- South Africa

- /

- Consumer Services

- /

- JSE:SDO

If EPS Growth Is Important To You, Stadio Holdings (JSE:SDO) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Stadio Holdings (JSE:SDO). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Stadio Holdings with the means to add long-term value to shareholders.

Check out our latest analysis for Stadio Holdings

How Quickly Is Stadio Holdings Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Stadio Holdings has managed to grow EPS by 31% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

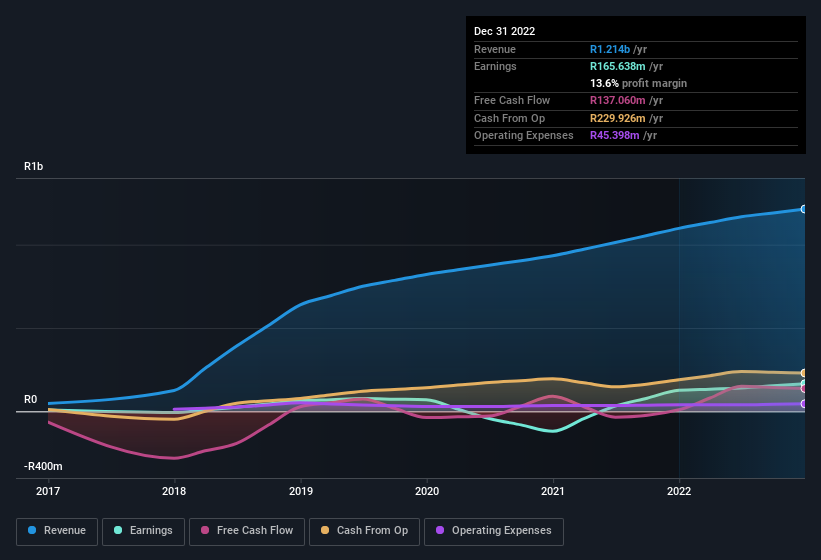

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Stadio Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 11% to R1.2b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Stadio Holdings isn't a huge company, given its market capitalisation of R3.3b. That makes it extra important to check on its balance sheet strength.

Are Stadio Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at Stadio Holdings were both selling and buying shares; but happily, as a group they spent R1.1m more on stock, than they netted from selling it. Shareholders who may have questioned insiders selling will find some reassurance in this fact. It is also worth noting that it was Non-Executive Director Christiaan Van Der Merwe who made the biggest single purchase, worth R5.0m, paying R3.80 per share.

Does Stadio Holdings Deserve A Spot On Your Watchlist?

For growth investors, Stadio Holdings' raw rate of earnings growth is a beacon in the night. Growth in EPS isn't the only striking feature with company insiders adding to their holdings being another noteworthy vote of confidence for the company. To put it succinctly; Stadio Holdings is a strong candidate for your watchlist. We should say that we've discovered 1 warning sign for Stadio Holdings that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, Stadio Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:SDO

Stadio Holdings

Through its subsidiaries, provides higher education programs in South Africa and Namibia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives