- United States

- /

- Renewable Energy

- /

- NYSE:VST

Has Vistra’s Clean Energy Push Created a New Opportunity After a 7.5% Stock Pullback?

Reviewed by Bailey Pemberton

- Wondering if Vistra is trading at a bargain or if you're showing up to the party late? You're not alone. Today's stock headlines are stirring up even more curiosity about what it's really worth.

- In just the past year, Vistra has soared 35.4% and boasts an incredible 733.5% return over three years. It has seen a 7.5% dip in the last month after a steady run up.

- This recent pullback has caught the eye of investors, especially after high-profile news about Vistra's major clean energy investments and deepened commitments to grid stability. These moves are shaping perceptions about the company's risk profile and raising new questions about its future value.

- According to valuation checks, Vistra scores just 2 out of 6 for being undervalued, making this the perfect moment to compare traditional valuation methods and uncover a smarter, more holistic approach by the end of this article.

Vistra scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Vistra Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the fair value of a company by projecting its future cash flows and discounting them back to today's value. This method helps investors understand what a business is worth based on how much cash it is expected to generate in the years ahead.

For Vistra, the current Free Cash Flow (FCF) is about $1.28 billion. Analyst estimates suggest FCF will rise each year, reaching $5.88 billion by 2029. Beyond 2029, projections extrapolated by Simply Wall St forecast FCF surpassing $8.5 billion by 2035. These growth rates combine analyst opinions for the next five years along with steady, moderate growth scenarios for the years following.

Applying the DCF model, the intrinsic value of Vistra's shares is calculated to be approximately $384. When compared to the current share price, this implies Vistra stock is trading at a 50.3% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vistra is undervalued by 50.3%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Vistra Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is a popular tool for valuing profitable companies, as it reflects what investors are willing to pay now for each dollar of current earnings. Since Vistra is solidly profitable, the P/E ratio provides a direct lens into how the market values its future potential relative to its current earnings.

It is important to remember that growth expectations and risk profiles play a large role in what constitutes a "normal" or "fair" P/E ratio. Fast-growing or lower-risk companies typically justify higher P/E ratios, while slower-growing or riskier businesses usually command lower multiples.

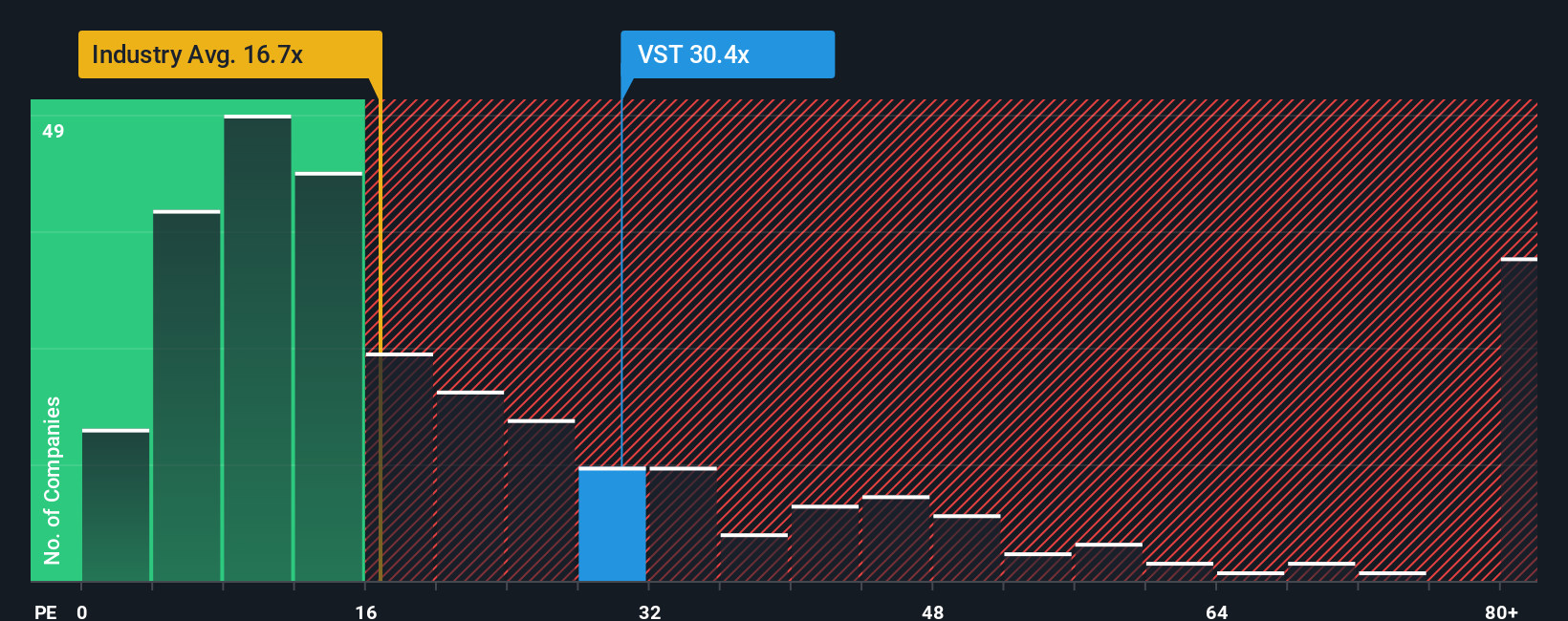

Currently, Vistra trades at a P/E ratio of 67.4x. For comparison, the average P/E for its renewable energy industry peers is just 17.9x, and its direct competitors trade at a peer average P/E of 30.4x. Both these benchmarks are significantly lower than Vistra’s current multiple.

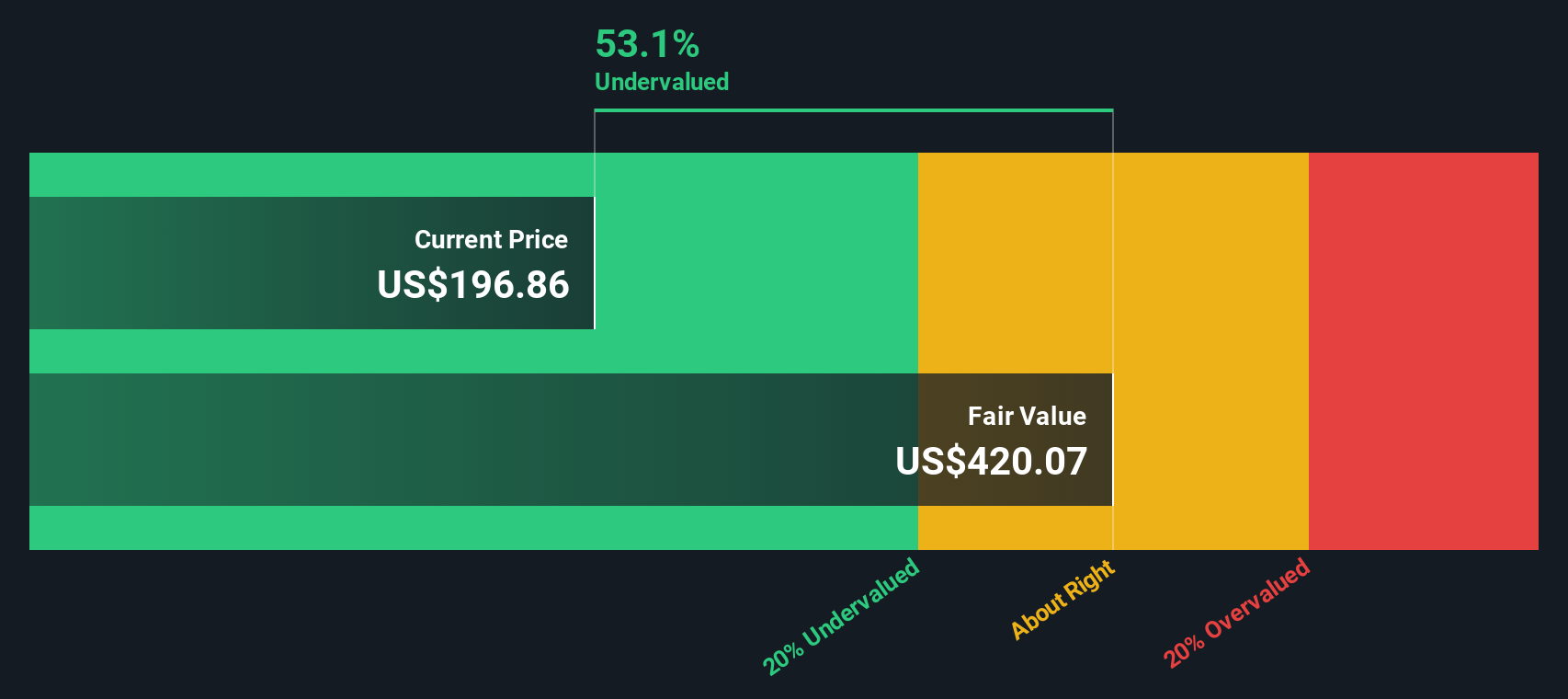

Simply Wall St’s proprietary "Fair Ratio" takes this analysis a step further. This metric weighs factors like Vistra’s earnings growth, industry, profit margins, market cap, and company-specific risks. Unlike simple peer or industry comparisons, the Fair Ratio captures the nuances that affect what a reasonable multiple should look like for Vistra specifically. For Vistra, the Fair Ratio is 53.1x, which is well above the industry and peer averages but still notably below the company’s current P/E.

Since Vistra’s actual P/E (67.4x) is materially higher than its Fair Ratio (53.1x), this suggests the stock is trading above what would typically be justified by its fundamentals and prospects.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vistra Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your simple, big-picture story about a company, weaving together your expectations for its future revenue, profits, and margins. This is not just numbers, but a clear perspective that brings meaning to the data and leads to your own estimate of fair value.

Narratives link a company's story, such as growth drivers or risks, directly to a set of financial forecasts and, ultimately, to a fair value that you can compare with today’s share price. This approach makes investing more accessible and personalized. On Simply Wall St’s Community page, millions of investors use Narratives to create and update their perspectives quickly and easily. Unlike static valuations, Narratives adapt automatically when new information such as earnings releases or news breaks, so your view stays current.

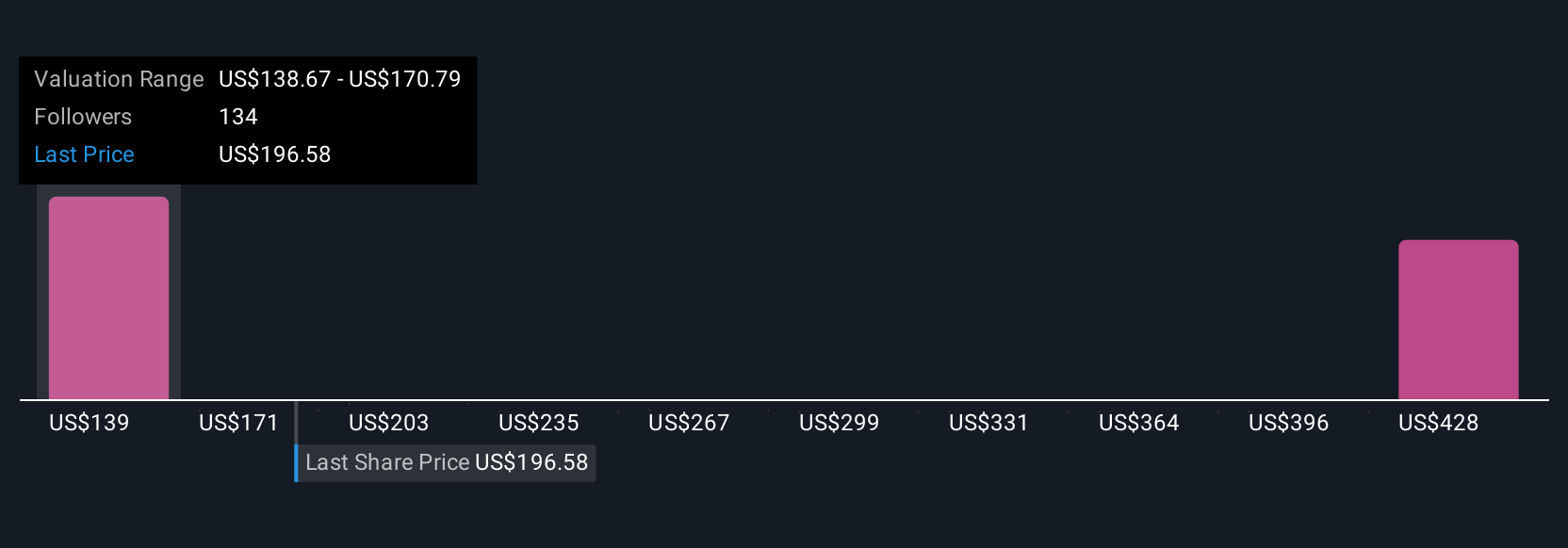

By building your own Vistra Narrative, you can compare your estimated fair value to the current price to decide if the stock is a buy or sell for you. For example, some investors feel bullish, predicting Vistra will trade above $261 as robust energy demand and long-term contracts unlock sustained growth. Others are more cautious, seeing fair value as low as $164 due to concerns about regulatory challenges and aggressive expansion into renewables. Narratives empower you to invest with confidence, based on your own understanding and real-time market changes.

Do you think there's more to the story for Vistra? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives