Key Takeaways:

- Avis Budget Group ( NASDAQ:CAR ) rose close to 60% on the expectation an increased car rental market as consumers switch their preferences to budget rentals in an economic downturn. The key risk to monitor for the stock is its debt burden.

- DexCom’s ( NASDAQ:DXCM ) continuous glucose monitoring system is showing increasing promise in the fight against diabetes, and more investors are noticing. Investors should be mindful that this company has exposure to one product, while traditional biotech companies utilize a diversified portfolio.

- It seems that the companies selling equipment and services to oil companies are the winning sub-industry for October, and Halliburton ( NYSE:HAL ) hit multiple fundamental marks after the earnings report.

After a period of stable decline, the S&P 500 rose by 4.83% in October. The market in general is quite volatile as companies are releasing their earnings reports and technology stocks are seeing wide declines, while the oil and gas industry is gaining on elevated energy prices from supply constraints.

In this analysis we will focus on the top gainers for October, which returned anywhere between 38% and 59%. The list below shows a mix of the highest performing stocks, which include energy, car rentals, biotech, and cruise tourism stocks.

This “Best Performers” list are selected based on those US listed companies that are over $5bn in market cap, and have the biggest percentage gain for the prior month.

11 Best Performing Stocks For October

Avis Budget Group: Record Performance Driven by Continued Demand

Avis Budget Group operates a portfolio of budget car rental brands. The company has more than 600 thousand vehicles, operating in 11 thousand locations across 180 countries. Key brands include: "Avis", "Budget", "Payless", and "Apex".

The stock jumped some 60% in anticipation of the earnings release , when the company hit record performance. Quarterly revenue was $3.5 billion, up 18% from last year, and net income came at $1 billion, allowing the company to stabilize their balance sheet.

While analysts don’t expect Avis’s current profitability level to continue , it is evident that the company performed well for investors.

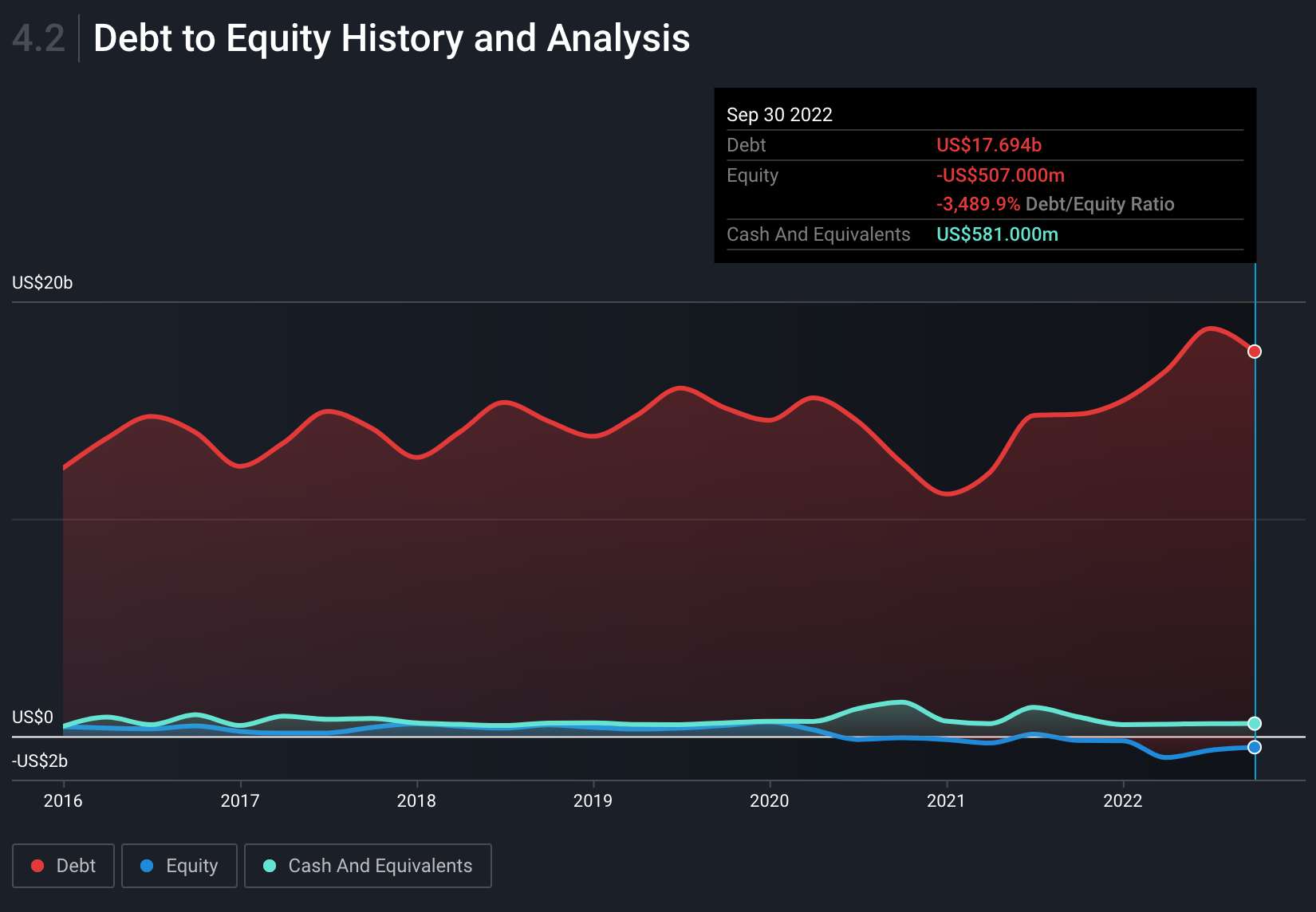

The car rental business is inherently risky because of its reliance on debt to maintain the rental fleet. Which is why it’s encouraging to see that Avis managed to reduce the record debt level from $18.8 billion from last quarter, to the current $17.7b.

Avis Debt to Equity History and Analysis - Simply Wall St

Debt levels have improved for Avis Group, but it remains a risk

While the debt has reduced, the negative shareholders equity (owing more than its assets) is less encouraging. At these elevated debt levels, a rise in rates noticeably increases interest expenses which is why monitoring interest rates is also important for investors in companies like this.

Companies with a rental fleet may also be borrowing against the future value of their assets (rentals), which they sell at auctions or to dealerships on a regular basis, meaning that the debt can be serviced by a partly-liquid asset base.

A possible problem arises when the used car economy slows down on the back of decreasing consumer purchasing power, which can increase the cost for refreshing the car fleet. Luckily, Avis indicated that it has no meaningful debt maturities until 2024 , which gives it even more room to stabilize operations in the event of a deeper recession.

While high, the debt to market equity is much better than in the past few years as the company has increased in market cap from around $3 billion before 2021, to more than $9 billion now.

Challenges facing the car rental market

The car rental business is highly competitive, and companies face challenges from peers with higher capital, fresh financing, and hightech ride-sharing alternatives. For example, Hertz Global Holdings ( NASDAQ:HTZ ) , a key competitor, is having difficulties stabilizing on the market as the company has recently recovered from bankruptcy.

This shows investors that car-rental stocks are a riskier class that have fundamental challenges. On the other hand, the rental business is expected to take precedence of traditional auto sales in times of economic downturn, which may partly explain why Avis’ stock enjoyed a hefty gain.

Finally, given that debt is a significant risk to the stock, a rise in stock prices may also come from the expectation of a decrease in future interest rates.

What This Means for Investors

Investors that are interested in Avis, need to be comfortable with high-debt levels, since that is a core part of the business model. Should the cost of debt financing rise in the future, Avis may consider decreasing their fleet assets and maximizing operations in markets where they are profitable.

If done well, this can increase the value of the future free cash flows, but investors may not be able to expect much higher revenue growth in the future. In a stable market, the company can ideally provide investor returns via buybacks.

Note, dividends are not the best option for cyclical businesses, but buybacks can be implemented flexibly in profitable years.

Next, we turn to the second top performer, which is a company taking on a prevalent healthcare epidemic - diabetes.

Investors back DexCom for diabetes treatment

Dexcom is a company that provides continuous glucose monitoring (CGM) systems to help people with diabetes. A CGM is a device that is strapped to the body - usually the upper arm, and uses a sensor to continuously read blood sugar levels.

When people with diabetes have abnormal blood sugar levels, the device alerts their phone app, allowing people to take necessary medication before diabetes does more damage to the body. This can greatly increase the quality of life, as people can respond faster to their condition.

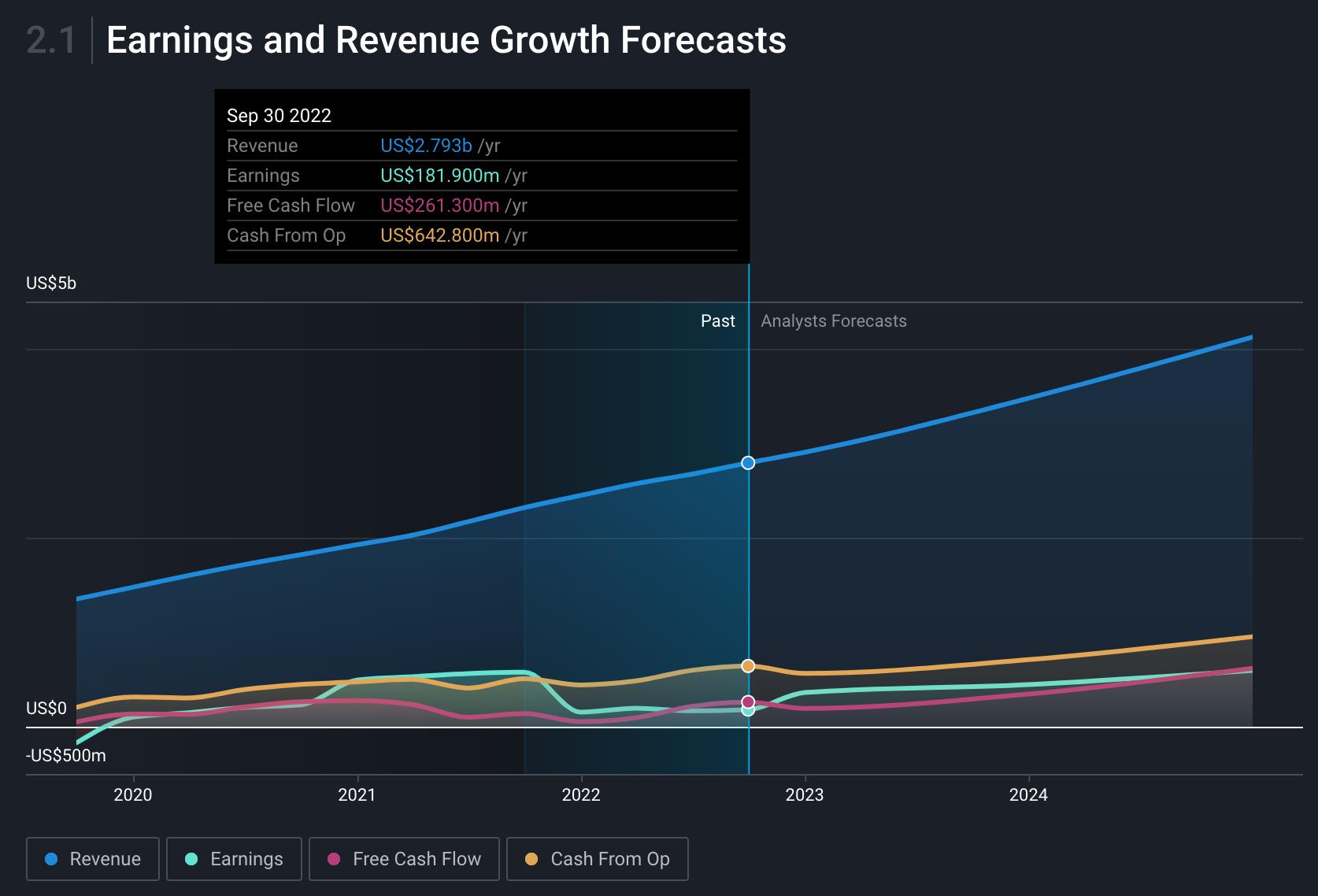

The company stock mostly jumped on high performance after its earnings release , as well as the provided forward guidance for $2.9 billion in revenue - representing an 18.5% growth for the fiscal year 2022. For investors, DexCom’s track record of consistent revenue growth and healthy 6.5% profit margins are signs of quality for the business.

DexCom Earnings and Revenue Growth forecasts - Simply Wall St

Global spending on Diabetes treatment is growing

Diabetes is a growing health problem. In 2019, 37.3 million people from the U.S. (11.3%) had diabetes . Globally , an estimated $966 billion was spent on diabetes-related healthcare in 2021 , with the U.S. making up 40% of that.

Expenditures are increasing, and estimated to reach $1 trillion by 2045. With $2.8 billion in revenue for the last 12-months, DexCom accounts for only 0.3% of the global diabetes expenditures, while providing a high quality product for patients.

This potential upside in future market share may be part of the reason why investors are willing to pay 13.3 times the forward sales for the company.

There are several competitors to DexCom's CGM products, including the FreeStyle Libre from Abbott ( NYSE:ABT ) , the Guardian Connect from Medtronic ( NYSE:MDT ), and the lesser known Eversense CGM from Senseonics Holdings ( NYSEAM:SENS ) .

DexCom’s sensor can be worn for up to 10 days, while Abbott's product is a sensor that is worn on the back of the upper arm and is replaced every 14 days. Medtronic’s product is a sensor that is worn on the abdomen and is replaced every seven days.

Finally, the Eversense CGM is placed in the upper arm and can be worn for 180 days, which may represent an emerging competitor for the industry.

What This Means for Investors

Dexcom is positioned in a large market intent on providing life-improving devices for diabetes patients internationally. The company is executing well and is expected to keep growing into the future.

Investors may consider mitigating some of the valuation and competition risk by spreading their investments across multiple companies involved in tackling diabetes instead of concentrating on one stock.

Finally, in the healthcare industry, there is always a low possibility of the appearance of breakthrough innovation, which can change the game in just a few years.

For our third analysis, we scanned the fundamentals of the top performers and decided to focus on Halliburton, as a stock that stands out among oil services companies.

Halliburton: Why Energy Services are Attractive for Investors

Halliburton is one of the world's largest oilfield services companies. It provides a wide range of services to exploration and production companies, including drilling, completion, and production. Drilling services include the drilling of wells.

Completion services involve the installation of production equipment and the completion of wells. Production services include the provision of production chemicals and equipment, as well as the management of production operations.

The company is primed to capitalize on the energy crisis in the world, especially Europe where energy insecurity is increasing. This causes a rise in oil prices which may continue to benefit the company in at least two ways.

First, higher oil prices lead to increased exploration and production activity, which in-turn drives demand for Halliburton's services. Second, higher oil prices increase the value of Halliburton's oil and gas reserves, which provides a boost to the company's bottom line.

Halliburton and other e nergy stocks have promising outlook

Energy services stocks rose across the industry in October and keep performing as the demand for more energy increases their profitability potential. As we can see from the list above, besides Halliburton, companies like SLB ( NYSE:SLB ) , NOV ( NYSE:NOV ) , ChampionX ( NASDAQ:CHX ) have risen on positive earnings results and their gains are persisting, indicating that analysts may see a longer upside for this industry.

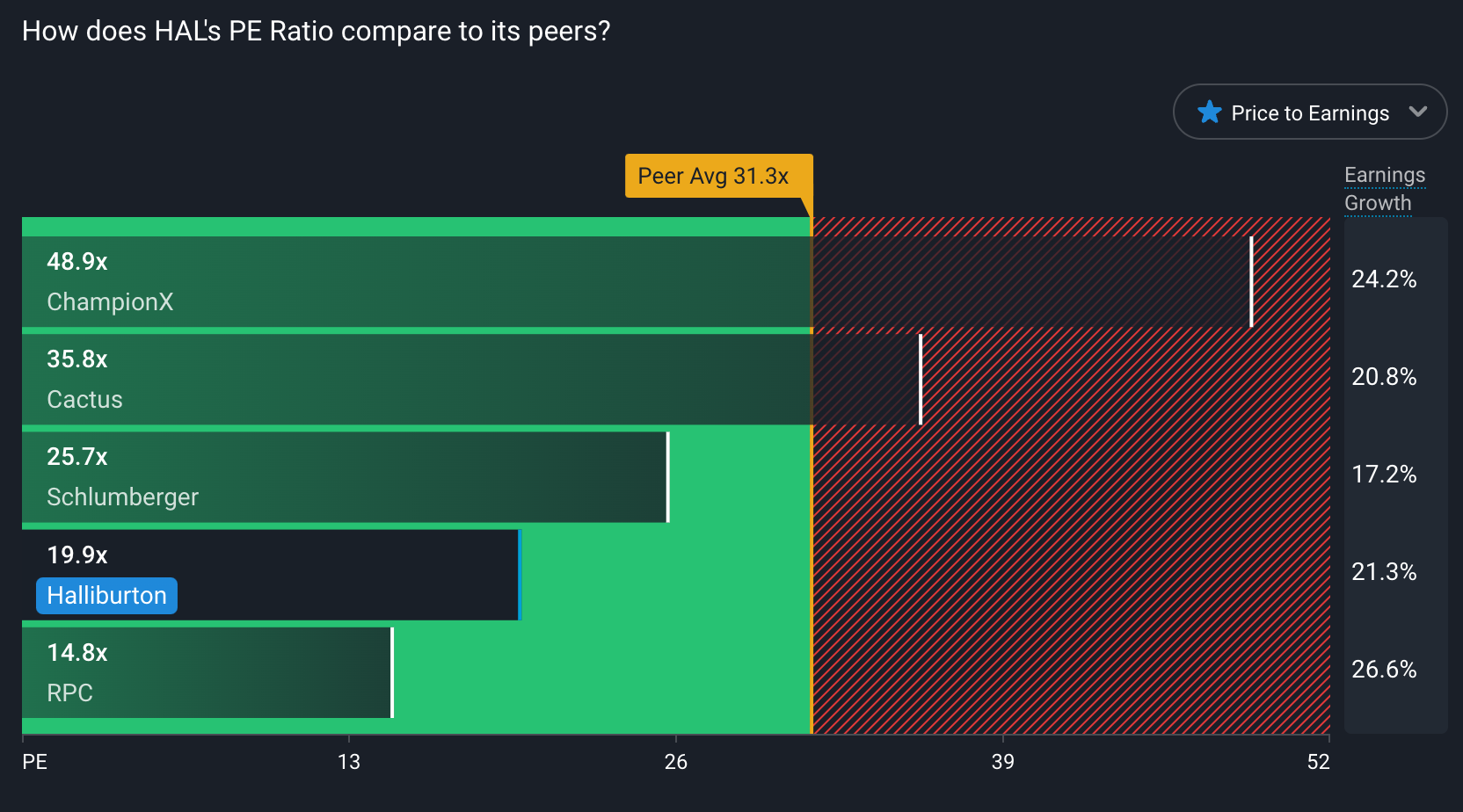

Looking at the peer pricing, it seems that investors may be neglecting Halliburton’s future earnings growth, and are instead more focused on investing in companies with a higher market cap like SLB.

Halliburton PE ratio vs Peers - Simply Wall St

This may provide an opportunity for those interested in Halliburton, because you’re paying a lower PE multiple, yet getting the same expected profit growth as the likes of Cactus, which is almost twice as expensive.

The company is trading at 14.9x its future earnings, which we can see are estimated to rise 21% next year. This combination of a low price relative to peers, with relatively good future earnings forecasts is why Halliburton may be worth looking into even post the October jump.

What This Means for Investors

Investors believing that energy prices will continue to stay at elevated levels, and see no quick fix for the world’s energy shortage may find themselves interested in energy service companies like Halliburton.

This company is effectively scaling up operations as the need for more oil drilling increases. Besides the fundamentals, investors may find opportunities in the mismatch between the global energy regulatory direction on one side, and the increased demand for cheap energy on the other.

Which Stocks performed the best in October?

Companies involved with energy services, cost-effective mobility, promising medical technology, and even cruise tourism were the winners for October.

While stock prices are a noisy signal, they can still show us the direction of the market. Currently, it seems that energy is a priority, and will be an ongoing concern for regions like Europe that are facing supply shortages.

Even though the focus is centered around the winter demand spike, it is unclear how the continent will deal with its energy needs after that. If we couple this with the effects of energy price inflation, we can see why these companies have been consistent winners for the past year.

Looking ahead, investors may want to consider defensive stocks, which prioritize loss reduction instead of maximizing gains. Even though everyone is aware of the economic downturn, it’s hard to tell how long or how intense it will be, so some preparation may be worth the time. You can also analyze your portfolio in our Portfolios section , and weigh the diversification balance of your investments. Because having uncorrelated bets (diversifcation) is a key part of reducing concentration risk.

If you want to know which stocks other investors are most excited about, take a look at our trending stocks list .

Our “Best Performers” are selected based on those US listed companies that are over $5bn in market cap, and have the biggest percentage gain for the prior month. All our data is from S&P Capital IQ, the world’s premier provider of financial data.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.