- South Africa

- /

- Specialty Stores

- /

- JSE:MTH

We Take A Look At Why Motus Holdings Limited's (JSE:MTH) CEO Compensation Is Well Earned

Key Insights

- Motus Holdings' Annual General Meeting to take place on 8th of November

- Salary of R11.3m is part of CEO Osman Arbee's total remuneration

- The overall pay is comparable to the industry average

- Over the past three years, Motus Holdings' EPS grew by 127% and over the past three years, the total shareholder return was 160%

We have been pretty impressed with the performance at Motus Holdings Limited (JSE:MTH) recently and CEO Osman Arbee deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 8th of November. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Motus Holdings

How Does Total Compensation For Osman Arbee Compare With Other Companies In The Industry?

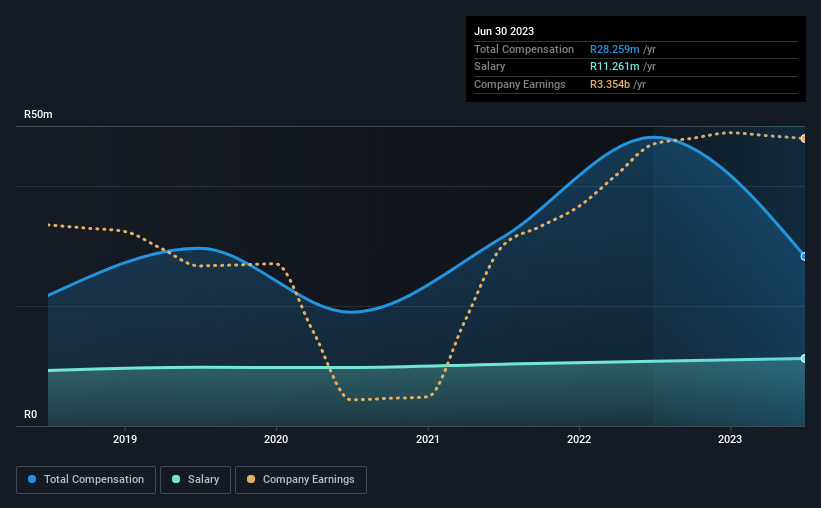

According to our data, Motus Holdings Limited has a market capitalization of R16b, and paid its CEO total annual compensation worth R28m over the year to June 2023. We note that's a decrease of 41% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at R11m.

On examining similar-sized companies in the South African Specialty Retail industry with market capitalizations between R7.5b and R30b, we discovered that the median CEO total compensation of that group was R28m. This suggests that Motus Holdings remunerates its CEO largely in line with the industry average. Moreover, Osman Arbee also holds R25m worth of Motus Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | R11m | R11m | 40% |

| Other | R17m | R37m | 60% |

| Total Compensation | R28m | R48m | 100% |

On an industry level, roughly 40% of total compensation represents salary and 60% is other remuneration. There isn't a significant difference between Motus Holdings and the broader market, in terms of salary allocation in the overall compensation package. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Motus Holdings Limited's Growth Numbers

Motus Holdings Limited's earnings per share (EPS) grew 127% per year over the last three years. Its revenue is up 16% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Motus Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with Motus Holdings Limited for providing a total return of 160% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 3 warning signs (and 1 which is potentially serious) in Motus Holdings we think you should know about.

Switching gears from Motus Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:MTH

Motus Holdings

Provides automotive mobility solutions in South Africa, the United Kingdom, Australia, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026