- United States

- /

- Electric Utilities

- /

- NYSE:PPL

Will Kentucky’s Green Light for New Gas Units Reshape PPL’s (PPL) Growth and Regulatory Outlook?

Reviewed by Sasha Jovanovic

- In late October 2025, the Kentucky Public Service Commission approved plans for PPL Corporation's subsidiaries to construct two new 645 MW natural gas units and authorized environmental upgrades at Ghent Generating Station, while also granting cost recovery mechanisms for select projects.

- This regulatory approval enables PPL to pursue significant infrastructure investments to support long-term electricity demand growth, particularly from expanding data center and industrial activity in key service regions.

- Next, we'll consider how Kentucky's approval of new generation and upgrades could reshape PPL's outlook for growth and regulatory stability.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

PPL Investment Narrative Recap

To own PPL shares, you need to believe in the sustained growth in electricity demand, particularly from data centers and industry, in its core regions, and the company's ability to recover major capital investments through stable regulatory support. The recent Kentucky approval empowers PPL to advance key infrastructure, supporting its largest short-term catalyst of serving rising customer demand. However, it does not meaningfully reduce the risk tied to regulatory lag or delayed cost recovery in other jurisdictions.

A standout recent announcement was PPL's formation of a joint venture with Blackstone Infrastructure to build new gas-fired generation for data centers. This move connects directly to the near-term catalyst: capturing large electricity loads from hyperscalers while seeking to ensure predictable, regulated-like returns. Paired with Kentucky's project approvals, it signals an intensified focus on meeting future load growth, but...

Read the full narrative on PPL (it's free!)

PPL's outlook anticipates $9.6 billion in revenue and $1.7 billion in earnings by 2028. This implies a 2.8% annual increase in revenue and a $714 million rise in earnings from the current $986 million.

Uncover how PPL's forecasts yield a $39.92 fair value, a 9% upside to its current price.

Exploring Other Perspectives

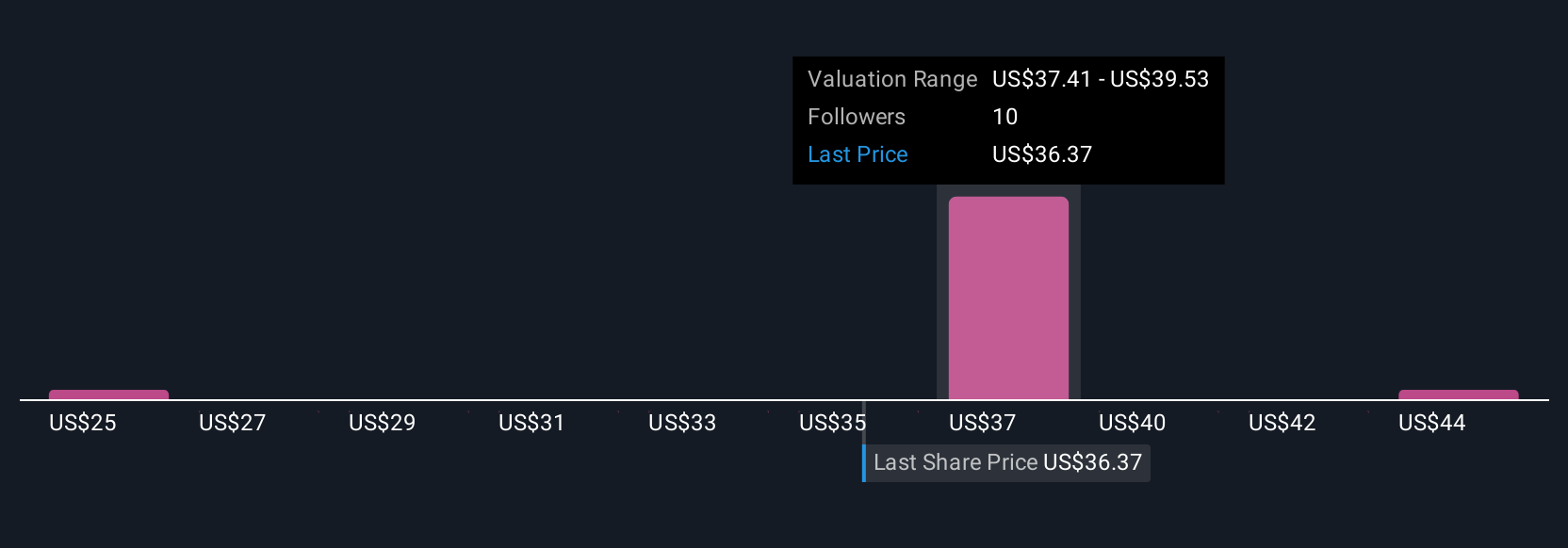

Simply Wall St Community members valued PPL between US$28.25 and US$39.92, across two distinct forecasts. While most see data center-driven demand as an opportunity, your own outlook on regulatory risk could lead you to very different conclusions about future value.

Explore 2 other fair value estimates on PPL - why the stock might be worth as much as 9% more than the current price!

Build Your Own PPL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PPL research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PPL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PPL's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPL

PPL

Provides electricity and natural gas to approximately 3.5 million customers in the United States.

Solid track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives