- South Africa

- /

- Software

- /

- JSE:ISA

Market Participants Recognise ISA Holdings Limited's (JSE:ISA) Earnings

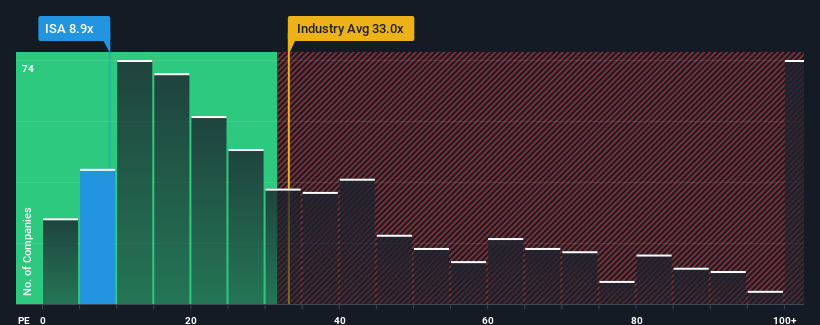

With a median price-to-earnings (or "P/E") ratio of close to 9x in South Africa, you could be forgiven for feeling indifferent about ISA Holdings Limited's (JSE:ISA) P/E ratio of 8.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

The earnings growth achieved at ISA Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for ISA Holdings

How Is ISA Holdings' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like ISA Holdings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 28%. The latest three year period has also seen an excellent 40% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's understandable that ISA Holdings' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that ISA Holdings maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 5 warning signs for ISA Holdings you should be aware of, and 3 of them are a bit unpleasant.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:ISA

ISA Holdings

An investment holding company, provides network, internet, and information security solutions to the sub-Saharan Africa market.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives