What Happened in the Market Last Week?

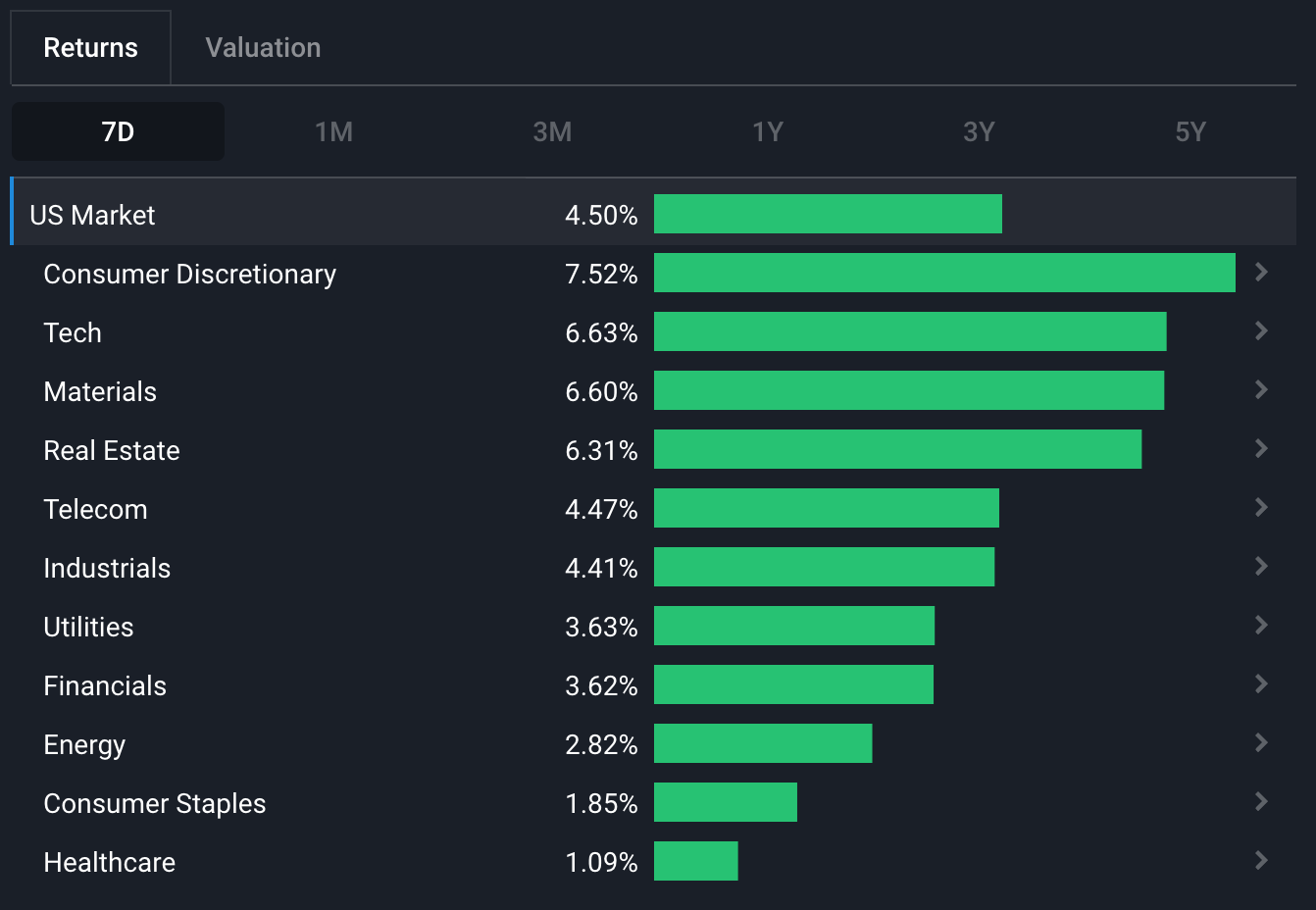

Equity markets continued a broad based rally in anticipation of a lower inflation print. In the US market, the economically sensitive energy , materials, and consumer discretionary sectors led the way, while the defensive sectors (utilities , consumer staples, healthcare) and real estate lagged.

Some of the developments we have been watching over the last week include:

- Fourth quarter earnings season is now under way and analysts are expecting 7 sectors to report an annual decline in earnings.

- Howard Marks’ recent “Sea Change” Memo outlined how we might be in for a new investing environment over the next few years, where the winning strategies of the past decade may not apply anymore.

Q4 Earnings Season Preview

Analysts have been cutting their forecasts since the beginning of the third quarter, and continued to do so during the fourth quarter as earnings were released. According to data gathered by Factset , earnings for S&P 500 companies are expected to be around 4% lower than they were in the fourth quarter of 2021. Other data aggregation services have estimates ranging from 0 and -7%.

As DataTrek pointed out, the average company usually beats consensus estimates by a few percent, so it wouldn’t be surprising to see earnings ultimately reported very close to where they were a year earlier.

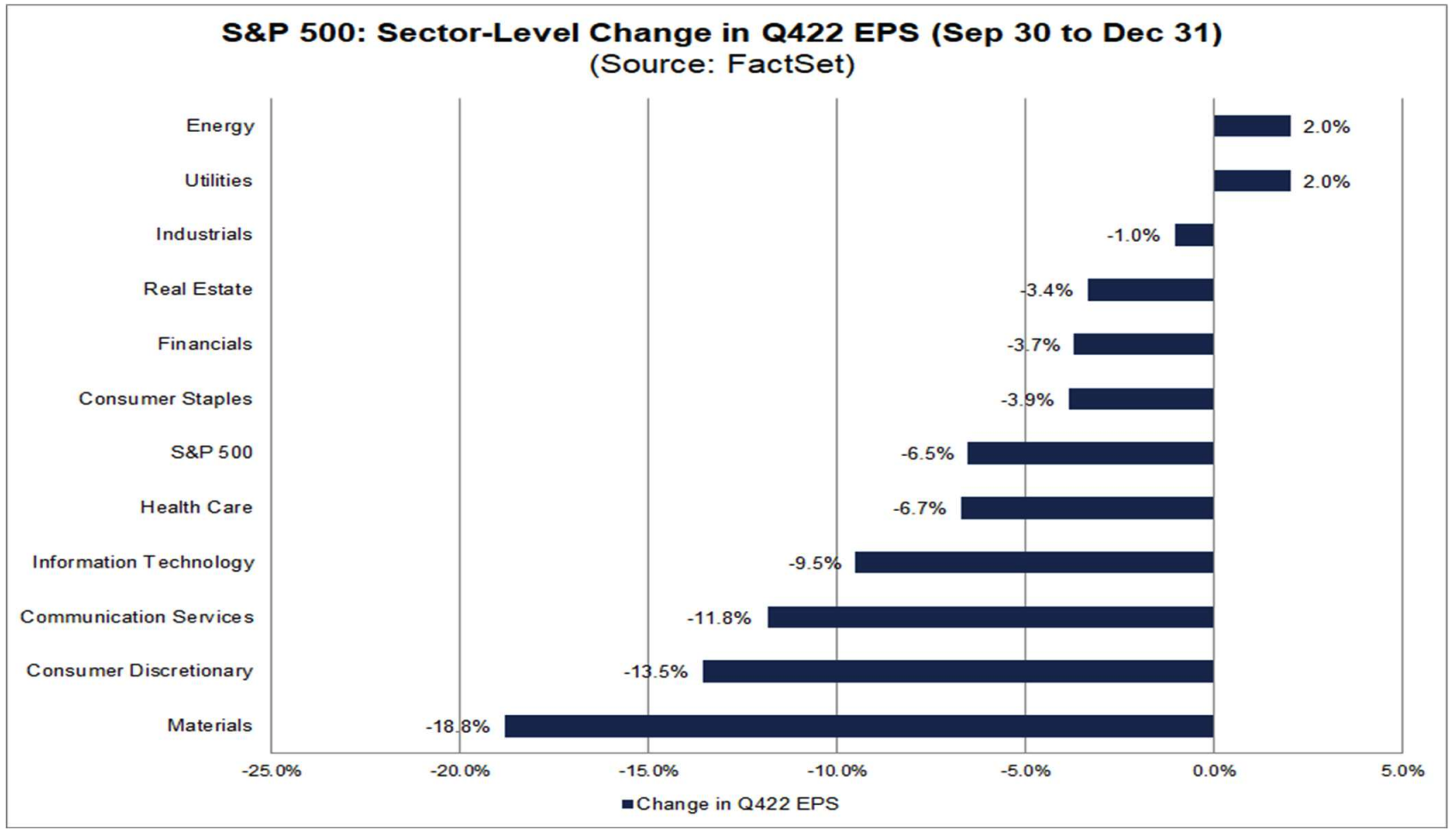

The largest cuts were to the materials sector - possibly the result of a slowdown in demand from China. Earnings forecasts for the consumer discretionary, tech, and telecom sectors were also cut substantially - continuing the trend from previous quarters. Forecasts for energy and utilities rose slightly.

Revenues are expected to be 3.8% higher. However, with a full year of consumer inflation above 7%, that shouldn’t be surprising. In fact, a 3.8% increase represents a decline of 3 to 4% in real terms.

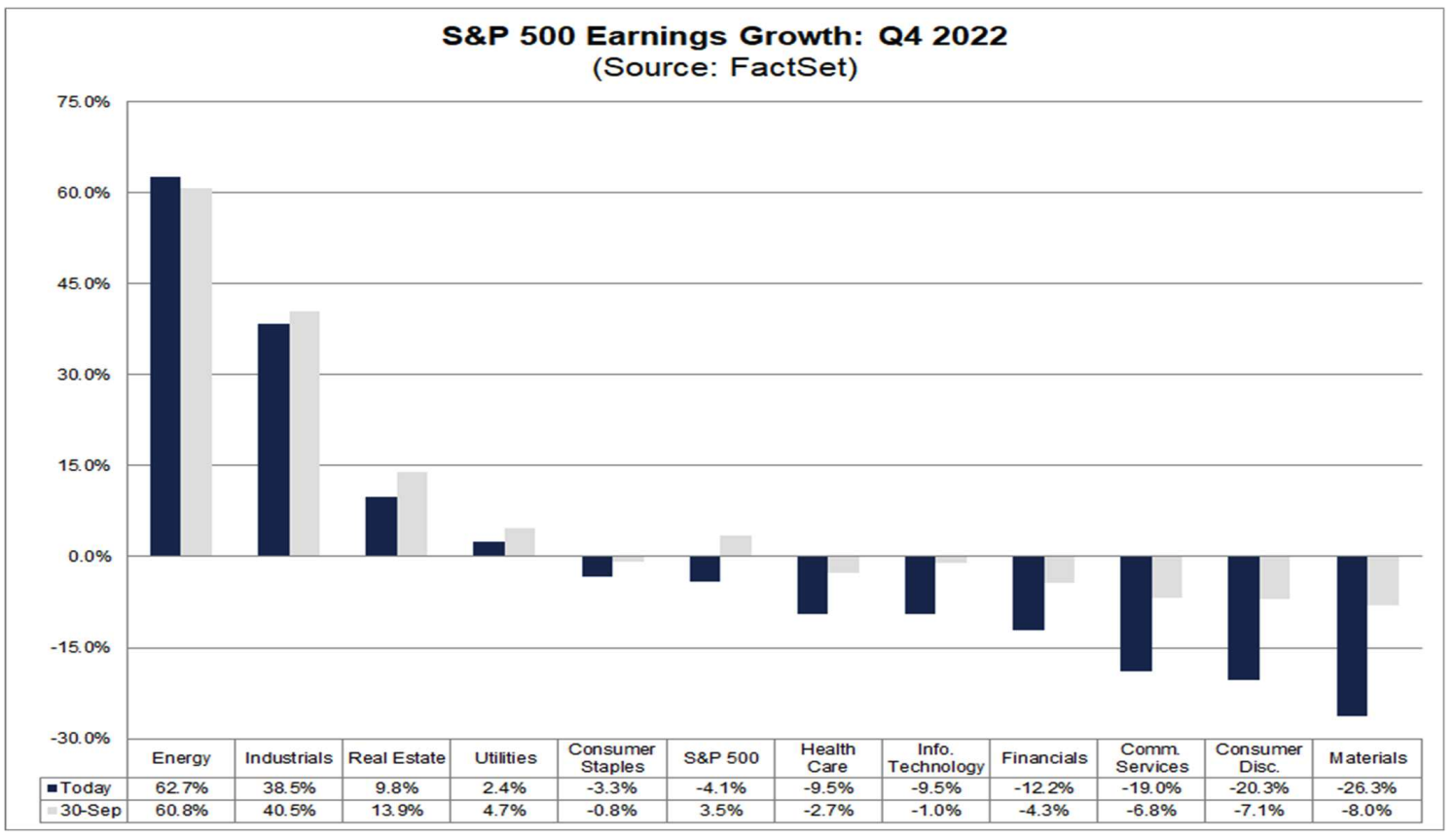

Sector expectations

At the sector level, the changes to forecasts were a continuation of the trend that started during the third quarter. However there are now seven sectors expected to report a year on year decline in earnings (compared to six sectors in the third quarter) and the magnitude of those declines is expected to increase.

The energy sector is once again expected to post strong growth. The resilience of the industrial sector is also worth noting and was driven primarily by the recovery in the airlines and aerospace industries.

Six sectors (healthcare, tech, financials, telecom, consumer discretionary, and materials) are expected to report a year-on-year decline in EPS of 9% or more. These are some of the largest sectors which mean they weigh on the entire market.

💡 The Insight: Uncertainty levels are high, but earnings are likely to continue declining

With the high level of uncertainty, analysts are adjusting their expectations one quarter at a time - but that does mean that expectations for subsequent quarters fall too. This is likely to continue until companies begin to raise their guidance.

Companies are now beginning to cut costs (mainly via job cuts) so when the earnings recession does end it may be due to lower costs rather than rising sales - ie. earnings may improve before the economy does due to cutting costs.

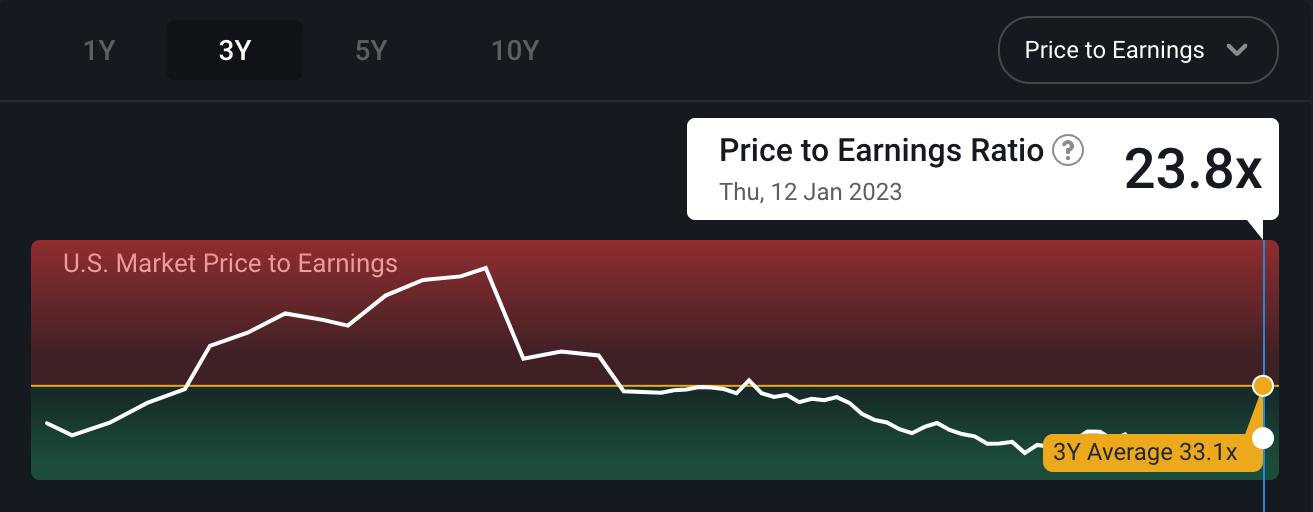

The current P/E ratio for the US Market of 23.8x looks low relative to where its 3-year average of 33.1x, but that will change if earnings continue to decline (all else being equal). So the trend in earnings and interest rates is likely to overshadow valuations until it starts to turn.

For Short or Medium-Term Investors (< 5 years)

Something worth thinking about is where upside and downside surprises may occur. While estimates for the utilities and consumer staples sectors have held up, some companies in those sectors are quite fully valued relative to expected growth rates.

On the other hand, expectations for the growth sectors are low, and valuations are now low relative to the expected growth rates over the longer term.

In other words, there is room for upside surprises in the tech and consumer sectors , and the risk for some defensive sector stocks is rising .

You can compare the P/E ratios to the expected annual earnings growth rates for sectors and industries by clicking on the ‘Valuation’ tab on the Simply Wall St Markets page.

For Long-Term Investors (5+ years)

Analysts are now taking things one quarter at a time, so we can expect earnings expectations to keep changing. If you are focussed on the long term (which we encourage you to be), you may want to pay more attention to qualitative insights from earnings calls . In particular you can look for signs that companies have a competitive advantage, or the confidence they have in making new investments.You can access the transcripts after the earnings call, or listen in to the call while it happens.

Doing this will help you keep your narratives up to date for the businesses you’re interested in.

Why the next few years could be a very different investing environment

In December, Howard Marks published an essay titled Sea Change . Marks is an influential and thoughtful investor and commentator, and his book The Most Important Thing is highly recommended. In this essay he described two major shifts (or sea changes) in the market that he witnessed over the last 53 years, as well as a third ‘sea change’ that he believes is happening now.

The gist of his message is that low inflation and declining interest rates have been the major factor contributing to strong equity returns over the last four decades. We may now be entering a period where rates are higher on average and no longer persistently declining. This will be a far more challenging environment for equity investors. This is something we have alluded to in previous newsletters.

Lower interest rates contribute to equity returns (and to economic growth) in several ways:

- The cost of borrowing is lower for companies, which means profits are higher and more projects are viable.

- Consumers can afford to borrow more, leading to higher spending.

- Bond yields are low which makes equities more attractive to investors.

- When borrowing costs are low, the use of leverage is incentivized.

- Future cash flows are discounted at a lower interest rate, which means stocks can justify higher valuations (future cash flows are worth more today)

- The net effect of lower interest rates on the equity and property market results in a wealth effect . Consumers feel wealthier which contributes to improved consumer and investor sentiment.

These factors have contributed to strong equity returns since 1980, but accelerated after 2009. As the yields on income producing assets fell, investors were forced to take on more risk - which paradoxically resulted in higher returns as asset prices were driven up.

Two factors that have contributed to low inflation rates, and therefore low interest rates, over the last few decades have been globalization and advances in technology. Technology advances may continue to provide a tailwind, but globalization is beginning to be reversed in many parts of the world.

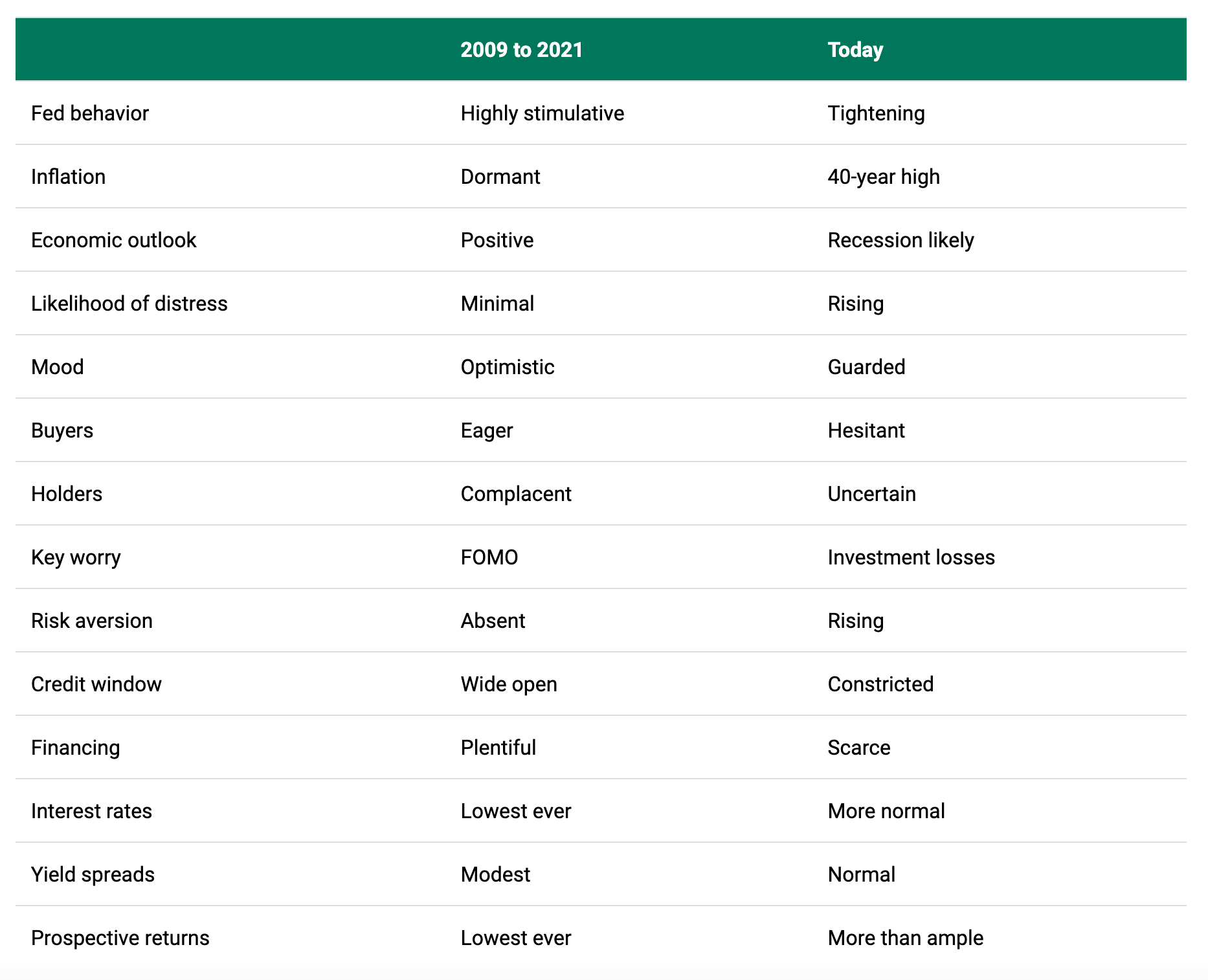

Marks summarizes the differences between the past and the present as follows:

The last line here refers to yields on debt/credit instruments - and this is the crux of his argument. Institutional investors can now earn reasonable returns without taking risk in the equity market.

Marks believes the Fed will struggle to bring inflation down to its 2% target range. Inflation has begun to soften as energy and commodity prices have fallen and supply chain bottlenecks have eased. But labor markets are tight and globalization is still being reversed. That will make it difficult for central banks to bring rates back to the levels of the last decade.

💡 The Insight: This macro environment is very different to the last 40 years

Markets go through ‘regimes’ which often govern investor psychology. The last regime which lasted from 2009 to 2020/21 was characterized by the ‘buy the dip’ mentality. That strategy kept working because a) a lot of people were doing it, b) money was cheap, and c) there were few alternatives to equities.

Investors who took on a lot of risk were rewarded, while those who engaged in low risk strategies like value investing underperformed.

But market regimes do eventually come to an end, and are then replaced by new regimes. If Howard Marks is correct, investors will need to adjust to a new environment for a while. That said, central banks might still be forced to cut rates if a financial crisis develops that is big enough to warrant them focusing on economic stability over inflation reduction.

What this means for investors

Marks may or may not turn out to be correct in his view, but investors should still be careful about being trapped by recency bias - ie. expecting the environment of 2009 to 2021 to return.

Regarding Mark’s outlook, if rates do stay higher for longer here are a few points to note:

- Projects and business models that rely on low rates may no longer be sustainable. This may also affect companies that have to refinance debt at higher rates than they are currently paying.

- Investors will need to build a higher interest rate or a wider margin of safety into their valuations to be sure of a return.

- It’s going to be difficult for companies without a clear path to profitability to attract investment.

- The risk of bankruptcies may rise - particularly in emerging markets and sectors.

- The real estate market will struggle if mortgage rates remain elevated.

Investors will need to be more selective - but high quality companies will still succeed, and may even be able to consolidate their competitive positions.

Key Events During the Next Week

This week, in the UK the inflation rate will be published on Wednesday and retail sales data is out on Friday.

In the US, PPI and retail sales are due on Wednesday and building permits will be published on Thursday.

Earnings season continues with the following notable companies reporting:

- Goldman Sachs (NYSE: GS)

- Morgan Stanley (NYSE: MS)

- Charles Schwaab (NYSE: SCHW)

- Alcoa (NYSE: AA)

- Netflix (Nasdaq: NFLX)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.