Stock Analysis

- South Africa

- /

- Oil and Gas

- /

- JSE:REN

The 15% return this week takes Renergen's (JSE:REN) shareholders five-year gains to 70%

Renergen Limited (JSE:REN) shareholders might be concerned after seeing the share price drop 18% in the last quarter. On the bright side the returns have been quite good over the last half decade. Its return of 70% has certainly bested the market return! Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 41% decline over the last twelve months.

The past week has proven to be lucrative for Renergen investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for Renergen

Renergen recorded just R35,210,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Renergen finds fossil fuels with an exploration program, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Renergen has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

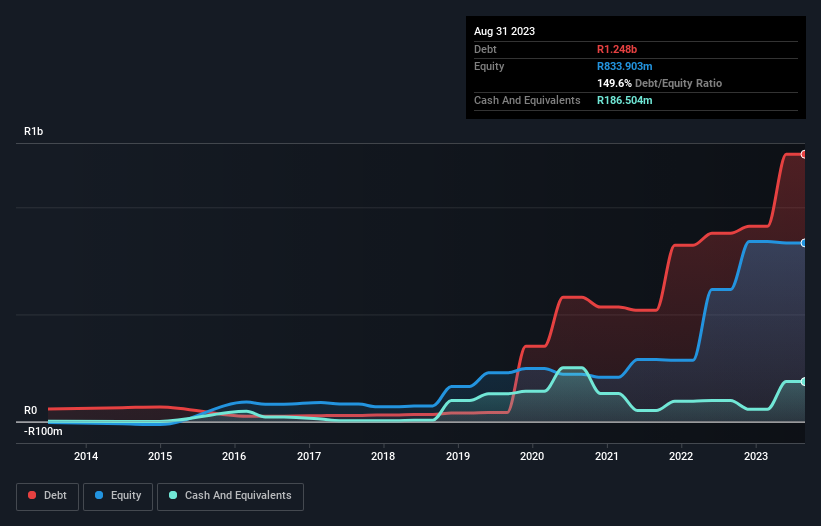

Renergen had liabilities exceeding cash by R1.2b when it last reported in August 2023, according to our data. That puts it in the highest risk category, according to our analysis. So we're surprised to see the stock up 113% per year, over 5 years , but we're happy for holders. Investors must really like its potential. You can click on the image below to see (in greater detail) how Renergen's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

Investors in Renergen had a tough year, with a total loss of 41%, against a market gain of about 5.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 11%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Renergen is showing 4 warning signs in our investment analysis , and 2 of those don't sit too well with us...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South African exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:REN

Renergen

An investment holding company, engages in the alternative and renewable energy businesses in South Africa and sub-Saharan Africa.

High growth potential low.