- United States

- /

- Other Utilities

- /

- NYSE:SRE

Investor Optimism Abounds Sempra (NYSE:SRE) But Growth Is Lacking

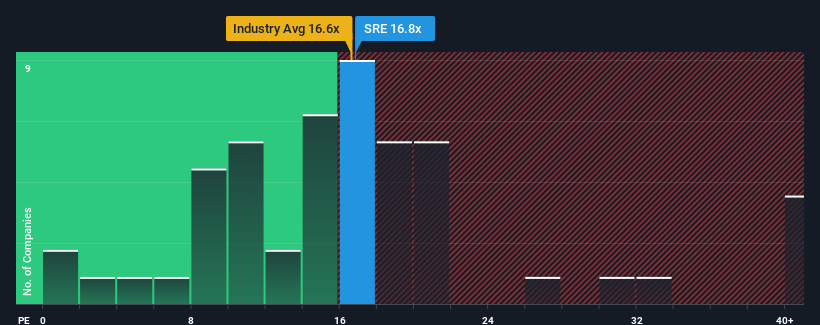

With a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for feeling indifferent about Sempra's (NYSE:SRE) P/E ratio of 16.8x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Sempra has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Sempra

Is There Some Growth For Sempra?

Sempra's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 17% gain to the company's bottom line. As a result, it also grew EPS by 26% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 7.3% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 10% each year, which is noticeably more attractive.

With this information, we find it interesting that Sempra is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Sempra's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Sempra currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 2 warning signs for Sempra (1 is potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRE

Sempra

Operates as an energy infrastructure company in the United States and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives