What Happened in the Market This Week?

Market Insight for 22nd April - 29th April

Over the last week, interest rates were the main focus of many markets as several central banks announced hikes to their benchmark interest rates. Every central bank attributed the rises to tackling the significant inflation affecting their economies and normalizing their respective monetary policies.

Changes to benchmark interest rates lead to substantial ripples in not only the investment markets, but businesses and individual investors as well.

In regards to investment markets, higher interest rates typically decrease the value of expected future cash flows (because they’re worth less when discounted back to today at a higher rate), especially those businesses that only expected to earn cash flows in the distant future and not today.

Additionally, investors often move their money from higher risk stocks to safer investments like government bonds and treasury bills because these investments now offer a higher yield which is likely to be closer to what they would’ve expected to receive from investing in stocks.

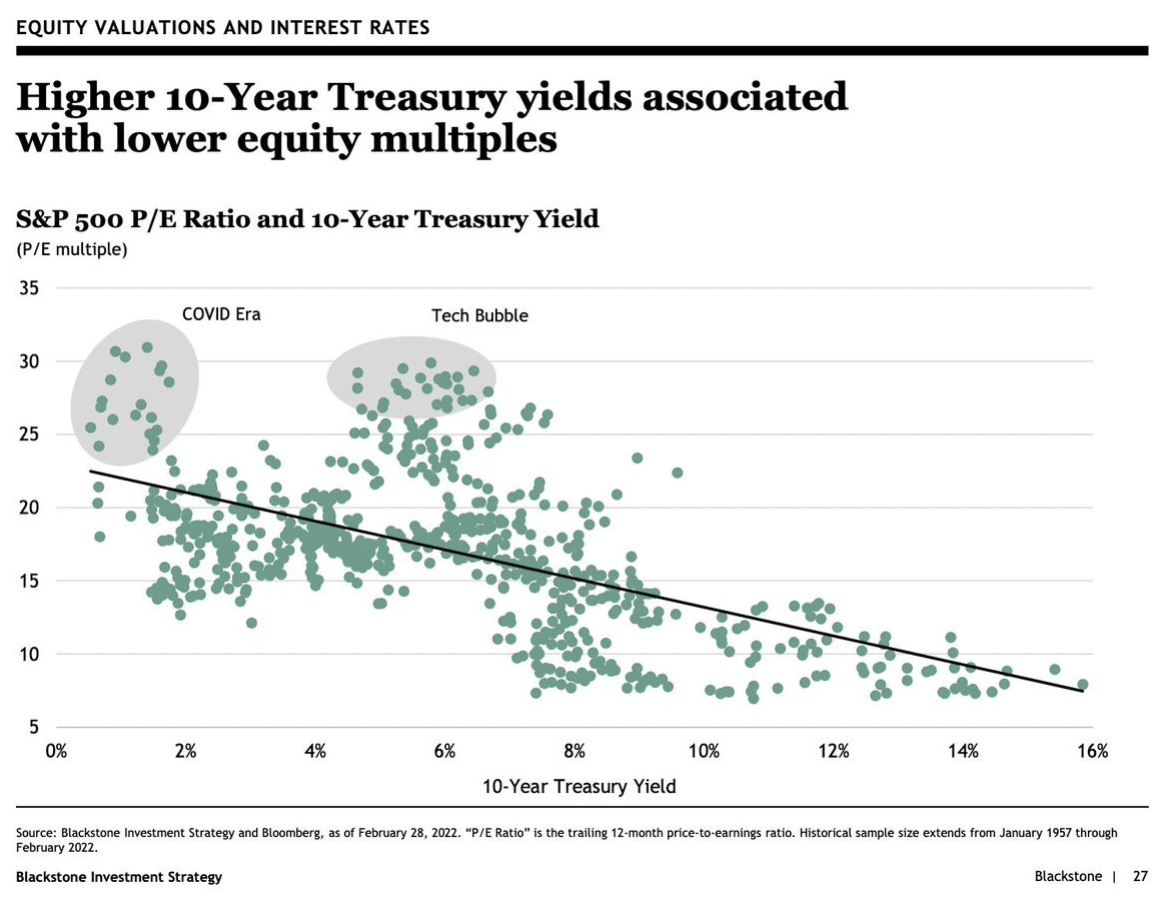

Below we can see how high P/E multiple can get when interest rates are low, and how low P/E multiples can get when interest rates are high.

As for consumers and businesses, they usually experience increases in their savings rates, but can also suffer from higher borrowing costs on things like mortgages if they have variable rates.

This week’s market update will focus solely on this topic, covering recent interest rate changes for different countries, their inflation rates, and any expected future rate hikes to give us an understanding of the current global monetary policy situation.

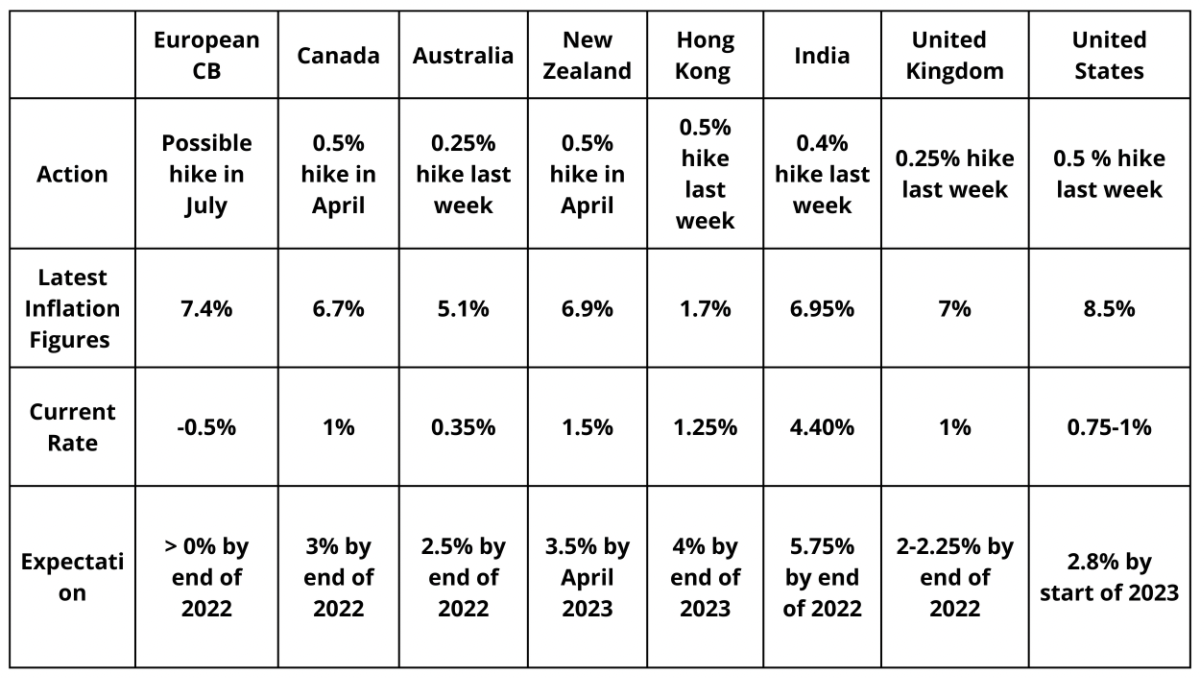

Central Bank’s actions, cash rates and expectations, with inflation figures - 9th May 2022

Europe

After almost 8 years of negative borrowing costs, the European Central Bank (ECB) looks set to potentially increase interest rates in July this year which is earlier than expected. This comes after the eurozone inflation reached 7.4% in March driven by soaring energy costs, which have increased 38% for the year to March.

This would mean “monetary policy normalization” (increasing interest rates and decreasing asset purchases) comes in sooner than originally expected, since the ECB originally appeared set on only increasing interest rates after it had finished its bond buying program in Q3 of this year.

These expected interest rate increases come at a difficult time, because real GDP growth is expected to reduce over the next few years from 3.7% this year, to 2.8% and 1.6% in the following two years. The ECB is in a difficult situation, because it wants to help Europe continue its recovery (with expansionary policies) but it also wants to combat inflation (with contractionary measures).

Canada

On April 13 2022, the Bank of Canada (BoC) increased its key interest rate by 0.5% to 1%, the highest increase in more than 20 years. The move comes amid inflation topping 6.7% which was a full 1% higher than the previous month's figure, and is the highest recorded figure in 30 years.

The BoC expects that Canada’s economy will continue to grow at 4.25%, 3.25% and 2.25% per year over the next 3 years. Given that it also expects inflation to hover around 6% for the first half of 2022, which is above its 2% inflation target, it appears that more rate hikes are likely on the horizon.

The next interest rate announcement will be on June 1st, and if inflation continues to remain elevated, further rate hikes will likely occur.

USA

The U.S. Federal Reserve (Fed) last week announced a rate hike of 0.5% in an attempt to reduce inflation, its highest rate increase in over two decades. With the current rate now sitting at a range of 0.75%-1%, several forecasts expect the interest rate to reach the levels of 2.75% - 3% by start of 2023.

The Fed has announced that it plans to reach this target by slowly increasing rates by 50 basis points (0.5%) in the coming months, with the next hike forecasted to be between June and July.

Australia & NZ

The Reserve Bank of Australia (RBA) recently increased its official case rate for the first time in 11 years from 0.1% to 0.35% as it also tries to tackle inflation which topped 5.1% in the March quarter.

Markets seem to expect the RBA cash rate to reach 2.75% by year end, whereas the RBA itself is guiding for 1.75% by year end, and 2.5% by mid 2023.

Meanwhile, The Reserve Bank of New Zealand (RBNZ) recently conducted its 4th hike in a row, raising rates 0.5% (which was the biggest hike in 20 years) to 1.5%.

The RBNZ has been one of the more aggressive central banks as it sought to unwind supportive policies to get on top of rising house prices and inflation.

Some forecasts expect the NZ cash rate to reach 3% by 2023.

Hong Kong

Following the U.S Fed’s hike, the Hong Kong Monetary Authority (HKMA) announced a raise in the benchmark rate by 0.5%, lifting it to 1.25%. This hike marks Hong Kong’s biggest rate increase in 22 years, and comes as the HKMA attempts to keep the country’s currency in line with their target range of 7.75-7.85 HKD per USD.

Despite the rate hike, Hong Kong’s largest consumer banks - HSBC, Bank of China, Hang Seng Bank, etc - decided to hold their own rates unchanged despite this lessening their own profit margins. With the country’s local economy still recovering from the effects of the pandemic, the banks deemed it to be too much pressure for the population if they were to transfer the cost of rate hikes to consumers.

Given that the country’s monetary policy has been run in lock-step with the U.S.’ since 1983, Hong Kong’s benchmark rate is expected to rise by another 2.75% to end at 4% by 2023 - following the Fed’s plan of slowly increasing rates until 2024.

India

Right before the Fed’s rate hike, the Reserve Bank of India (RBI) announced a surprise rate increase of 0.4% last Wednesday (May 4, 2022). This leads the country’s base rate to 4.4% - up from 4%, which was the lowest rate the RBI has ever had in its history.

The RBI also announced a 0.5% increase in the country’s cash reserve ratio - the percentage of cash that banks need to have in their reserves against their total deposits - requiring banks to put in more cash with the RBI in order to combat higher inflation.

The rate increase is considered part of a synchronized action by the RBI with the central banks of other countries. Expectations have been set to a 5.75% benchmark rate by the end of the year, following forecasted increases for other countries.

United Kingdom

With the U.K.’s inflation currently at its highest levels in 30 years, the U.K.’s Monetary Policy Committee (MPC) raised rates by 0.25%, the fourth time since December. The rise was announced a day after the Fed’s rate hike, and led the country’s base rate to 1%.

The Bank of England expects the U.K.’s current inflation rate of 7% (with 2% as the target rate) to increase by an additional 10%, driven by the Russia-Ukraine war and lockdowns in China. Consequently, the MPC is expected to raise rates to a range between 2-2.25% by the end of 2022.

The Insight

As inflation surges through many countries around the world, central banks will do their best to reduce it by increasing interest rates, while also trying not to cause unintended repercussions in their economies. This is proving difficult because increasing interest rates is a contractionary measure, and in a world of slowing growth and higher indebtedness amongst individuals and countries, those interest rate increases need to be managed with precision.

It’s a balancing act that is very difficult given all of the variables involved, but investors can do well by having a high level understanding of what happens when different levers move. If investors stick to more risk-averse investments, such as those established businesses that are profitable with low debt, then typically over the longer term they can weather most storms better than those invested in highly leveraged or unproven business models.

Until next week,

Invest Well

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.