Here's Why Naspers (JSE:NPN) Can Afford Some Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Naspers Limited (JSE:NPN) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Naspers

What Is Naspers's Net Debt?

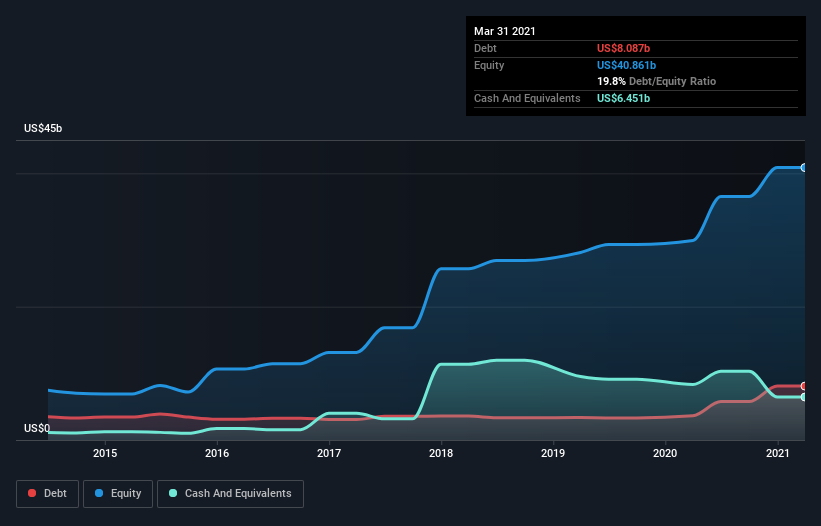

You can click the graphic below for the historical numbers, but it shows that as of March 2021 Naspers had US$8.09b of debt, an increase on US$3.64b, over one year. However, because it has a cash reserve of US$6.45b, its net debt is less, at about US$1.64b.

A Look At Naspers' Liabilities

According to the last reported balance sheet, Naspers had liabilities of US$4.31b due within 12 months, and liabilities of US$8.65b due beyond 12 months. Offsetting these obligations, it had cash of US$6.45b as well as receivables valued at US$813.0m due within 12 months. So its liabilities total US$5.69b more than the combination of its cash and short-term receivables.

Since publicly traded Naspers shares are worth a very impressive total of US$84.9b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Naspers can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Naspers wasn't profitable at an EBIT level, but managed to grow its revenue by 48%, to US$5.9b. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Even though Naspers managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost US$1.1b at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled US$67m in negative free cash flow over the last twelve months. So to be blunt we think it is risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Naspers insider transactions.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Naspers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:NPN

Naspers

Operates as a consumer internet company in Africa, Asia, Europe, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives