“India's economy is a sleeping giant. Once it awakens, it will be a force to be reckoned with" - Jack Ma, Alibaba Founder

India is both the most populous country in the world, and the fastest growing economy amongst the world’s largest nations. So it’s no surprise to see investors looking for growth in international markets cast their eye on the Indian economy.

Despite some challenges, it’s got a lot of the ingredients for a bright future, and trends are heading in the right direction. However, word seems to have gotten out, because it’s been rallying hard over the last few years.

This week, we’re going to look into the opportunities and challenges within the Indian market, and how to get exposure to it if you’re interested!

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts !

What Happened In Markets This Week?

Here’s a quick summary of what’s been going on:

- 🇨🇳 China’s population fell for a second consecutive year in 2023 ( CNN )

- Our Take: China’s population growth rate has been declining since 2012 and turned negative in 2022. From investor exodus and deflation to an aging population and decline, you can expect these trends will likely force the government to continue making structural changes to its economy.

- 🤝 Synopsis Agrees to Acquire Ansys for $35 billion ( Reuters )

- Our take: There are obvious synergies between these companies complimentary design and testing tools for semiconductor chips. It wouldn’t be surprising to see more deals like this as companies seek to position themselves in these growing markets. Of course this still needs to get past EU regulators - which seems to be getting more difficult with every new deal. If all goes to plan, expect this to finalize 1H 2025 (if there are no delays).

- 🏦 US Banks reported mixed results for Q4 23 ( WSJ )

- Our take : Results were mostly ahead of estimates, but some were still down significantly from Q4 22. One thing that stood out was the fact that performance for various segments, from wealth management to investment banking and consumer lending varied widely from one bank to the next. This sector definitely needs to be assessed on a bank by bank basis.

And some of the key economic data released recently:

-

🇨🇳 China’s economy grew 5.2% in 2023 which was in line with government targets , but far off the average growth rate of the prior decade. During the quarter growth accelerated from 4.9% during the third quarter, but fell short of consensus estimates of 5.3%. Other data, including retail sales numbers for December remained depressed.

-

🇩🇪 Germany’s economy contracted by] 0.3% in 2023 as expected. This compared to growth of 1.9% in 2022. The economy is expected to contract further in 2024 due to the effect of higher interest rates and lower trade volumes.

-

🇬🇧 UK unemployment remained at 4.2% in the quarter ending November. The number of people claiming unemployment benefits rose by 11,700 in December. Wage inflation declined slightly in December, which will be good news for those hoping rate hikes are coming to an end.

-

🇨🇦 Canada’s inflation rate rose to 3.4% in December from 3.1% in November , showing that inflationary forces are still in place.

The India Investment Opportunity

We have mentioned India’s stock market quite a few times over the last year, and it's also a firm favorite amongst market strategists, as you might have seen in our 2024 outlook .

Nominal GDP growth is expected to be amongst the highest in the world this year, so it isn’t surprising to see the country’s benchmark indexes close to record highs.

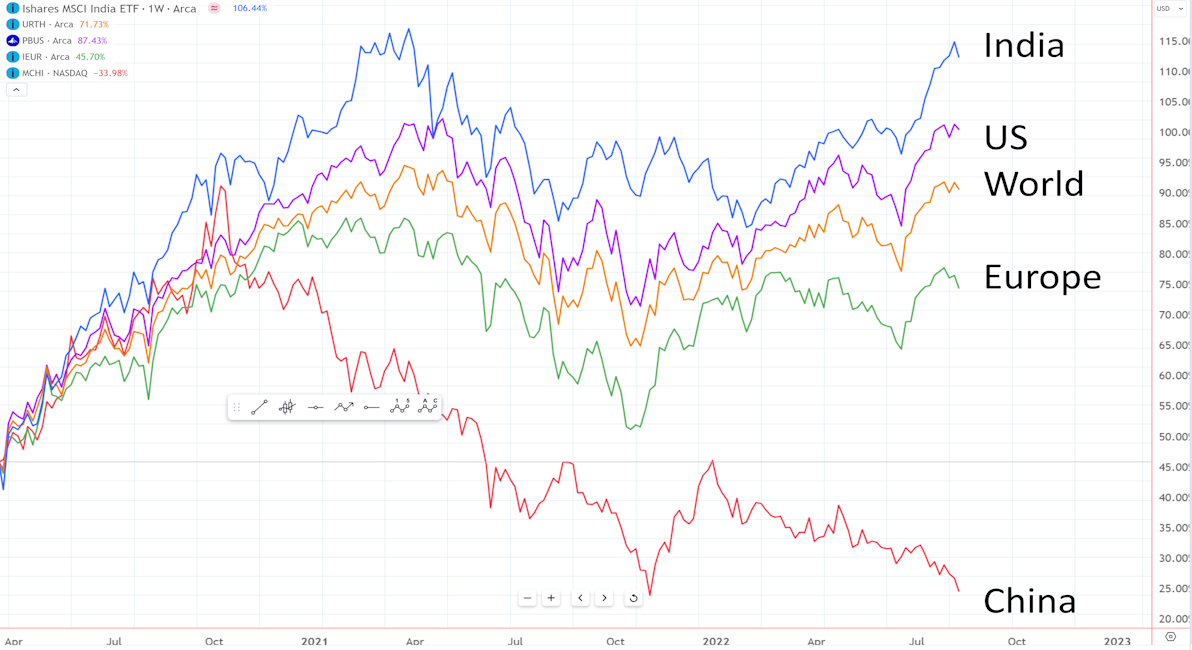

India’s overall stock market is now the fifth largest in the world, while the National Stock Exchange of India is the world’s seventh largest exchange. The market has outperformed since the pandemic lows, and beaten China’s market by nearly 130% in that time.

The following chart reflects the relative performance of the MSCI India index and other major markets.

India’s Youthful Economy Is Poised For Growth

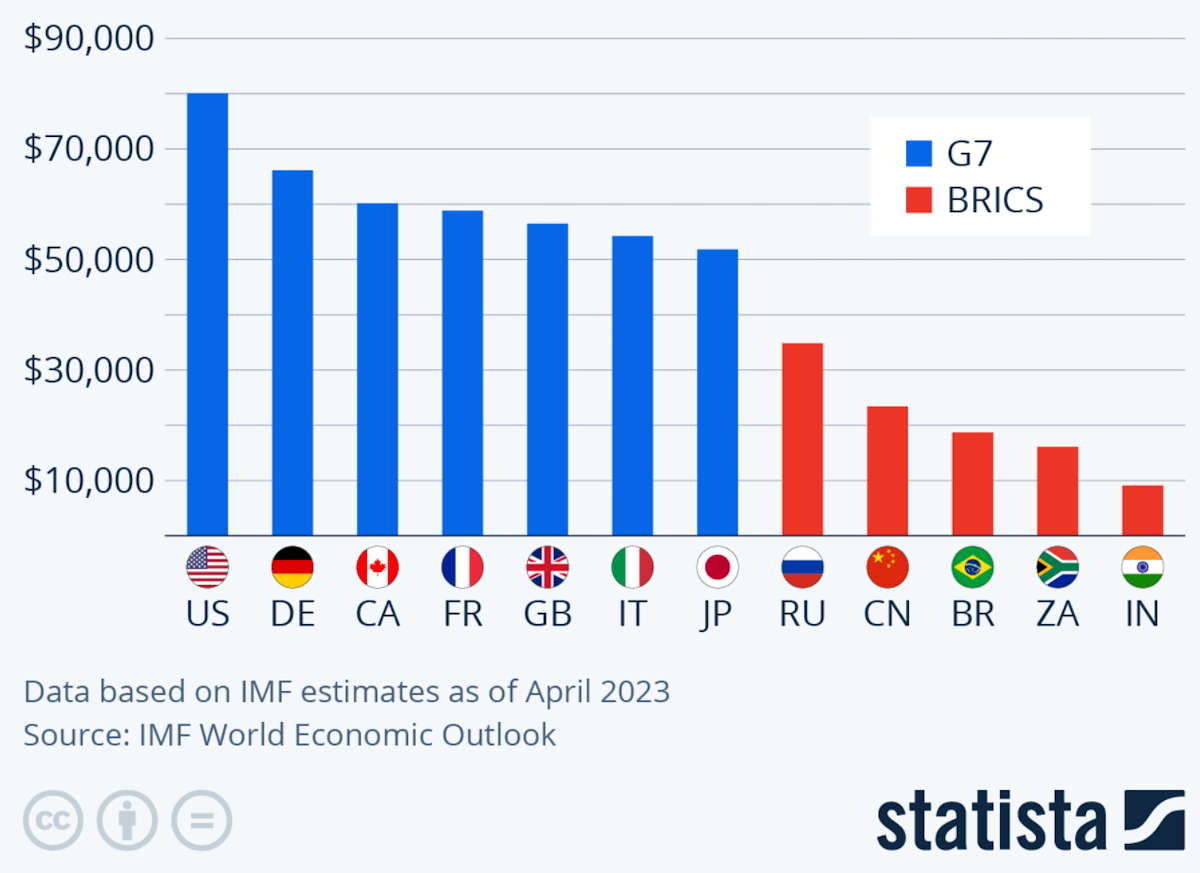

India’s economy has been slower than others in Asia to modernize and to become integrated in the global economy. The result, as the following chart from Statista reflects, is that its per capita GDP is way below that of the other major emerging markets, not to mention G7 nations.

Note: this chart reflects GDP at purchasing power parity, which is a lot higher than the nominal figure of $2,400.

Since 2014 when Narendra Modi became prime minister, the economy has been liberalized and modernized, resulting in increased foreign investment and more rapid economic growth.

✨ The fact that India has such low GDP per capita, the largest population in the world, and is beginning to modernize, means there is massive potential for further growth. In addition, India’s population is still young and growing, and isn’t facing the demographic challenges that China is.

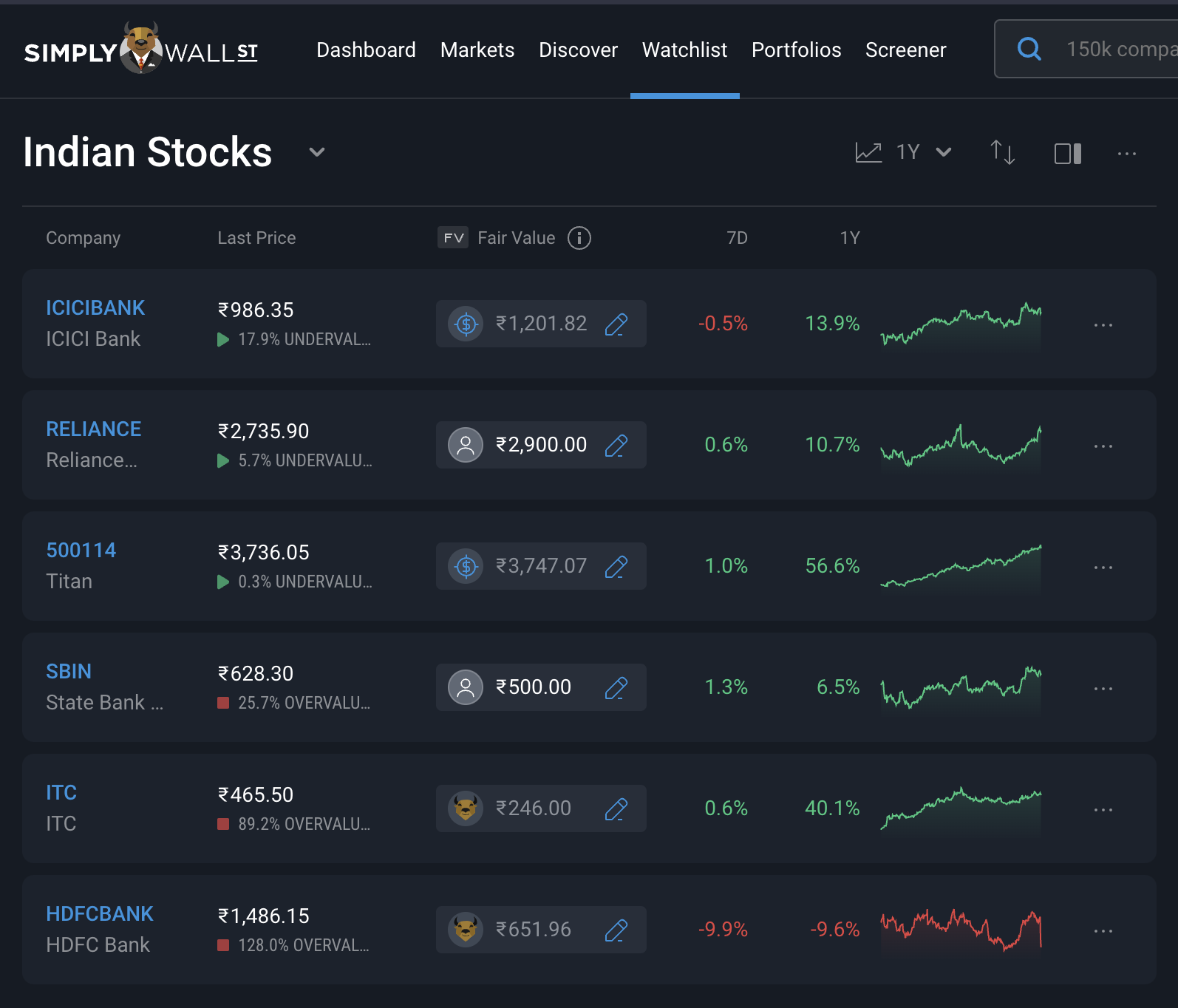

There are more than 2,000 companies listed on India’s two exchanges, the NSE (National Stock Exchange) and the BSE (Mumbai Stock Exchange). Of these, about 500 are worth more than $1 billion.

There has been a very active local investor base for some time, but global investors are only just beginning to discover this market.

Visual Capitalis t published a great infographic to illustrate the sector diversification and market size of India’s most valuable 50 companies .

Many Sectors Are Well Positioned To Benefit

There are two sides to investing in the India story;

- Companies that benefit from economic growth within India and

- Those that benefit from the export of goods and services.

Industrialization requires investment and infrastructure development.

As India’s economy develops and modernizes, the companies that finance and build infrastructure (ie. banks and construction companies) are key beneficiaries, along with materials companies (particularly cement producers), transport and utilities .

When economies industrialize, a growing percentage of the population begin to earn enough to make discretionary purchases beyond meeting their basic needs. This is often referred to as a “growing middle class”, which comprehensively changes the marketplace and drives growth in new areas of business .

This most often manifests itself in increased spending on consumer goods and services, healthcare and real estate . And all of this can be financed by, you guessed it, banks .

✨ Banks are often a great way to invest in emerging economies, as they are exposed to whichever parts of the economy are growing and require finance each year.

The other side of India’s economy is the companies that export goods and services.

These include India’s vibrant technology , pharmaceutical and biotech and auto industries, amongst others.

But There Are Some Challenges Facing The Economy

India’s industrialization and modernization are not without their challenges, some of which include:

- 🏦 As much as 40% of India’s economy can still be classified as informal , which means it lacks access to finance.

- ⚠️ The regulatory landscape is famously bureaucratic, and corruption is still a problem.

- 🏗️ A lot more infrastructure development is still required in rural areas.

- 📚 The education system hasn’t managed to keep up with the pace of development.

- 👷 Female participation in the formal economy remains low.

- 🧑🌾 Recently, the challenges of moving to urban areas have caused many workers to return to rural villages .

The government has made significant steps to address these challenges over the last decade, but there’s a long way to go. The good news is that this environment should offer investors plenty of opportunities for decades to come.

From the point of view of investors, valuations in some sectors and industries may be rising too fast. The following graphic reflects the P/E ratios and expected growth rates for each sector.

How To Invest In India

Foreign investors have three options when it comes to investing in India’s stock market:

- 📈 Opening a local trading account - which is possible but requires a fair amount of paperwork.

- 🌏 Investing in Indian companies listed on global exchanges.

- 💱 Investing in India ETFs listed on global exchanges.

Unfortunately, only a handful of Indian companies are listed on major global exchanges.

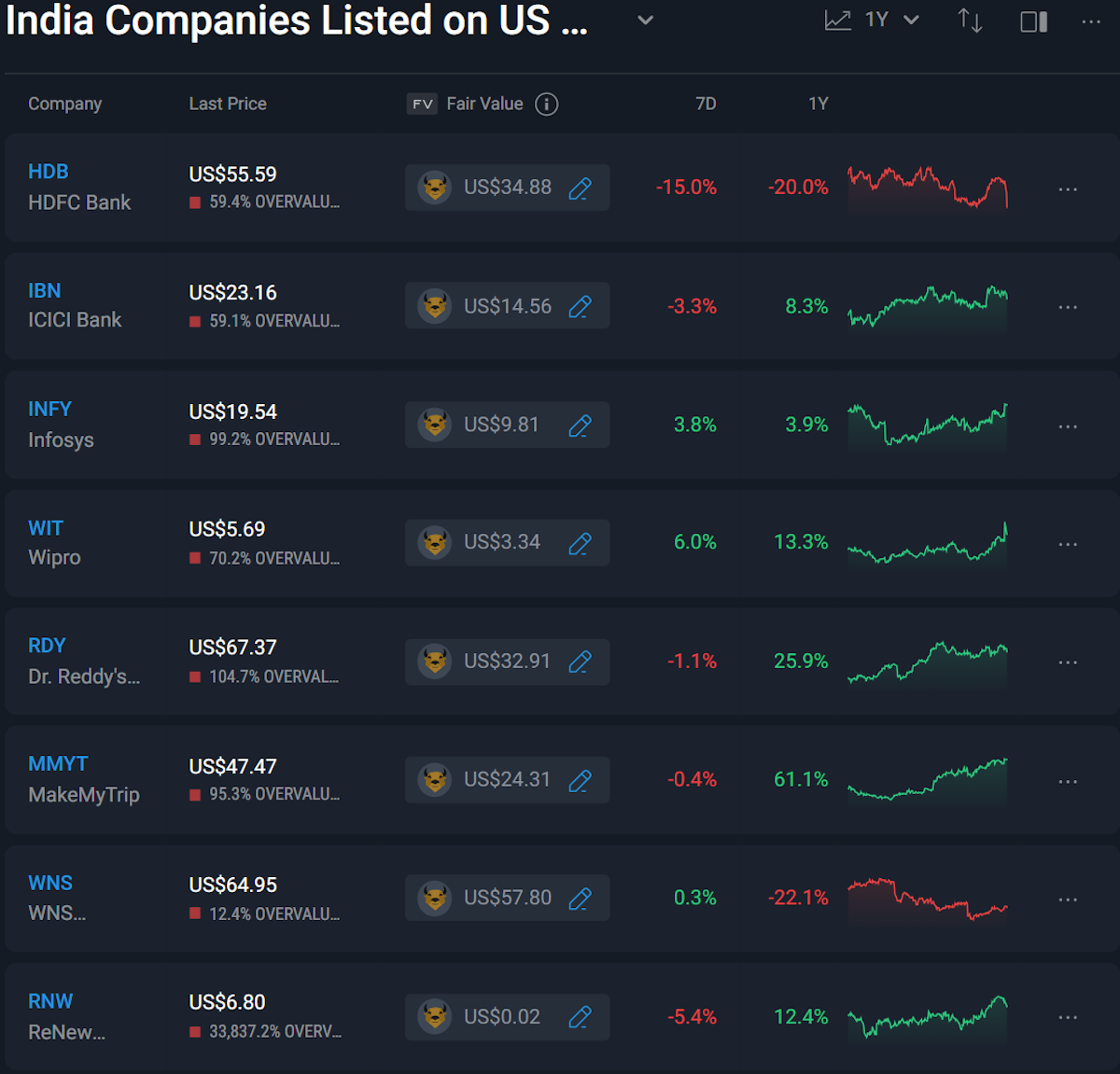

The following are the eight largest Indian companies with listings on US exchanges - and many of these are also listed on the London Stock Exchange as well as exchanges in Europe and Asia.

✨ Most of these appear to be trading at a premium when current growth forecasts are considered. When lots of investors are chasing a limited pool of options, there is a risk that valuations become unsustainable.

Getting Exposure Through India ETFs

For most foreign investors, ETFs are the most realistic way to invest in India. The following are the largest funds, along with the number of companies held by each.

- iShares MSCI India ETF ( INDA ) - 133 holdings

- WisdomTree India Earnings Fund ( EPI ) - 481 holdings

- iShares India 50 ETF ( INDY ) - 52 holdings

- First Trust India NIFTY 50 Equal Weight ( NFTY ) - 52 holdings

- Franklin FTSE India ETF ( FLIN ) - 215 holdings

- Franklin FTSE India UCITS ETF ( FLXI ) - Europe listed

There are also lots of ETFs that invest in specific sectors and themes within the Indian stock market.

✨ If you are considering an ETF, make sure you understand how the stocks are selected and how concentrated the portfolio is.

VettaFI and justETF are great resources for ‘looking under the hood’ with ETFs to see what the biggest holdings are, and how the ETFs work. Then, you can use our portfolio tool and stock reports to get a better understanding of the largest holdings in each fund.

The Insight: Take A Long Term View

There are quite a few reasons to be optimistic about India’s market in 2024 . In particular, economic growth is expected to be high in both relative and absolute terms, and the prospect of rate cuts is looking likely. But India has also become one of the most popular markets, and valuations could easily run ahead of fundamentals.

As mentioned, India’s growth story has a long way to go, so there is no reason to chase prices. When it comes to India, it’s worth taking a long term view, and looking for opportunities that can generate returns over the next few decades, rather than the next 12 months.

Picture yourself looking at India in 5,10 or even 15 years time. What does it look like?

- 👀 What does the economy look like?

- 💹 Has it grown considerably more than what it is today?

- 🚧 Has it worked through the challenges it’s currently dealing with?

- 📈 Most importantly: have the companies “ grown into ” what their 2024 valuations were implying?

If you’re optimistic about the country, and want exposure to its growth, but not sure when to invest, you could:

- Dollar-cost-average each month into an India ETF that suits your needs and criteria, if you don’t feel confident on valuing the stocks (to handle volatility if the market goes up or down).

- If you’re confident enough to value individual stocks, you can review the biggest holdings within an ETF and value these companies on an individual basis. Then, set a fair value estimate for each and use this as a proxy for when you buy the ETF , to take advantage of potential market volatility.

Key Events During The Next Week

This week kicks off on Monday with China’s announcement of the 1 and 5-year prime loans rates, which are expected to be kept at 3.45% and 4.2% respectively.

On Tuesday, it’s Japan’s turn as the BOJ sets its rate - currently expected to remain at -0.1%.

On Wednesday, Japan’s balance of trade data will be released. The trade deficit is expected to narrow to ¥400 billion from ¥777 billion.

Also on Wednesday, the German HCOB Manufacturing PMI Flash index will be published. It’s expected to tick up to 44.6 from 43.3.

The Bank of Canada will be making an interest rate announcement on Wednesday. Economists expect the bank to keep rates at 5%.

The ECB will be announcing its next rate decision on Thursday, and is expected to keep the benchmark rate at 4.5%.

On Thursday, the first estimate for US fourth quarter GDP will be published. The consensus estimate is 2.3%, down from 4.9% in the third quarter.

On Friday, the Core PCE price index will be published along with personal income and spending data.

It’s one of the biggest weeks for 2023 Q4 earnings, as the first of the big tech companies report earnings. These are the largest companies reporting - the Nasdaq website has a more comprehensive list:

- United Airlines

- Abbott Laboratories

- Microsoft

- Johnson and Johnson

- Proctor and Gamble

- Netflix

- General Electric

- Texas Instruments

- Tesla

- ASML

- Visa

- Intel

- American Express

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.