- United States

- /

- Electric Utilities

- /

- NYSE:PPL

PPL (PPL) Valuation Check After Recent Share Price Pullback

Reviewed by Simply Wall St

PPL (PPL) has quietly slipped about 7% over the past week and 6% over the past month, even though its year to date return is still positive. This invites a closer look at what has changed.

See our latest analysis for PPL.

Even with this recent pullback in the share price, which leaves the latest close at $34.16, PPL still boasts a solid multi year total shareholder return. This suggests the market is reassessing near term risk rather than abandoning the longer term story.

If PPL’s move has you rethinking your portfolio mix, it could be a good moment to explore fast growing stocks with high insider ownership for other compelling opportunities beyond the utilities space.

With earnings still growing, a modest discount to analyst targets, and a long run of positive returns, is PPL quietly slipping into value territory, or is the market simply pricing in its next leg of growth?

Most Popular Narrative: 15.6% Undervalued

With PPL closing at $34.16 against a narrative fair value near $40, the gap reflects a confident long term view built around rising regulated earnings.

The accelerating growth in data center construction and new economic development (particularly in Pennsylvania and Kentucky) is driving unprecedented electricity demand, positioning PPL for outsized long-term rate base and revenue growth as it invests to serve these large new loads.

Major planned grid infrastructure upgrades and generation capacity expansions, totaling $20B through 2028 (with upside from potential data center-driven transmission and new generation projects), set the stage for nearly 10% average annual rate base growth directly supporting higher regulated revenues and future earnings.

Curious how steady revenue growth, expanding margins, and a rich future earnings multiple can still point to upside from here? Unpack the full valuation playbook inside.

Result: Fair Value of $40.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case depends heavily on constructive regulators and data center demand materializing as expected, leaving earnings vulnerable to policy shifts or overestimated load growth.

Find out about the key risks to this PPL narrative.

Another View: Valuation Through Earnings

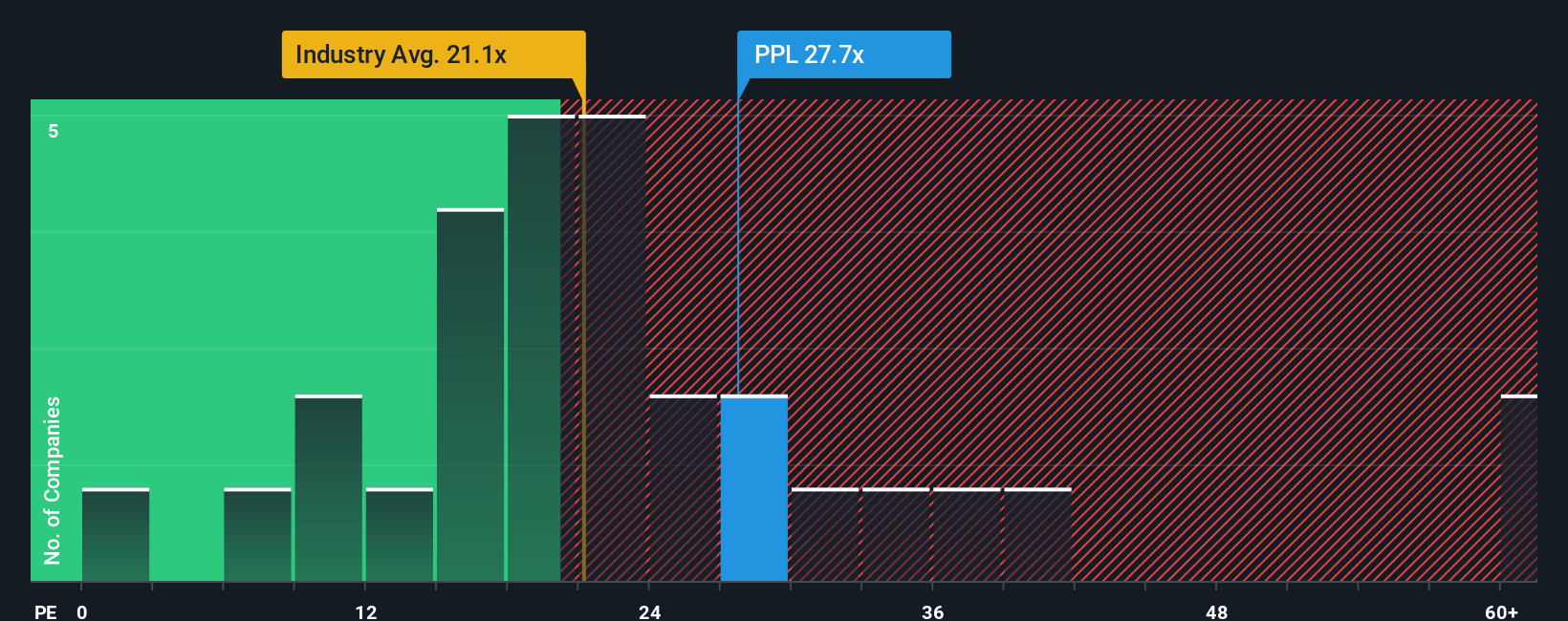

On an earnings basis, PPL looks anything but cheap, trading at roughly 23.2 times earnings versus about 20.1 times for the wider US electric utilities group and 14.7 times for peers, even though a fair ratio near 24.4 times suggests only limited upside from multiple expansion.

That leaves investors weighing a modest valuation edge against richer peer comparisons and asking whether today’s price is a springboard for future growth or a signal that expectations are already running hot.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PPL Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your PPL research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by scanning fresh opportunities on Simply Wall St’s Screener, where new ideas are waiting for focused investors.

- Capture potential mispricings by reviewing these 907 undervalued stocks based on cash flows that pair solid cash flows with attractive entry points.

- Ride structural growth trends by targeting these 30 healthcare AI stocks transforming how medicine, diagnostics, and patient care are delivered.

- Tap into fast moving digital finance by tracking these 81 cryptocurrency and blockchain stocks positioned at the front line of blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPL

PPL

Provides electricity and natural gas to approximately 3.5 million customers in the United States.

Solid track record and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026