- United States

- /

- Gas Utilities

- /

- NYSE:SWX

What Southwest Gas Holdings (SWX)'s CFO Transition Could Mean for Its Financial Leadership

Reviewed by Sasha Jovanovic

- Southwest Gas Holdings, Inc. announced the promotion of Justin S. Forsberg to Senior Vice President and Chief Financial Officer, effective December 1, 2025, following the departure of Robert J. Stefani.

- Forsberg's extensive background in finance and accounting, including experience at IDACORP and Idaho Power, is expected to bring seasoned financial leadership to the company.

- We'll examine how Forsberg's appointment as CFO and leader of financial operations could influence Southwest Gas Holdings' investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Southwest Gas Holdings Investment Narrative Recap

To be a shareholder in Southwest Gas Holdings, you need confidence in the company's regulated natural gas utility operations, its ability to grow its customer base in the Southwest, and a stable regulatory outlook. The recent promotion of Justin S. Forsberg to Chief Financial Officer provides management continuity at a critical time for the company's ongoing large-scale expansion projects, but the impact on the most immediate catalysts and risks, including execution challenges around major capital initiatives, appears limited, with no material shift in the risk-reward profile for now.

Of the recent announcements, the board’s decision to maintain its quarterly cash dividend at US$0.62 per share is most relevant, reinforcing the company’s commitment to shareholder returns despite ongoing executive changes. Reliable dividends can be attractive in the short term, but ongoing expansion project execution remains a monitoring point for investors looking ahead.

By contrast, investors should also be aware of the persistent risk of cost overruns and delays in the company’s largest expansion efforts, since...

Read the full narrative on Southwest Gas Holdings (it's free!)

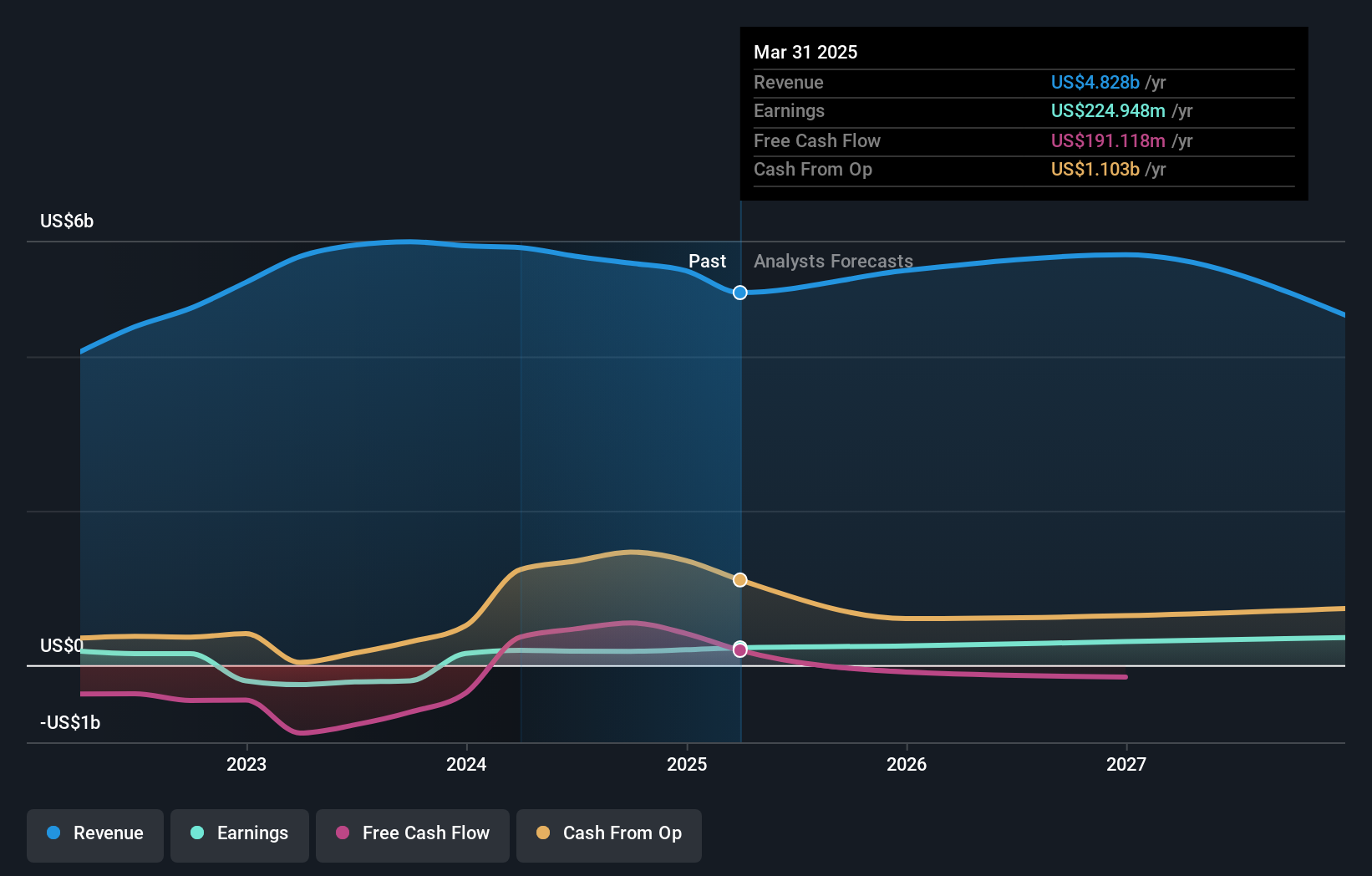

Southwest Gas Holdings is forecast to reach $4.5 billion in revenue and $409.8 million in earnings by 2028. This outlook assumes a yearly revenue decline of 1.8% and an earnings increase of $216.1 million from current earnings of $193.7 million.

Uncover how Southwest Gas Holdings' forecasts yield a $86.50 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely from US$40.84 to US$86.50 across two viewpoints. Diverse investor perspectives sit alongside execution risks facing Southwest Gas’s major infrastructure projects, directly affecting confidence in future returns and business stability.

Explore 2 other fair value estimates on Southwest Gas Holdings - why the stock might be worth less than half the current price!

Build Your Own Southwest Gas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Gas Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Southwest Gas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Gas Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, purchases, distributes, and transports natural gas for residential, commercial, and industrial customers in Arizona, Nevada, and California.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026