- United States

- /

- Electric Utilities

- /

- NYSE:POR

What You Can Learn From Portland General Electric Company's (NYSE:POR) P/E

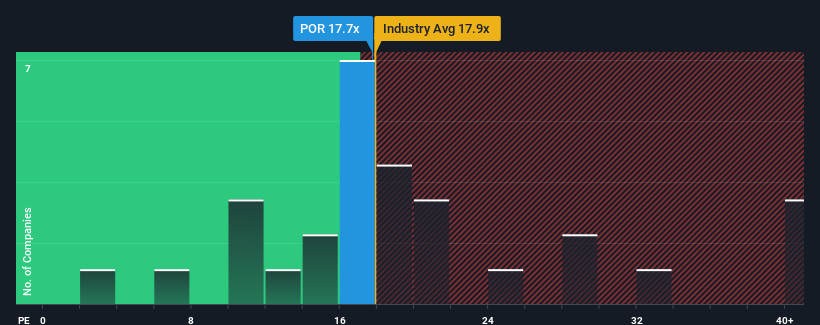

With a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for feeling indifferent about Portland General Electric Company's (NYSE:POR) P/E ratio of 17.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Portland General Electric's negative earnings growth of late has neither been better nor worse than most other companies. It seems that few are expecting the company's earnings performance to deviate much from most other companies, which has held the P/E back. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue tracking the market.

View our latest analysis for Portland General Electric

Is There Some Growth For Portland General Electric?

There's an inherent assumption that a company should be matching the market for P/E ratios like Portland General Electric's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.4% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 34% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 9.7% per year during the coming three years according to the eight analysts following the company. With the market predicted to deliver 10% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Portland General Electric's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Portland General Electric's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Portland General Electric (1 is a bit concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Portland General Electric, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives