- United States

- /

- Electric Utilities

- /

- NYSE:PNW

Will Higher 2025 Earnings Guidance and Sales Growth Shift Pinnacle West Capital’s (PNW) Investment Narrative?

Reviewed by Sasha Jovanovic

- Pinnacle West Capital Corporation recently raised its 2025 earnings guidance and provided a new 2026 outlook following the release of third-quarter results, citing higher customer and sales growth alongside weather-related impacts.

- These updates, accompanied by new long-term sales growth projections, highlight management’s confidence in operational trends despite ongoing cost pressures and evolving energy market conditions.

- We’ll now explore how the improved 2025 earnings guidance and promising sales outlook influence Pinnacle West’s investment narrative moving forward.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Pinnacle West Capital Investment Narrative Recap

To be a shareholder in Pinnacle West Capital, you need to believe that Arizona’s strong population and economic expansion will continue to underpin demand and support rate base growth, fueling earnings even as operational and regulatory headwinds persist. The recent upward revision to 2025 earnings guidance, driven by robust sales expectations, is a clear positive for near-term sentiment, but it does not materially lessen the immediate risk posed by regulatory lag as major capital spending ramps up before rate relief takes effect in 2026.

Of the recent announcements, the raised 2025 consolidated earnings guidance stands out as most relevant. The move from a range of US$4.40–$4.60 to US$4.90–$5.10 per diluted share reflects stronger-than-expected customer and sales growth so far this year, partially offset by higher operations and maintenance expenses, and sets a more optimistic tone for near-term financial performance amid ongoing cost pressures.

However, despite encouraging guidance, investors should be aware that regulatory delays could pinch margins when capital needs are highest...

Read the full narrative on Pinnacle West Capital (it's free!)

Pinnacle West Capital's outlook anticipates $6.1 billion in revenue and $791.6 million in earnings by 2028. This scenario is based on a projected annual revenue growth rate of 5.1% and an earnings increase of $215.5 million from the current $576.1 million.

Uncover how Pinnacle West Capital's forecasts yield a $96.07 fair value, a 8% upside to its current price.

Exploring Other Perspectives

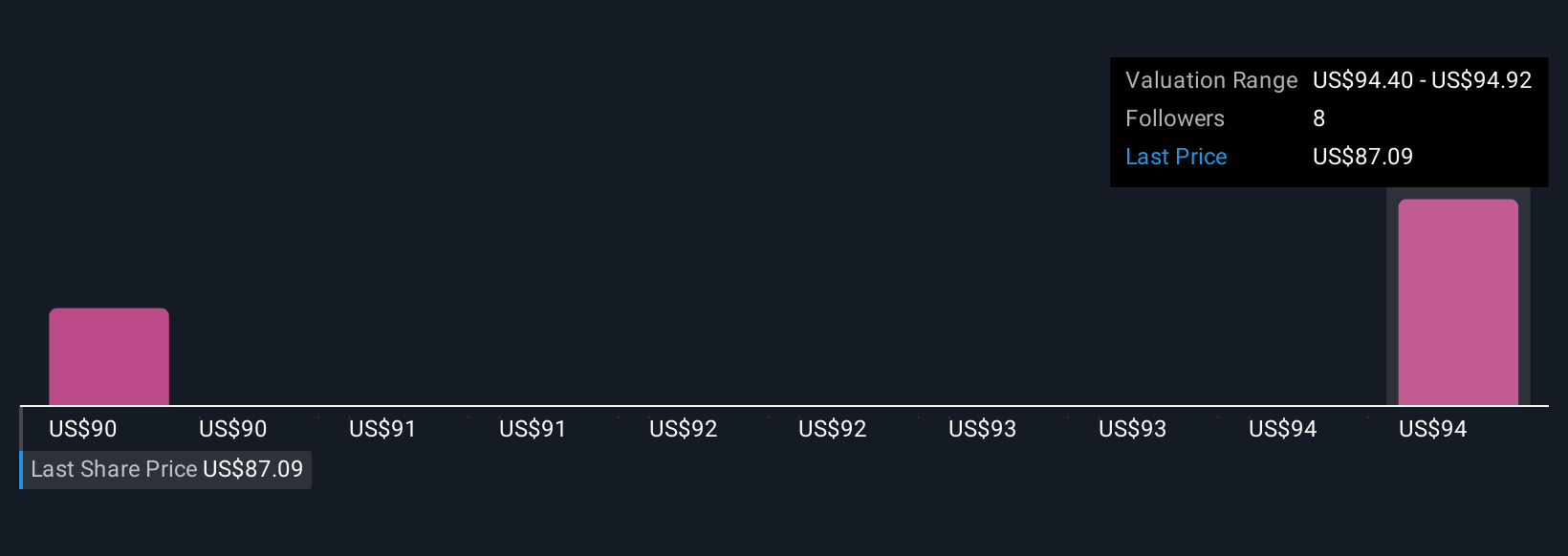

Simply Wall St Community members have set fair values from US$86.47 to US$96.07, reflecting two distinct forecasts for Pinnacle West Capital. With regulatory lag still a central risk, you can compare how investor confidence in future earnings may vary sharply.

Explore 2 other fair value estimates on Pinnacle West Capital - why the stock might be worth as much as 8% more than the current price!

Build Your Own Pinnacle West Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pinnacle West Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pinnacle West Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pinnacle West Capital's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNW

Pinnacle West Capital

Through its subsidiary, provides retail and wholesale electric services primarily in the state of Arizona.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives