- United States

- /

- Renewable Energy

- /

- NYSE:XIFR

XPLR Infrastructure (XIFR): Deepening Losses Challenge Bullish Turnaround Narrative Despite Low Valuation

Reviewed by Simply Wall St

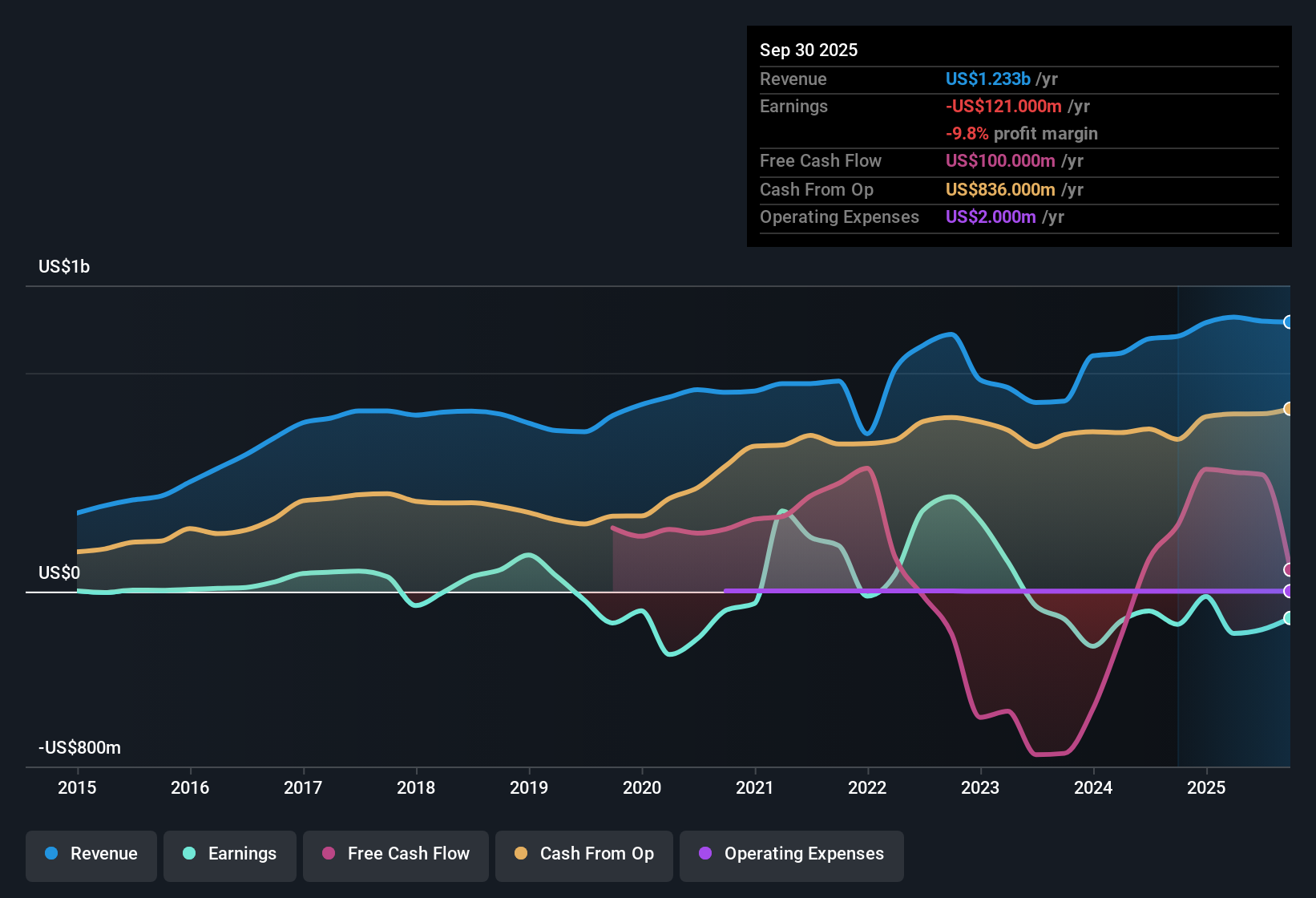

XPLR Infrastructure (XIFR) saw losses deepen at an average rate of 44% per year over the past five years, with no improvement in its net profit margin and no record of high-quality earnings. Revenue is projected to grow 3% annually, which is notably slower than the broader US market’s 10.5% expected annual pace. However, earnings are forecast to rise at a robust 38.82% per year, and the company is expected to reach profitability within three years. Investors have a clear catalyst to watch here, as XIFR’s discounted valuation and potential for earnings growth are keeping expectations high for a turnaround despite recent unprofitability.

See our full analysis for XPLR Infrastructure.The next step is comparing this quarter’s financial reality to the big-picture investor narratives and assessing which expectations these latest results challenge or support.

See what the community is saying about XPLR Infrastructure

Margins Set to Swing From -14.1% to 5.8%

- Profit margins are forecast to rise from -14.1% today to 5.8% in three years, highlighting a potential step-change in underlying profitability as the company shifts focus from past losses to future earnings leverage.

- Analysts' consensus view emphasizes the pivotal role of suspending distributions in fueling this turnaround:

- By redeploying cash flow into projects with higher returns, such as repowering wind assets and adding storage, XPLR aims to strengthen net margins and extend asset lifespans.

- This margin improvement hinges on executing growth without relying on new equity, which could magnify returns if operational efficiency gains materialize as planned.

- Analysts' consensus also notes that these margin expectations are anchored in new management’s strategy, which relies on operational discipline and partnership with NextEra Energy to unlock higher profitability across the clean energy portfolio.

- The leap in margins supports the consensus perspective that XPLR’s reinvestment and operational strategy may finally reverse years of losses. However, the strength of this turnaround will depend on successfully navigating growth with tighter capital constraints.

For a balanced view on how these profit margin shifts could impact investor outcomes, see the full consensus narrative and what analysts are watching next. 📊 Read the full XPLR Infrastructure Consensus Narrative.

Price-to-Sales at 0.7x Versus 2.9x Industry Average

- XPLR trades at a 0.7x Price-to-Sales multiple compared to the industry’s 2.9x average and peers’ 7.9x, marking it as a notable outlier on valuation relative to both the broader renewable energy space and immediate competitors.

- Analysts' consensus narrative views this low multiple as both a reward and a signal of the market's skepticism:

- A valuation discount this steep suggests the market is waiting for evidence that XPLR can deliver on its projected earnings growth and margin recovery, making future results a key catalyst.

- Consensus points out that discounted valuation could attract value and turnaround investors, providing potential upside if the company achieves its growth targets without slipping further behind on revenue expansion.

DCF Fair Value at $175.51 Far Outpaces Current Price

- DCF fair value is calculated at $175.51 per share, dwarfing the recent share price of $9.05 and even the analyst price target of $11.41. This highlights the starkly different perspectives that discounted cash flow models versus traditional analyst targets can paint for future upside.

- Analysts' consensus narrative tempers expectations around DCF-based upside:

- While the DCF model implies massive undervaluation, the consensus emphasizes the challenge of hitting bullish forecasts for margins and revenue required to justify such a steep rise, especially with lingering financial risks and investor dissatisfaction over suspended distributions.

- The substantial DCF premium versus peer multiples and price targets commands a careful sense check, reminding investors to balance optimism about XPLR’s turnaround opportunity with the company’s checkered track record and risk profile.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for XPLR Infrastructure on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Put your insights into action and craft your own perspective in just a few minutes. Do it your way

A great starting point for your XPLR Infrastructure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

XPLR’s inconsistent revenue growth, history of persistent losses, and delayed profitability set it apart from companies that demonstrate steady performance through market cycles.

If you want greater reliability, use stable growth stocks screener (2073 results) to spot companies that consistently expand revenue and earnings and offer more predictable outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XIFR

XPLR Infrastructure

Acquires, owns, and manages contracted clean energy projects in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives