🤖 A.I. Enters the “Show Me The Money” Phase

Reviewed by Bailey Pemberton, Michael Paige

Quote of the Week: "The future of AI is not about replacing humans, it's about augmenting human capabilities." - Sundar Pichai, CEO of Google

The AI frenzy of 2023 and 2024 has cooled down and entered the "show me the money" phase. Earnings season has shed a lot of light on where we stand.

So it’s time for an update on the industry and a look at the companies successfully deploying AI, monetizing it, and the potential opportunities for investors.

What Happened in Markets this Week?

A lot of these stories involve President Trump across multiple industries, but that just seems to be the market these days.

Here’s a quick summary of what’s been going on:

-

🧑⚖️ US trade court says Trump’s global tariffs are illegal ( Financial Times )

- The U.S. Court of International Trade just ruled Trump's April 2 global tariffs illegal, saying he overstepped by using emergency powers not meant for trade policy.

- The decision knocks the legs out from under Trump's tariff agenda and could stall or even unravel recent trade talks.

- This ruling reduces near-term tariff risk, which investors liked. Stock futures and Asia markets saw gains. Sectors sensitive to trade flows, like semiconductors, retailers, and automakers, could benefit from a more stable import landscape. However, expect volatility because the White House said it would launch an appeal.

- While Trump’s tariff plans just hit a legal wall, investors should watch for trade deal resets, not new levies.

-

💸 Nvidia beats Wall Street expectations even as Trump tamps down China sales ( The Guardian )

- Nvidia crushed revenue expectations with $44.1B in Q1, despite missing on EPS and taking a $4.6B hit from excess China-focused chip inventory.

- U.S. export restrictions blocked billions in AI chip sales to China, but Nvidia offset losses with strong global data center demand and Gulf region growth.

- China’s market is slipping out of reach, but Nvidia’s global dominance in AI hardware keeps it firmly in the driver’s seat. With $45B guidance and surging Middle East orders, Nvidia remains a core AI play, even with geopolitical brakes on.

- So while the company may be shut out of China, it's still cashing in on the AI gold rush everywhere else.

-

☢️ Trump signs orders to overhaul Nuclear Regulatory Commission, speed reactor deployment ( CNBC )

- Trump signed orders to overhaul the Nuclear Regulatory Commission, fast-track reactor approvals, and authorize new builds on federal land.

- Moves aim to cut red tape, revive mothballed reactors like Three Mile Island, and fuel data center demand amid the AI boom.

- This is bullish for uranium miners, nuclear utilities like Constellation , and AI-linked energy plays. Accelerated permitting could ease long-standing nuclear bottlenecks and attract more private investment, especially from tech giants needing stable power.

- Trump’s orders could jolt the nuclear sector out of gridlock, just in time for AI’s insatiable energy appetite. Europe’s even pivoting back to nuclear.

- Check out our Global Uranium Mining Screener and our Global Nuclear Energy Screener for stock ideas in this space.

-

🌊 Trump’s push to break China’s mineral dominance paves the way for a deep-sea gold rush ( CNBC )

- Trump’s executive order greenlights deep-sea mining in U.S. and international waters, aiming to cut China’s chokehold on critical minerals like cobalt, nickel, and manganese.

- The move triggered a surge in investor interest, with The Metals Company racing to secure a first-of-its-kind commercial seabed mining license.

- This could open a high-risk, high-reward frontier for mineral supply chains. Expect regulatory battles and ESG pushback, but also tailwinds for mining tech, defense, and battery materials if licensing moves forward.

- The U.S. just threw a wrench into China’s mineral game, and now the race for ocean-floor resources is officially on.

-

👜 LVMH warns Chinese are curtailing travel, overseas spending ( Fortune )

- LVMH flagged a slowdown in Chinese luxury spending, citing weaker tourist traffic and shifting preferences toward domestic brands.

- The company also paused price hikes in wine and spirits, admitting consumer pushback and softening demand.

- China's post-COVID luxury rebound is losing steam, pressuring global players like LVMH. With tariffs clouding the U.S. outlook, expect margin compression and cautious guidance across the sector.

- China’s luxury engine is cooling, and LVMH just warned the rest of the industry to buckle up.

-

🚘After a nearly 6-month search, Stellantis names former Jeep boss as its new CEO ( Sherwood )

- Stellantis named Antonio Filosa, former Jeep chief, as CEO after a six-month search triggered by collapsing U.S. sales and a 70% profit drop.

- Filosa takes over just as tariff breaks expire and automakers prep for price hikes, making his focus on U.S. market share all the more urgent.

- The leadership change signals a clear pivot toward fixing Stellantis' chronic U.S. underperformance. But with rising vehicle prices and intensifying EV competition, Filosa’s margin for error is razor-thin.

- While there’s a new CEO, it’s the same uphill climb. Filosa’s challenge is to make Stellantis matter again in America.

🤖 AI Check-Up Q2 2025: Who’s Winning, Who’s Fading, and Where’s the Value?

Early last year, we wrote about AI. If you missed those articles, you can find them here:

It’s time for an update, which we will do through the lens of the AI value chain.

To recap, McKinsey & Co. identified 6 levels to the AI value chain:

- 🧠 Hardware: Datacenter AI infrastructure and chips

- ☁️ Cloud Platforms: Compute power as an on-demand service

- 🧬 Foundation Models: The Large Language Models that make the magic happen

- 🛠️ Model Hubs and MLOps: Tools to manage the development process

- 📱 Applications: The tools available to end users

- 🧑💼 Services: The consulting companies that help companies navigate their AI strategies

The important analogy to this value chain is the early years of the Internet.

While the dotcom frenzy focused on hardware providers like Cisco, the real value was created in the applications that were later built on the web: Google, Amazon and Meta in particular.

Let’s see where we are now…

⚙️ Computer Hardware: Trends maturing and questions arising

The early winners in the AI arms race were the companies that provided the GPUs (Nvidia) and other hardware required to scale data centers.

The largest cloud providers have poured hundreds of billions into AI infrastructure, and quarterly investments continue to rise, although the acceleration has slowed somewhat.

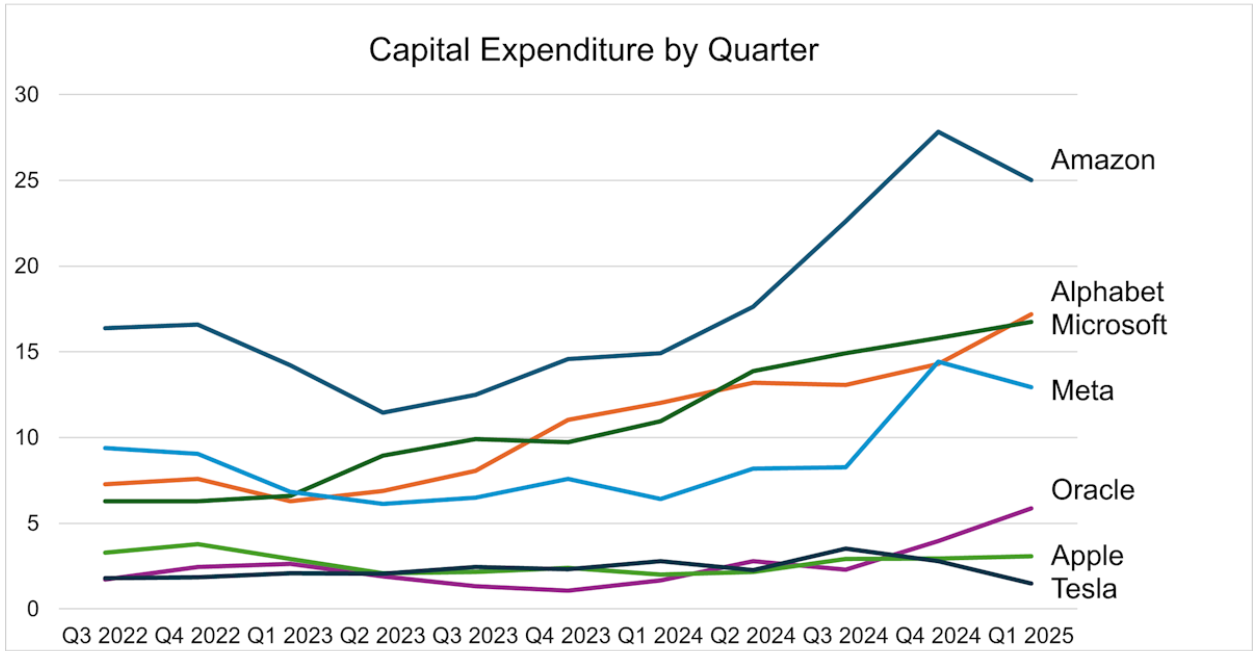

Not all CapEx goes into AI infrastructure (particularly for the likes of Amazon, Tesla, and Apple), but it’s a reasonable proxy for hardware investments.

Quarterly Capex by Big Tech

The tailwinds for companies like Nvidia, TSMC, and Broadcom are firmly in place. But the trend has matured, so the questions now revolve around:

- 📈 Valuation vs likely growth rates: Growth in spending has been more sustained than many expected. But stocks priced for perfection would still be sensitive to any sign of a slowdown.

- 🥊 Competition: The growing market for AI chips and other hardware has led to growing investment in the sector. Chinese companies have an additional incentive in the form of the US export ban.

- SMIC plans to start manufacturing AI chips for Huawei next year. Eventually, Chinese companies may have something that competes with Nvidia’s GPUs, though they would no doubt become yet another geopolitical football.

- 💵 Margins: When competition intensifies, margins tend to come under pressure. Companies like Nvidia and TSMC have IP and capacity that’s hard to replicate. But for companies selling more generic equipment, margin pressure is likely.

☁️ Cloud Platforms: Growth materialising, but at a cost

AI is driving growth for the world’s largest cloud providers (Amazon Web Services, Microsoft Azure, and Google Cloud) - and for smaller rivals like Oracle, IBM and in China, Alibaba and Tencent.

They will be relieved to see their CapEx beginning to bear fruit.

Newly listed CoreWeave has grown revenue ten-fold to $2.7 billion in 24 months, but it’s currently spending billions of dollars to do that .

Coreweave is a specialist AI cloud provider, so it’s a great pure-play entry, that is, if you can justify the arguably frothy valuation.

🏗️ Foundation Models: Rapid progress, rising competition, and looming limits

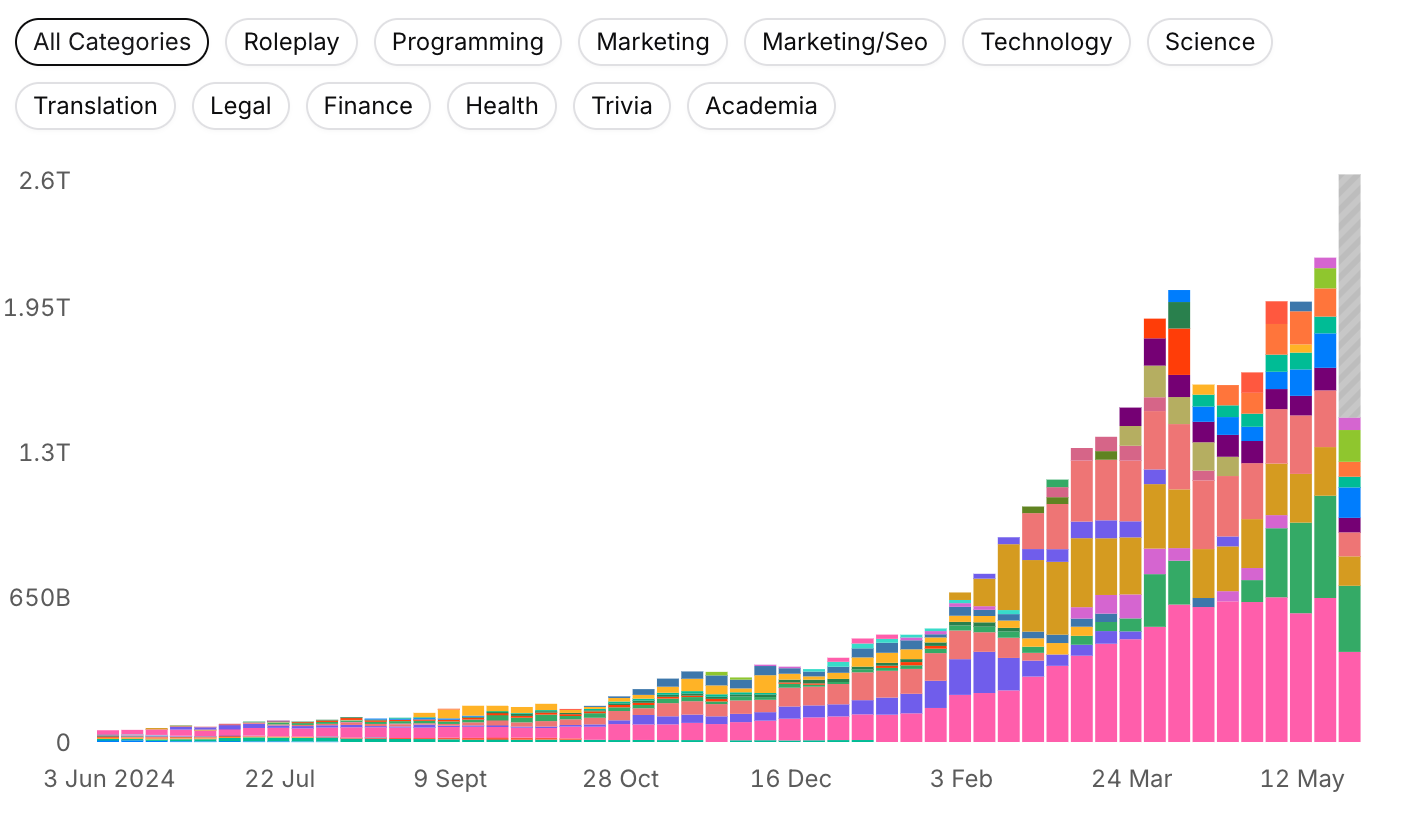

The LLMs powering generative AI continue to impress with their capabilities, and they’re seeing increased traffic too. The chart below from OpenRouter shows how model use has accelerated since the beginning of the year.

LLM Token Usage Last 12 Months - OpenRouter

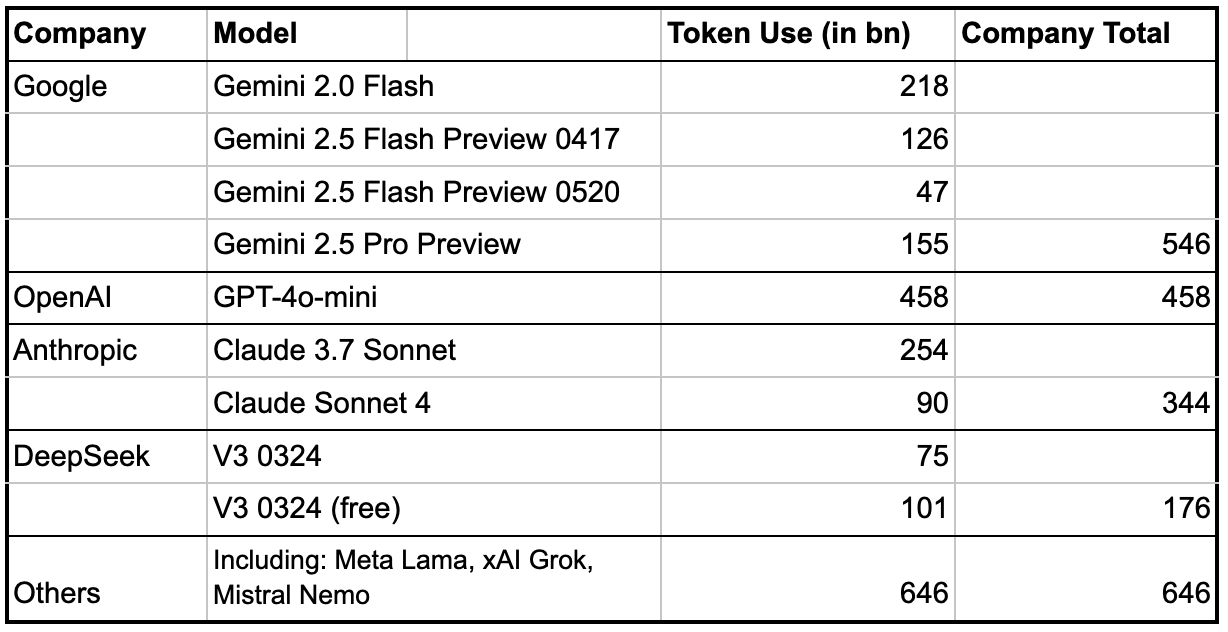

…and here’s the breakdown for the week ending 19th May (in billions)…

LLM Token Usage for Week Ending 19th May (Token Use in Billions) - OpenRouter

✨ The table shows that the market is very competitive. But it also shows that having access to potential users (ie. Google and Microsoft) goes a long way.

As far as capabilities go, it’s even more competitive.

Websites like Livebench score LLMs for specific tasks like reasoning, coding, data analysis, and language. Typically, a different model leads in each category, but only until another, more powerful model is released.

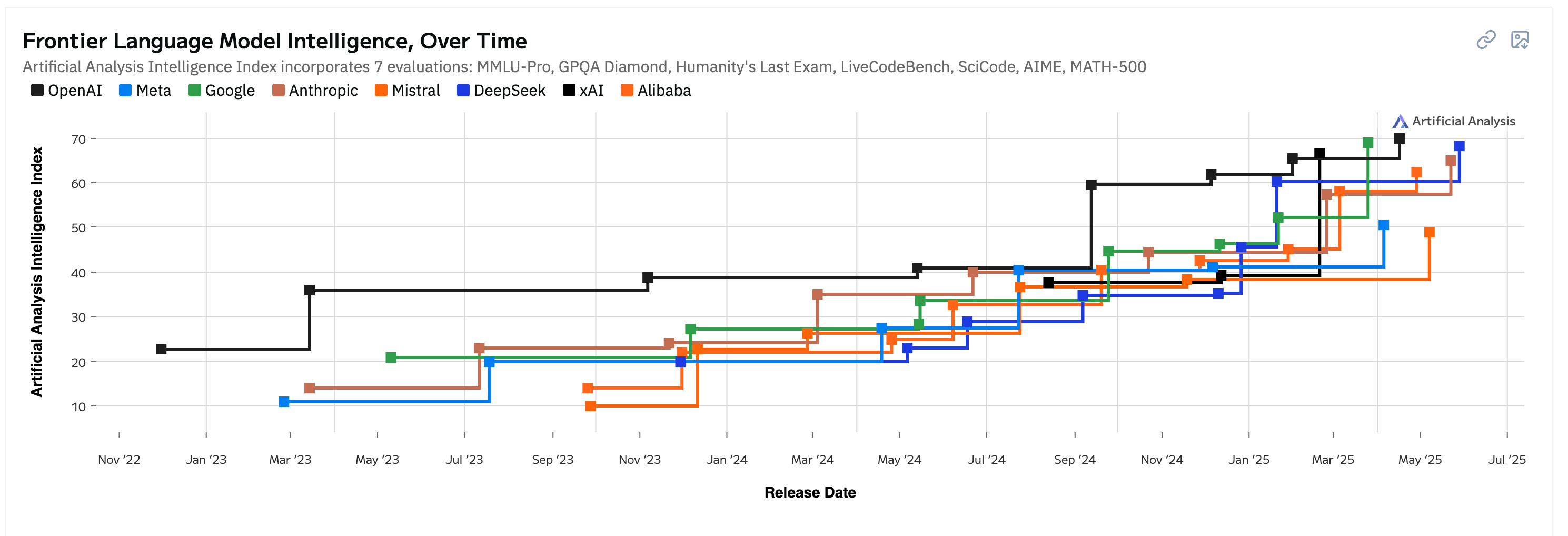

Here’s how model intelligence has progressed since 2022.

✨ It’s notable that open source models like Meta’s Llama, DeepSeek, and Qwen lag slightly, but catch up with the best models in a matter of months.

LLM ‘Intelligence’ 2022 to 2025 - ArtificialAnalysis

Something that’s becoming increasingly apparent is that a lot of platforms and tools are model agnostic.

Two popular tools, Github Copilot (below) and Perplexity AI Search , let you choose from a list of models, including all the top-performing ones.

Competition between the model providers is likely to remain intense as applications give users a choice ranging from free, open-source LLMs to the very latest and most powerful models.

✨ LLM models are likely to face scaling issues at some point - possibly quite soon, as some believe.

If, or when that happens, the pace of model improvement will slow, so they could become even more commoditized. The bottom line is that having customers is probably more important than having the best model.

🧰 Model Hubs and MLOps: Critical infrastructure, limited investment access

MLOps tools have become a crucial part of the ecosystem.

Expensive resources need to be managed - and the process also needs to be secure. The rush to roll out new AI tools introduces a host of potential vulnerabilities, so MLOps, goes hand in hand with DevSecOps (Development Security and Operations).

There’s no shortage of companies operating in this space, but there aren’t many options available to equity investors:

- On the one hand, all the big AI/Cloud providers offer MLOps tools > but they are part of the overall service, and don’t really move the needle.

- And, then there are smaller companies like Databricks , DataRobot and Kubeflow that have made a name for themselves in this space. But they are all unlisted.

There are two listed companies to have a look at:

- JFrog provides software development tools and recently launched JFrog ML, which integrates with its other tools.

- Gitlab also provides a suite of software development tools with a focus on DevSecOps, including MLOps tools.

📲 Applications: Adoption rising, but the killer use case remains elusive

The application layer is beginning to see more adoption, as companies increase their AI investments and users become more comfortable with AI.

Still, it’s probably fair to say we haven’t seen a killer app just yet.

✨ The Business of Apps estimates the AI app market at around $4.5 billion now, which is peanuts compared to the hundreds of billions already invested.

One of the most used AI apps is Microsoft Copilot, which now has around 33 million active users across various platforms. That’s not bad, but it’s a fraction of the 1.5 billion odd Microsoft Office users.

Needless to say, it’s still early for applications - but there are less obvious applications in widespread use:

- 🤖 Chatbots : Millions of websites have AI-powered bots handling queries. Many are built internally, and customers don’t pay for them. But they can help companies increase sales and reduce costs, so they contribute to the bottom line indirectly.

- 🛡️ Cybersecurity : Companies like Crowdstrike use GenAI extensively to mimic and predict threats and cyberattacks.

- 📢 Advertising: Google and Meta were the most successful monetizers of AI long before ChatGPT was a thing. They are still doing so - and now they have even better tools to do it.

- Many of the other big winners from AI are also ad businesses. AppLovin has been a big winner, growing net income 220% in the last year. Mobvista in China has also seen revenue accelerate due to its AI-powered ad engine.

🤖 About those Agents...

2025 was dubbed the year of the agent - so where are they?

Agents are AI tools that perform tasks, rather than merely making suggestions. That includes tasks like making payments, placing orders, signing contracts, and booking flights.

Two companies going all in on agents are ServiceNow and Salesforce . Both released suites of agents late last year and added new features during Q1.

These tools aren’t moving the needle yet, but analysts are optimistic. ServiceNow and Salesforce both raised guidance after the Q1 results and attributed better-than-expected sales to AI in general, rather than to the adoption of agents specifically.

Right now, companies are investing more in capacity - and probably testing agentic tools if not subscribing to them. This is something to watch over the next few quarters - if agents prove their ability to reduce costs and improve efficiency, adoption could pick up quickly.

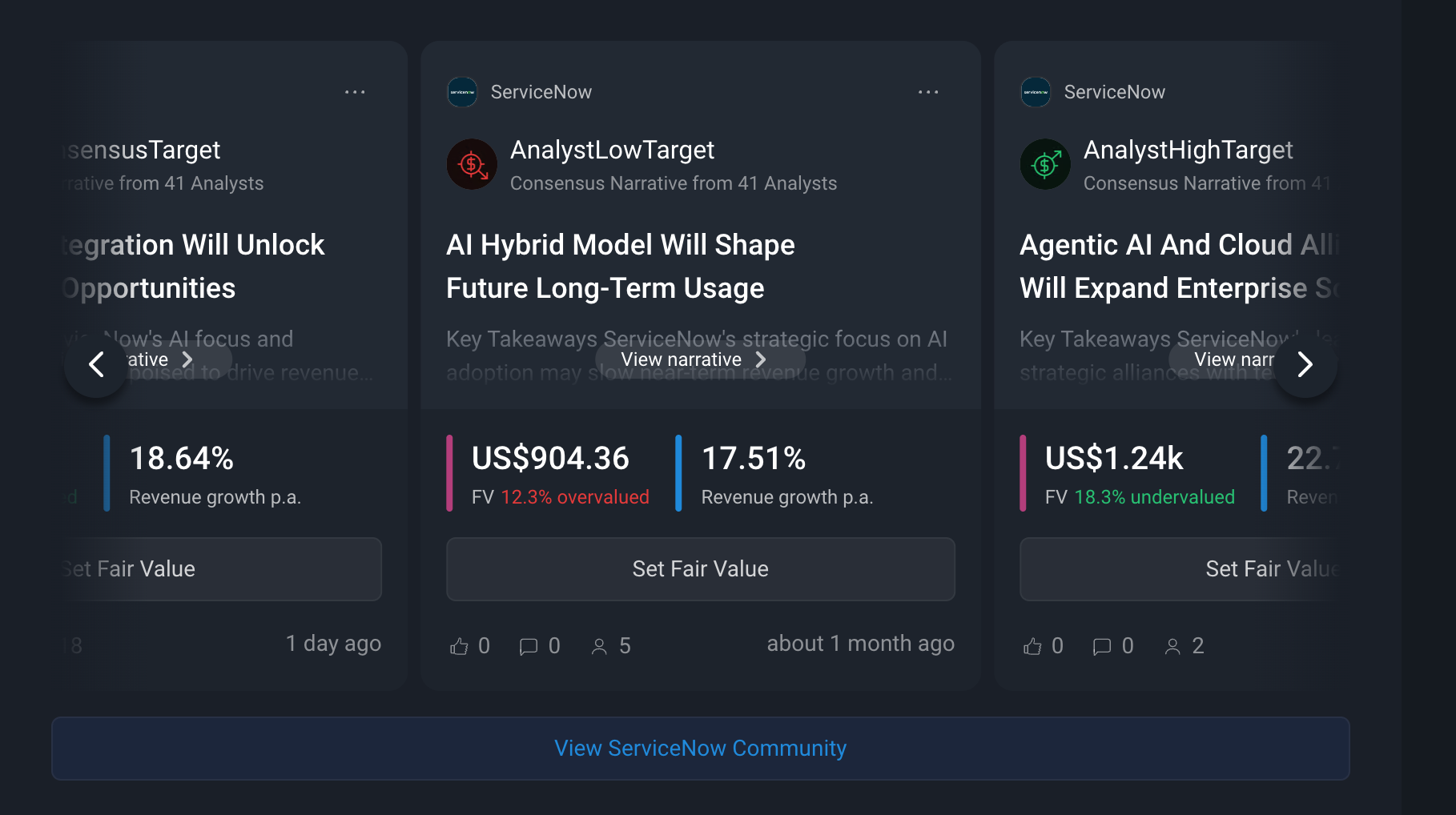

Simply Wall Street is also leveraging AI to make it easier to see what analysts think and why. You may have seen the AI-generated AnalystConsensusTarget narratives . These are generated using analyst consensus estimates and transcripts from earnings calls.

These narratives connect the dots between company and industry catalysts and consensus price targets and forecasts, and they're a great starting point to create your own narrative.

We’ve recently released bullish and bearish analyst narratives based on the highest and lowest target prices published by analysts. These can help you figure out if the market might be over- or underestimating the outlook.

Check out the narratives for ServiceNow and see which one makes more sense to you:

ServiceNow Narratives - Simply Wall St

🧱 Data: Digital gold with compounding strategic value

One of the biggest winners during earnings season was Snowflake, a company that helps its customers manage data across multiple platforms. The company is seeing demand for its latest tools.

Data is essential to AI, and it’s one of the best ways for a company to differentiate itself. To get the most out of agents and other AI tools, companies need to make sure they can gather, organize, and access as much useful data as possible.

Data is also a key part of the strategy for companies like Salesforce, which has just acquired data management platform Informatica for $8 billion.

Another big winner over the last year has been Palantir, which has seen sales accelerate for eight consecutive quarters and is now running at 39%. Palantir provides data analytics tools for a number of industries, including the government.

✨ Data management platforms are having a moment right now, but there’s another takeaway for investors: Companies that already gather a lot of rich data have an unfair advantage with AI.

- Notable data hoarders include Amazon , Meta , Alphabet , Visa , Mastercard, and PayPal .

🛠️ Services: High demand, mixed results, and overlooked potential

AI investments are being ramped up around the world, but at the same time, there’s a shortage of skilled AI professionals. This should be great news for IT consulting companies that advise corporations on IT and digital strategy.

Strangely, it hasn’t really translated into sales growth for most of the companies in the sector. Maybe the bar was already high as they advised on cloud and remote work strategies.

✨ Nevertheless, analysts are optimistic about the future, and specifically for Kyndryl , Accenture plc , Grid Dynamics Holdings, and Endava plc .

Something to keep in mind is that revenue for consulting companies isn’t always recurring. So you need to be careful about extrapolating current earnings into the future.

- On the positive side, this can mean companies get overlooked as the market chases subscription revenue.

💡 The Insight: AI as a Lens, Not Just a Sector

🤖 AI is touching every industry : It’s no longer just a tech story. Going forward, every investment case will need to consider how AI could help or hurt a business.

🔍 Some key questions for investors are :

- 🛠️ Can this company leverage AI to improve its competitive position?

- ⚠️ Is the company at risk of being disrupted?

- 📈 Does it have a clear, effective strategy to adopt AI and stay relevant?

🏰 Some Moats Could Disappear

Some competitive advantages that have been solid for decades could disappear overnight. Software companies are particularly vulnerable, as a lot of tools can be replicated very cheaply.

Adobe is a prime example. Adobe’s Creative Cloud isn’t cheap, and a lot of content can now be created using tools available for free. But there are two ways to look at this:

- The company could be disrupted as new AI tools become available.

- Alternatively, if the same tools are available to everyone, creators have even more need for something that makes their work stand out.

Adobe knows its market better than anyone. So it’s still best placed to create the best content creation tools. But the company will have to navigate this transition carefully and make sure its tools really do stand out from the crowd.

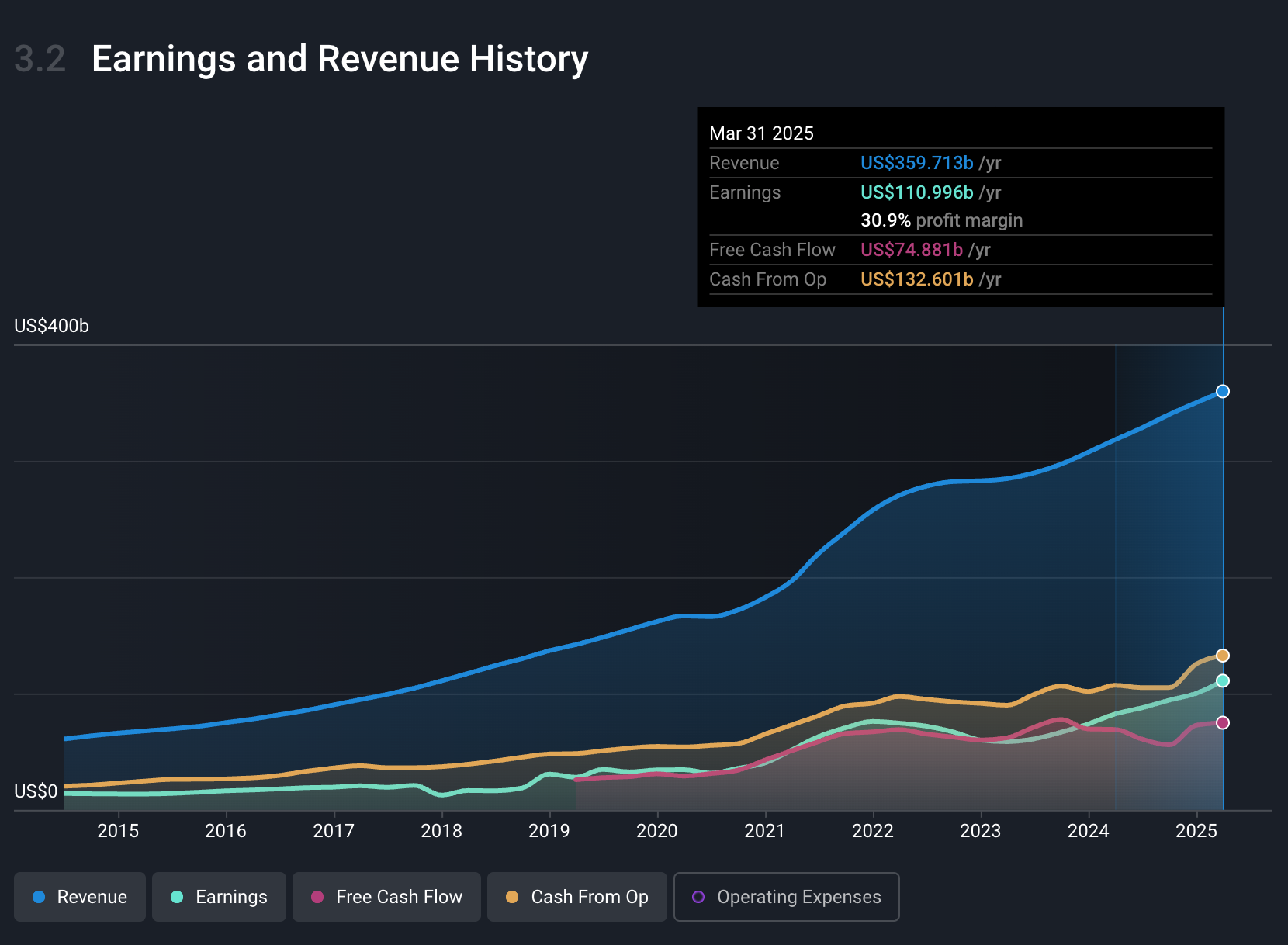

📈 AI Adoption can be a key driver of Earnings Growth

All types of companies can benefit through higher sales and lower costs through implementing AI in their business, which ultimately boosting margins. Look at what Alphabet, Microsoft and Meta have been able to do already just over the last 2 years to their operating margins.

- Alphabet: 25% → 31%

- Microsoft: 41% → 45%

- Meta: 28% → 42%

Alphabet Revenue, Earnings and Cash Flow - Simply Wall St

Key Events During the Next Week

This week, there are a few key employment reports and interest rate decisions in Europe and Canada.

Tuesday

- 🇪🇺 Eurozone Core Inflation Rate (Flash)

- 📊 Previous: 2.2%. Forecast ↘️ 2.1%

- ➡️ Why it matters: A dip in core inflation boosts the case for ECB rate cuts sooner rather than later.

- 🇺🇸 US JOLTS Job Openings (Apr)

- 📊 Previous: 7.192M. Forecast ↘️ 7.05M

- ➡️ Why it matters: Fewer openings suggest the labor market is loosening, raising the odds of Fed rate cuts.

Wednesday

- 🇦🇺 Australia GDP (QoQ) (Q1)

- 📊 Previous: 0.6%. Forecast ↘️ 0.5%

- ➡️ Why it matters: A softer print pressures the RBA to stay cautious, while a beat could lift the Aussie dollar.

- 🇨🇦 Bank of Canada Rate Decision

- 📊 No change expected, currently 2.75%.

- ➡️ Why it matters: With rates likely on hold, all eyes are on the BoC’s tone for clues on future cuts.

Thursday

- 🇪🇺 Eurozone ECB Interest Rate Decision

- 📊 Expected cut from 2.40% to 2.15%

- ➡️ Why it matters: With a cut expected, markets will focus on signals about how much further the ECB plans to ease.

Friday

- 🇨🇦 Canada Unemployment Rate (May)

- 📊 Previous: 6.9%. Forecast ↗️ 7%

- ➡️ Why it matters: A rise in unemployment could strengthen the case for Bank of Canada rate cuts.

- 🇺🇸 US Non-Farm Payrolls (May)

- 📊 Previous: 177K. Forecast ↘️ 130K

- ➡️ Why it matters: A major miss or beat here can move everything from Fed expectations to stocks, bonds, and the dollar.

- 🇺🇸 US Unemployment Rate (May)

- 📊 No change expected, currently 4.2%

- ➡️ Why it matters: A steady or higher rate signals cooling in the labor market, boosting the case for Fed easing.

Earnings reports have slowed to a trickle. There are a just a few large caps due to report over the next few weeks, mostly software and retailers:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.