- United States

- /

- Gas Utilities

- /

- NYSE:SWX

Southwest Gas Holdings (SWX): Assessing Valuation Following Profit Jump and CFO Departure

Reviewed by Simply Wall St

Southwest Gas Holdings (SWX) caught investors’ eyes after posting third-quarter earnings that revealed higher profitability despite a revenue drop. At the same time, the company announced its Chief Financial Officer is stepping down.

See our latest analysis for Southwest Gas Holdings.

Shares of Southwest Gas Holdings have responded positively over the past year, building on a 15.63% year-to-date share price return and delivering a total shareholder return of 8.98% in twelve months. The stock’s steady climb, despite leadership changes and mixed earnings in the headlines, signals growing confidence in its underlying fundamentals over the long run.

If these latest moves have you watching utilities, it might be time to broaden your perspective and discover fast growing stocks with high insider ownership

With profits climbing even as revenues dip and management going through changes, the question remains: is Southwest Gas Holdings trading at an attractive price, or has the market already accounted for its next phase of growth?

Most Popular Narrative: 4.7% Undervalued

At $81.30 per share, Southwest Gas Holdings is trading just below the narrative’s consensus fair value estimate of $85.29. This suggests the market is close but not fully pricing in all assumptions. With only a slim margin above the last close, the narrative’s fair value projection depends on specific expectations for growth and margins in the years ahead.

“Favorable regulatory developments such as Nevada's new alternative ratemaking legislation and progress on formula rates in Arizona and California provide visibility into faster cost recovery and mitigated regulatory lag. This should enhance margin stability and earnings predictability.”

Want to find out what’s really driving this bullish price target? The narrative depends on stronger profit margins and a potential future earnings jump that could shift Wall Street’s expectations. Which forecasts do analysts believe are bold enough to justify this number? See all the details that could change your view of Southwest Gas Holdings.

Result: Fair Value of $85.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating decarbonization trends and stricter regulatory caps could pose significant risks to long-term demand and profit growth for Southwest Gas Holdings.

Find out about the key risks to this Southwest Gas Holdings narrative.

Another View: Is the Market Overpaying?

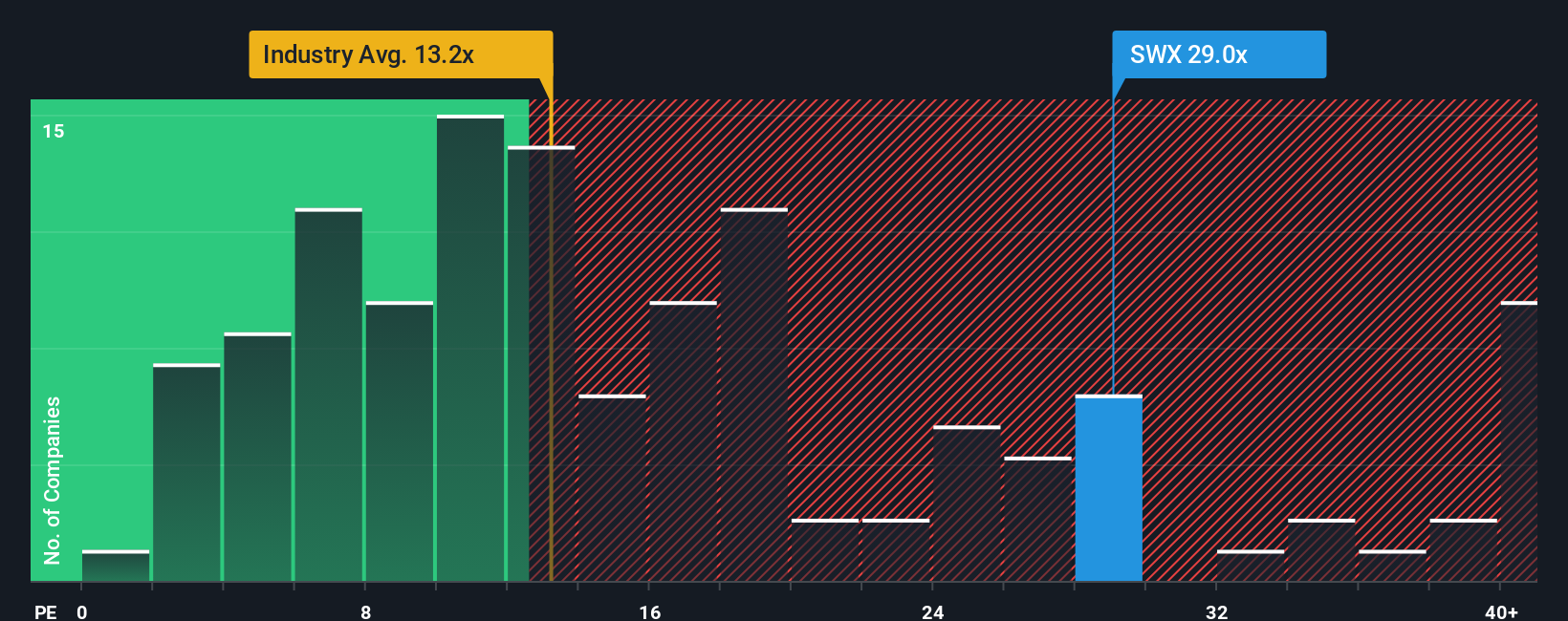

Looking at Southwest Gas Holdings through the lens of price-to-earnings, the stock trades at 24.6 times earnings. That is significantly higher than both the global gas utilities industry average of 14.1 and peers at 17.5, as well as above its fair ratio of 22.6. This steeper valuation leaves less room for error if growth projections fall short. Might the market be taking on more risk here than it realizes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southwest Gas Holdings Narrative

If you see things differently or want to dig into the numbers on your own, it's easy to piece together your perspective in just a few minutes. Do it your way

A great starting point for your Southwest Gas Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock greater potential for your portfolio by targeting a new wave of opportunity. Missing out on these trends could mean leaving smart gains on the table.

- Capitalize on disruptive innovation by reviewing these 25 AI penny stocks, making headlines for advancements in artificial intelligence and automation.

- Boost your income strategy with these 16 dividend stocks with yields > 3%, delivering consistent yields that can help strengthen the foundation of your investments.

- Catch the early momentum from market upstarts through these 3593 penny stocks with strong financials before mainstream attention pushes valuations higher.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, purchases, distributes, and transports natural gas for residential, commercial, and industrial customers in Arizona, Nevada, and California.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives