Quote of the Week: "I believe that water will one day be employed as fuel, that hydrogen and oxygen which constitute it, used singly or together, will furnish an inexhaustible source of heat and light, of an intensity of which coal is not capable." - Jules Verne

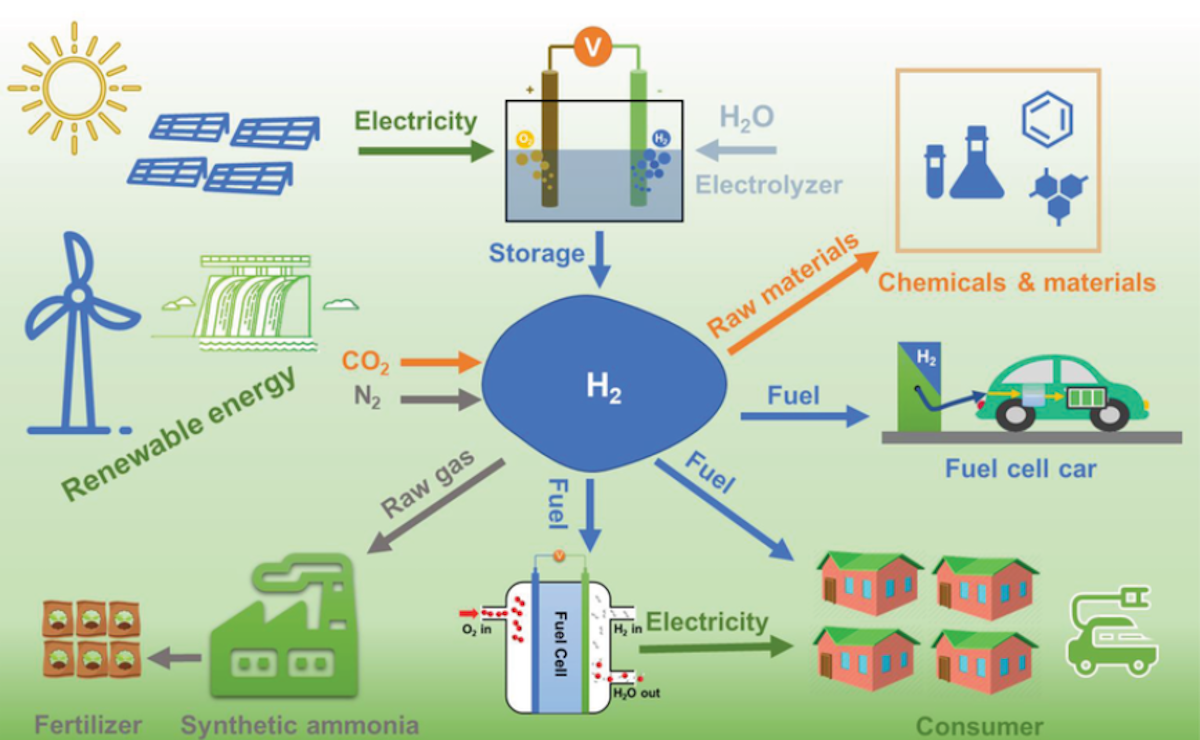

The vision for a hydrogen economy sees H 2 , the most abundant molecule in the universe, as the primary means of storing and transporting energy. This would allow most of the world’s energy to be generated from renewable sources when available, and then used when needed.

This week we are checking in on the prospects, opportunities and challenges facing this industry.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🤖 Nvidia keeps the AI wave rolling ( CNBC )

- Our take: Nvidia beat top and bottom line estimates, and importantly raised forward guidance. Something that really stood out to us were the margins: gross margins of 78.9% are usually reserved for software companies, and the operating margin of 69.3% is even better than Visa.

-

💰 JP Morgan to limit share buybacks at current levels ( Morningstar )

- Our take: Most companies with cash are going full steam ahead with buybacks. JP Morgan’s CEO Jamie Dimon says the bank (which has $54 billion in cash) isn’t going to be buying many shares at the current price. This doesn’t necessarily mean he thinks the share price is overvalued. Dimon has been more pessimistic than most about the economy, and if he’s right, he’ll be able to do a lot with that cash.

-

🔫 Microsoft Considering Putting Call of Duty 2024 on Xbox Game Pass on Day One ( WSJ )

- Our take: By making COD 2024 available to Game Pass subscribers, Microsoft could bring a lot more subscribers to the platform. But doing so would mean sacrificing outright sales (at ~$70 each) from Game Pass’s current subscriber base. Subscription models have generally been successful over the long term (just look at Netflix, Spotify, Adobe etc), but they can mean sacrificing a quarterly windfall.

-

💻 Qualcomm Sneaks into PC market ( Bloomberg )

- Our Take: Microsoft’s new Copilot+ PC category includes Microsoft Surface tablets and PCs manufactured by Dell, HP and others. The initial round of PCs will be powered by Qualcomm’s Snapdragon X processors - though Intel and AMD processors power the PCs at a later stage. Qualcomm’s PC chips use the ARM architecture and promise extended battery life.

- For the last two decades, the PC chip battle has been between Intel and AMD. Qualcomm made some inroads last year, but this opportunity could be its chance to really make its mark.

-

⛏️ Anglo American rejects $48 billion bid from BHP Group ( CNBC )

- Our take: This was the third bid from BHP, which is already the world’s largest diversified mining company. The deal isn’t completely dead as talks have been extended. If it does go ahead, it would be the first mega-merger in the mining industry in over a decade and would likely spark renewed interest in the sector. It would also make BHP the largest copper producer in the world, at a time when copper is seeing record demand.

-

💊 Hims & Hers Health takes on weight loss drug market ( Quartz )

- Our take: As Jeff Bezos said, “your margin is my opportunity”. Novo Nordisk's blockbuster diabetes and weight loss drugs Ozempic and Wegovy cost patients over $1000 a month. Him’s is now bringing a generic version to the market for $199 a month. Their version isn’t FDA approved, but they are taking advantage of a ‘loophole’ that allows compounded drugs that are in short supply to be sold without the usual approvals.

-

💻 Google announced a revamped, AI powered search engine ( The Verge )

- Our take: Another 99 things were covered at the even Following the Google I/O 2024 event, and the Alphabet CEO Sundar Pichai was interviewed by Nilay Patel of the Verge . Besides AI, the interview covered the future of search, content and the web. It covers some uncomfortable realities, and Pichai struggled to answer some questions. It’s worth checking out if you are interested in the future, and fate, of search and the web.

The Hydrogen Economy: Inevitable Or Wishful Thinking?

As we’ve mentioned recently, the clean energy transition faces numerous challenges.

Perhaps the biggest of these is energy storage. Wind and solar power can only be generated when it’s windy or sunny, and the batteries available today are expensive and require vast amounts of lithium and other minerals.

This makes the idea of a hydrogen economy compelling. Hydrogen can be produced using renewable energy, it can be traded, stored and transported as a liquid or gas, and then it can be turned into electricity or heat when needed.

Fuel cells are used to turn hydrogen into electricity, with water vapor being the only byproduct. This process can be used at any scale, ranging from powering an electric vehicle, to supplying power to electric grids.

The term 'green hydrogen' specifically refers to hydrogen created using renewable energy. The generated electricity is used in an electrochemical reaction to split water into its components of hydrogen and oxygen. This is the eventual goal for the hydrogen economy - but there are a few more pragmatic variations:

- ☢️ Pink hydrogen is produced using nuclear power, which doesn’t produce carbon dioxide.

- 🛢️ Blue hydrogen is produced using fossil fuels, but most of the CO2 produced is captured and stored.

- ⛽ Grey, brown and black hydrogen are produced from coal, natural gas or methane without CO2 capture.

Prior to the renewable energy transition, there was already a large hydrogen industry.

The gas is used to produce fertilizer (specifically ammonia), to refine oil, and to process iron ore.

Currently, these processes consume nearly 100 million tonnes a year of hydrogen, and nearly all of it is produced from natural gas, making it grey hydrogen. Carbon dioxide emissions can therefore be reduced by shifting this production to green hydrogen.

🧪 More Science Required

In theory, an energy industry built around green hydrogen would solve many of the challenges facing the clean energy transition. The reality is that there are a lot of steps in the various processes, and most of them aren’t efficient, viable or scalable enough to be game changers yet.

📉 Efficiency

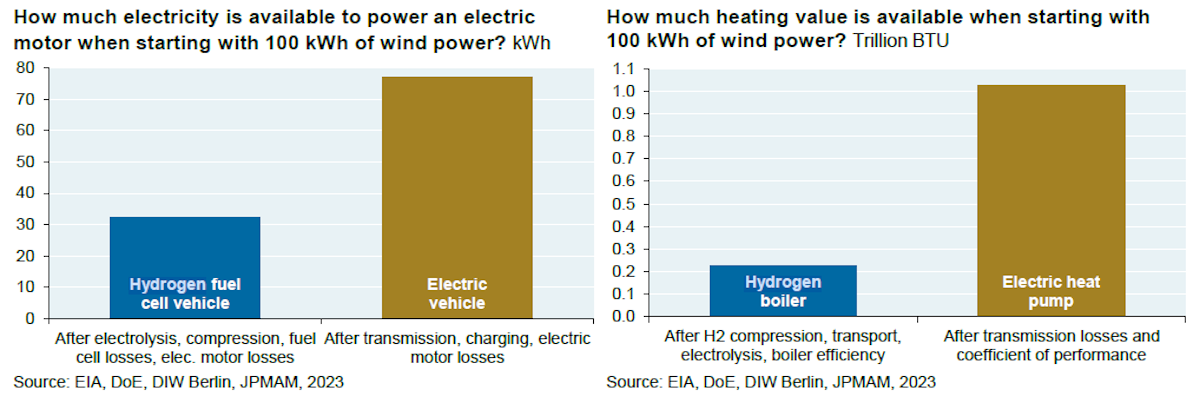

The most glaring problem is energy loss on both ends of the chain. Energy is lost when electricity generated from wind and solar is turned into hydrogen, and then it's lost again when hydrogen is converted back into electricity. In addition, significant power is used to store and transport the gas, and to build the infrastructure.

The result is that only 20 to 30% of the power initially generated can be used to power a vehicle, home or factory. When it comes to heating buildings, the losses relative to electric heat pumps are worse.

There have already been some improvements in the first part of this process. Hysata, based in Australia, is scaling up its electrolyser that it says splits water into H2 and O2 with 95% efficiency , compared to the 80% currently offered by systems at scale.

🪫 Energy Density

Because hydrogen is a gas, its energy density by volume is inherently low. Even liquid hydrogen only contains 25% of the energy of an equivalent amount of gasoline. To store and transport hydrogen it needs to be compressed (which requires energy), or liquified, which requires even more energy.

Either way, the low energy density by volume means it's relatively expensive to store and transport - but a lot of research and development is going into lowering these costs.

🪙 Scarce Resources

Several relatively rare metals and minerals, including platinum and iridium, are used for electrolysis and fuel cells. In addition, substantial amounts of fresh water are used - which is a problem in some places.

Scarcity is a reality for every form of power generation, it’s not unique to the hydrogen economy. But it does add another hurdle to the process.

🚙 Fuel Cell Vehicles

The challenges listed above might seem to make the whole idea of a hydrogen economy a non-starter.

But there are applications that are just about viable, and with further innovations the list of viable use cases will grow. Several analysts believe green hydrogen could be cheaper than the current processes to produce blue/grey hydrogen in 2030.

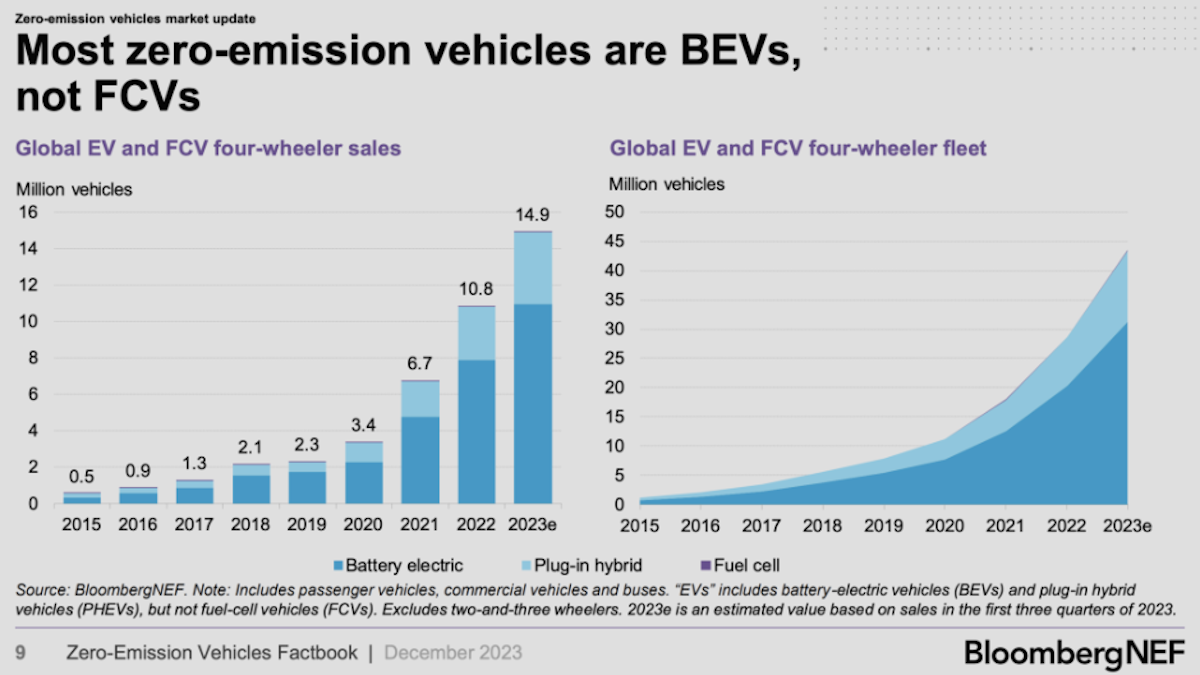

The part of the hydrogen industry that really seems to be on shaky ground is fuel cell powered passenger vehicles (FCVs). In the first quarter this year, just 223 FCVs were sold in the US , which is lower than the same quarter in 2016. Reasons include lack of refueling infrastructure, high costs of hydrogen and vehicle models being discontinued.

When it comes to passenger vehicles, battery electric vehicles (BEVs) seem to have won the EV race. While that seems to be the consensus, some automakers are still pushing ahead and even doubling down on FCVs.

For larger vehicles, including trucks, buses, and trains, fuel cells make more sense. In these cases, space is less of a concern, and the refueling challenges are easier to solve when vehicles travel regular routes. Nevertheless, some operators are still facing problems keeping their fleets in service .

The fuel cell vehicle industry is facing a ‘chicken or egg’ dilemma.

To really get off the ground, cheaper hydrogen and a refueling infrastructure needs to be available. The other awkward reality is the fact that if most of the hydrogen being produced results in CO2 emissions, it defeats the original purpose of EVs.

Without affordable green hydrogen, the fuel cell vehicle industry is unlikely to gain momentum. But governments around the world have realized this and are beginning to provide large incentives for green hydrogen production.

Investing In The Hydrogen Economy

For investors, there are few things that make hydrogen interesting and could act as catalysts for companies in the sector:

- The fact that the whole process is currently inefficient means there's a lot of room for improvement. This means there is opportunity for companies that can create the technology to solve the various problems.

- Governments are getting serious about hydrogen and starting to provide incentives to companies and investors. A week ago, the US Department of Energy offered Plug Power a $1.66 billion loan guarantee to build six green hydrogen plants . The European Commission recently awarded €720m in subsidies for green hydrogen projects .

- Regardless of the energy use cases, there is already demand for hydrogen from heavy industry. This should allow green hydrogen production to scale, which will make it more affordable as an energy storage solution.

The hydrogen energy companies that grab most of the headlines are US and Canada based Plug Power, Bloom Energy and Ballard Power . There are quite a few in Europe and Asia too, including Nel (Norway), SFC Energy (Germany) and Doosan Fuel Cell (South Korea).

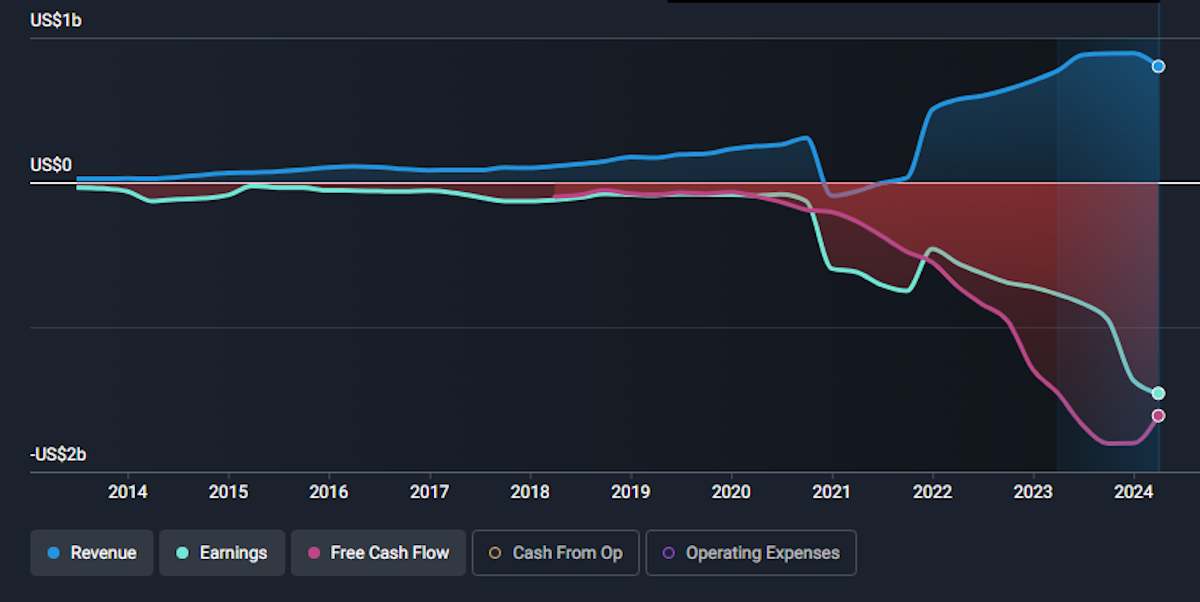

Many of these smaller companies are burning cash as they try to develop the technology and business model required to be viable. Plug Power’s revenue vs cash flow chart below reflects the reality facing many of these companies.

However, if they get it right, the potential upside is massive. If you’re investing in these companies, you really need to understand the technology as well as the economics of the business.

There are also large and established industrial gas producers like Linde Plc in the UK and Air Products and Chemicals in the US. These companies have a very long track record (Linde since 1879!) producing various types of gas and the associated technologies. These companies are now investing substantial amounts in green hydrogen production, and may end up dominating the industry.

Hydrogen ETFs, like the Global X Hydrogen ETF are another option - and as always they are also a good way to find more ideas. The holdings page for the Global X ETF is also a very comprehensive list of hydrogen companies around the world.

Key Events During the Next Week

It’s a slow start to the week, as most of this week’s economic data is due on Friday:

Wednesday

- 🇩🇪 German inflation data is due. Inflation is currently at 2.2%.

Thursday

- 🇺🇲 US GDP estimates for the first quarter will be published. This is the second estimate and is forecast to be 1.6% compared to 3.4% in Q4 23.

Friday

- 🇨🇳 China’s NBS Manufacturing PMI is expected to be 50.2, slightly down from the prior level of 50.4.

- 🇫🇷 France’s inflation rate (also currently at 2.2%) will be published.

- 🇨🇦 Canada 1st quarter GDP growth rate is forecast to be 1.2%, up from 1% in Q4 23.

- 🇺🇸 US Core PCE price data, and personal income and spending data are due to be published.

We are into the tail end of earnings seasons and once again it's mostly cloud software and retail in the spotlight:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.