- South Africa

- /

- Chemicals

- /

- JSE:SOL

Sasol (JSE:SOL) Faces 22% Weekly Decline Amid Global Trade Tensions

Reviewed by Simply Wall St

Sasol (JSE:SOL) has experienced a significant 22% price decline over the past week, paralleled by a broader market downturn amidst heightened global trade tensions. The volatility in energy stocks, partly driven by falling oil prices due to increased output plans and fears of a global trade war, has intensified selling pressure on Sasol. As the Dow Jones and other major indices continued to plummet, Sasol's total shareholder return was further impacted, starkly contrasting the market's year-long upward trend. This environment of uncertainty appears to have weighed heavily on Sasol's market performance.

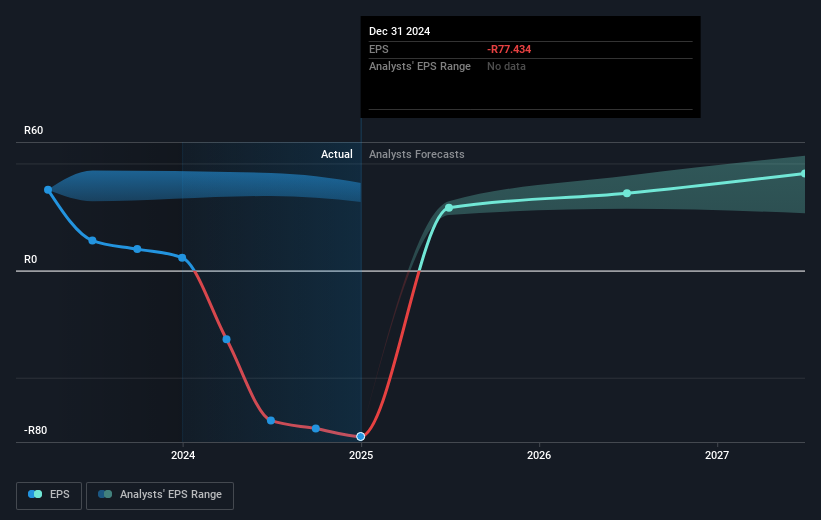

While the last five years have seen Sasol's total shareholder return decrease by 9.31%, several factors provide context for this performance. Sasol’s earnings faced impacts from declining Brent crude prices and reduced sales volumes, significantly affecting its bottom line as reported in their H1 2025 results, with net income dropping to ZAR 4.6 billion. Additionally, financial constraints, highlighted by a net debt of US$4.1 billion surpassing dividend policy limits, led to the cessation of final dividends in 2024. These financial strains are compounded by the challenges of maintaining competitiveness amid global market volatility.

Efforts to pivot towards renewable energy and reduce carbon emissions, evidenced by power purchase agreements for 690 MW of renewable capacity, reflect Sasol's initiative towards sustainable growth. This ongoing transition, together with leadership changes like the appointment of Simon Baloyi as CEO, underscores Sasol's attempts to adapt and enhance operations amidst evolving market conditions. Such strategic shifts may influence long-term profitability and shareholder returns, even as current financial performance remains pressured.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About JSE:SOL

Sasol

Operates as a chemical and energy company in South Africa and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives