- United States

- /

- Electric Utilities

- /

- NYSE:POR

A Closer Look at Portland General Electric’s Valuation After Dividend Reaffirmation and Upbeat Analyst Upgrades

Reviewed by Simply Wall St

On October 22, 2025, Portland General Electric (NYSE:POR) declared a quarterly dividend of $0.525 per share. This move reinforces its commitment to shareholder returns as the company navigates rising industrial demand and regulatory milestones.

See our latest analysis for Portland General Electric.

Portland General Electric’s share price has picked up momentum lately, gaining over 12% in the past 90 days as upbeat earnings, a steady dividend, and sector-wide bullishness around future energy demand catch investors’ attention. While its 1-year total shareholder return is modest, consistent returns over three and five years reflect stable long-term performance despite ongoing regulatory and industrial shifts.

For those drawn to signals of change in established sectors, now is a great time to broaden your search and discover fast growing stocks with high insider ownership.

With shares approaching recent highs and analysts lifting price targets, the big question is whether Portland General Electric is undervalued or if the market has already priced in all the good news. Is there still a buying opportunity here, or is future growth already reflected in today’s stock price?

Most Popular Narrative: 2.9% Undervalued

Portland General Electric’s narrative valuation sits slightly above the latest close, suggesting the potential for modest upside if growth targets materialize as outlined. With the fair value estimated at $47.55 compared to the closing price of $46.16, the story hinges on ambitious fundamentals and operational improvements.

*Ongoing transition to clean energy, including major renewable procurements (2023 and 2025 RFPs) and battery storage integration, positions PGE to capitalize on declining renewable costs and federal tax credits. These factors may drive rate base growth, lower operational costs, and support future margin improvement.*

Curious how a utility company can justify a higher price than the market implies? The answer: a growth forecast, margin expansion, and a bold clean energy strategy. Want to see which powerful financial levers set this story apart? The full narrative unpacks the forward-looking assumptions that drive the analysts’ target.

Result: Fair Value of $47.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if distributed energy resources grow faster than expected or if regulatory constraints tighten, Portland General Electric’s upside potential could face meaningful headwinds.

Find out about the key risks to this Portland General Electric narrative.

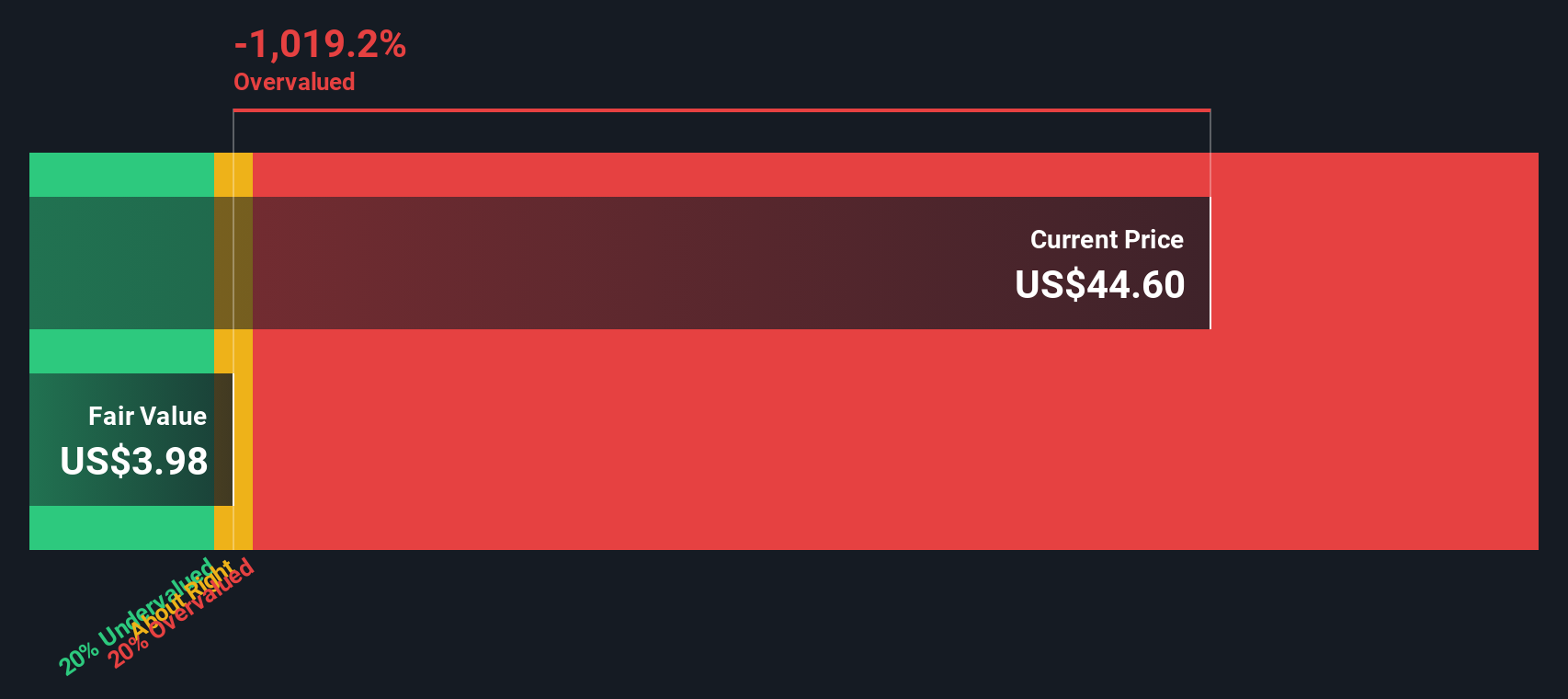

Another View: DCF Model Tells a Different Story

While the narrative-based estimate suggests the stock is modestly undervalued, our DCF model tells a less optimistic tale. According to the SWS DCF model, Portland General Electric is trading above its calculated intrinsic value, which could indicate overvaluation if cash flow assumptions are conservative. Which scenario will play out, and what does it mean for risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Portland General Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Portland General Electric Narrative

Prefer forging your own insights or bringing a fresh perspective? Dive into the data yourself and see where the numbers lead. Creating your own story takes less than three minutes. Do it your way

A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you only watch the obvious opportunities, you could miss the emerging trends driving the next wave of outperformance. Don’t let these unique stocks pass you by. Expand your horizons and spot what others overlook with these targeted stock ideas:

- Uncover hidden value as you seize these 877 undervalued stocks based on cash flows that meet crucial fundamental benchmarks and appear set for potential upside.

- Catch powerful innovation waves by checking out these 27 AI penny stocks, as companies with transformative artificial intelligence are reshaping industries every day.

- Build a resilient income stream when you examine these 17 dividend stocks with yields > 3% that consistently deliver attractive yields above 3% in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives