- South Africa

- /

- Food

- /

- JSE:QFH

Market Participants Recognise Quantum Foods Holdings Ltd's (JSE:QFH) Revenues Pushing Shares 45% Higher

The Quantum Foods Holdings Ltd (JSE:QFH) share price has done very well over the last month, posting an excellent gain of 45%. The annual gain comes to 231% following the latest surge, making investors sit up and take notice.

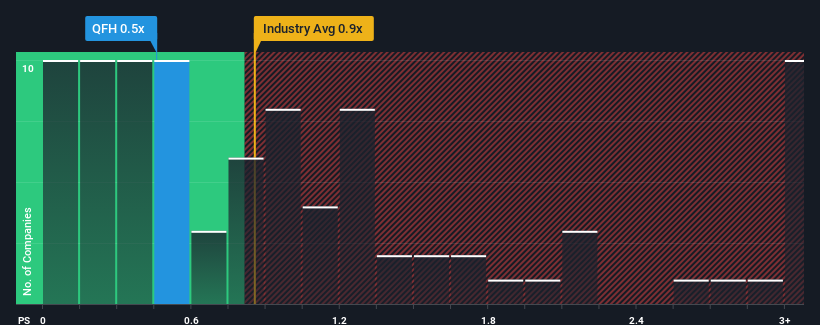

Although its price has surged higher, there still wouldn't be many who think Quantum Foods Holdings' price-to-sales (or "P/S") ratio of 0.5x is worth a mention when it essentially matches the median P/S in South Africa's Food industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Quantum Foods Holdings

What Does Quantum Foods Holdings' Recent Performance Look Like?

For instance, Quantum Foods Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Quantum Foods Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Quantum Foods Holdings' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.0%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 5.8% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Quantum Foods Holdings' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Bottom Line On Quantum Foods Holdings' P/S

Quantum Foods Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears to us that Quantum Foods Holdings maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It is also worth noting that we have found 3 warning signs for Quantum Foods Holdings (2 are concerning!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Foods Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About JSE:QFH

Quantum Foods Holdings

Engages in the feed, poultry, and egg businesses in South Africa and other African markets.

Excellent balance sheet and good value.

Market Insights

Community Narratives