- South Africa

- /

- Food

- /

- JSE:AHL

It's Unlikely That Shareholders Will Increase AH-Vest Limited's (JSE:AHL) Compensation By Much This Year

Key Insights

- AH-Vest's Annual General Meeting to take place on 28th of January

- CEO Muhammed Naasif Darsot's total compensation includes salary of R958.2k

- The total compensation is 72% less than the average for the industry

- Over the past three years, AH-Vest's EPS fell by 27% and over the past three years, the total loss to shareholders 73%

The underwhelming performance at AH-Vest Limited (JSE:AHL) recently has probably not pleased shareholders. At the upcoming AGM on 28th of January, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

Check out our latest analysis for AH-Vest

Comparing AH-Vest Limited's CEO Compensation With The Industry

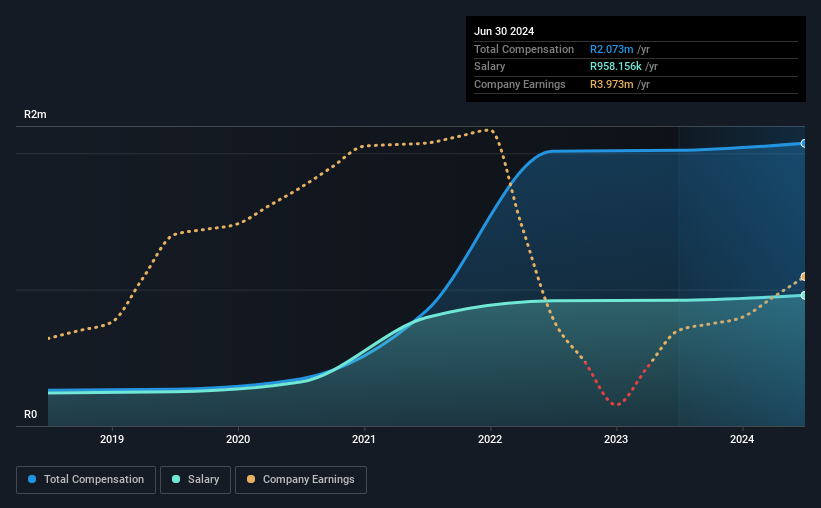

Our data indicates that AH-Vest Limited has a market capitalization of R14m, and total annual CEO compensation was reported as R2.1m for the year to June 2024. This means that the compensation hasn't changed much from last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at R958k.

For comparison, other companies in the South African Food industry with market capitalizations below R3.7b, reported a median total CEO compensation of R7.3m. Accordingly, AH-Vest pays its CEO under the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | R958k | R922k | 46% |

| Other | R1.1m | R1.1m | 54% |

| Total Compensation | R2.1m | R2.0m | 100% |

On an industry level, roughly 43% of total compensation represents salary and 57% is other remuneration. Our data reveals that AH-Vest allocates salary more or less in line with the wider market. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at AH-Vest Limited's Growth Numbers

AH-Vest Limited has reduced its earnings per share by 27% a year over the last three years. Its revenue is up 12% over the last year.

Overall this is not a very positive result for shareholders. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has AH-Vest Limited Been A Good Investment?

With a total shareholder return of -73% over three years, AH-Vest Limited shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for AH-Vest that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:AHL

AH-Vest

Engages in the manufacture and sale of food products in South Africa.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives