- United States

- /

- Electric Utilities

- /

- NYSE:SO

Southern Company (SO): Evaluating Valuation After Strong Q3 Earnings and Recent Sector Underperformance

Reviewed by Simply Wall St

Southern (SO) has caught investor attention after delivering third-quarter results that topped expectations. The company reported year-over-year revenue growth and a rise in adjusted earnings per share. Despite this, recent performance has continued to lag behind the broader Utilities sector.

See our latest analysis for Southern.

While Southern delivered strong third-quarter results, its momentum has yet to fully translate into the stock’s performance. The 1-year total shareholder return stands at 5.7%, and shares are up 11.0% year-to-date. However, recent months have seen some cooling, with a 3.1% share price dip over the past 30 days. Long-term investors have still benefited, with a total return approaching 79% over five years, suggesting periods of volatility but ultimately solid overall gains.

If you’re curious what other companies are drawing renewed interest right now, it could be the perfect time to broaden your investing search and discover fast growing stocks with high insider ownership

With Southern trading below its all-time highs despite solid earnings surprises and analyst targets indicating further upside, investors must consider if the current weakness signals an undervalued opportunity or if the market has already factored in future growth.

Most Popular Narrative: 8% Undervalued

Southern’s fair value in the most widely followed narrative stands above its last close price, with a consensus forming around a higher upside target. The narrative brings together key business drivers and market expectations that frame today's value debates.

“Robust regional growth and electrification projects are fueling strong demand, supporting revenue gains and significant long-term expansion across regulated operations. Increased investment in renewables, modern infrastructure, and nuclear positions the company for lower-cost funding, margin improvement, and stable returns amid rising clean energy demand.”

Want to know the catalyst driving analyst optimism? The number-crunchers behind this fair value are betting on a revenue surge and profit expansion that may surprise more cautious investors. Find out which ambitious projections are powering the higher price target and uncover what could shift Southern’s valuation narrative.

Result: Fair Value of $99.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher capital spending and ongoing uncertainty around long-term electricity demand could limit earnings growth and present challenges for Southern’s upside narrative.

Find out about the key risks to this Southern narrative.

Another View: How Does Valuation Stack Up on Earnings?

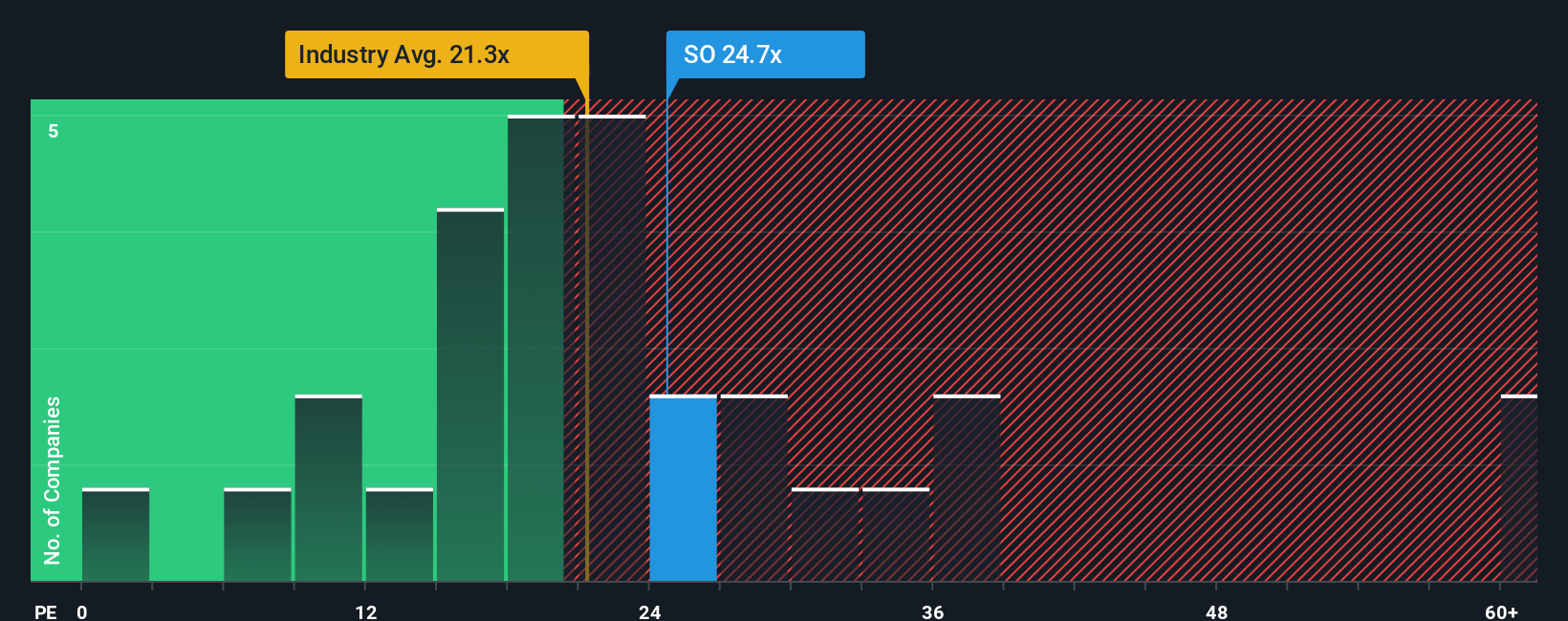

Looking beyond the consensus price target, Southern is priced at about 22.5 times earnings, just above the electric utilities industry average of 21 but noticeably below the peer group at 26.7x. Compared to the fair ratio of 23.3x, Southern trades at a slight discount but not a dramatic one. This tight spread suggests Southern is reasonably valued, though not necessarily a bargain. Does this modest gap make Southern safer, or does it limit your upside if the market shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southern Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Southern research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio and discover what others might be missing with three standout stock opportunities from Simply Wall Street’s powerful screeners. Don’t let the next breakout slip away; these ideas could lead you straight to your next winning move.

- Unlock high-yield potential with these 15 dividend stocks with yields > 3% and see which companies are rewarding shareholders with strong, reliable income.

- Spot emerging stars by exploring these 3561 penny stocks with strong financials that demonstrate real financial strength and offer unique growth stories.

- Get ahead of market trends by tapping into these 25 AI penny stocks, featuring the most promising innovators leveraging artificial intelligence for tomorrow’s breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SO

Southern

Through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026