- United States

- /

- Electric Utilities

- /

- NYSE:TXNM

Is TXNM Energy’s Strong 37.5% Rally Backed by Fundamentals After Regulatory Surge?

Reviewed by Bailey Pemberton

- Curious if TXNM Energy is a hidden bargain or just part of the hype? You are not alone; many investors want to know what this stock is really worth before making their move.

- The stock has been on a strong run this year, climbing 16.5% year-to-date and an impressive 37.5% over the last twelve months, though it has barely budged in the past week.

- Recent news around TXNM Energy has highlighted growing investor demand for renewable energy and a surge of interest following regulatory changes in the utilities sector. Coverage also notes increased institutional activity, which some see as a sign that the stock could be gaining broader credibility in the market.

- Despite the buzz, TXNM Energy scores just 0/6 on our undervaluation checks. Next, we will break down what this means using several valuation approaches, and we will also reveal why there is another layer to valuation that you should not miss at the end of the article.

TXNM Energy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: TXNM Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a stock's value by projecting its future dividends and discounting them back to today. This model factors in expected growth rates and the sustainability of dividend payments. It is especially relevant for companies, like TXNM Energy, that pay regular dividends.

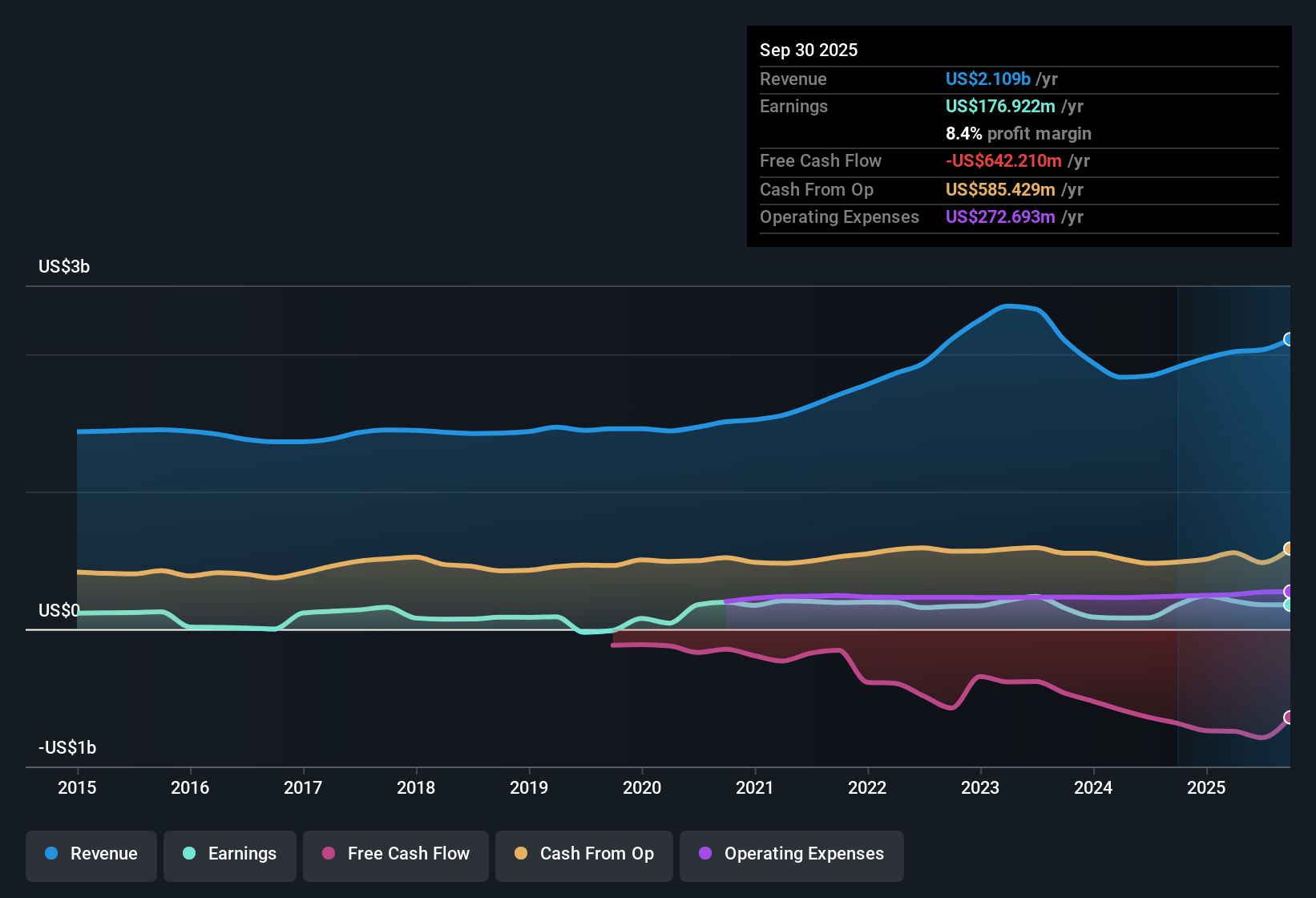

TXNM Energy currently pays out a dividend per share of $1.74, with a payout ratio of 74.5%. This means that nearly three-quarters of its earnings are being distributed to shareholders. Its return on equity (ROE) is 7.99%, providing a moderate base for future dividend growth. Based on the DDM methodology, the expected annual growth in dividends is projected at 2.04%, calculated from the proportion of earnings retained and the company's ROE.

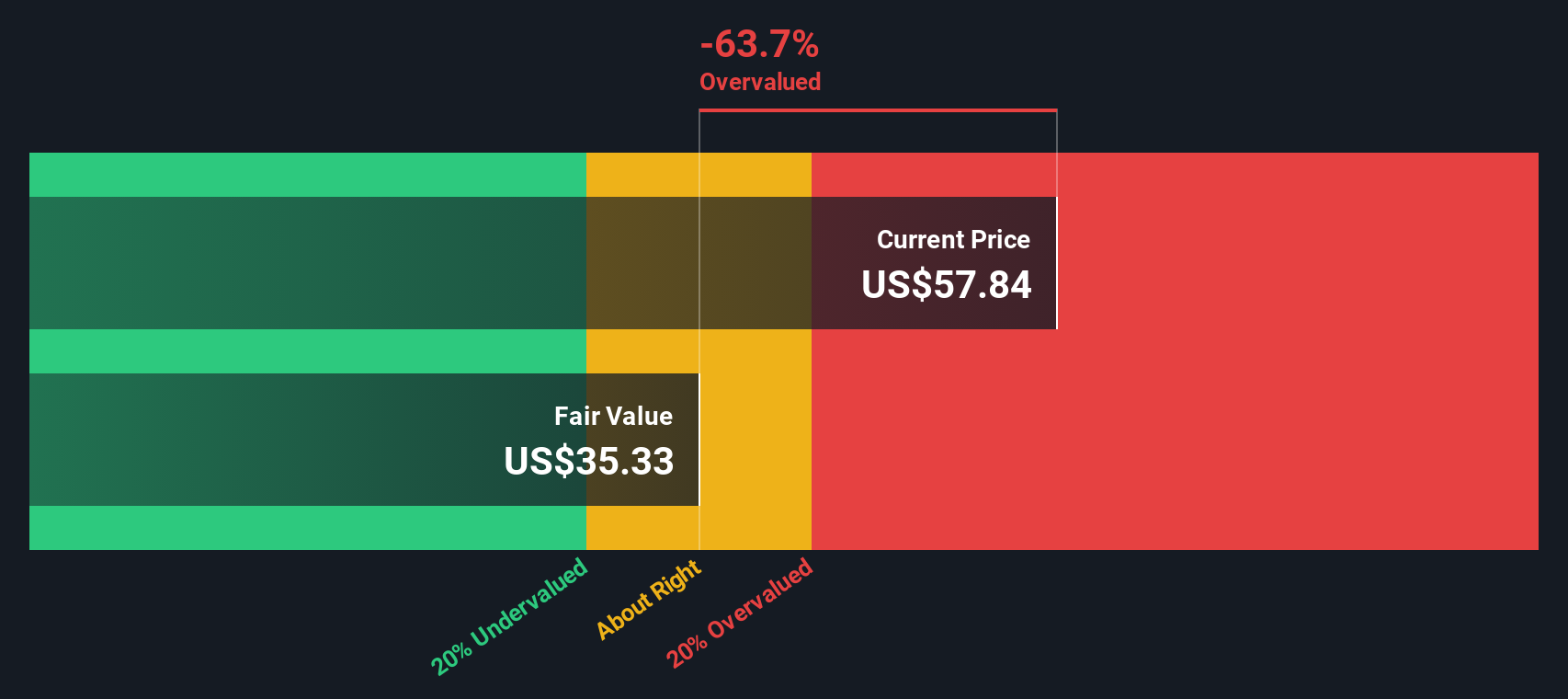

Using these figures, the Dividend Discount Model estimates TXNM Energy's intrinsic value at $36.67 per share. However, compared to the current market price, this suggests the stock is 55.2% overvalued and indicates that investors are paying a significant premium today for future dividend income that may not justify such a high price.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests TXNM Energy may be overvalued by 55.2%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: TXNM Energy Price vs Earnings (PE) Ratio Analysis

The Price-to-Earnings (PE) ratio is a preferred valuation metric for profitable companies because it directly relates the market price of a stock to its underlying earnings. This ratio helps investors understand how much they are paying for each dollar of earnings and is especially relevant for established utility businesses like TXNM Energy, which generate reliable profits.

The “right” PE ratio for a company is influenced by expectations for future growth and the level of risk investors are taking on. Companies with stronger growth outlooks or lower perceived risks typically command higher PE multiples. On the other hand, slower growth or greater risks generally push the fair valuation down.

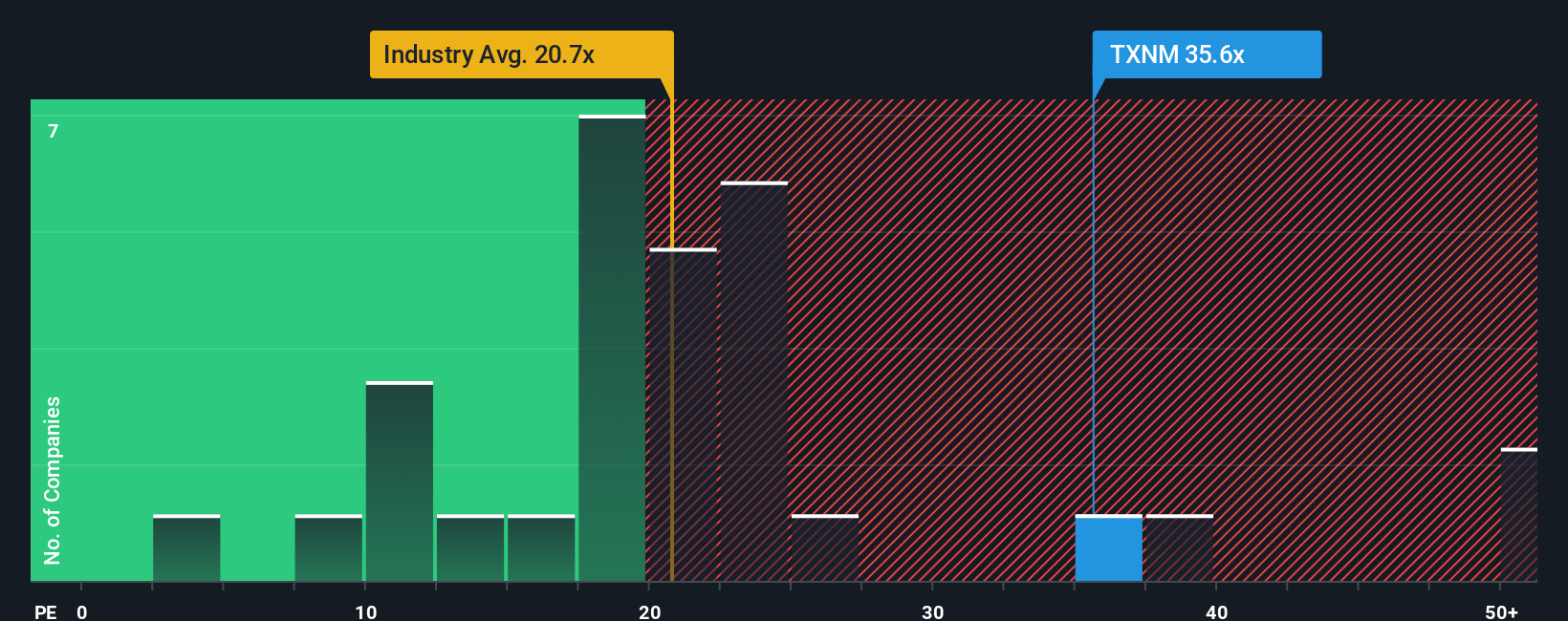

Currently, TXNM Energy’s PE ratio stands at 35x. This is well above both the industry average of 21.61x and the peer group average of 20.19x. These figures suggest that the stock is trading at a significant premium compared to similar electric utility companies. To offer more context, Simply Wall St’s “Fair Ratio” for TXNM Energy is calculated at 30.58x, a metric that adjusts for specific factors like the company’s earnings growth, profit margin, sector characteristics, size, and inherent risks unique to the business.

Unlike simple industry or peer comparisons, the Fair Ratio provides a more tailored and holistic view by blending company-specific strengths, weaknesses, and broader market context. By comparing TXNM Energy’s current PE multiple of 35x with its Fair Ratio of 30.58x, it appears that the market is still placing a sizable premium on the stock over what is justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TXNM Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a way of combining your unique view of a company's story with real numbers, connecting beliefs about TXNM Energy’s business outlook to actual forecasts and ultimately to a fair value. Instead of only comparing ratios and models, you can take what you know about TXNM Energy, such as state-supported grid investment, earnings growth, and regulatory tailwinds or, on the flip side, concerns about cost recovery risk and grid modernization costs, and weave it into a set of future expectations for revenue, profit margins, and other key metrics that drive fair value.

Narratives are simple to create and update on the Simply Wall St Community page, where millions of investors use them to make and compare investment decisions. By translating a story into numbers and instantly seeing how your estimated fair value stacks up against the latest share price, you gain a personalized buy or sell signal that responds as conditions change. Since Narratives update automatically when news, earnings, or analyst estimates shift, you are always working with the most current data.

For TXNM Energy, one investor might create a bullish Narrative emphasizing ongoing infrastructure investment and project a fair value above $61 per share, while another, focusing on margin pressure and regulatory hurdles, might land at only $56. This demonstrates how the same company can inspire different but equally data-driven perspectives.

Do you think there's more to the story for TXNM Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TXNM Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TXNM

TXNM Energy

Through its subsidiaries, provides electricity and electric services in the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives