What Happened in the Market This Week?

Market Insight for 4th April - 11th April

US stocks traded lower last week (down 2.1%) after three weeks of gains. Growth stocks were the major losers as attention once again turned to rising interest rates. Some global markets like the United Kingdom and India fared slightly better (up 1.6% and 2.1% respectively), but for the most part were slightly lower during the week.

-

The US Federal Reserve intends to begin reducing its balance sheet as soon as May. This news spooked the market, negatively affecting the information technology and consumer discretionary sectors in particular. In response, investors bought stocks in the more defensive healthcare, consumer staples, and utilities sectors.

-

Natural gas futures rallied to new highs as European leaders came under pressure to reduce their dependence on imports from Russia. In the US, energy was the strongest sector despite the oil price falling slightly during the week.

-

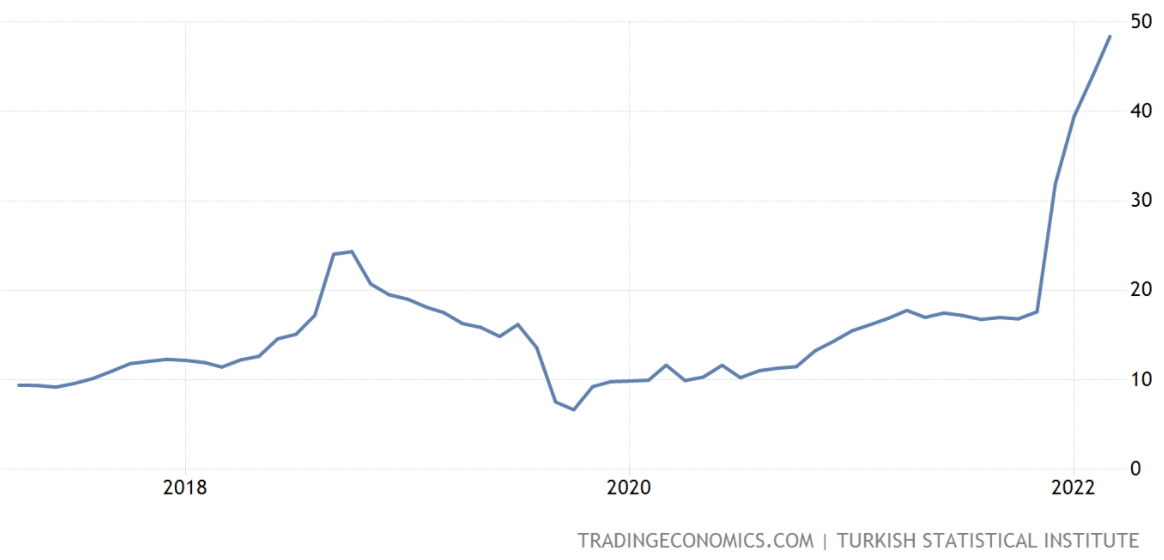

Turkey’s Inflation rate rose to 61% as the country’s weak currency compounded the effect of rising energy costs.

US Sectors 7D performance - April 8th, 2022

Federal Reserve Balance Sheet Reduction

The minutes from the Federal Open Market Committee (who sets the Federal Reserve’s interest rate policy) meeting held in March were released on Wednesday. The committee had already announced that it was raising rates on 16th March, but the minutes indicated that the Fed intends to begin reducing its $9 trillion balance sheet as early as May.

Over the last two years, the Fed’s balance sheet has grown from approximately $4 trillion to around $9 trillion, as a result of market support offered in response to the Covid-19 pandemic, which took the form of bond purchases.

These supportive measures (low interest rates and bond purchasing) aren’t intended to run forever, and so the Fed intends to normalize its policies and reduce the inflation we’re seeing.

In order to unwind the balance sheet, the bank will need to sell these bonds which will increase the supply of bonds in the market. The Fed’s intention is to sell about $95 billion worth of bonds each month. All else being equal, increased supply of bonds leads to lower bond prices and higher yields.

As we’ve discussed before, the valuation of growth stocks can be negatively affected by higher interest rates. The reason for this is that the stock price of a growing company reflects profits that will only be earned in the future, and those profits need to be discounted by an appropriate interest rate (because of the time value of money). The sectors that are most affected are the technology and consumer discretionary sectors, and it was these sectors that fell the most after the FOMC minutes were released.

The Insight: Growth stocks don’t necessarily underperform whenever rates are rising, but they are more susceptible when there is uncertainty about the duration and magnitude of a cycle of rate increases. This is because a lot of growth stocks value is derived from distant cash flows, rather than cash flows generated today.

Natural Gas Prices Rising

Last week, US and European leaders announced a new round of sanctions against Russia over its invasion of Ukraine. Leaders in Europe, and in Germany specifically, are now under pressure to cut imports of natural gas from Russia. In 2021, Germany imported 55% of its natural gas from Russia, and it will be difficult to replace this supply. In total, Europe imports about 30% of its oil and 40% of its gas from Russia, providing valuable funding to the Putin regime. To apply effective pressure on Russia, these imports will need to be reduced or stopped entirely. Europe also faces the risk that Russia may preemptively cut off this supply.

The market for natural gas is tighter than the oil market as there are fewer alternatives sources of supply. So it wasn’t surprising to see natural gas prices rise during the week with US natural gas futures up 9.7%. Natural gas is expensive to transport, but if the price is high enough, US Gas producers may still be able to export gas to Europe profitably.

The Insight: It’s worth noting that a lot of the activity in this market (both the price of gas and the stock prices of natural gas producers) have been speculative because the market still doesn't know if imports from Russia will actually be halted.

Inflation in Turkey

On Monday, Turkey’s Central Bank announced that consumer inflation rose to 61.14% in March. This was the result of the higher cost of Turkey’s energy and commodity imports, combined with a weakening currency. Turkey has been experiencing a currency crisis since 2018 with the Turkish Lira losing more than 70% of its value when measured against the US dollar. Last year, Turkey began to cut interest rates aggressively with the goal of stimulating its economy, but this instead resulted in further currency weakness due to the excess money supply lowering the currency’s purchasing power. Additionally, most of Turkey’s energy is generated from imported resources, which means that the a large portion of the currency is leaving the country instead of circulating within the local economy.

Turkey Consumer Price Inflation, Source: tradingeconomics.com

The cost of electricity and transport feeds into the prices of most physical goods, so when energy costs rise, inflation follows. The countries that are worst affected are those that import oil, gas and coal, and those with structurally weak currencies. A country is likely to have a structurally weak currency if it has a negative current account balance (imports more than it exports) and a budget deficit (spends more than it can raise from tax revenues). Some of the other significant economies with structurally weak currencies include India, Indonesia, The Philippines, Brazil, Egypt and South Africa.

The Insight: Turkey is particularly susceptible to the effects of rising energy costs, but if energy costs continue to rise, more countries may experience very high inflation rates. This is a big problem for the companies in these countries that are dependent on the local economy. But it can also help exporters, as they benefit from higher commodity prices, and their revenues are earned in US dollars while their expenses are paid in the local currency.

Looking Ahead

On Tuesday the 12th of April, US consumer price inflation data for March will be released. Economists expect CPI to reach 8.4%, up from 7.9% in February. If the reported figure is meaningfully higher than forecasts, the market may adjust its expectations for further interest rate increases. Analysts currently expect inflation to have peaked in March or to peak in the next few months and to then decline, but remain substantially higher than the central bank’s target of 2%.

The ECB (European Central Bank) and the central banks of Canada and New Zealand will be meeting this week to discuss interest rate policy. The ECB is expected to keep rates unchanged while Canada and New Zealand are expected to raise rates. Analysts will be closely monitoring the commentary that accompanies these announcements for any indication of future policy direction.

US banks will begin reporting first quarter financial results this week. Bank stocks often follow interest rates higher, but that hasn’t been the case over the last few weeks as the stock prices of major banks have been under pressure. These results may provide insights on the effect of rising interest rates on the profits banks have managed to generate.

Until next week,

Invest Well

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.