Stock Analysis

- South Africa

- /

- Consumer Services

- /

- JSE:COH

Curro Holdings' (JSE:COH) earnings have declined over five years, contributing to shareholders 54% loss

Curro Holdings Limited (JSE:COH) shareholders will doubtless be very grateful to see the share price up 30% in the last quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. In fact, the share price has declined rather badly, down some 57% in that time. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

The recent uptick of 15% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Curro Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

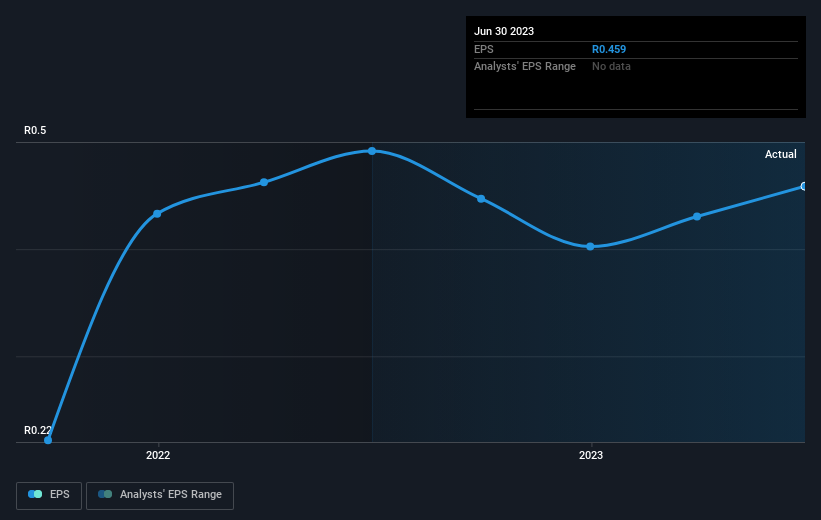

Looking back five years, both Curro Holdings' share price and EPS declined; the latter at a rate of 4.8% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 15% per year, over the period. This implies that the market was previously too optimistic about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Curro Holdings the TSR over the last 5 years was -54%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Curro Holdings has rewarded shareholders with a total shareholder return of 29% in the last twelve months. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Curro Holdings that you should be aware of before investing here.

Curro Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South African exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:COH

Curro Holdings

Develops, acquires, and manages independent schools primarily in South Africa, Namibia, and Botswana.

Slight with mediocre balance sheet.