- United States

- /

- Gas Utilities

- /

- NYSE:SR

Assessing Spire (SR) Valuation After Recent Share Price Gains and Analyst Divergence

Reviewed by Simply Wall St

See our latest analysis for Spire.

Looking at the bigger picture, Spire’s momentum has been picking up steam as investors become more optimistic about its outlook. With a 31.11% share price return year to date and a robust 45.27% total shareholder return over the past year, the stock is not only rebounding but showing renewed confidence well beyond short-term gains.

If Spire’s steady climb has you thinking about what else is gaining traction, consider broadening your scope and discover fast growing stocks with high insider ownership

Given Spire’s impressive run, the question now is whether further upside remains or if today’s price already accounts for future growth. Is there still a buying window, or is the market one step ahead?

Most Popular Narrative: 10% Overvalued

Spire’s most widely followed valuation places the fair value at $80.93, while the last close was $89.68, signaling a premium to this consensus. This sets up a debate about whether the market is already pricing in all of Spire’s growth drivers.

Significant and ongoing investments in infrastructure modernization and system resilience, supported by constructive regulatory frameworks and reliable cost recovery mechanisms, are growing Spire's regulated asset base, which should result in higher allowed returns and gradual increases in net income.

Want to know what’s powering this elevated valuation? The narrative hinges on bold long-term forecasts and ambitious assumptions about Spire’s profit margins and growth outlook. Most investors will be surprised by the aggressive projections required to justify today’s share price. Don’t miss the financial logic backing that target.

Result: Fair Value of $80.93 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting regulations that push electrification and increased competition from alternative energy sources could challenge Spire’s growth thesis in the coming years.

Find out about the key risks to this Spire narrative.

Another View: Discounted Cash Flow Model

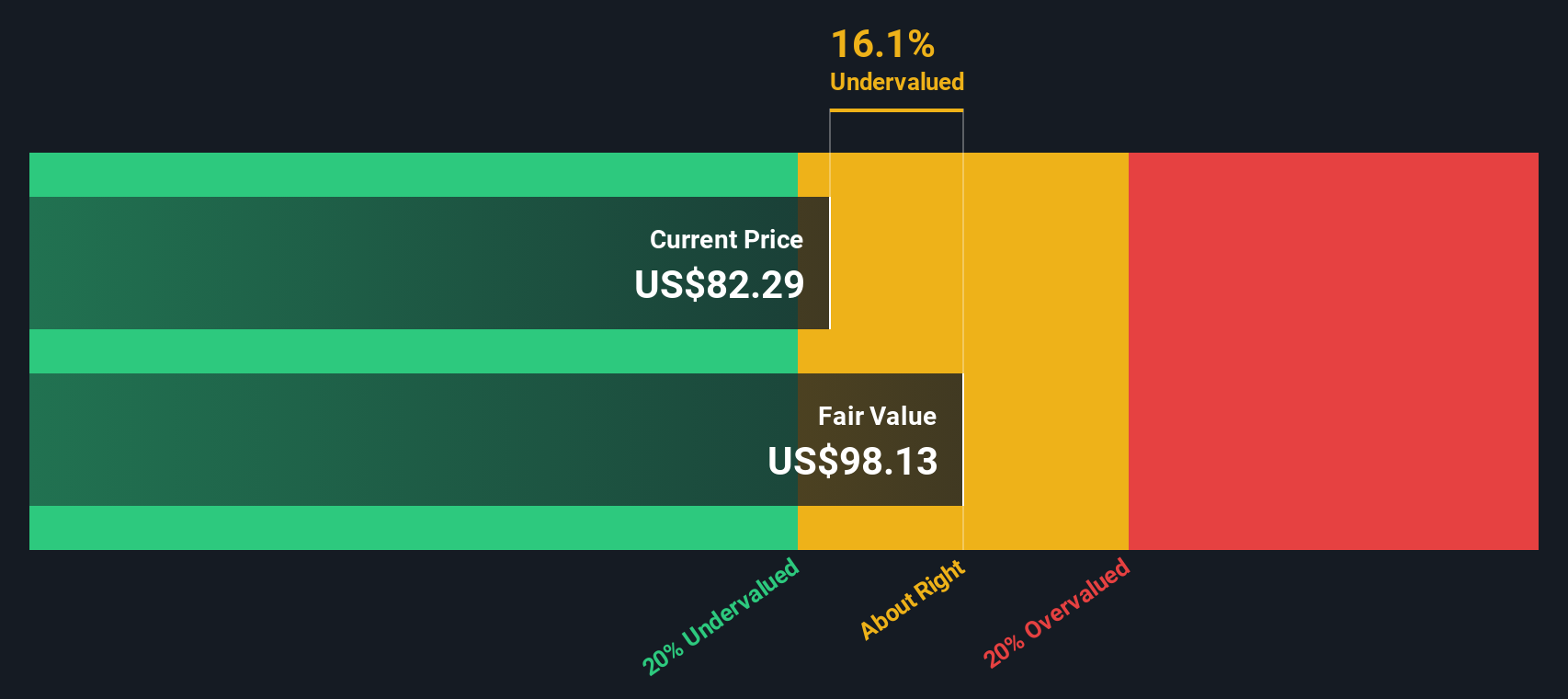

Taking a step back from market multiples, the Simply Wall St DCF model suggests Spire may actually be undervalued, with a fair value estimate of $98.03 compared to its latest share price. This presents a stark contrast to the consensus view. Could the market be underestimating Spire's long-term prospects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Spire for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Spire Narrative

If you see the story differently or prefer hands-on analysis, dig into the numbers and craft your own perspective in just a few minutes. Do it your way

A great starting point for your Spire research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Your next winning stock may be just a few clicks away. Don’t let standout opportunities pass you by. The Simply Wall St Screener points you toward exciting companies tailored to your strategy, helping you stay one step ahead of the market.

- Uncover income potential with steady payers by checking out these 16 dividend stocks with yields > 3% that consistently offer yields above 3% and robust fundamentals.

- Spot undervalued gems quickly by tapping into these 870 undervalued stocks based on cash flows primed for solid growth based on cash flow signals.

- Catch the momentum in digital assets by accessing these 82 cryptocurrency and blockchain stocks making moves in blockchain tech and the future of finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SR

Spire

Engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives