- United States

- /

- Renewable Energy

- /

- NYSE:VST

How Investors May Respond To Vistra (VST) Expanding With New Power Deals and Multi-Year Earnings Guidance

Reviewed by Sasha Jovanovic

- In recent days, Vistra Corp. issued new earnings guidance for 2025 and 2026, securing a long-term 20-year power purchase agreement at its Comanche Peak Nuclear Plant and completing the acquisition of approximately 2.6 gigawatts of natural gas-fired assets from Lotus Infrastructure Partners.

- These actions coincide with a confident outlook for higher future adjusted EBITDA and net income, reflecting both an expansion of Vistra’s power generation portfolio and long-term revenue visibility.

- We’ll examine how the newly issued multi-year earnings guidance and long-term contract commitments may reshape Vistra’s overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vistra Investment Narrative Recap

To own Vistra shares now, you need confidence in the company’s ability to translate major acquisitions and long-term power contracts into durable earnings growth, while managing leverage and market volatility. The latest 2025 and 2026 guidance and Comanche Peak contract support improved earnings visibility and portfolio expansion, but the most important short-term catalyst, realizing higher power prices while integrating new assets, and the biggest risk, elevated debt and refinancing, both remain central to the investment case. These updates reinforce that, while the long-term outlook is improving, near-term outcomes still depend on execution and capital discipline.

Among recent announcements, Vistra’s completion of a 2.6 gigawatt natural gas asset acquisition from Lotus Infrastructure Partners stands out, directly tying into expansion efforts and increased guidance. This bolsters Vistra’s ability to address surging regional demand and aligns with commitments to secure cash flows, serving as a near-term test of how effectively the company can deliver on expected earnings and margin improvements.

In contrast, investors should be aware that the company’s sizeable debt and ongoing refinancing needs continue to represent a key risk should credit conditions shift unexpectedly...

Read the full narrative on Vistra (it's free!)

Vistra's narrative projects $24.5 billion revenue and $3.4 billion earnings by 2028. This requires 9.8% yearly revenue growth and a $1.2 billion earnings increase from $2.2 billion today.

Uncover how Vistra's forecasts yield a $227.03 fair value, a 21% upside to its current price.

Exploring Other Perspectives

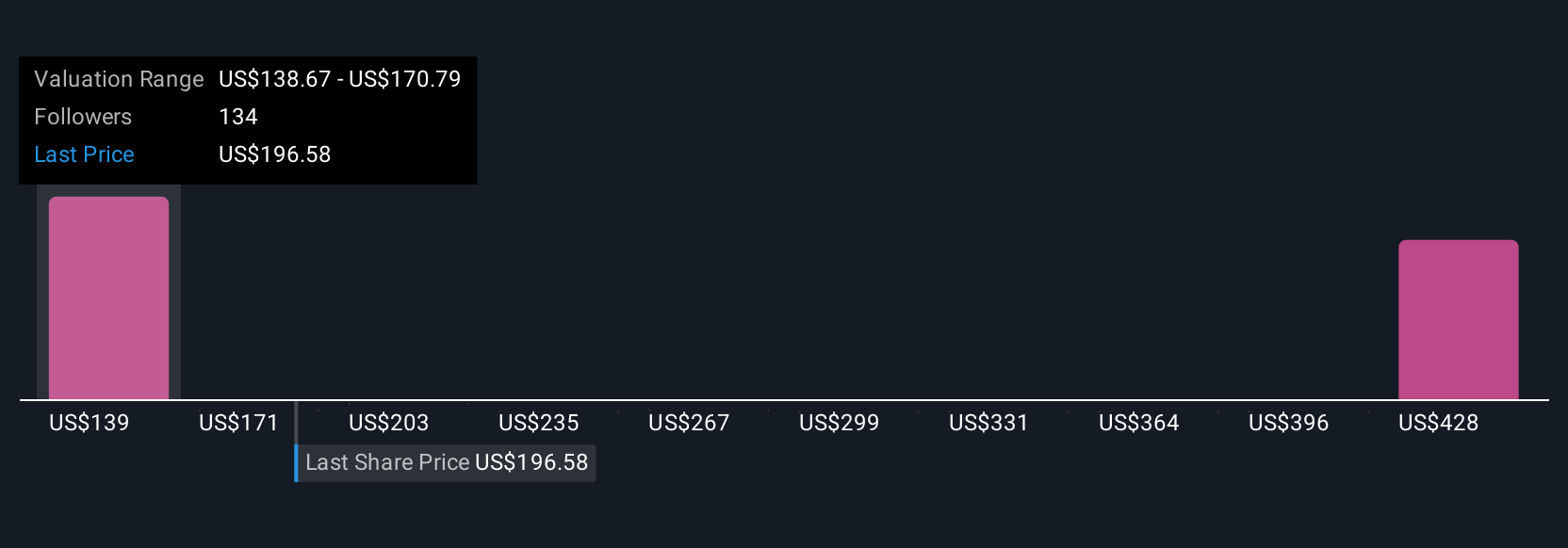

Thirteen fair value estimates from the Simply Wall St Community range widely from US$142 to US$383 per share. Against this backdrop, the company’s heightened leverage and refinancing risks call for a closer look at the possible earnings impact in changing market conditions, see how your view compares.

Explore 13 other fair value estimates on Vistra - why the stock might be worth 25% less than the current price!

Build Your Own Vistra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vistra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vistra's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives