- United States

- /

- Gas Utilities

- /

- NYSE:SPH

The Bull Case For Suburban Propane Partners (SPH) Could Change Following Expansion Into Renewable Fuels – Learn Why

Reviewed by Sasha Jovanovic

- Suburban Propane Partners LP recently reported strong revenue growth and heightened operational efficiency in its Propane segment, while accelerating investments in renewable propane and renewable natural gas.

- While seasonality and weather continue to shape the company’s performance, its focused push into renewables highlights a shift towards supporting cleaner energy solutions.

- We'll examine how Suburban Propane Partners' expansion into renewable fuels could reshape its investment outlook and future prospects.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Suburban Propane Partners Investment Narrative Recap

To be a shareholder in Suburban Propane Partners, you need to believe in the company’s ability to generate reliable income from its propane operations while successfully transitioning toward renewable fuels. The recent report of strong growth and operational efficiency broadly supports the view that Suburban Propane’s core business remains robust. However, these developments don’t fundamentally change seasonality, still the biggest short-term catalyst, or lessen the impact of weather, which remains the clearest risk for earnings and cash flow predictability.

Among recent announcements, the partnership with NASCAR to supply propane-powered track dryers stands out as a visible step aligning with the company's expansion in cleaner energy solutions. This move provides a clear connection to the short-term catalyst of growing demand for renewable fuels and cleaner technologies, while also reinforcing Suburban Propane’s position with high-profile partners in an evolving energy market.

However, investors should remember that despite new initiatives, ongoing volatility in regulatory credits for renewable fuels could impact future margin potential...

Read the full narrative on Suburban Propane Partners (it's free!)

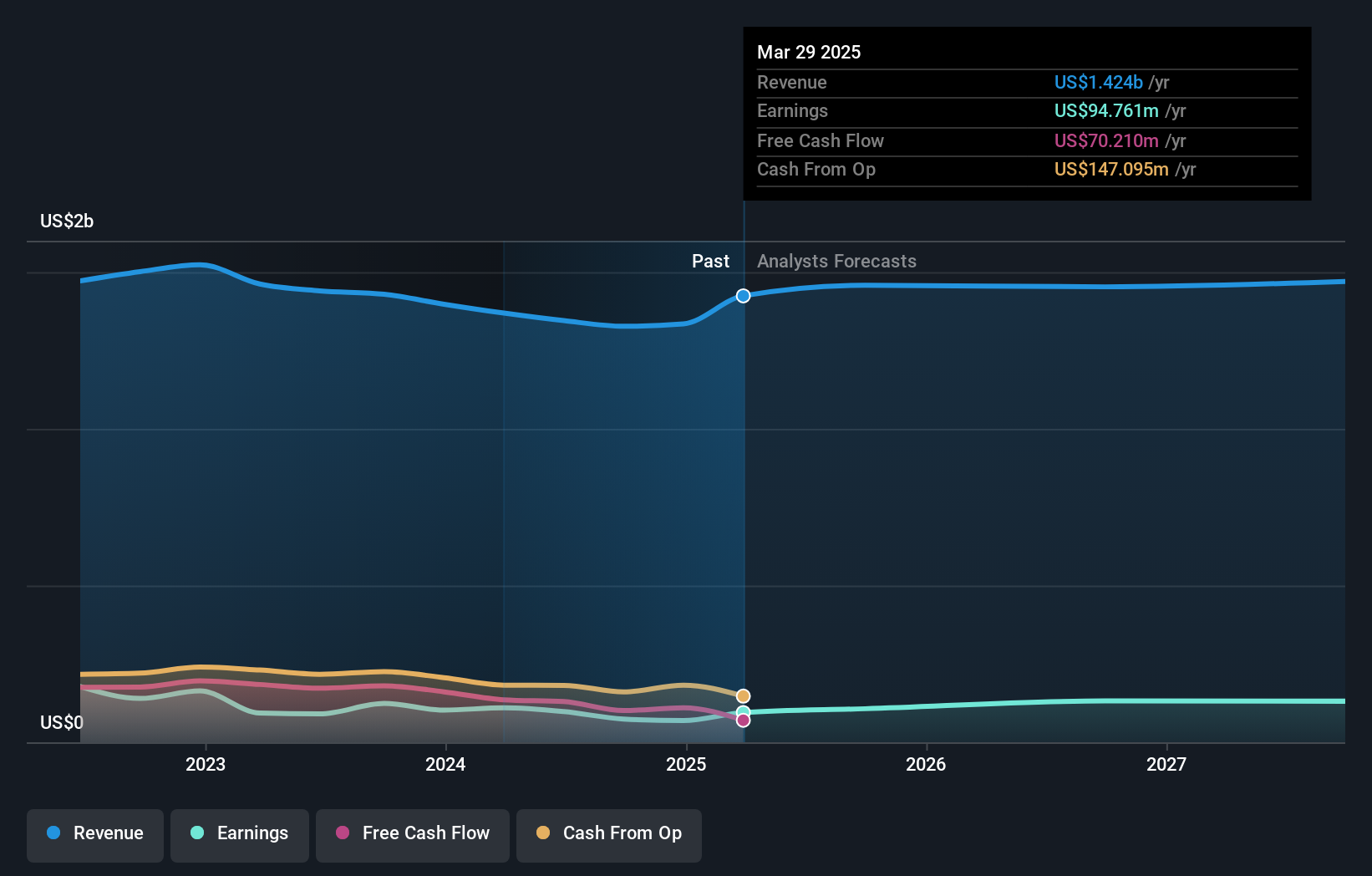

Suburban Propane Partners is projected to deliver $1.5 billion in revenue and $132.3 million in earnings by 2028. This outlook is based on an expected annual revenue decline of 1.0% and a $35.2 million increase in earnings from the current $97.1 million.

Uncover how Suburban Propane Partners' forecasts yield a $17.00 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Every fair value estimate from the Simply Wall St Community falls at US$17, showing little variation across 1 analysis before this recent news. Against this consensus, investor focus remains on the unpredictable role of weather, highlighting the importance of understanding diverse viewpoints for Suburban Propane’s future.

Explore another fair value estimate on Suburban Propane Partners - why the stock might be worth 13% less than the current price!

Build Your Own Suburban Propane Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suburban Propane Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Suburban Propane Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suburban Propane Partners' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPH

Suburban Propane Partners

Through its subsidiaries, engages in the retail marketing and distribution of propane, renewable propane, renewable natural gas, fuel oil, and refined fuels in the United States.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026