Quote of the Week:

“An investment said to have an 80% chance of success sounds far more attractive than one with a 20% chance of failure. The mind can't easily recognize that they are the same.”

- Daniel Kahneman

One of the surprising aspects of 2023 was the resilience of consumers.

With prices and interest rates both rising, it seemed inevitable that consumers would become overextended and spending would collapse. For the most part, that didn't happen.

This week we are having a look at consumer spending, solvency and confidence data to see if there are any red flags we as investors need to keep an eye on.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

💸 Amazon ups Anthropic investment to $4 Billion ( CNBC )

- Our take: Big tech companies are in a unique position: They are each sitting on $80+ billion in cash, which they can’t use for acquisitions due to regulatory pressure. By investing in GPUs and AI startups, they get to keep that value on their balance sheets, so it doesn't show on the income statement. These companies are making a bet with limited downside and unlimited upside potential, which makes a lot of sense. Two things to keep in mind though: if or when they decide they have enough capacity, demand for AI chips could fall quickly, and they will need to depreciate those assets (GPUs), which means they will eventually show up on the income statement.

-

🏢 GE Completes three-way split with GE Vernova spin off ( Reuters )

- Our take: GE has been a sprawling, underperforming conglomerate since 2000. After a lengthy series of asset sales, the remaining assets have now been separated into three entities, and investors get to decide which one’s they want to hold. A year ago, the health tech business was spun off as GE HealthCare Technologies (GEHC). Last week GE Verona (GEV), which includes the renewable energy and energy technology business, began trading as a separate entity. The remaining business is GE Aerospace which retains the ‘GE’ ticker.

-

🇺🇸 US Census data shows 60% of current jobs didn’t exist before 1940 ( MIT )

- Our take: We all know that technology destroys some jobs while creating new ones. MIT’s recent paper puts some numbers to this reality, which provides context to the potential impact of AI on job descriptions.

And some of the key economic data released recently:

- 🇦🇺 RBA March minutes included no mention of rates going higher

- This is good news for Australian investors, asset holders and prospective borrowers, however, they also suggested it would take "some time" before the board could be confident inflation is returning to target.

- 🇪🇺 Eurozone’s inflation - which was expected to remain flat - actually fell from 2.6% to 2.4%.

- 🇺🇸 ISM Manufacturing data showed a stronger than expected rebound in manufacturing activity.

- Manufacturing employment, prices, new orders and the PMI index were all up month-on-month and higher than expected.

- 🇺🇸 JOLTs Job Openings rose slightly, but less than expected.

- The 8.7 million job openings is slightly higher than the lowest level recorded in October, and appears to reflect a stable labor market.

- 🇺🇸 The US ADP National Employment Report was hotter than expected

- With 184k new jobs compared to consensus estimates of 125k.

- 🇨🇦 Canada’s trade surplus widened more than expected, coming in at CA$1.39 Billion, much higher than the CA$500 Million forecasted.

- Both imports and exports were higher, while record gold exports contributed to the wider surplus.

Food for Thought

A recent episode of The Compound and Friends podcast included an interesting interview with Jason Hsu, with some interesting perspectives on ‘Friendshoring’ aka nearshoring which we mentioned recently.

The interview runs to the 43-minute mark and also includes some unique and contrarian insights on China, India, emerging markets and US chip manufacturing.

How Is Consumer Strength Around The World?

USA’s Spending Power Could Weaken Given Concerning Savings Levels

Consumer spending makes up 68% of US GDP, so the financial health of consumers matters to the US and global economy.

✨ Over the course of 2023 consumers did change their spending patterns in response to higher prices, but overall spending remained strong. Spending also accelerated at the end of the year, and then rebounded in February after a dip in January.

There have been some slightly alarmist headlines about surging credit card delinquencies and debt levels. Yes, credit card delinquencies rose more than 50% in 2023, and consumer debt reached record levels, but some context is needed.

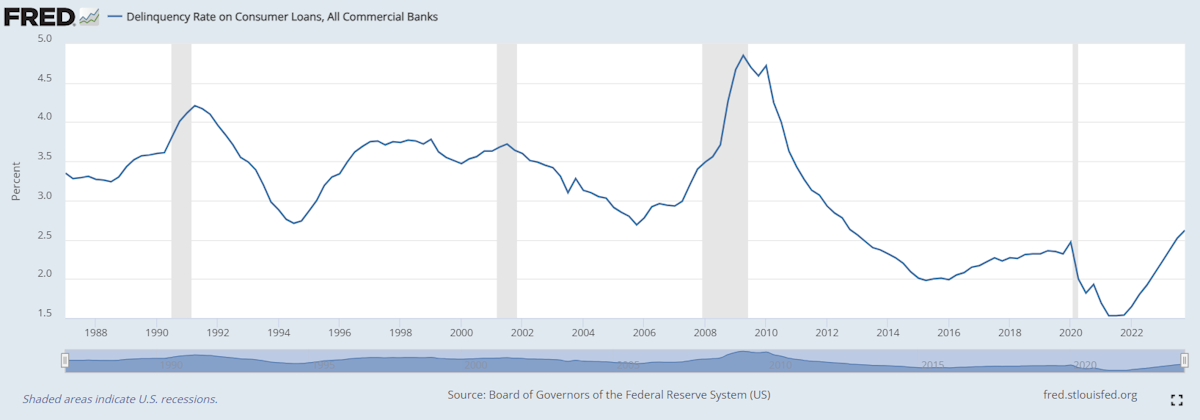

While consumer debt is high in absolute terms, household debt as a percent of GDP is the lowest it's been in 20 years. The chart below from the St Louis Fed shows consumer delinquency rates are rising, but are still lower than they were at any point from 1988 to 2012.

One number that is a bit worrying is the personal savings rate, which fell to 3.6% in February.

The saving rate surged to record levels during the pandemic, but those savings have now been completely depleted and savings are very low by historical standards. So, while debt doesn’t seem to be out of control, consumers don’t have much in the way of savings to fall back on, which is a possible cause in the rise of delinquencies

The CEOs of JP Morgan and Bank of America have both recently warned that consumer spending power is likely to run out soon . That’s relevant, as they both expressed confidence in consumer resilience just a few months ago.

The bottom line is that US consumers could really use a rate cut soon. Consumers managed through 2023, but they’ll struggle if inflation rebounds in 2024.

Consumer Confidence Is Low In The UK And The Eurozone, But Cooling Inflation Is A Beacon Of Hope

It’s been a different story in Europe and the UK. In Europe, consumer spending is barely higher than it was in 2019, and in the UK it’s below pre-pandemic levels.

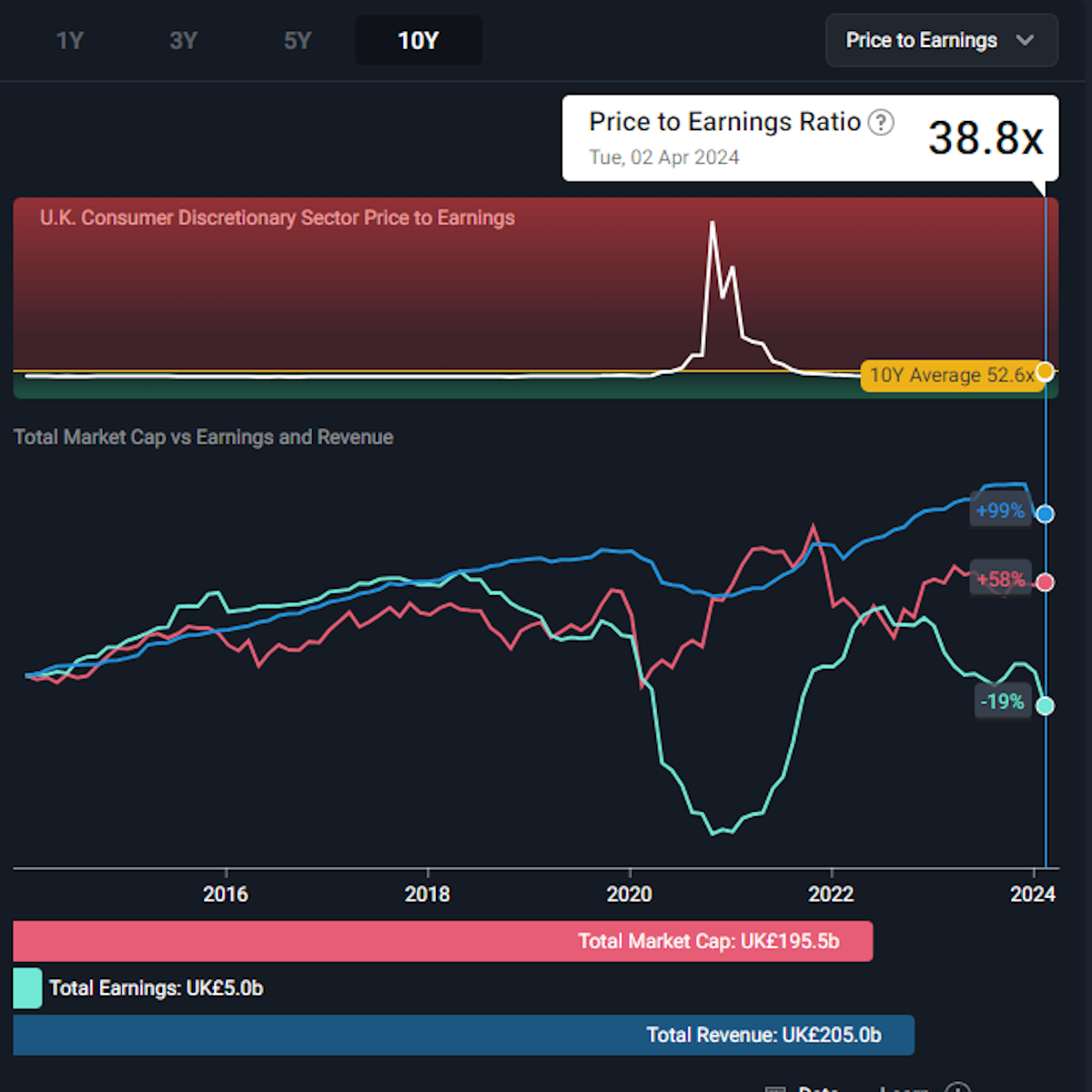

The chart above from the Simply Wall St Market’s page reflects the struggle UK consumer discretionary businesses are facing.

This is a great tool to get an overview of the performance of a sector or industry over a period of time. When things are going well, revenue should be rising, with earnings ideally rising at a faster pace.

Consumer businesses in the UK saw their profits decimated during the pandemic, and then squeezed by rising costs. However, share prices are still depressed - so any improvement in the outlook could offer opportunities.

✨ Recent data suggest that UK consumer sentiment has begun to improve as inflation has cooled , and lower rates appear to be on the horizon. Consumer confidence is likely to be very sensitive to any news on interest rates and inflation in the next few months.

Asia Is A Mixed-Bag of Consumer Confidence, But Most Economies Are On The Road To Recovery

In Asia, consumer spending has been mixed with economies at markedly different stages of the economic cycle.

In China, spending, credit growth and sentiment have all been depressed since 2021, though things have stabilized. Consumer confidence is closely tied to real estate, which is the primary savings vehicle in the country.

✨ Japan and India both experienced strong growth in consumer spending through 2023. In Japan, there was a noticeable slowdown in December and January, followed by a slight recovery in February. For India, consumer spending data has not been released since December, but there was a meaningful rise in consumer confidence in January.

South Korea experienced a dramatic slowdown in consumer spending in 2023 and in November became one of the first countries to cut rates. Since then, consumer confidence and credit growth has improved, though retail sales have yet to recover meaningfully. This economy will be interesting to watch to see how quickly consumer spending recovers as rates come down.

The Nuances Of Consumer Sentiment Data

Visual Capitalist recently published this comparison of consumer confidence around the world as of Q4 2023.

One of the things that stands out is how disconnected sentiment can be from hard data. China was ranked second while experiencing a major economic slump, while the US was below average coming off the back of the best quarter in two years.

.png)

There are a few reasons for these discrepancies. Consumer sentiment/confidence indicators are interesting and can be useful, but they need context.

For one, they aren't really comparable from one country to the next, as sentiment in different countries is often tied to unique, local factors.

Indicators within each country can also be very different. They are usually based on one or more very specific questions, which means they end up measuring very different things.

In the US two popular indicators are the Consumer Confidence Index and the University of Michigan Consumer Sentiment Index. The first of these asks consumers about the general state of the economy, while the second is more focussed on spending.

Lastly, it’s important to note the sample size of these surveys. These two surveys above typically have a sample size of 3,000 and 600 respondents respectively, so in the grand scheme of things, they’re using a miniscule portion of the population to reflect the broader consumer’s opinion, which as you can imagine, can lead to some misrepresentations when you compare it to the macro data releases.

💡 The Insight: Hedging Your Portfolio Against Consumer Weakness

Over the next few months, inflation data and central bank policy is likely to have a profound effect on consumer behavior around the world.

If consumers believe prices have stopped rising and interest rates are peaking, sentiment could improve quickly. But, if inflation persists, or rebounds, they are likely to ‘batten down the hatches’ and they have little to fall back on.

The consumer facing businesses in your portfolio will obviously be sensitive to consumer spending. So, what types of companies are less sensitive to consumer spending?

There are actually three groups of companies to consider:

- 🛡️Defensive sectors: Earnings for the healthcare, utility and consumer staples sectors are typically less cyclical.

- But companies still need to be assessed on their individual merits. In the current cycle, utility companies have been underperformers and some may offer value, whereas consumer staples companies are now having their margins squeezed.

- 🛢️ ⚡ Energy and materials companies: Oil producers are often a good hedge when inflation erodes margins for consumer businesses.

- Materials businesses can also benefit if manufacturing activity or infrastructure development continues while consumer activity slows.

- 💻 Technology growth stocks: If a company’s share price is discounting earnings that are only expected to occur five or more years into the future, a near term slowdown is less material to the valuation. Keep in mind that valuations for growth stocks are still very sensitive to interest rates.

For help in discovering companies for your portfolio that are less sensitive to consumer spending, be sure to check out Simply Wall St’s Stock Screener !

Key Events During The Next Week

Monday

- 🇩🇪 Trade data is due in Germany. A $27.5 billion surplus was reported for the previous month.

Wednesday

-

🇺🇲 US consumer inflation data may provide clues to the Fed’s next move. The inflation rate is expected to rise slightly from 3.2% to 3.3%, however the core inflation rate is forecast to be slightly lower.

-

🇺🇸 The minutes from the last FOMC meeting will also be published.

Thursday

- 🇪🇺 The ECB is expected to keep the interest rate steady at 4.5%

- 🇺🇸 US PPI is forecast to rise from 1.6% to 2.1%.

Friday

- 🇬🇧 UK monthly GDP data is due. The economy is expected to have contracted by 0.3%.

First quarter earnings season officially kicks off on Friday with the first of the big banks. Prior to that, a handful of other prominent companies are also reporting:

- Aehr Test Systems

- Delta Air Lines

- Infosys Limited

- Constellation Brands

- JP Morgan

- Wells Fargo

- BlackRock

- Citigroup

- State Street

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.