Improved Earnings Required Before Blue Label Telecoms Limited (JSE:BLU) Stock's 26% Jump Looks Justified

Despite an already strong run, Blue Label Telecoms Limited (JSE:BLU) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 31% in the last year.

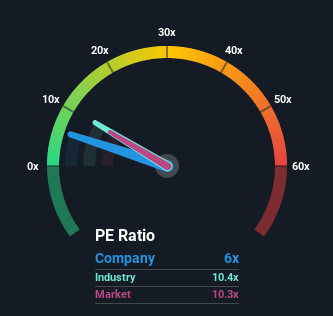

Even after such a large jump in price, given close to half the companies in South Africa have price-to-earnings ratios (or "P/E's") above 11x, you may still consider Blue Label Telecoms as an attractive investment with its 6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Blue Label Telecoms certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Blue Label Telecoms

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Blue Label Telecoms would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 238%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Blue Label Telecoms is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Despite Blue Label Telecoms' shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Blue Label Telecoms revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Blue Label Telecoms that you should be aware of.

Of course, you might also be able to find a better stock than Blue Label Telecoms. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Blu Label Unlimited Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:BLU

Blu Label Unlimited Group

Provides prepaid products and distributes virtual electronic merchandise in South Africa and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026