What Happened in the Market Last Week?

US markets received a boost on Tuesday when inflation data showed prices rising slightly less than expected. However those gains were given back on Wednesday when the Fed raised rates by 0.5%, taking the target range to 4.25 to 4.5%, the highest it's been in 15 years. The 0.5% increase was expected, but the expected “terminal rate” of 5.1% by the end of 2023 was 0.5% higher than it was in September.

This week we're looking back on the year that was 2022, and considering where we are as we head into 2023. It’s been quite a year, and a lot has happened - time for a quick recap

Also, this will be our last Market Insights for 2022, before we take 2 weeks off and resume again on the 9th of January!

2022 in the Rearview Mirror

As we started the year, a post-Covid global economic recovery was gathering momentum and supply chain bottlenecks were beginning to ease.

Global markets reflected optimism for the most part with major indexes making new all time highs in November and December 2021.

Inflation rates were rising, but central bankers were reluctant to raise rates. The theory was that inflation was “transient” and would fall when the economy normalized. US 10 Yr Treasuries ended 2021 at 1.51%, well below where they had spent most of the previous decade.

First quarter: War breaks out and rate hikes begin

Markets began to slide early in the year, as inflation continued to rise and Russia-Ukraine tensions began to escalate. Interestingly the sectors that performed best in January went on to outperform through the remainder of the year. Crude oil, and gold also began to rally early in the year as geopolitical tensions increased.

On 24th February Russia invaded Ukraine, which created a new supply chain crisis. The price of crude oil touched $129 in March, which was probably the final nail in the coffin for the transient inflation theory. In late February we outlined the potential opportunities with energy stocks, and the potential risks facing growth stocks. Both of which have somewhat come to fruition.

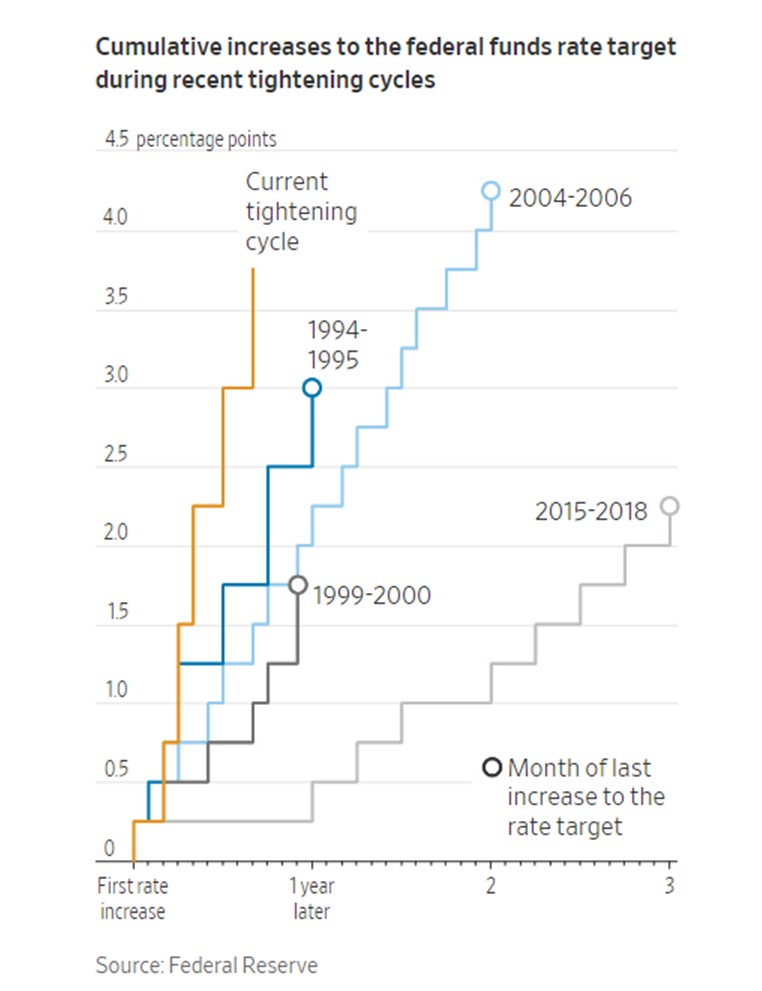

The US Federal Reserve raised interest rates by 0.25% in early March. This was less than expected and markets rebounded through the end of the quarter. However, that first rate hike marked the start of what may be the steepest hiking cycle in history.

During the first quarter the MSCI World index fell 6% and the S&P 500 fell 5%, though both ended the quarter well off their lows.

Second quarter: Reality sets in

During the second quarter, investors were confronted with concerning news on several fronts.

- Inflation rates continued to rise around the world. In April, the US consumer consumer inflation rate for March was reported at 8.5%, the highest it had been since the 1980s . Prices rose at similar rates in Europe and elsewhere.

- The Fed raised rates by 0.5% in May, and began to warn that rate hikes might become more aggressive. Elsewhere around the world, central banks began to raise rates or indicated that they soon would.

- Mortgage rates around the world began to rise sharply, and it became clear that already overheated housing markets were in trouble. While house prices didn’t immediately decline, home sales fell sharply around the world.

- The 2 year/10 year yield curve inverted - an indicator that has predicted most recessions in the past.

- US first quarter GDP surprised with a negative print.

As investors digested these developments, markets plunged. The MSCI world index fell 14%, during the quarter while S&P 500 fell 16%. Most major indexes around the world fell into bear market territory - more than 20% off their highs. Riskier assets fared even worse. The popular, growth-oriented ARKK ETF fell 40% and Bitcoin fell 56% during the quarter.

US 10 year treasury yields rose to 3%, double where they started the year. The only asset to own was the USD which continued to rally for the fourth consecutive quarter.

During the second quarter, stocks were repriced to account for higher rates. Price earnings multiples declined sharply, but in most cases earnings weren’t impacted. In fact, during the second quarter earnings growth was remarkably strong. This created the illusion that stocks were cheaper than they really were .

Third quarter: Earnings expectations fall

Despite the bleak outlook, markets ended the second quarter with another bear market rally which continued half way through the third quarter. The rally ran out of steam as another round of negative news started.

The US Fed warned that rate hikes were likely to continue for some time. The US slipped into technical recession, though policy makers said it wasn’t quite there yet.

In Europe and the UK, things began to look even more dire as Russia cut off gas supplies to Europe. The Euro fell to parity with USD for the first time in 20 years, and it became likely that the UK would be in a recession by year end.

Economic data in China worsened and resulted in a surprise rate cut . Global markets grew concerned that the crisis in China’s property market could spread to its entire financial system.

Corporate results from the second quarter began to show the effects of inflation and the strong USD on profit margins. During the third quarter, analysts began to revise their EPS estimates lower, and by the end of the quarter, estimates for the quarter had already fallen 6% and pointed to a potential earnings peak.

The next round of selling gathered momentum when inflation rates continued to surprise to the upside. By the end of the quarter, equity markets had fallen to a new 52-week low, but soon reversed higher again as speculation grew that the Fed would pivot.

Fourth quarter: Cyclicals rebound

The fourth quarter started with the UK in turmoil. Lizz Truss had replaced Boris Johnson as Prime Minister, but her economic plan was quickly rejected by investors. The U.K. stock market and bond markets were hammered and the British pound touched a record low of $1.035. By the end of October, the UK had its third Prime Minister in two months as Rishi Sunak took the reins.

Third quarter earnings season went better than feared - but expectations were low. While EPS showed single digit growth, they were actually negative if you exclude the impact of energy stocks, which reported a 140% increase. Fairly early in the earning season estimates for 4th quarter EPS pointed to a year over year decline.

Economic forecasts during the fourth quarter have suggested that most countries will come close to a recession in 2023, with a recovery toward the end of the year.

While profits are under pressure, consumers have shown resilience. Consumer budgets are stretched, but consumers aren’t overextended yet. Most, but not all retailers are struggling.

Despite the lack of encouraging news, markets have rebounded during the fourth quarter. Cyclical sectors, particularly oil and energy began to show relative strength amidst a growing case for a new commodity super cycle. This is despite the oil price falling more than 40% since March.

As of 14th December, the MSCI world index, and US and European indexes have recovered around half their losses for the year. In general investors seem to be pricing in a Santa Claus rally and a soft landing.

Where does this leave us?

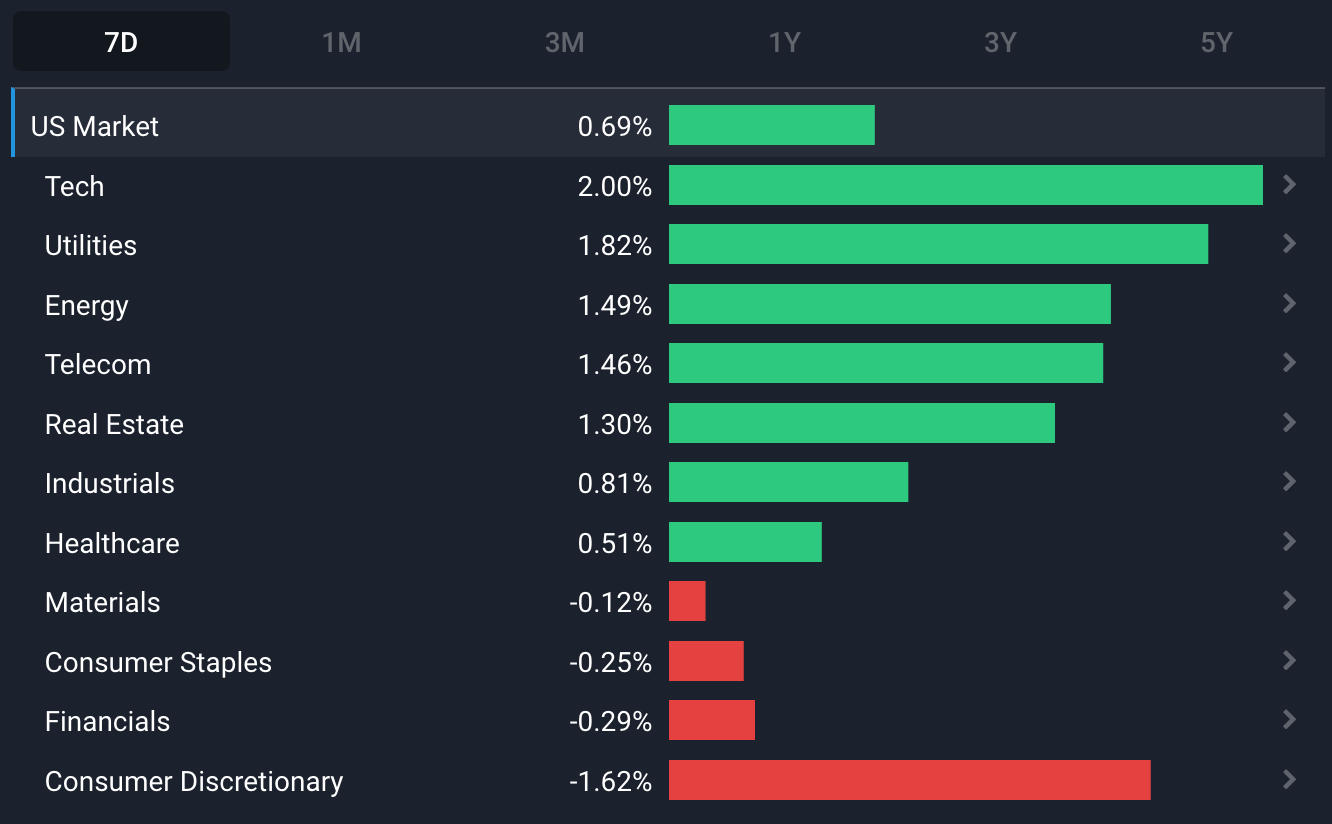

As of mid-December, the US equity market is down around 18% over 12 months. The energy sector, up 52%, is the only sector in the green. The utilities and consumer staples sectors have proved themselves as more defensive sectors and are all but flat. Healthcare did a less impressive job on defense, losing 8% as the sector continued to normalize after the pandemic.

The other cyclical sectors (materials , industrials , and financials) have rebounded over the last two months, leaving them down less than 10%. The interest rate and growth sensitive US Telecom, US Tech, US Real Estate, and US Consumer Discretionary sectors remain deep in negative territory.

Amongst other assets, the USD index has fallen from a high of 114, to 103, having started the year at 95. 10 year bond yields have fallen from a high of 4.29% to 3.4%, and the oil price is down 40% since March.

Inflation is falling - very slowly - and the market seems to be expecting rates to stop rising soon.

However, the market may still be at odds with Fed policy, as the latest projection from the central banks see interest rates at 5.1% by the end of 2023

The Insight: The hard and soft landing are still both on the table

A hard landing would mean that central banks really struggle to bring inflation under control. If that happens, they would keep raising interest rates which would put more strain on consumer spending, investment, and ultimately on corporate profits. This would probably mean a severe recession with rising unemployment.

The soft landing would occur if inflation falls to a manageable level, allowing central banks to stop raising rates. Economic growth rates might fall to around zero (there isn’t really much difference between a positive or negative 0.5% change in GDP) but would recover quite quickly.

Both of these scenarios could still play out. Economic forecasts are mixed, though some are starting to improve.

What this means for investors

The prospect of a hard landing may not seem too appealing for investors, but it’s important to remember the words of our friend Warren Buffett, imploring investors to be “fearful when others are greedy, and greedy when others are fearful.” Difficult periods for equity markets are rough periods for holding stocks, but excellent opportunities to buy high quality companies at prices that you may consider to be undervalued.

While the outlook remains uncertain, diversification is as important as ever. Defensive sectors have performed well this year, but that may change quickly if the outlook begins to improve. You can look for stocks with good fundamentals in each sector by heading to the Simply Wall Street markets page for any country, diving deep into a sector by clicking on it. Then compare the valuations and growth forecasts for each industry to see where the opportunities lie.

The graphic below shows the industries within the US market, along with the P/E ratio and forecast growth rate for each. If you click on an industry, you’ll see news and performance data for companies within that industry.

What’s in store for the future?

In October, the IMF released its latest forecasts for GDP growth in the world’s major economies for 2023 and 2024. Contrary to the noise around inflation, rising rates and plunging equity valuations, many major economies are expected to deliver decent growth across 2022.

That’s not to say that we’re out of the woods just yet, with the forecasted low-point being pushed back from 2022 to 2023. While 2023 is expected to be somewhat weak for global markets, some economies such as India and Korea are expected to deliver growth. As for the rest of the world, it appears investors will have to wait until 2024 to start seeing signs of a recovery.

While looking at these figures, it’s important to understand that economies aren’t stock markets. Macroeconomic forecasts have a tendency to be either wrong or completely unrelated to equity market performance.

If you refer to the chart above, you’ll see that despite the dull GDP forecast for the US economy, declining from 1.6% growth in 2022 to just 1% in 2023, many major US market sectors are actually anticipating earnings growth on an annual basis.

Put simply, while the macro picture seems un-inspiring from those IMF forecasts, there could be opportunities in specific sectors that diligent investors can benefit from.

As always, only invest in what you know, diversify appropriately, think in years rather than months, and buy high quality businesses at fair prices.

Key Events This Week

There’s no major economic data due, but a few data points may be of interest this week:

- In Japan the latest interest rate decision will be announced on Tuesday and the inflation rate on Friday.

- In the US, building permits will be released on Tuesday and personal spending and income data on Friday.

It may be late in the quarter, but there are still a few large companies due to report. They include:

- FactSet (NYSE:FDS)

- FuelCell Energy (Nasdaq: FCEL)

- General Mills (NYSE: GIS)

- Fedex (NYSE: FDX)

- Nike (NYSE:NKE)

- Carnival Corp (NYSE:CCL)

- Micron Technology (Nasdaq:MU)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.