- South Africa

- /

- Capital Markets

- /

- JSE:MTNZF

MTN Zakhele Futhi (RF)'s (JSE:MTNZF) Shareholders Are Down 40% On Their Shares

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in MTN Zakhele Futhi (RF) Limited (JSE:MTNZF) have tasted that bitter downside in the last year, as the share price dropped 40%. That contrasts poorly with the market decline of 1.6%. MTN Zakhele Futhi (RF) may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 13% in about a quarter. That's not much fun for holders.

Check out our latest analysis for MTN Zakhele Futhi (RF)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

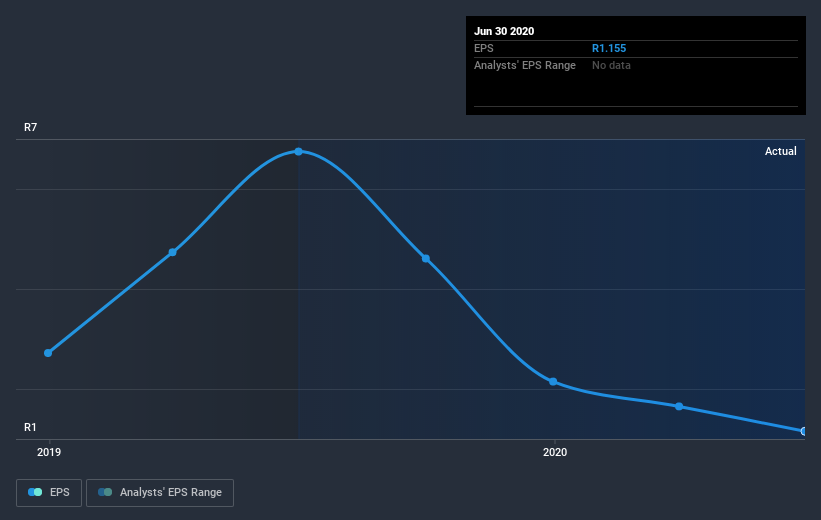

Unfortunately MTN Zakhele Futhi (RF) reported an EPS drop of 83% for the last year. This fall in the EPS is significantly worse than the 40% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on MTN Zakhele Futhi (RF)'s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

MTN Zakhele Futhi (RF) shareholders are down 40% for the year, even worse than the market loss of 1.6%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 13% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with MTN Zakhele Futhi (RF) (at least 1 which is concerning) , and understanding them should be part of your investment process.

Of course MTN Zakhele Futhi (RF) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ZA exchanges.

When trading MTN Zakhele Futhi (RF) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About JSE:MTNZF

MTN Zakhele Futhi (RF)

An investment company, operates as the special purpose investment vehicle to effect MTN Group’s Broad Based Black Economic Empowerment transaction.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives