“I make no attempt to forecast the market—my efforts are devoted to finding undervalued securities.” Warren Buffett

Investors started the year wondering if the global economy was in for a hard landing that would force central banks to pivot and start cutting rates, or if a ‘soft landing’ was still achievable.

Well, so far, there has been no pivot, so how’s that soft landing looking? This week we’re checking in on what’s happened over the last six months, where things stand, and what the second half might bring.

What’s Happened?

Let’s start with a quick recap of what’s happened over the last six months:

The Economy

In June last year, many economies were expected to slip into a recession by the end of 2022 or early in 2023. By the beginning of this year, those forecasts had been pushed out to later in the year. The US economy has proved to be resilient so far, and some economists now think a recession is avoidable. However, recent data showed that the economies of New Zealand and Germany actually shrank in Q4 ‘22 and Q1 ‘23 - implying a technical recession.

Now, you might also recall the US also saw a technical recession with two consecutive quarters of GDP contraction early in 2022, BUT it managed to avoid falling into an actual recession. As confusing as that may sound, it was because of factors like a strong labor market, decent wage growth and accelerating industrial production keeping the economy alive.

You could argue economists are becoming more like accountants these days. Where accountants can make 4+4 equal whatever you want it to equal, economists can make the definition of a recession mean whatever you want it to mean (tongue in cheek of course).

If we continue to see recessionary pressures linger around for the remainder of 2023, it could be helpful to refer back to unemployment and wage data to ascertain how the economy is really tracking.

In China the year started with a bang after harsh pandemic restrictions were finally relaxed. Initially the data was encouraging, but the recovery slowed as quickly as it began. Emerging markets which looked set to benefit from increased demand for commodities have also come under pressure as a result.

While economic growth is slowing, unemployment rates in most countries have remained low, and consumer spending has shown resilience - so far.

Inflation And Rates

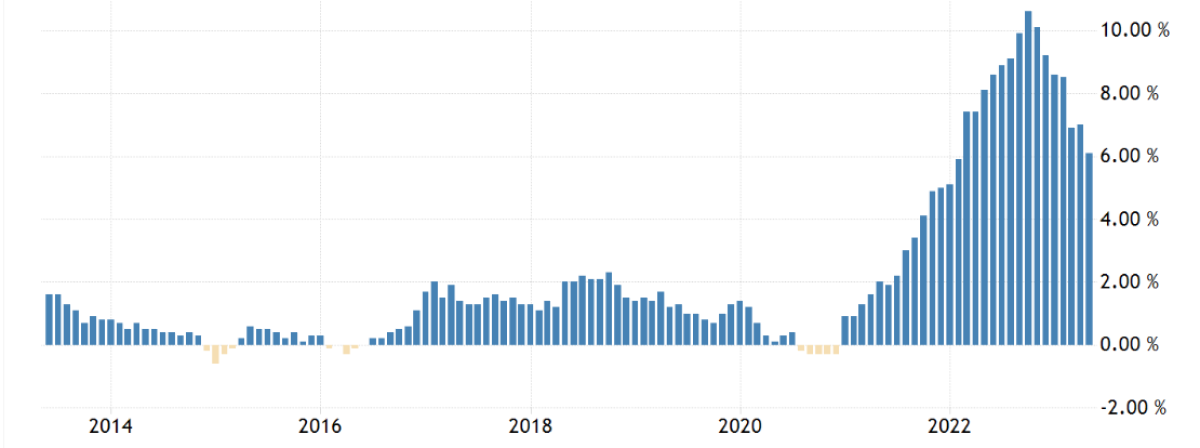

Inflation has fallen significantly in most countries, with falling energy and commodity prices playing a big role. Unfortunately core inflation isn’t falling as quickly (due to inputs like housing and food remaining higher), which means rates may have to stay higher for longer.

Below, the Euro Area’s inflation rate shows there still quite a long way to go:

Several countries have now paused on rate hikes, but it looks like the UK and Europe will have to keep raising. Analysts and some investors have repeatedly bet that rates will soon be falling , but recent comments from central bankers (and data in some economies like the UK) suggest there’s a long way to go before we see lower rates.

Corporate Earnings

The earnings recession really became apparent when companies reported results for the fourth quarter of 2022. Analysts responded by cutting EPS estimates for Q1 2023 by 6% which set a very low bar for the recent round of quarterly reports. It turned out that their estimates were about right at the start of the year, with earnings falling 1-2% on average.

The good news is that EPS declines have stabilized and companies are dealing with lower cost increases. However, it's difficult to see a catalyst that results in a major improvement in the near term.

The Big Stories

The two big stories of the year have been the US banking crisis, which threatened to derail the financial system, and AI which has reignited enthusiasm for technology investing.

In the US several regional banks, and most notably Silicon Valley Bank, collapsed . Prompt action by regulators prevented the crisis spreading to other parts of the financial system. But these bank failures have put pressure on the start-up sector in California and on commercial real estate as these banks were a key source of funding. The crisis also highlighted the risks posed by banks with concentrated customer bases.

The rapid adoption of generative AI models like ChatGPT has highlighted the potential for artificial intelligence. Companies in just about every sector are now investing in AI, with most roads leading to Nvidia and AMD, the companies that sell the picks and shovels (GPUs) that power AI models. While this is sure to be an exciting area, some of the price action looks very much like a bubble. Investors will need to do their homework before piling into any company that announces an AI initiative.

Market Performance

While the media is full of stories about a new bull market, under the hood things are less convincing. We’ve already mentioned that most of the S&P500’s recent strength is due to just 15 stocks. For a different perspective, here’s the year-to-date performance of the stocks in Dow Jones Industrial Average. Of the 30 stocks in the index only 13 are higher than they were at the end of 2022, and only 5 are up more than 10%.

The year-to-date outperforming sectors and markets:

- Almost any company with an AI strategy, with Nvidia leading the way (up 194% year-to-date)

- US Big Tech: The tech component of the S&P 500 and the Nasdaq 100 are both up 36% year to date. The telecom and consumer discretionary sectors rose 36% and 29% respectively, largely due to the performance of Alphabet , Meta , Amazon and Tesla .

- European large caps have also outperformed, with luxury goods company LVMH emerging as the most valuable company in Europe.

- Japan is back on investor’s radars as the Nikkei 225 index closes in on its 1989 peak. As we mentioned last week, a new era may be beginning for Japan’s equity markets.

The notable underperformers:

- US Energy and utilities stocks are under pressure after strong performance in 2022.

- China’s equity market rally fizzled out early in the year as the economic recovery stalled.

- Small caps have for the most part struggled as investors favor companies with large balance sheets and profit margins.

💡 The Insight: The Second Half Is Clear As Mud, But Investors Have Options

This hasn’t been a typical interest rate cycle. Usually central banks raise rates to prevent inflation as economic growth accelerates. This time around the inflation was caused by a war, supply chain disruptions and fiscal stimulus - and central banks probably responded too late.

There really isn’t a blueprint for how this will play out for the economy and markets. Pundits now have widely divergent views on where we go from here.

It’s always a good idea for investors to take a long term view - and that’s especially relevant now. Rather than worrying about how a company might perform over the next six months, consider where it's likely to be in five to ten years.

With that in mind, the most important questions to answer are:

- Which companies do I feel confident estimating the future performance of for the next 5-10 years?

- Look for companies within your circle of competence.

- What purchase price is likely to give me an acceptable return over the next 5 to 10 years?

- Have I estimated a fair value for this stock, and what price would I be happy to pay beneath my estimate to give myself a bit of a margin of safety?

- And finally, is the company in a strong enough position to survive through more economic weakness if that’s what we get?

- What downside risks are there to this company’s future, and how likely are they?

- While it’s tempting to think only of upside, we need to consider what can go wrong, because this will help us avoid confirmation bias , or survivorship bias .

To help with this, we’ve written a 6-part series on “ How to invest like the best ” , where we cover from start to finish how to follow the timeless investing principles that the best investors use to increase their chances of success in the stock market.

It covers aspects like how to discover stocks within your circle of competence, how to value a stock, how to know when to buy and sell a stock, and we even provide an investment checklist that you can use for your future investments! If you have any feedback on it, we’d love to hear!

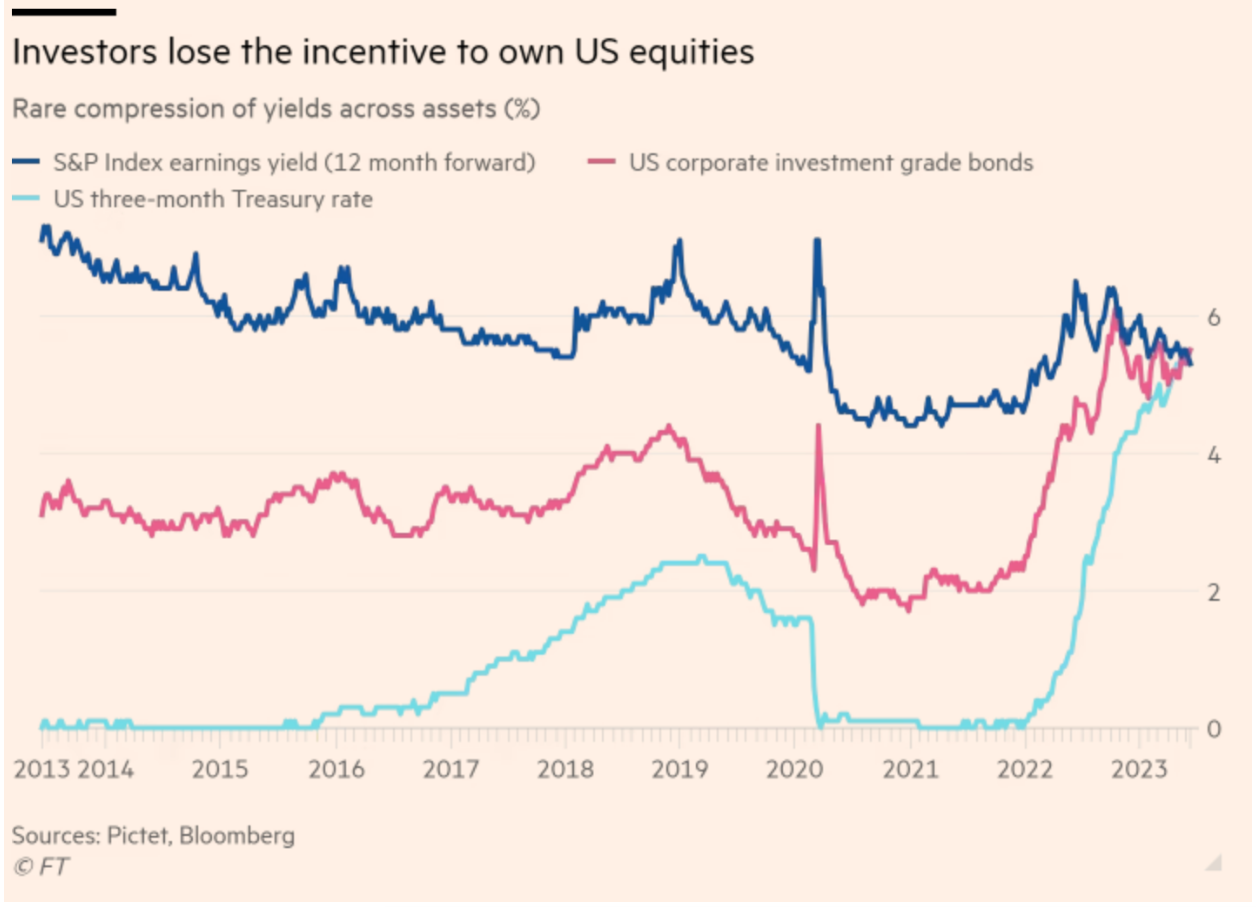

One more thing to consider: In January we mentioned Howard Mark’s Essay in which he said: “low inflation and declining interest rates have been the major factor contributing to strong equity returns over the last four decades. We may now be entering a period where rates are higher on average and no longer persistently declining.”

It’s worth accounting for a higher interest rate when working out how much a business is worth (higher discount rate). It’s also worth considering how fixed income might have a place in your portfolio, since the Financial Times recently reported that the incentive to hold US equities has eroded and expected returns are now equal to that of US corporate bonds and US 3 month treasuries.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇺🇸 US Fed Chair Jerome Powell reiterated his view that more rate hikes are likely . He said inflationary pressure still remained in some parts of the economy, but did say that the pace of further rate hikes would be more moderate .

- 🇺🇸 US housing starts and building permits were stronger than expected. Housing starts rose 21% from April to May, the highest in three decades , while new building permits rose 5%. Despite high interest rates, a housing shortage and improving consumer confidence is leading to rising demand .

- 🇬🇧 UK’s inflation rate unexpectedly remained at 8.7% in May. Economists had expected a 0.3% decline, and the Bank Of England is now certain to raise rates for a 13th consecutive time. The UK still has the highest inflation rate amongst developed economies .

And then, a few news items that we thought were worth noting…

- 📪 Fedex reported a 10% decline in revenue during its fourth quarter which ended in May. The company also lowered its guidance for the full year.

- The decline was mostly attributed to global volumes and does point to a general slowdown in the world economy.

- The company is also in the middle of a major cost cutting exercise which should result in better margins when volumes improve.

- 🏡

KB Home , a US homebuilder, reported quarterly results that were well ahead of consensus estimates. The company also raised its full year guidance for the second time this year.

- Home building stocks have been notable outperformers recently, and this result along with the strong housing starts data confirms the trend.

- This is also another sign of resilience amongst US consumers.

- 💶

Alibaba is planning to bring its

Tmall ecommerce service to Europe . Unlike AliExpress which sells Chinese goods around the world, Tmall will sell local products in Europe.

- E-commerce is already fiercely competitive, and this could make for even tighter margins in Europe. Good news for consumers, but possibly not for competitors.

- This could also be the beginning of a broader global expansion plan for the restructured Alibaba.

Key Events During the Next Week

Friday is the big day for data this week, starting in Europe with Eurozone employment data and the Flash inflation rate. The inflation rate will be closely watched after the UK’s higher than expected inflation data last week.

Also on Friday, US personal spending and the Core PCE (Personal Consumption Expenditures) price index will be published. This data will reflect the strength of consumers as well as their contribution to inflation pressures, which will give the Fed more context on their upcoming rate decisions.

It’s mostly OTC companies still reporting, but there are a few prominent names too:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.