- South Africa

- /

- Industrials

- /

- JSE:HCI

Should You Be Adding Hosken Consolidated Investments (JSE:HCI) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Hosken Consolidated Investments (JSE:HCI). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hosken Consolidated Investments with the means to add long-term value to shareholders.

View our latest analysis for Hosken Consolidated Investments

Hosken Consolidated Investments' Improving Profits

Hosken Consolidated Investments has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. It's good to see that Hosken Consolidated Investments' EPS has grown from R34.58 to R40.11 over twelve months. This amounts to a 16% gain; a figure that shareholders will be pleased to see.

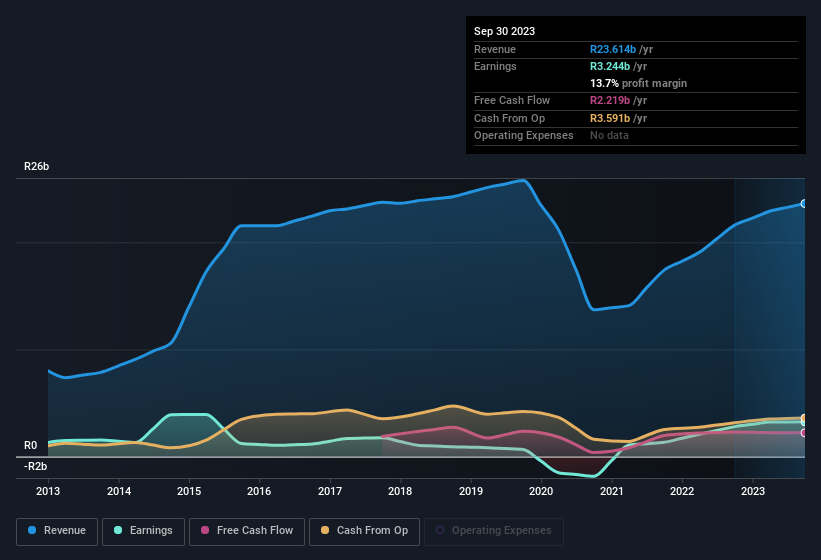

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Hosken Consolidated Investments maintained stable EBIT margins over the last year, all while growing revenue 9.3% to R24b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Hosken Consolidated Investments' balance sheet strength, before getting too excited.

Are Hosken Consolidated Investments Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Hosken Consolidated Investments is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. In other words, the CEO & Executive Director, John Copelyn, acquired R118m worth of shares over the previous 12 months at an average price of around R200. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

The good news, alongside the insider buying, for Hosken Consolidated Investments bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at R2.3b. Coming in at 14% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Does Hosken Consolidated Investments Deserve A Spot On Your Watchlist?

As previously touched on, Hosken Consolidated Investments is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. We don't want to rain on the parade too much, but we did also find 3 warning signs for Hosken Consolidated Investments that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, Hosken Consolidated Investments isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hosken Consolidated Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:HCI

Hosken Consolidated Investments

An investment holding company, operates media and broadcasting, gaming, transport, properties, coal mining, and branded products and manufacturing businesses in South Africa, Other African countries, the Middle East, Europe, and the United Kingdom.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives