- United States

- /

- Gas Utilities

- /

- NYSE:SR

Is Spire’s (SR) Dividend Increase Shaping New Expectations for Income and Management Confidence?

Reviewed by Sasha Jovanovic

- On November 13, 2025, Spire Inc. announced a 5.1% increase in its annual common stock dividend, raising it to US$3.30 per share, and declared a regular quarterly dividend on its preferred stock payable in early 2026.

- This dividend increase highlights Spire's management confidence in its financial outlook and reinforces its commitment to rewarding shareholders consistently.

- We'll examine how Spire's dividend hike may influence its investment narrative and investor expectations for future income growth.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Spire Investment Narrative Recap

To be a Spire shareholder, you need to believe that regulated natural gas utilities can deliver steady income growth in a sector facing mounting decarbonization pressures and ongoing capital requirements. Spire’s November dividend increase underscores management’s confidence but does not meaningfully change the main catalyst, successful integration and revenue uplift from the Piedmont Tennessee acquisition, nor does it resolve the bigger risk of stricter decarbonization policies potentially weighing on future demand and margins.

The recent board decision to increase the common stock dividend by 5.1 percent to US$3.30 per share, alongside a regular preferred dividend, stands out as the most relevant announcement for yield-focused investors. While these moves confirm Spire’s commitment to shareholder returns, the company’s long-term growth story still hinges on achieving regulatory approval and the anticipated benefits from its expanded Tennessee footprint.

However, investors should be aware that, in contrast, the continued rise of state-led electrification initiatives could eventually challenge...

Read the full narrative on Spire (it's free!)

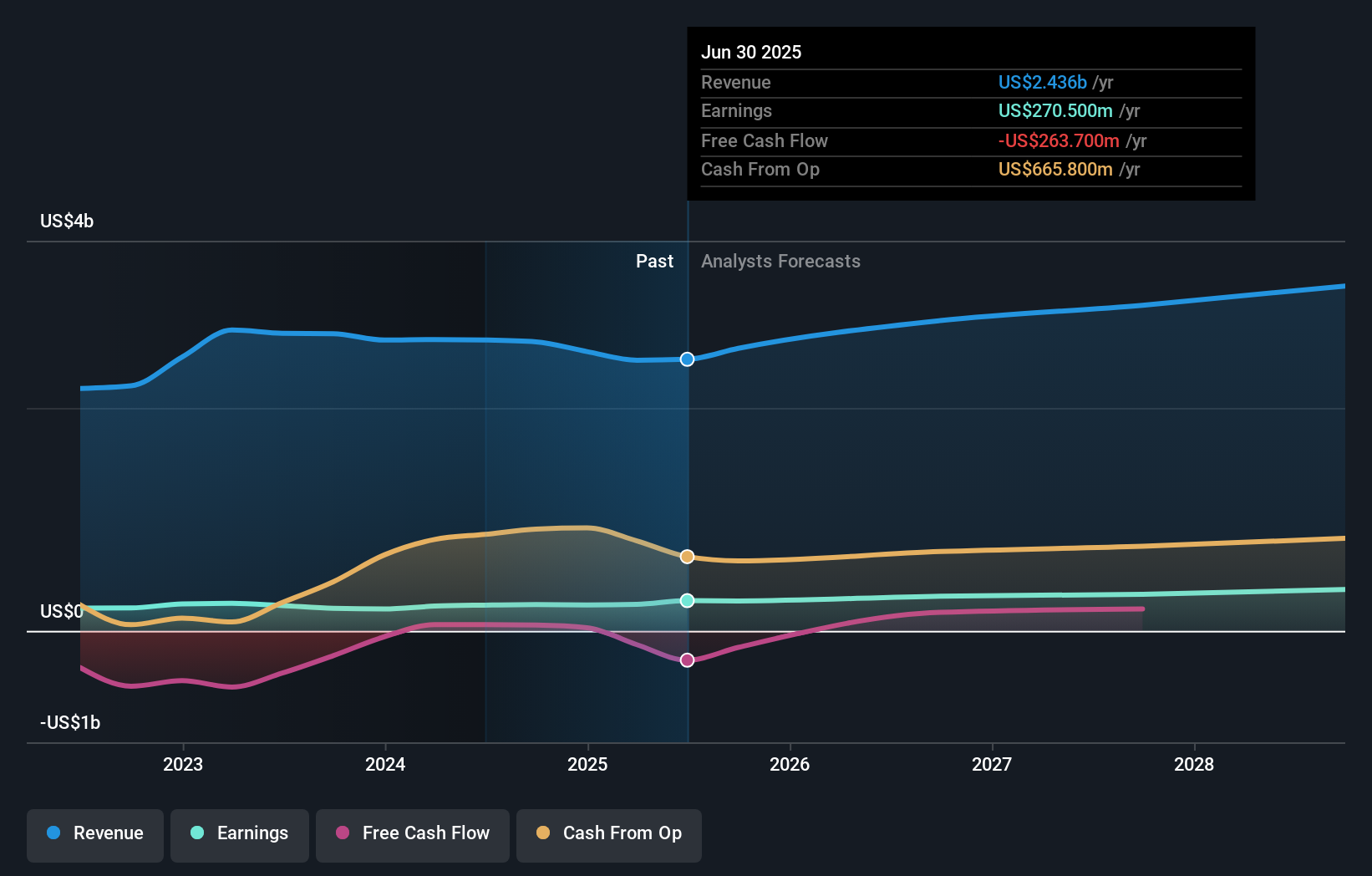

Spire's outlook projects $3.2 billion in revenue and $344.9 million in earnings by 2028. This requires 9.4% yearly revenue growth and a $74.4 million increase in earnings from the current $270.5 million.

Uncover how Spire's forecasts yield a $89.61 fair value, in line with its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community placed Spire at US$98.50 per share, indicating limited diversity in private investor views. As you consider this opinion, recall that the company’s future performance will also depend on how it manages tightening regulations and secures cost recovery for major capital projects.

Explore another fair value estimate on Spire - why the stock might be worth just $98.50!

Build Your Own Spire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spire research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Spire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spire's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SR

Spire

Engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives