- United States

- /

- Other Utilities

- /

- NYSE:SRE

Sempra (SRE): A Fresh Look at Valuation After Recent Share Price Movements

Reviewed by Simply Wall St

Sempra (SRE) shares have seen some movement lately, catching the attention of investors looking for steady utility sector plays. With recent performance data in hand, let us examine how Sempra is stacking up right now.

See our latest analysis for Sempra.

While Sempra’s share price has recently dipped 1.53% in the last day, the longer-term story is steadier. The 90-day share price return stands at 13.54%, and the 1-year total shareholder return is 1.24%, signaling some regained momentum after a quieter stretch.

If you’re looking beyond utilities, now may be a good moment to broaden your horizons and discover fast growing stocks with high insider ownership

With Sempra trading nearly 8.5% below consensus analyst targets and recent gains building, investors face an important question: Is there real value left to be captured, or is the company’s future growth already priced in?

Most Popular Narrative: 6.7% Undervalued

Compared to the last close at $92.47, the narrative’s fair value estimate of $99.07 suggests there could still be meaningful upside for Sempra. The logic underpinning this valuation hinges on a blend of moderating growth forecasts and improved operating margins.

Legislative and regulatory changes in Texas (notably HB 5247 and the Unified Tracker Mechanism) are set to accelerate the recovery of capital invested in infrastructure, reducing regulatory lag and improving Oncor's earned ROE by 50 to 100 basis points, which should boost net margins over time.

Curious about which assumptions power this value call? From margin boosts to capital returns, the underlying projections might surprise you. Uncover the numbers shaping this narrative and see what gives Sempra that valuation edge.

Result: Fair Value of $99.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent wildfire threats in California and unforeseen regulatory shifts in key markets could quickly change Sempra's current growth outlook.

Find out about the key risks to this Sempra narrative.

Another View: Multiples Signal High Hurdles

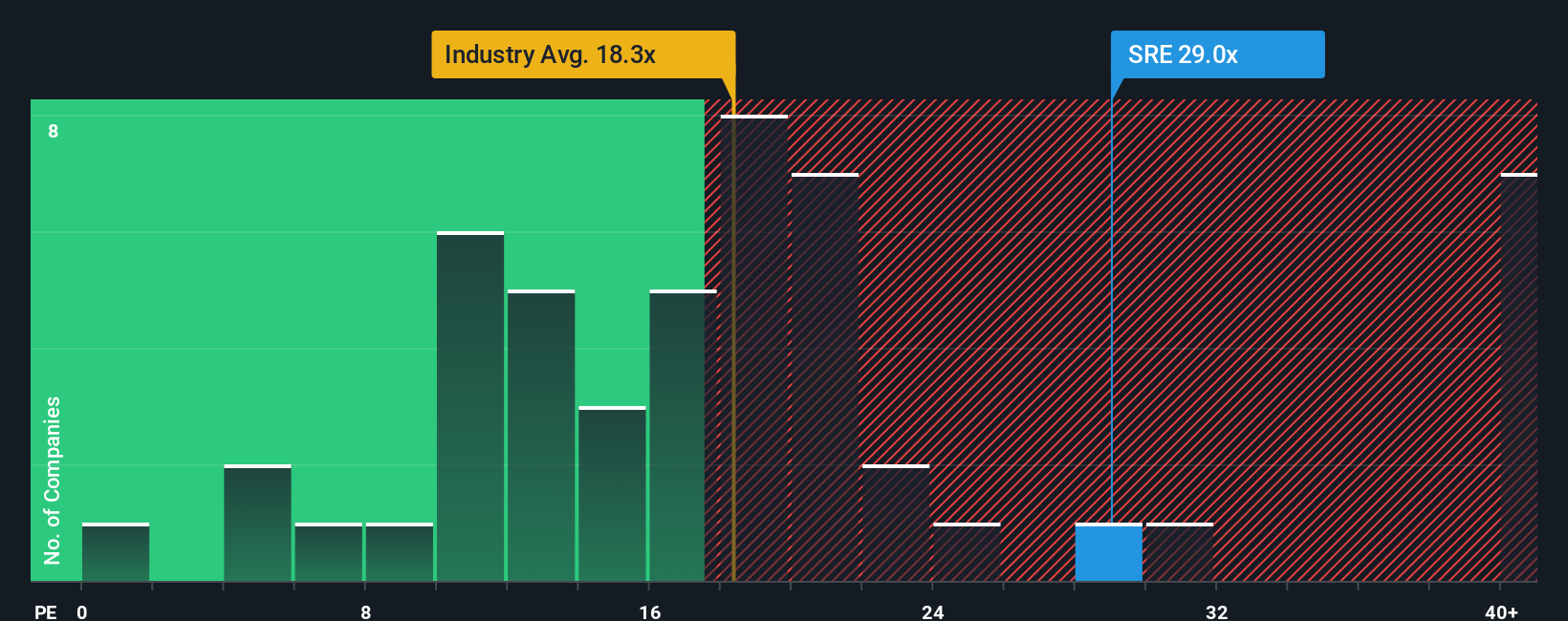

Looking at share valuation through the lens of price-to-earnings, Sempra trades at 28.6x. This is well above both its industry peers at 19.7x and the global industry at 17.7x. The market’s fair ratio comes in even higher at 29.2x, intensifying pressure around today's lofty multiple. Could this mean future growth is already priced in, or is the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sempra Narrative

If you want to dig into the numbers and shape your own perspective, you can craft a custom narrative based on your research in just a few minutes. Do it your way

A great starting point for your Sempra research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Start building a smarter portfolio by checking out other unique stock opportunities. Don’t let the next potential winner pass you by. Use these tailored stock ideas today.

- Uncover new passive income streams by checking out these 14 dividend stocks with yields > 3%, which boasts yields above 3% and a track record of stable dividends.

- Seize the chance to invest where healthcare and artificial intelligence meet by reviewing these 30 healthcare AI stocks at the front line of medical innovation.

- Capitalize on undervalued opportunities before the market catches on by targeting these 929 undervalued stocks based on cash flows, driven by future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRE

Sempra

Operates as an energy infrastructure company in the United States and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success