK is now the only G7 economy that the IMF expects to contract in 2023.

💡 The Insight: European markets have benefited from increased risk appetite

Flows into European funds have been strong in 2023. $7.1 billion flowed into European equity ETFs in January, compared to $1.7 billion in outflows from US equity funds. As we pointed out two weeks ago, risk appetite has increased amongst investors around the world and capital is flowing into some of the beaten-down markets trading on lower valuations. Like China and other emerging markets, this applies to Europe.

The economic outlook for Europe is better than it was a few months ago, but conditions are still far from rosy - inflation is still high, rates are rising and there is still ongoing war in Ukraine. Risk aversion could return quite quickly.

For Short or Medium-Term Investors (< 5 years)

While Europe and the UK’s interest rates catch up with US rates, the USD becomes less attractive on a relative basis - and the Euro and Pound strengthen. This benefits European companies that import, while exports are worth less. This could of course reverse if the inflation expectations rise in the US.

For Long-Term Investors (5+ years)

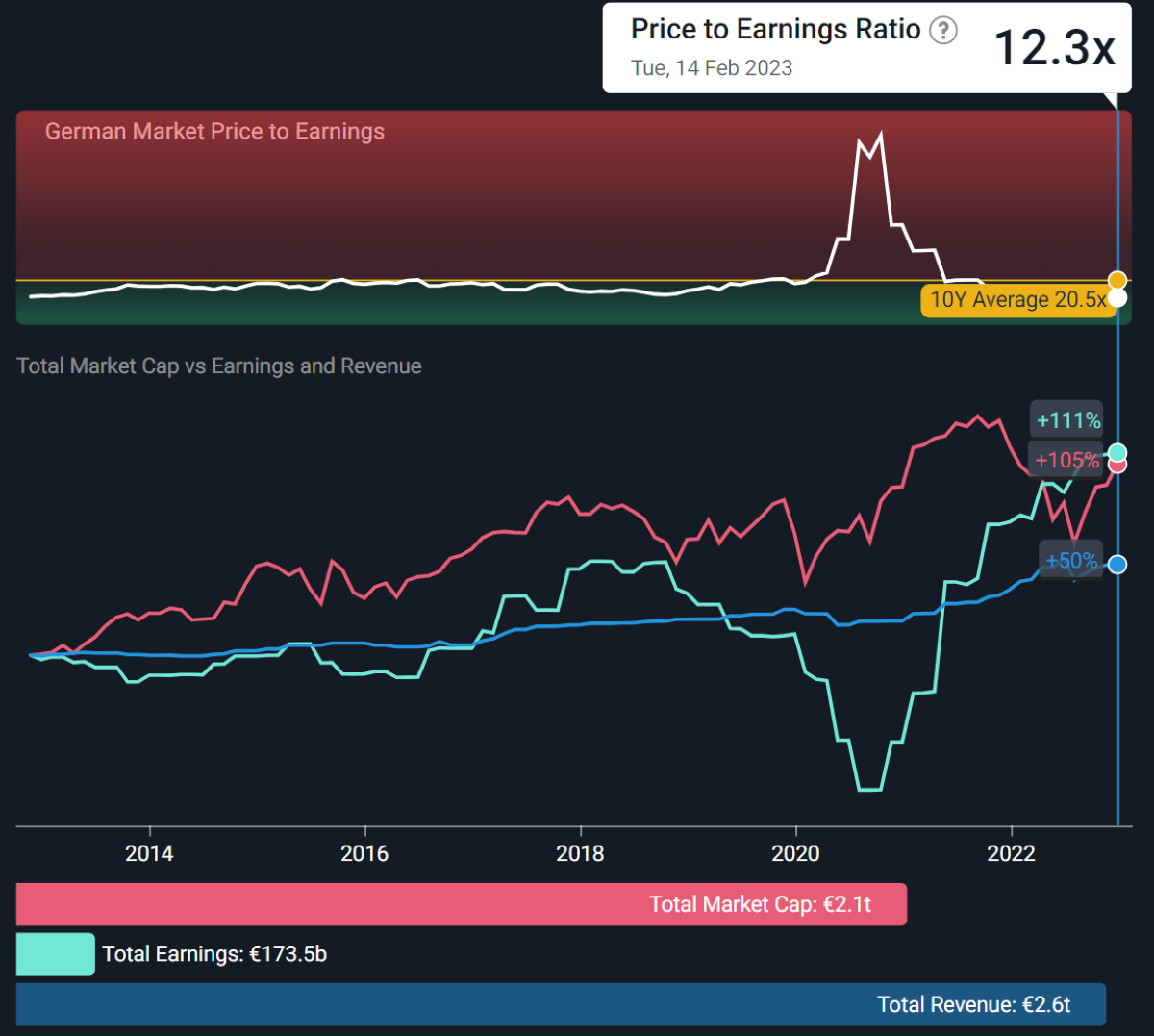

UK and European equities are mostly trading on lower price-to-earnings ratios than the US, while in some cases, like Germany, corporate earnings are at record levels. The lower valuations could imply the market is pricing in higher risk and lower earnings growth forecasts. However, this is the type of situation that can create opportunities, particularly amongst high-quality companies that operate around the world.

Key Events During the Next Week

Inflation will probably be the focus with the EU inflation rate out on Thursday and the US PCE price index on Friday. Elsewhere, Australia's central bank will announce its interest rate decision on Tuesday and the FOMC minutes from the last meeting will be released on Wednesday.

We are about 80% of the way through earnings season, but there are some large companies still due to report this week:

- Walmart ( NYSE:WMT )

- Home Depot ( NYSE:HD )

- Coinbase ( Nasdaq: COIN )

- Baidu ( Nasdaq:BIDU )

- Nvidia ( Nasdaq:NVDA )

- Alibaba ( NYSE:BABA )

- Palo Alto ( Nasdaq:PANW )

- Etsy ( Nasdaq: ETSY )

- Dutch Bros ( NYSE:BROS )

- Block ( NYSE:SQ )

- Moderna ( Nasdaq:MRNA )

- Intuit ( Nasdaq: INTU )

- Beyond Meat ( NYSE: BYND )

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.