- South Africa

- /

- Capital Markets

- /

- JSE:KST

If You Like EPS Growth Then Check Out PSG Konsult (JSE:KST) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like PSG Konsult (JSE:KST). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for PSG Konsult

How Fast Is PSG Konsult Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, PSG Konsult has grown EPS by 8.1% per year. That's a pretty good rate, if the company can sustain it.

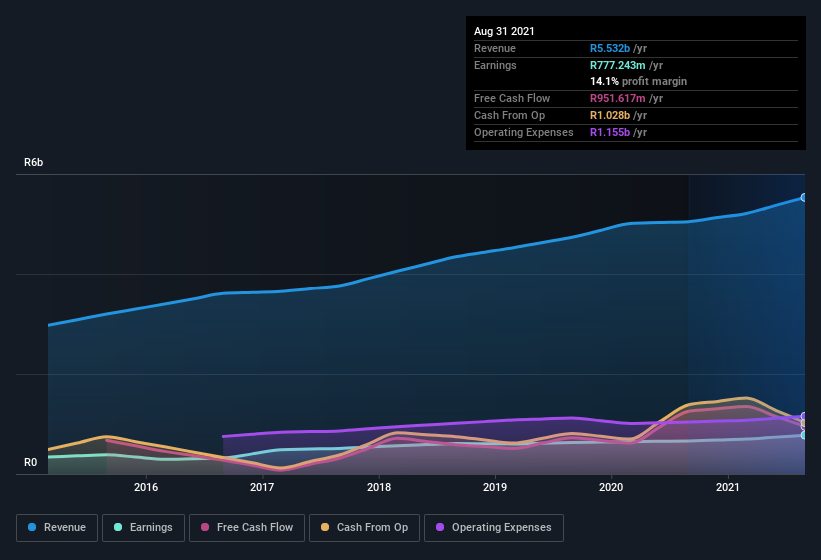

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that PSG Konsult's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. PSG Konsult maintained stable EBIT margins over the last year, all while growing revenue 9.6% to R5.5b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check PSG Konsult's balance sheet strength, before getting too excited.

Are PSG Konsult Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see PSG Konsult insiders walking the walk, by spending R5.3m on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. It is also worth noting that it was CEO & Executive Director Francois Gouws who made the biggest single purchase, worth R3.8m, paying R10.22 per share.

Along with the insider buying, another encouraging sign for PSG Konsult is that insiders, as a group, have a considerable shareholding. Indeed, they hold R542m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 3.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add PSG Konsult To Your Watchlist?

As I already mentioned, PSG Konsult is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if PSG Konsult is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of PSG Konsult, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:KST

PSG Financial Services

Provides various financial services and products in South Africa and Namibia.

Outstanding track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives