- South Africa

- /

- Retail REITs

- /

- JSE:EXP

Are Exemplar REITail Limited's (JSE:EXP) Mixed Fundamentals The Reason Behind The Stock's Muted Performance Recently?

Looking at Exemplar REITail's (JSE:EXP) mostly flat share price movement over the past week, it is easy to think that there’s nothing interesting about the stock. We decided to study the company's financials, which appear to be inconsistent, to assess what this could mean for future share prices as markets tend to be aligned with a company's long-term fundamentals. Specifically, we decided to study Exemplar REITail's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Exemplar REITail

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Exemplar REITail is:

6.7% = R246m ÷ R3.7b (Based on the trailing twelve months to August 2020).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every ZAR1 of its shareholder's investments, the company generates a profit of ZAR0.07.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Exemplar REITail's Earnings Growth And 6.7% ROE

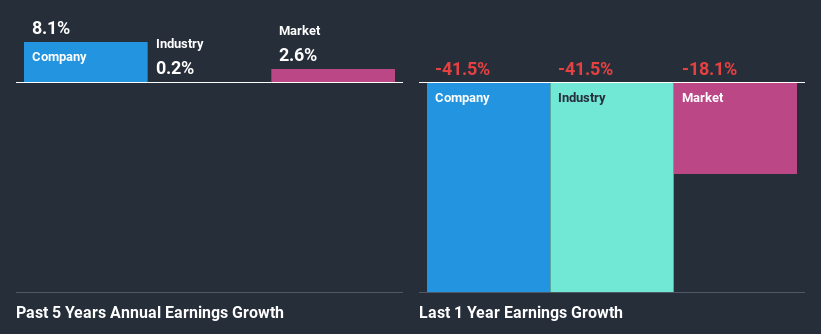

As you can see, Exemplar REITail's ROE looks pretty weak. Further, we noted that the company's ROE is similar to the industry average of 6.4%. So we are actually pleased to see that Exemplar REITail's net income grew at an acceptable rate of 8.1% over the last five years. Given the low ROE, it is likely that there could be some other aspects that are driving this growth as well. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Exemplar REITail's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 0.2%.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is Exemplar REITail fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Exemplar REITail Making Efficient Use Of Its Profits?

Exemplar REITail's high three-year median payout ratio of 101% suggests that the company is paying out more to its shareholders than what it is making. However, this hasn't really hampered its ability to grow as we saw earlier. Although, the high payout ratio is certainly something we would keep an eye on if the company is not able to keep up its growth, or if business deteriorates. You can see the 4 risks we have identified for Exemplar REITail by visiting our risks dashboard for free on our platform here.

While Exemplar REITail has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend.

Conclusion

In total, we're a bit ambivalent about Exemplar REITail's performance. While the company has posted impressive earnings growth, its poor ROE and low earnings retention makes us doubtful if that growth could continue, if by any chance the business is faced with any sort of risk. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Exemplar REITail and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you decide to trade Exemplar REITail, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Exemplar REITail might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:EXP

Exemplar REITail

A listed Real Estate Investment Trust (REIT), which develops, owns and manages township and rural retail real estate.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026