- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (VST): Valuation in Focus as Earnings Drop, Strategic Growth Plans and Dividend Hike Shape Investor Outlook

Reviewed by Simply Wall St

Vistra has just released its third quarter results, showing declines in revenue and net income from the previous year. However, new earnings guidance for 2025 and 2026, along with a long-term nuclear energy deal, points to an interesting shift ahead.

See our latest analysis for Vistra.

Despite the flurry of recent updates, from a small impairment charge to the announcement of new earnings targets, share repurchases, and a dividend increase, Vistra’s share price has pulled back, with a 14.5% one-month decline and a 4.8% drop over the last trading day. Still, momentum for the stock remains impressive in the bigger picture, with a one-year total shareholder return of 26.8% and eye-catching long-term gains of over 725% for those who have held on for three years or more. This suggests that market sentiment continues to reflect both growth potential and periodic swings in risk appetite.

If Vistra’s big moves have you wondering where else opportunity may lie, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With long-term growth plans and new earnings forecasts on the table, is Vistra’s recent price dip a rare chance to buy an undervalued leader, or has the market already factored in the company’s future potential?

Most Popular Narrative: 21.1% Undervalued

At $179.16 per share, Vistra’s most popular narrative implies the market is missing substantial upside, with a fair value pegged over $225. Analysts driving this narrative see room for re-rating if planned earnings growth plays out.

Disciplined capital allocation and favorable market conditions enhance shareholder value, reduce risk, and support sustained earnings expansion.

What is the secret behind this bullish outlook? Hint: bold profit expansion, strategic contracts, and a profitability surge underpin the narrative’s target. Want to know exactly which aggressive assumptions power this valuation? Uncover the full story and see what could drive Vistra’s next move.

Result: Fair Value of $227.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated debt from acquisitions and greater regulatory uncertainty could quickly challenge assumptions behind Vistra's positive growth story.

Find out about the key risks to this Vistra narrative.

Another Perspective: Is the Valuation Too Rich?

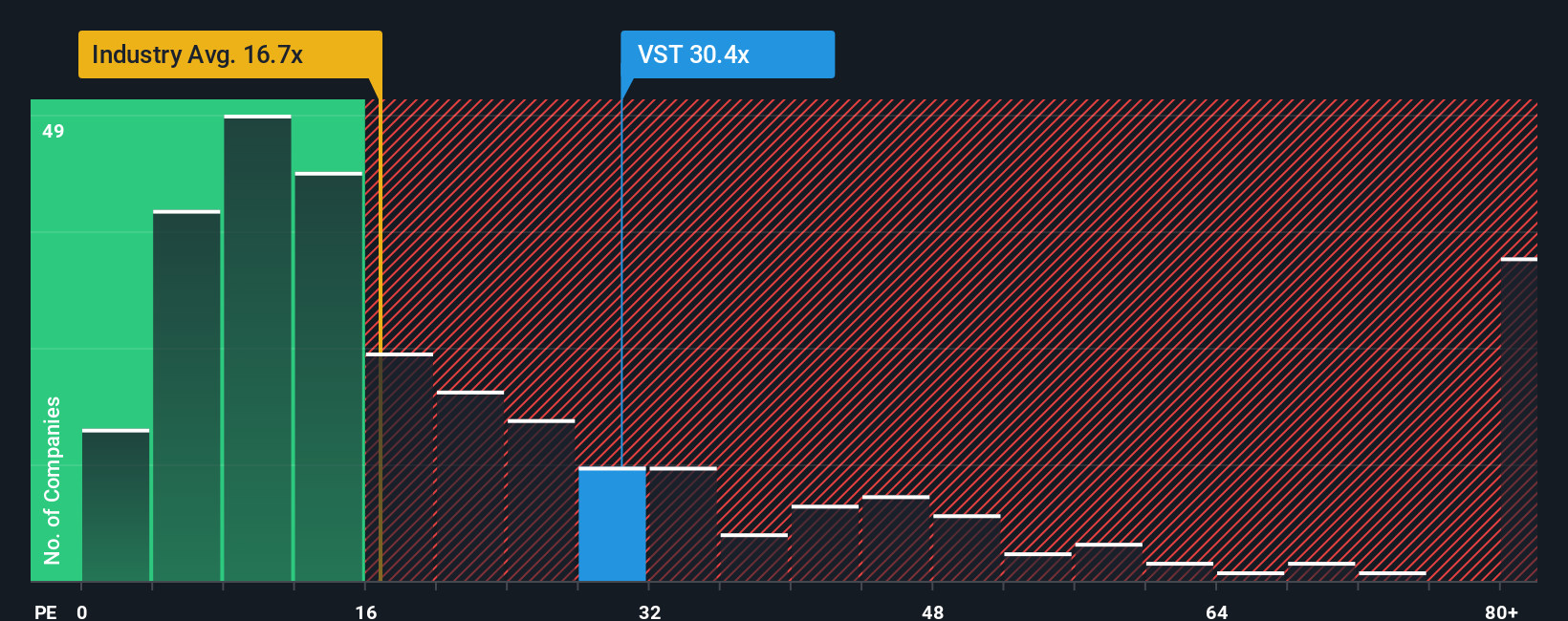

Looking at market valuation multiples, Vistra trades at 63.2 times earnings, which is more than double its peer average of 29.8 and far above the global industry average of 17.9. Even compared to the fair ratio of 56.3, the stock appears pricey, adding a layer of risk if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vistra Narrative

If you see the story differently, or would rather dig into the numbers first-hand, you can build your own full perspective in just a few minutes. Do it your way

A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Standout Investment Ideas?

Every investor wants an edge. Don’t settle for what everyone else is watching when you can get ahead using tailored screeners with real growth potential.

- Tap into lower-priced opportunities with strong financials when you browse these 3572 penny stocks with strong financials, shaping the comeback stories and hidden gems of tomorrow's markets.

- Position yourself for high future rewards by checking out these 15 dividend stocks with yields > 3%, offering reliable income and the power of compounding for your portfolio.

- Lead the way into the next tech revolution by exploring these 27 quantum computing stocks, packed with companies pushing the boundaries in computing and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives