- United States

- /

- Gas Utilities

- /

- NYSE:SWX

Should Southwest Gas Holdings’ (SWX) Profit Jump and CFO Departure Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Southwest Gas Holdings reported that third quarter net income reached US$270.48 million despite revenues falling to US$316.91 million, and announced that CFO Robert J. Stefani will leave the company effective December 1, 2025.

- The company reaffirmed its 2025 net income guidance, providing more earnings visibility just as it manages both rising profitability and major executive changes.

- Now, we'll consider how the jump in net income, despite lower revenues and a CFO transition, could alter Southwest Gas Holdings' investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Southwest Gas Holdings Investment Narrative Recap

To be a shareholder in Southwest Gas Holdings, one needs confidence in the company's ability to generate resilient net income and sustain regulated utility earnings even as the long-term outlook for natural gas faces headwinds from electrification and regulatory changes. The recent announcement of strong third quarter net income coupled with reaffirmed 2025 guidance largely reinforces the short-term earnings catalyst, while the CFO transition itself does not introduce a material new risk but does add some near-term management uncertainty.

Amid these developments, the company's guidance reaffirmation stands out: management expects 2025 net income between US$265 million and US$275 million, providing a degree of clarity at a time when execution risks linger, especially around large-scale projects like the Great Basin pipeline. Maintaining transparency on future earnings continues to be a central factor in shaping short-term investor confidence, especially as major leadership changes take effect.

However, it’s important not to overlook the ongoing risk that stricter environmental regulations or policy-driven cost caps could constrain infrastructure investment and...

Read the full narrative on Southwest Gas Holdings (it's free!)

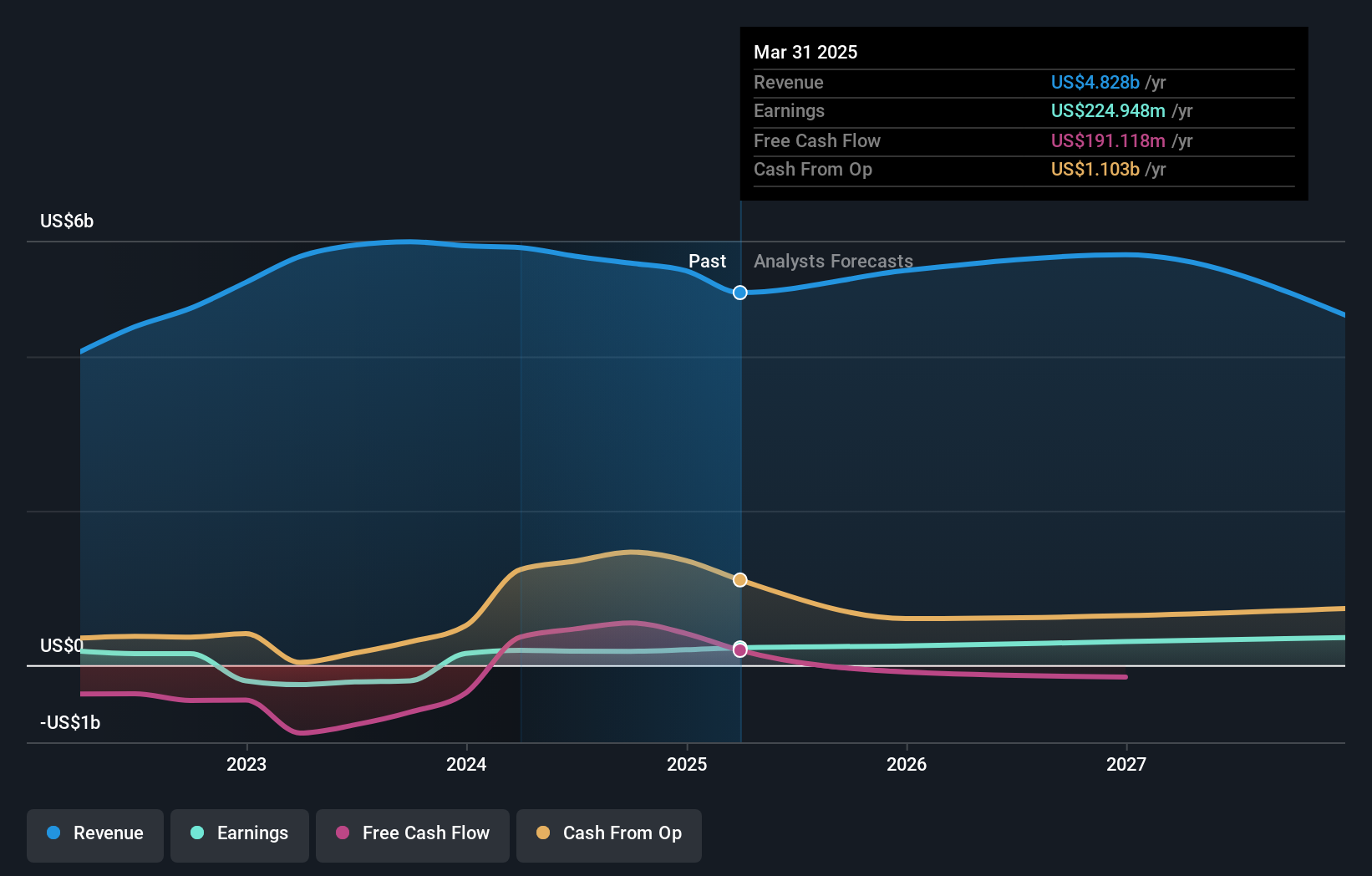

Southwest Gas Holdings' outlook anticipates $4.5 billion in revenue and $409.8 million in earnings by 2028. This scenario assumes a 1.8% annual revenue decline and an earnings increase of $216.1 million from current earnings of $193.7 million.

Uncover how Southwest Gas Holdings' forecasts yield a $85.29 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range from US$40.76 to US$85.29 per share. While investor outlooks differ widely, tightening regulations remain a central issue with potential long-term impact for Southwest Gas Holdings.

Explore 2 other fair value estimates on Southwest Gas Holdings - why the stock might be worth less than half the current price!

Build Your Own Southwest Gas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Gas Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Southwest Gas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Gas Holdings' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, purchases, distributes, and transports natural gas for residential, commercial, and industrial customers in Arizona, Nevada, and California.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives